Congratulations on choosing to trade in the stock market! By doing so, you’re following in the footsteps of legendary figures like Warren Buffet, Peter Lynch, and George Soros. These icons have paved the way for countless others to achieve financial success and independence.

Think of the stock market as a fertile garden. With the right care, knowledge, and tools, your investments can grow and flourish, providing a bountiful harvest for years to come. Each stock you pick is like planting a seed, and with time and patience, you can watch your financial future blossom.

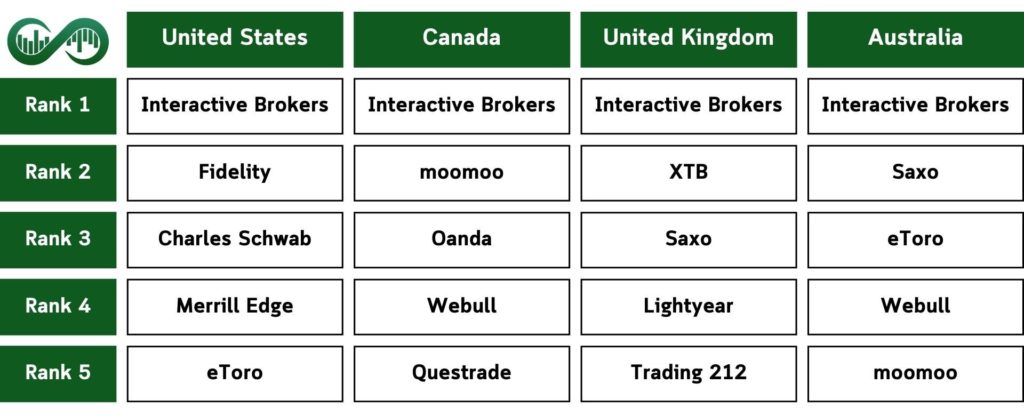

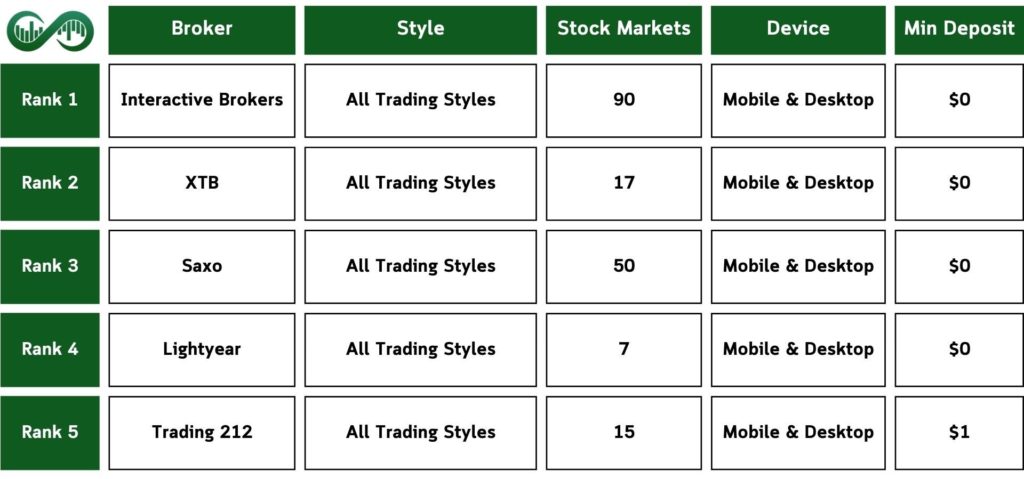

For a quick overview, we’ve prepared a handy table summarizing the top regional stock brokers in the US, Canada, UK, and Australia. If you prefer diving into details, keep reading! This blog will guide you through the process of analyzing different stock brokers, helping you understand what to look for and what to avoid when selecting a new broker.

After learning the key metrics and factors to consider, you’ll find our ranked list of the top stock brokers in each region, complete with their pros and cons. Whether you’re a professional trader or just starting out, this guide will provide valuable insights to help you make informed decisions on your journey to financial independence.

Before we introduce the best brokers for your personal traits and strategy, we will cover how to analyze brokers, what to look for and avoid, and how to weigh their pros and cons to choose the best option. We will start by discussing the crucial metrics you should consider for your next brokerage. As the saying goes, “Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime.”

Table of Contents

How to Pick the Right Stocks Broker?

Imagine the stock market as a grand orchestra, with numerous instruments creating a complex and beautiful symphony. Selecting a good stock broker is like choosing a skilled conductor to lead this orchestra. Just as a conductor doesn’t play the instruments themselves but guides the musicians to create harmony and balance, a reliable stock broker provides you with the insights, tools, and support you need to make informed decisions and achieve financial success.

Without a dependable broker, you might find yourself out of sync, missing opportunities, and facing unnecessary risks. When shopping for a new stock broker, what should you seek out, and what should you avoid? Consider the following key metrics:

✔ When evaluating fees and commissions, look for brokers that offer competitive rates, as lower costs can significantly enhance your overall returns, especially if you plan to trade frequently. Make sure the broker clearly discloses all fees and charges without hidden costs and provides detailed fee schedules on their website. Check for discounts and offers, such as those for high-volume trading or special promotions for new clients.

✘ Avoid brokers with high or hidden fees for things like account maintenance, withdrawals, or inactivity, as these can unexpectedly eat into your profits. Steer clear of brokers with overly complex or opaque pricing models that make it hard to understand what you’re paying for.

✔ A good trading platform should be intuitive and easy to use, allowing you to execute trades quickly and efficiently. Look for platforms that offer advanced charting tools, technical analysis features, and real-time data to help you make informed trading decisions. Ensure the broker offers a robust mobile app so you can trade on the go.

✘ Avoid brokers with slow, outdated platforms that can hinder your trading experience or lead to missed opportunities. Steer clear of platforms that lack essential tools and features, as this can limit your ability to analyze and trade effectively.

✔ Aim for brokers that offer round-the-clock customer service, especially if you trade in multiple markets with varying hours. Good brokers provide various ways to get in touch, including phone, email, and live chat. Ensure that the customer service team is knowledgeable and can assist with both technical and trading-related issues.

✘ Avoid brokers with slow or unresponsive customer service, as timely support is crucial for resolving trading issues. Steer clear of brokers whose support is only available during limited hours, which might not align with your trading schedule.

✔ Look for brokers that offer a wide range of products, including stocks, bonds, ETFs, mutual funds, options, and futures, to diversify your portfolio easily. If you’re interested in trading globally, ensure the broker provides access to international markets.

✘ Avoid brokers with a very narrow range of products, as this can restrict your trading opportunities. Steer clear of brokers that impose too many restrictions on what and where you can trade.

✔ Ensure the broker offers various account types, such as individual, joint, and retirement accounts, to suit your specific needs. Look for brokers that have low or no minimum deposit requirements, making it easier to start trading.

✘ Avoid brokers that require high minimum deposits, which can be a barrier to entry for new traders. Steer clear of brokers that don’t offer a range of account options, limiting your ability to manage your investments effectively.

✔ Seek brokers that provide a wealth of educational resources, including articles, webinars, videos, and tutorials to help you grow as a trader. Ensure the educational content is updated regularly to reflect the latest market trends and strategies.

✘ Avoid brokers that offer minimal educational materials, as this can hinder your growth and understanding of the market. Steer clear of brokers whose educational resources are outdated and no longer relevant to current market conditions.

✔ Ensure the broker is regulated by reputable financial authorities, which adds a layer of protection to your investments. Look for brokers that use advanced security measures, such as encryption and two-factor authentication, to protect your personal and financial information.

✘ Avoid brokers that are not regulated or have a questionable regulatory status, as this increases the risk of fraud or malpractice. Steer clear of brokers with inadequate security measures, which can leave your information vulnerable to breaches.

✔ When considering deposit and withdrawal options, look for brokers that offer a variety of methods, including bank transfers, credit/debit cards, and e-wallets. Ensure that these options are convenient and efficient for your needs. Pay attention to any fees associated with deposits and withdrawals, as these can add up over time.

✘ Avoid brokers with limited deposit and withdrawal options, as this can make it difficult to access your funds. Steer clear of brokers that charge high fees for these transactions, as this can reduce your overall profitability.

✔ Research the broker’s reputation by looking for reviews and ratings from other traders. A broker with a strong, positive reputation is likely to provide a better trading experience. Check for any awards or recognitions the broker may have received, as these can indicate a high level of service and reliability.

✘ Avoid brokers with numerous negative reviews or a history of complaints from clients. Steer clear of brokers that have been involved in scandals or have a poor reputation in the industry, as this can be a red flag for potential issues.

Best Stock Brokers

We have probed and analyzed tens of brokers to help you choose your Stock broker with confidence. From our research, we’ve selected the best brokers that cater to early Stock traders. Since your choice heavily depends on where you live, we’ve separated the rankings for each major region to ensure you get the most suitable options tailored to your needs.

Top Stock Brokers for US citizens

The Table below ranks the top brokers you can use as a beginner Stock trader living in the U.S.

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Commission-free US stocks and ETFs

- Great trading platforms and research

- Excellent product selection

Established in 1946, Fidelity Investments is a global financial services corporation that serves over 30 million customers with $10 trillion in client assets. Fidelity offers a wide range of investment products, including mutual funds, ETFs, retirement planning services, and wealth management solutions.

Fidelity is renowned for its advanced trading tools, comprehensive research resources, and competitive pricing. The firm’s focus on customer education and personalized financial advice makes it a preferred choice for investors seeking to build and manage their portfolios effectively. Fidelity is especially well-suited for long-term investors and retirement planners in the U.S. looking for extensive resources and personalized service.

- Commission-free US stocks and ETFs (US and international stocks)

- Great trading platforms and research

- High level of investor protection

- Free withdrawal & deposit and No inactivity fee

- Several account base currencies

- Easy account opening with no minimum deposit and various account types

- User-friendly Mobile app with good search function and various order types

- Desktop platform offers a clear fee report, customization, and various order types

- High mutual fund fees and margin rates

- No negative balance protection

- Does not hold a banking license

- Not listed on stock exchange

- Credit/Debit card not available

- Account opening can be slow and may not be fully digital in some cases

- No two-step safe login for Mobile app

- Desktop platform can be slow

- Free stock and ETF trading

- Outstanding research

- Great customer service

Founded in 1971, Charles Schwab is a major American brokerage and banking company that provides comprehensive investment services to over 32 million clients. With $7 trillion in client assets, Schwab offers a wide range of financial products and services, including brokerage accounts, retirement planning, and wealth management.

Charles Schwab is known for its low-cost trading, advanced trading platforms, and extensive research tools. The firm’s commitment to customer service and innovation has made it a trusted name in the financial industry, helping clients achieve their financial goals through personalized advice and robust investment solutions. Schwab is particularly well-suited for U.S. investors looking for a reliable and full-service brokerage with extensive resources.

- Commission free stock, ETF and some funds/bonds trading

- No deposit fee

- Outstanding research and learning materials

- Great customer service

- High level of investor protection and Banking background

- Account opening is fast, fully digital and there’s no minimum Deposit for US clients.

- Mobile app is user-friendly, supports Touch/Face ID login and order confirmation

- The desktop platform is user-friendly, customizable, and supports various order types

- High fees for Futures and some mutual funds

- Only US/Canada markets available

- No negative balance protection

- High fee for wire (bank transfer) withdrawals

- $25,000 minimum deposit for non-US clients

- Mobile app does not support price alerts

- Low trading fees

- Easy and seamless account opening

- Strong parent company

Launched in 2010 by Bank of America, Merrill Edge is a major brokerage platform offering comprehensive investment services. With millions of clients and significant client assets, Merrill Edge provides a wide range of financial products, including brokerage accounts, retirement planning, and wealth management. The platform’s integration with Bank of America ensures a seamless banking and trading experience.

Merrill Edge is particularly well-suited for U.S. investors seeking a full-service brokerage with robust resources and personalized financial advice. Its advanced trading tools and extensive research resources make it an attractive option for both novice and experienced investors. Whether you’re planning for retirement or managing your investments, Merrill Edge provides the support and tools needed to achieve your financial goals.

- Low trading fees & non-trading fees

- No deposit and withdrawal fee

- Easy and seamless account opening

- Strong parent company & Banking background

- Commission-free trading (stocks, ETFs)

- High level of investor protection

- Account opening is fast, digital and with no minimum deposit

- Convenient Mobile app with Two-step safe login and Touch/Face ID login

- Customizable Desktop platform with advanced tools and clear fee report

- No demo account

- Few options for deposit/withdrawal

- High margin rates for stock trading

- No negative balance protection

- Bank card is not available for deposits and withdrawals

- Slow withdrawal process

- Mobile app has poor search function

- Free stock and ETF trading

- Seamless account opening

- Social trading

Established in 2007, eToro has revolutionized the online trading landscape with its innovative social trading platform. With over 20 million users in more than 100 countries, eToro allows traders to observe, copy, and learn from the strategies of experienced investors, making it an attractive option for beginners and seasoned traders alike.

eToro offers a wide range of tradable assets, including stocks, cryptocurrencies, commodities, and more. The platform’s user-friendly interface and unique CopyTrader system enable users to replicate the trades of top-performing investors, while its extensive educational resources help traders improve their skills and knowledge. eToro is particularly suited for social traders and those who prefer a community-driven approach to investing, making it popular in Europe and Asia.

eToro is an excellent choice for beginner traders due to its intuitive app and competitive fees.What sets eToro apart is its outstanding copy-trading feature, which surpasses similar services from other brokers. However, short-term traders might find its CFD fees less competitive. Hence, it is more preferable for traders with swing and position trading style in mind.

- Free stock and ETF trading

- Social trading & Low trading fees

- Negative balance protection

- Financial information is publicly available

- Credit/debit card available (in US & UK only debit card)

- Fast and Easy account opening with low minimum deposit

- Great Mobile app with Two-step safe login, Good search function, and Touch/Face ID login

- Web Trading platform is user-friendly with Two-step safe login and clear fee report

- $5 withdrawal fee

- Inactivity fee charged

- Only USD as base currency

- Customer support should be improved

- Does not hold a banking license

- Not listed on stock exchange

- Conversion fee for non-USD deposits

- Web Trading platform has limited customizability (for charts, workspace).

Top Stock Brokers for Canadians

The Table below ranks the top brokers you can use as a beginner Stock trader living in Canada.

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Commission-free stock and ETF trading

- Fast and easy account opening

- Quality analytical tools and excellent education services

- Pays high interest on uninvested cash

Founded in 2018, MooMoo is a trading platform by Futu Holdings, offering commission-free trading and advanced trading tools. The platform’s user-friendly interface and real-time market data make it a popular choice for traders looking for a seamless trading experience. MooMoo’s commitment to providing comprehensive market insights and educational resources helps users make informed trading decisions.

MooMoo is particularly well-suited for retail traders in the Americas and Asia seeking a commission-free trading platform with advanced tools. Its robust customer support and extensive resources make it accessible to both new and experienced traders. Whether you’re looking to trade stocks, options, or ETFs, MooMoo provides the tools and support needed for effective trading.

- Commission-free stock and ETF trading

- Fast and easy account opening with no minimum deposit

- Quality analytical tools and excellent education services

- No inactivity and No deposit fee

- Pays 5.1% on uninvested cash

- High level of investor protection

- Parent company listed on stock exchange

- Mobile app is convenient with good search function and various order types

- Desktop platform is convenient with clear fee report and good workspace customizability

- Limited product portfolio

- Only bank transfer for deposit/withdrawal

- US index option trading carries a contract fee

- No negative balance protection

- Only one account base currency

- High wire withdrawal fee

- Available only in few countries

- No two-step safe login and no Touch/Face ID login for Mobile app

- No two-step safe login for desktop platform

- Great trading platforms

- Outstanding research tools

- Fast and user-friendly account opening

Founded in 1996, Oanda is a pioneer in online forex trading, known for its competitive spreads and advanced trading tools. Serving millions of clients globally, Oanda offers a comprehensive suite of services that include forex, commodities, indices, and bonds trading.

Oanda’s platform caters to both individual traders and institutional clients, providing powerful API integration and real-time market data. With a strong emphasis on transparency and customer education, Oanda is ideal for traders who prioritize comprehensive market analysis and reliable trading execution. It’s especially suited for North American and Asian traders looking for a trusted and well-established broker.

- Great trading platform with top notch research tools

- Fast and user-friendly account opening with no minimum deposit

- First card withdrawal each month is free

- Low trading fees and No deposit fee

- Credit/Debit card available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

- Financial information is publicly available

- Convenient Mobile app with good search function

- User-friendly Desktop platform with clear fee report and workplace customizability

- Only FX and CFD available for most clients (Stocks only in EU)

- No stock exchange listing and banking background

- Inactivity fee

- High fee for wire withdrawals

- Does not hold a banking license

- Not listed on stock exchange

- Customer support is not 24/7

- No Touch/Face ID login for Mobile app

- No price alerts for Desktop Platform

- Free stock/ETF trading and high 5% interest on uninvested cash

- Fast and easy account opening

- Great trading platform

Established in 2017, Webull is a mobile-first brokerage platform known for its commission-free trading and advanced trading tools. With millions of users globally, Webull offers a seamless and intuitive trading experience, providing real-time market data and comprehensive analytics. The platform’s focus on innovation and user experience has made it a popular choice for retail traders.

Webull is particularly well-suited for tech-savvy traders in North America and Asia who value a mobile-first approach and advanced tools. Its user-friendly interface and robust customer support make it accessible to both new and experienced traders. Whether you’re trading stocks, options, or ETFs, Webull provides the tools and resources needed for effective trading.

- Free stock/ETF trading and high 5% interest on uninvested cash

- Fast and easy account opening

- Great trading platforms

- No commission (for stocks, ETFs, options)

- High, 5% interest on cash balance

- ACH transfers are free for funding & payout

- High level of investor protection

- Limited product portfolio

- Only bank transfer for deposit/withdrawal

- Poor phone support

- High wire transfer costs

- No negative balance protection

- Does not hold a banking license

- Not listed on stock exchange

- Low stock and ETF fees

- Solid research tools

- Great customer service

Founded in 1999, Questrade is a leading Canadian brokerage known for its low-cost trading and advanced trading platforms. With hundreds of thousands of clients, Questrade offers a wide range of investment options, including stocks, ETFs, mutual funds, and more. The platform’s focus on innovation and customer service has made it a popular choice for Canadian investors.

Questrade is particularly well-suited for Canadian traders seeking a low-cost brokerage with extensive resources and support. Its user-friendly interface and comprehensive research tools make it accessible to both new and experienced investors. Whether you’re saving for retirement or building your portfolio, Questrade provides the tools and resources needed for effective investing.

- Low stock, ETF, and fund fees / Free stock trading

- Low non-trading fees

- No Deposit and Withdrawal fees

- High level of investor protection

- CAD 10 million per account additional insurance

- Great customer service and Solid research tools

- Easy, fast and fully digital account opening

- Convenient Mobile app with good variety of order types and two-step safe login

- User-friendly Desktop Platform with workspace customizability and various order types

- Slow account opening for non-Canadians

- High withdrawal fee for non-Canadians

- Limited account base currencies

- High margin rates

- No negative balance protection

- Does not hold a banking license & Not listed on stock exchange

- High fee wire withdrawals with slow withdrawal process

- Non-Visa debit card not available

- Account opening minimum deposit is higher than $500

- No clear fee report available for Desktop Platform

Top Stock Brokers for UK citizens

The Table below ranks the top brokers you can use as a beginner Stock trader living in the UK.

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Commission-free stocks and ETFs (for trades up to €100k per month)

- Free and fast deposit and withdrawal

- Easy and fast account opening

- High interest paid on cash

Founded in 2002, XTB has emerged as a leading European brokerage, celebrated for its award-winning xStation platform and competitive trading conditions. Serving over 300,000 clients worldwide, XTB offers a broad spectrum of tradable assets, including forex, indices, commodities, and cryptocurrencies.

XTB is committed to providing low-cost trading and extensive market coverage, with advanced tools and educational resources making it accessible to traders of all experience levels. Its robust customer service and intuitive platform make it particularly suitable for European traders looking for a reliable and user-friendly trading experience.

- Commission-free stock and ETFs (for trades up to €100k per month)

- Deposits and Withdrawals are mostly free (Credit/Debit card available)

- User-friendly and Modern mobile app with price alerts.

- User-friendly desktop platform with clear fee report and good search function

- Negative balance protection & E-wallets available

- Listed on stock exchange & Regulated by top-tier FCA

- Easy and Fast account opening with no minimum deposit

- Interest on uninvested funds (at XTB UK)

- Inactivity fee charged

- High conversion fee

- Does not hold a banking license

- Few minor account currencies accepted

- No safe two-step login option on mobile app and desktop platform

- Great trading platform

- Outstanding research

- Broad product portfolio

- Interest paid on uninvested cash

Established in 1992 in Denmark, Saxo Bank is a leading fintech specialist offering multi-asset trading and investment services globally. With over 800,000 clients across 170 countries, Saxo Bank’s state-of-the-art platforms, SaxoTraderGO and SaxoTraderPRO, provide access to a wide range of markets and financial instruments.

Saxo Bank is known for its competitive pricing, comprehensive research tools, and user-friendly interface, making it an ideal choice for both individual investors and institutional clients. Its extensive market coverage and advanced trading platforms make it particularly appealing for European and Asian traders who require a robust and versatile trading environment.

- First-class web trading platform with Superb educational tools

- Great deposit and withdrawal options with no fees

- Inactivity fee charged only after 2 years

- Listed on stock exchange

- Negative balance protection

- Bank card available

- Fully digital account creation with low minimum deposit

- Convenient Mobile app with food search function and Touch/Face ID login

- User-friendly web trading platform with clear fee report and Two-step safe login

- High options, futures and custody fees

- Electronic wallets not available

- Not listed on stock exchange

- No 24/7 customer service

- Minimum deposit high in some countries

- Commission-free ETF and low commission on stock trades

- High interest on uninvested cash

- Quick account opening

- Easy-to-use mobile trading platform

Founded in 2020, Lightyear is a fintech startup that offers commission-free trading, rapidly gaining popularity among retail traders. The platform features a user-friendly interface and advanced trading tools, making it an attractive choice for those seeking a seamless trading experience. Lightyear’s focus on providing comprehensive market insights and educational resources helps users make informed trading decisions.

Lightyear is particularly well-suited for European traders looking for a commission-free trading platform with robust tools. Its extensive customer support and accessible resources make it ideal for both new and experienced traders. Whether you’re trading stocks, ETFs, or other financial instruments, Lightyear equips you with the necessary tools and support for effective trading.

- Commission-free ETF and low commission on stock trades

- High interest on uninvested cash

- No inactivity, Custody and Withdrawal fee

- Multi Currency account (Debit card available)

- US stocks are protected up to $500k

- Fast and fully digital account opening with no minimum deposit

- Well-designed mobile trading platform with price alerts and good search function

- User-friendly and well-designed Web Trading Platform

- 0.35% FX fee and 0.5% card fee after a limit

- 0.5% card deposit fee after a limit

- Only bank transfer for withdrawal

- Missing asset classes (e.g. options or funds)

- Does not hold a banking license

- Not listed on stock exchange

- Limited order types on Mobile app

- Only email support available

- Lack of educational tools

- No price alerts and limited customizability on Web Trading Platform

- Real stocks and ETFs are commission-free (other fees may apply)

- Quick and easy account opening

- Great trading platforms

- Pays interest on uninvested cash in an investment account

Established in 2004, Trading 212 began as a Bulgarian-based brokerage. It gained popularity by pioneering commission-free trading in Europe and expanding its reach globally.

Trading 212 offers commission-free trading on stocks, ETFs, forex, and CFDs. Its intuitive mobile app is highly rated for ease of use, and the platform provides a wealth of educational materials, including tutorials and demo accounts. Real-time market data and analytical tools make it a favorite among both novice and experienced traders.

- Real stocks and ETFs are commission-free

- Pays interest on uninvested cash

- No deposit, withdrawal and inactivity fee (Credit/Debit card available)

- Negative balance protection

- Regulated by the FCA

- Fast and Fully digital account opening with no minimum deposit

- Convenient Mobile app with good search function and price alerts

- User-friendly Web trading platform with two-step safe login & Good search function

- Limited product portfolio

- High forex fees and financing rate

- Limited research tools

- Does not hold a banking license

- Not listed on stock exchange

- Financial information is not publicly available

- Skrill and Neteller not available

- Limited customizability for Web trading platform workspace.

Top Stock Brokers for Australians

The Table below ranks the top brokers you can use as a beginner Stock trader living in Australia.

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Great trading platform

- Outstanding research

- Broad product portfolio

- Interest paid on uninvested cash

Established in 1992 in Denmark, Saxo Bank is a leading fintech specialist offering multi-asset trading and investment services globally. With over 800,000 clients across 170 countries, Saxo Bank’s state-of-the-art platforms, SaxoTraderGO and SaxoTraderPRO, provide access to a wide range of markets and financial instruments.

Saxo Bank is known for its competitive pricing, comprehensive research tools, and user-friendly interface, making it an ideal choice for both individual investors and institutional clients. Its extensive market coverage and advanced trading platforms make it particularly appealing for European and Asian traders who require a robust and versatile trading environment.

- First-class web trading platform with Superb educational tools

- Great deposit and withdrawal options with no fees

- Inactivity fee charged only after 2 years

- Listed on stock exchange

- Negative balance protection

- Bank card available

- Fully digital account creation with low minimum deposit

- Convenient Mobile app with food search function and Touch/Face ID login

- User-friendly web trading platform with clear fee report and Two-step safe login

- High options, futures and custody fees

- Electronic wallets not available

- Not listed on stock exchange

- No 24/7 customer service

- Minimum deposit high in some countries

- Free stock and ETF trading

- Seamless account opening

- Social trading

Established in 2007, eToro has revolutionized the online trading landscape with its innovative social trading platform. With over 20 million users in more than 100 countries, eToro allows traders to observe, copy, and learn from the strategies of experienced investors, making it an attractive option for beginners and seasoned traders alike.

eToro offers a wide range of tradable assets, including stocks, cryptocurrencies, commodities, and more. The platform’s user-friendly interface and unique CopyTrader system enable users to replicate the trades of top-performing investors, while its extensive educational resources help traders improve their skills and knowledge. eToro is particularly suited for social traders and those who prefer a community-driven approach to investing, making it popular in Europe and Asia.

eToro is an excellent choice for beginner traders due to its intuitive app and competitive fees.What sets eToro apart is its outstanding copy-trading feature, which surpasses similar services from other brokers. However, short-term traders might find its CFD fees less competitive. Hence, it is more preferable for traders with swing and position trading style in mind.

- Free stock and ETF trading

- Social trading & Low trading fees

- Negative balance protection

- Financial information is publicly available

- Credit/debit card available (in US & UK only debit card)

- Fast and Easy account opening with low minimum deposit

- Great Mobile app with Two-step safe login, Good search function, and Touch/Face ID login

- Web Trading platform is user-friendly with Two-step safe login and clear fee report

- $5 withdrawal fee

- Inactivity fee charged

- Only USD as base currency

- Customer support should be improved

- Does not hold a banking license

- Not listed on stock exchange

- Conversion fee for non-USD deposits

- Web Trading platform has limited customizability (for charts, workspace).

- Free stock/ETF trading and high 5% interest on uninvested cash

- Fast and easy account opening

- Great trading platform

Established in 2017, Webull is a mobile-first brokerage platform known for its commission-free trading and advanced trading tools. With millions of users globally, Webull offers a seamless and intuitive trading experience, providing real-time market data and comprehensive analytics. The platform’s focus on innovation and user experience has made it a popular choice for retail traders.

Webull is particularly well-suited for tech-savvy traders in North America and Asia who value a mobile-first approach and advanced tools. Its user-friendly interface and robust customer support make it accessible to both new and experienced traders. Whether you’re trading stocks, options, or ETFs, Webull provides the tools and resources needed for effective trading.

- Free stock/ETF trading and high 5% interest on uninvested cash

- Fast and easy account opening

- Great trading platforms

- No commission (for stocks, ETFs, options)

- High, 5% interest on cash balance

- ACH transfers are free for funding & payout

- High level of investor protection

- Limited product portfolio

- Only bank transfer for deposit/withdrawal

- Poor phone support

- High wire transfer costs

- No negative balance protection

- Does not hold a banking license

- Not listed on stock exchange

- Commission-free stock and ETF trading

- Fast and easy account opening

- Quality analytical tools and excellent education services

- Pays high interest on uninvested cash

Founded in 2018, MooMoo is a trading platform by Futu Holdings, offering commission-free trading and advanced trading tools. The platform’s user-friendly interface and real-time market data make it a popular choice for traders looking for a seamless trading experience. MooMoo’s commitment to providing comprehensive market insights and educational resources helps users make informed trading decisions.

MooMoo is particularly well-suited for retail traders in the Americas and Asia seeking a commission-free trading platform with advanced tools. Its robust customer support and extensive resources make it accessible to both new and experienced traders. Whether you’re looking to trade stocks, options, or ETFs, MooMoo provides the tools and support needed for effective trading.

- Commission-free stock and ETF trading

- Fast and easy account opening with no minimum deposit

- Quality analytical tools and excellent education services

- No inactivity and No deposit fee

- Pays 5.1% on uninvested cash

- High level of investor protection

- Parent company listed on stock exchange

- Mobile app is convenient with good search function and various order types

- Desktop platform is convenient with clear fee report and good workspace customizability

- Limited product portfolio

- Only bank transfer for deposit/withdrawal

- US index option trading carries a contract fee

- No negative balance protection

- Only one account base currency

- High wire withdrawal fee

- Available only in few countries

- No two-step safe login and no Touch/Face ID login for Mobile app

- No two-step safe login for desktop platform

Final Words

Finding the right Stock trading broker is crucial for your trading success. By carefully analyzing the features, fees, and regulations of brokers, you can make an informed decision that suits your needs. Whether you’re in the US, UK, Canada, or Australia, there are excellent options available to help you find profits in the Stocks world of plenty. Remember, the right broker can make all the difference in your trading journey, so take no shortcuts when selecting your broker.

FAQ

It very much depends on your trading style and where you live, but in general, Interactive Brokers provide the overall best services for stock traders around the world.

The best broker mostly depends on the user preferences, but for US citizens, brokers like Interactive Brokers, Fidelity, Charles Schwab, Merrill Edge and eToro are among the best brokers.

The best broker mostly depends on the user preferences, but for Canadians, brokers like Interactive Brokers, moomoo, Oanda, Webull and Questrade are among the best brokers.

The best broker mostly depends on the user preferences, but for UK citizens, brokers like Interactive Brokers, XTB, Saxo, Lightyear and Trading 212 are among the best brokers.

The best broker mostly depends on the user preferences, but for Australians, brokers like Interactive Brokers, Saxo, eToro, Webull and moomoo are among the best brokers.