So you are interested in the world of crypto trading, a market full of potential profits but also rife with risks. If you’ve ever heard horror stories about scams, massive pump-and-dumps, and volatile prices, you might think trading cryptocurrencies is like riding a roller coaster with no seat belts. But here’s the shocker: proper crypto trading isn’t much different from trading Stocks or Forex, except the price action looks on gear!

An inseparable part of crypto trading that every crypto trader must have a faint idea of is Blockchain technology. In simple terms, blockchain is a system that records transactions across many computers in a way that ensures the security and transparency of the data. Imagine trying to transfer money between 100 different cities, each with its own unique banking system and no overlap.

That’s what blockchain networks are like, transferring funds (on-chain transfers) between these “cities” is nearly impossible. While there are ways to trade across different blockchains (cross-chain trades), it’s like moving goods between cities and costs additional fees, making it quite inconvenient. For beginners, it’s often best to avoid the blockchain altogether.

Keep in mind that for beginners and pro traders who are alien to crypto trading, traditional brokerages are their go to. If you have traded crypto before and have basic knowledge on how the Blockchain technology and its products work, then you might want to step up and trade in Centralized Exchanges. And if you are among the professional crypto traders, nothing like risky but lucrative trades of Decentralized Exchanges may satisfy your adrenaline itch.

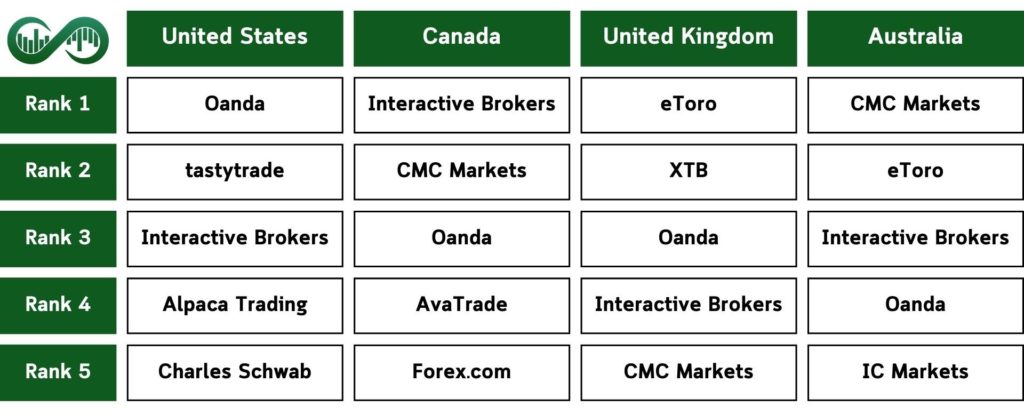

If you are in a rush, you may want to check the top brokers of your region in the Grab-and-Go table we made. But as the saying goes:“Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime.”, before introducing which brokers are best for your personal use and strategy, we will cover how you can analyze brokers, what you should look for and avoid, and finally how to put its pros and cons on the scales to choose the best option.

Table of Contents

How to Pick the Right Crypto Broker?

Choosing a crypto broker is like deciding whether to sail the high seas with a seasoned crew of experienced sailors or a ragtag band of paid pirates and mercenaries. Imagine setting sail with an experienced crew that knows every wave and current, allowing you to make the most out of the stormy crypto market.

Now, contrast that with a ship full of pirates who’d sell your compass for a quick buck and break every maritime law just for the thrill of it. One moment, they’re promising you boundless treasures, and the next, they’re plotting to maroon you on a deserted island. The difference is as wild as a calm voyage to a tropical paradise versus a chaotic, rule-breaking adventure with a bunch of scallywags who’d rather see you walk the plank than reach your destination safely.

But how can you find the right broker that is perfectly tailored to your needs? It’s essential to consider several key metrics to make an informed decision. These key metrics include:

✔ Ensure the broker uses robust security measures like two-factor authentication (2FA), encryption, and cold storage for cryptocurrencies. Also, look for brokers with solid regulations, track record and reputation for maintaining user security.

✘ Avoid brokers with a history of security breaches or lacking transparent security protocols. Steer clear of brokers that do not offer additional security features beyond basic password protection.

✔ Look for brokers with transparent fee structures, competitive commission and fee rates.

✘ Avoid brokers with hidden fees or complex fee structures that are difficult to understand. Stay away from brokers with high fees that can significantly impact your trading profits.

✔ Choose brokers that offer a wide variety of cryptocurrencies, including major coins and promising altcoins. Brokers that regularly update and expand their list of supported cryptocurrencies are preferable.

✘ Brokers that only offer only Bitcoin are not preferable.

✔ Look for a broker with a user-friendly and intuitive trading platform. Ensure the platform has advanced features like charting tools, real-time data, and customizable dashboards.

✘ Avoid brokers with outdated or overly complicated trading platforms. Steer clear of platforms that frequently experience technical issues or downtime.

✔ Seek brokers with positive user reviews and high ratings for overall satisfaction. Look for brokers that offer a seamless and efficient trading experience across devices.

✘ Avoid brokers with consistently negative reviews regarding user experience. Stay away from platforms that are difficult to navigate or use.

✔ Look for brokers offering multiple deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets. Ensure the broker has reasonable processing times for deposits and withdrawals.

✘ Avoid brokers with limited or inconvenient deposit and withdrawal methods. Steer clear of brokers with long processing times or high withdrawal fees.

✔ Choose brokers with high liquidity to ensure smooth and quick trades. Look for brokers that provide real-time liquidity data and transparent order books.

✘ Avoid brokers with low liquidity, which can lead to slippage and poor trade execution. Stay away from brokers that do not provide clear information about their liquidity.

✔ Look for brokers offering flexible margin and leverage options suitable for your trading strategy. Ensure the broker provides clear information and guidelines about margin trading.

✘ Avoid brokers with excessively high leverage that can lead to significant losses. Steer clear of brokers with unclear or hidden margin policies.

✔ Look for brokers that offer a variety of account types to suit different trading needs and experience levels. Choose brokers that provide clear information about the benefits and requirements of each account type.

✘ Avoid brokers with limited account options that do not cater to different trading preferences. Stay away from brokers that do not provide transparent information about account features and requirements.

✔ Choose brokers with responsive and knowledgeable customer support available 24/7. Look for brokers offering multiple support channels, including live chat, email, and phone.

✘ Avoid brokers with poor customer support reviews or limited support hours. Steer clear of brokers that are difficult to contact or slow to respond to inquiries.

✔ Ensure the broker is regulated and licensed by reputable financial authorities. Look for brokers that adhere to strict regulatory standards and provide transparent information about their licensing.

✘ Avoid brokers that operate without proper regulation or licensing. Stay away from brokers that do not provide clear information about their regulatory status.

✔ Look for brokers with positive reviews and a strong reputation in the crypto trading community. Consider brokers that are well-regarded by industry experts and have a history of reliable service.

✘ Avoid brokers with numerous negative reviews or a poor reputation. Steer clear of brokers that have been involved in controversies or have a history of customer complaints.

Best Crypto Brokers

We have probed and analyzed tens of brokers to help you choose your crypto broker with confidence. From our research, we’ve selected the best crypto brokers that cater to early crypto traders. Since your choice heavily depends on where you live, we’ve separated the rankings for each major region to ensure you get the most suitable options tailored to your needs.

Top Crypto Brokers for US citizens

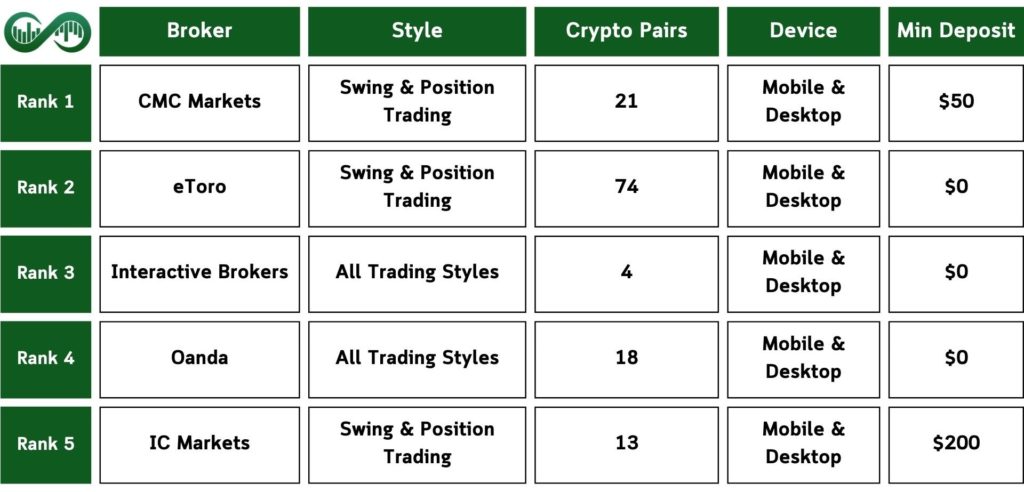

The Table below ranks the top crypto brokers you can use as a beginner crypto trader living in the U.S.

- Great trading platforms

- Outstanding research tools

- Fast and user-friendly account opening

Founded in 1996, Oanda is a pioneer in online forex trading, known for its competitive spreads and advanced trading tools. Serving millions of clients globally, Oanda offers a comprehensive suite of services that include forex, commodities, indices, and bonds trading.

Oanda’s platform caters to both individual traders and institutional clients, providing powerful API integration and real-time market data. With a strong emphasis on transparency and customer education, Oanda is ideal for traders who prioritize comprehensive market analysis and reliable trading execution. It’s especially suited for North American and Asian traders looking for a trusted and well-established broker.

- Great trading platform with top notch research tools

- Fast and user-friendly account opening with no minimum deposit

- First card withdrawal each month is free

- Low trading fees and No deposit fee

- Credit/Debit card available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

- Financial information is publicly available

- Convenient Mobile app with good search function

- User-friendly Desktop platform with clear fee report and workplace customizability

- Only FX and CFD available for most clients (Stocks only in EU)

- No stock exchange listing and banking background

- Inactivity fee

- High fee for wire withdrawals

- Does not hold a banking license

- Not listed on stock exchange

- Customer support is not 24/7

- No Touch/Face ID login for Mobile app

- No price alerts for Desktop Platform

- Low trading fees

- Great educational materials

- Good research tools

Launched in 2017, TastyTrade is a trading platform focused on options trading. With a rapidly growing user base, TastyTrade offers advanced options trading tools, competitive pricing, and extensive educational content. The platform’s focus on innovation and customer service has made it a popular choice for options traders.

TastyTrade is particularly well-suited for active options traders in North America seeking advanced tools and comprehensive educational resources. Its user-friendly interface and robust customer support make it accessible to both new and experienced traders. Whether you’re trading options, futures, or stocks, TastyTrade provides the tools and support needed for effective trading.

- Low options trading fees and Free stock trading

- Free and convenient deposit & ACH withdrawals in the US

- No inactivity fee

- High level of investor protection

- Financial information is publicly available (Audited by PwC)

- Fast and fully digital account opening with no minimum deposit

- Convenient Mobile app with Touch/Face ID login and order confirmation

- Customizable Desktop Platform with clear fee report and price alerts

- Great educational materials and research tools

- Few deposit and withdrawal options

- High margin rates for stock trading

- Does not hold a banking license

- Not listed on stock exchange

- Credit/Debit card not available

- High fee for wire withdrawals

- No price alerts in Mobile app

- Limited product selection and No demo account

- Desktop Platform is not suited for beginners

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Great API trading service

- Free stock & ETF trading

- Fantastic charting tools

Founded in 2015, Alpaca Trading is an API-first brokerage platform that offers commission-free stock, ETF, and options trading and advanced API integration. Alpaca caters to a rapidly growing user base, providing real-time market data and automated trading capabilities.

Alpaca’s platform is designed for developers and traders who seek to build and deploy their own trading algorithms. The broker’s focus on innovation and technology ensures that clients have access to cutting-edge tools and resources, making it an ideal choice for those looking to leverage automated trading strategies. Alpaca is particularly suited for tech-savvy traders and developers in North America who value flexibility and customization.

However, Alpaca’s Trading API relies heavily on community forums like GitHub and Slack for support, with limited customer service. Deposits and withdrawals are only possible via bank transfer, ACH transfers, and CurrencyCloud. Additionally, the product selection is limited to US stocks, ETFs, options, and crypto.

- Commission-free stock and ETF trading

- No inactivity fee

- Convenient deposits and withdrawals with no fees

- High level of investor protection

- Account opening is digital and fast with no minimum deposit

- Mobile app is user-friendly with Order confirmation and Two-step safe login

- Web trading platform is convenient with modern design and two-step safe login

- Limited customer support

- Limited deposit and withdrawal options

- Only US stocks, ETFs, options and crypto available

- Does not hold a banking license

- Not listed on stock exchange

- Financial information is not publicly available

- Credit/Debit card not available

- Only one account base currency

- High withdrawal fee for wire transfers

- Account opening is a complex process for integrating third-party tools

- Mobile app has poor search function, no price alerts and no Touch/Face ID login

- Free stock and ETF trading

- Outstanding research

- Great customer service

Founded in 1971, Charles Schwab is a major American brokerage and banking company that provides comprehensive investment services to over 32 million clients. With $7 trillion in client assets, Schwab offers a wide range of financial products and services, including brokerage accounts, retirement planning, and wealth management.

Charles Schwab is known for its low-cost trading, advanced trading platforms, and extensive research tools. The firm’s commitment to customer service and innovation has made it a trusted name in the financial industry, helping clients achieve their financial goals through personalized advice and robust investment solutions. Schwab is particularly well-suited for U.S. investors looking for a reliable and full-service brokerage with extensive resources.

- Commission free stock, ETF and some funds/bonds trading

- No deposit fee

- Outstanding research and learning materials

- Great customer service

- High level of investor protection and Banking background

- Account opening is fast, fully digital and there’s no minimum Deposit for US clients.

- Mobile app is user-friendly, supports Touch/Face ID login and order confirmation

- The desktop platform is user-friendly, customizable, and supports various order types

- High fees for Futures and some mutual funds

- Only US/Canada markets available

- No negative balance protection

- High fee for wire (bank transfer) withdrawals

- $25,000 minimum deposit for non-US clients

- Mobile app does not support price alerts

Top Crypto Brokers for Canadians

The Table below ranks the top crypto brokers you can use as a beginner crypto trader living in Canada.

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Low forex fees

- Great web and mobile platforms

- Advanced research and educational tools

Founded in 1989, CMC Markets is a leading global provider of online trading, known for its competitive pricing and advanced trading platforms. Serving thousands of clients with high daily trade volumes, CMC Markets offers a wide range of tradable assets, including forex, commodities, indices, and shares. The platform’s commitment to innovation and customer service has solidified its reputation as a reliable and efficient trading provider.

CMC Markets is particularly well-suited for European and Australian traders seeking a full-service brokerage with advanced tools. Its user-friendly platform and comprehensive educational resources make it accessible to both novice and experienced traders. Whether you’re looking to trade forex, commodities, or indices, CMC Markets provides the tools and support needed for successful trading.

- Low trading and non-trading fees

- No Deposit, Withdrawal and inactivity fees

- Regulated by top-tier financial authority

- Negative balance protection for clients under ASIC

- Credit/Debit card available

- Fast and fully digital account opening with no minimum deposit

- Customizable Desktop Platform with price alerts and clear fee report

- Great customer service

- Basic educational material

- Limited product selection

- No investor protection

- Not listed on stock exchange

- No minor account currencies accepted

- No two-step safe login/ No Touch or Face ID login in Mobile app

- Poorly designed Desktop Platform with no two-step safe login

- Great trading platforms

- Outstanding research tools

- Fast and user-friendly account opening

Founded in 1996, Oanda is a pioneer in online forex trading, known for its competitive spreads and advanced trading tools. Serving millions of clients globally, Oanda offers a comprehensive suite of services that include forex, commodities, indices, and bonds trading.

Oanda’s platform caters to both individual traders and institutional clients, providing powerful API integration and real-time market data. With a strong emphasis on transparency and customer education, Oanda is ideal for traders who prioritize comprehensive market analysis and reliable trading execution. It’s especially suited for North American and Asian traders looking for a trusted and well-established broker.

- Great trading platform with top notch research tools

- Fast and user-friendly account opening with no minimum deposit

- First card withdrawal each month is free

- Low trading fees and No deposit fee

- Credit/Debit card available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

- Financial information is publicly available

- Convenient Mobile app with good search function

- User-friendly Desktop platform with clear fee report and workplace customizability

- Only FX and CFD available for most clients (Stocks only in EU)

- No stock exchange listing and banking background

- Inactivity fee

- High fee for wire withdrawals

- Does not hold a banking license

- Not listed on stock exchange

- Customer support is not 24/7

- No Touch/Face ID login for Mobile app

- No price alerts for Desktop Platform

- Easy and fast account opening

- Free deposit and withdrawal options

- Great research tools

Founded in 2006, AvaTrade is a leading online broker that offers a diverse range of tradable assets, including forex, commodities, indices, and cryptocurrencies. With over 200,000 registered clients worldwide, AvaTrade provides competitive spreads and advanced trading platforms, making it a popular choice for traders of all levels.

AvaTrade is known for its robust educational resources and user-friendly platforms, such as AvaTradeGO and MetaTrader. The broker’s commitment to customer service and continuous innovation ensures that clients have the tools and support they need to succeed in the dynamic world of online trading. AvaTrade is particularly suited for Canadian, European and Asian traders seeking a well-rounded broker with a strong focus on education and support.

- Free deposit and withdrawal options & Low forex fees

- Supports Credit/Debit cards, electronic wallets

- Great research tools & Negative balance protection

- Opening an account is easy, fast, fully digital and requires low minimum deposit

- The mobile app is user-friendly with a good search function and AvaProtect order type

- Desktop platform supports Price alerts, workspace customization and clear fee report

- Only CFDs, forex, and cryptos offered

- Slow withdrawal – over 3 days

- High inactivity fees, Average CFD & FX fees

- Does not hold a banking license

- Not listed on stock exchange

- Financial information is not publicly available

- Mobile app only supports English and does not have a two-step safe login

- Desktop platform has poor design and no two-step safe login

- Low forex fees

- Great variety of currency pairs

- Diverse technical research tools

Launched in 2001, Forex.com is a global leader in online forex trading, known for its competitive pricing and advanced trading platforms. Operating in over 180 countries, Forex.com handles millions of transactions annually, providing traders with access to a wide range of markets and financial instruments.

Forex.com offers an array of features designed to enhance the trading experience, including comprehensive market research, educational content, and cutting-edge trading tools. Whether you are a novice trader or an experienced professional, Forex.com provides the resources and support needed to succeed in the fast-paced world of forex trading. It’s particularly well-suited for traders in the Americas and Europe who seek a well-rounded trading platform with extensive support and resources.

- Low Forex & Stock Commissions

- Low minimum deposit

- No Deposit and Withdrawal fee

- Great variety of currency pairs

- Diverse technical research tools

- High level of investor protection

- Parent company listed on stock exchange

- User-friendly Mobile app with a good variety of order types and search functions.

- Customizable workspace on Desktop Platform with various order types & clear fee report.

- Product portfolio limited to forex and CFDs

- High stock CFD fees

- Inactivity fee charged

- Desktop platform not user-friendly

- Problem with credit card withdrawal

- Relatively slow account verification

- No two-step safe login for Mobile app and Desktop platform

- Desktop platform has an outdated and inconvenient design

Top Crypto Brokers for UK citizens

The Table below ranks the top crypto brokers you can use as a beginner crypto trader living in the UK.

- Free stock and ETF trading

- Seamless account opening

- Social trading

Established in 2007, eToro has revolutionized the online trading landscape with its innovative social trading platform. With over 20 million users in more than 100 countries, eToro allows traders to observe, copy, and learn from the strategies of experienced investors, making it an attractive option for beginners and seasoned traders alike.

eToro offers a wide range of tradable assets, including stocks, cryptocurrencies, commodities, and more. The platform’s user-friendly interface and unique CopyTrader system enable users to replicate the trades of top-performing investors, while its extensive educational resources help traders improve their skills and knowledge. eToro is particularly suited for social traders and those who prefer a community-driven approach to investing, making it popular in Europe and Asia.

eToro is an excellent choice for beginner traders due to its intuitive app and competitive fees.What sets eToro apart is its outstanding copy-trading feature, which surpasses similar services from other brokers. However, short-term traders might find its CFD fees less competitive. Hence, it is more preferable for traders with swing and position trading style in mind.

- Free stock and ETF trading

- Social trading & Low trading fees

- Negative balance protection

- Financial information is publicly available

- Credit/debit card available (in US & UK only debit card)

- Fast and Easy account opening with low minimum deposit

- Great Mobile app with Two-step safe login, Good search function, and Touch/Face ID login

- Web Trading platform is user-friendly with Two-step safe login and clear fee report

- $5 withdrawal fee

- Inactivity fee charged

- Only USD as base currency

- Customer support should be improved

- Does not hold a banking license

- Not listed on stock exchange

- Conversion fee for non-USD deposits

- Web Trading platform has limited customizability (for charts, workspace).

- Commission-free stocks and ETFs (for trades up to €100k per month)

- Free and fast deposit and withdrawal

- Easy and fast account opening

- High interest paid on cash

Founded in 2002, XTB has emerged as a leading European brokerage, celebrated for its award-winning xStation platform and competitive trading conditions. Serving over 300,000 clients worldwide, XTB offers a broad spectrum of tradable assets, including forex, indices, commodities, and cryptocurrencies.

XTB is committed to providing low-cost trading and extensive market coverage, with advanced tools and educational resources making it accessible to traders of all experience levels. Its robust customer service and intuitive platform make it particularly suitable for European traders looking for a reliable and user-friendly trading experience.

- Commission-free stock and ETFs (for trades up to €100k per month)

- Deposits and Withdrawals are mostly free (Credit/Debit card available)

- User-friendly and Modern mobile app with price alerts.

- User-friendly desktop platform with clear fee report and good search function

- Negative balance protection & E-wallets available

- Listed on stock exchange & Regulated by top-tier FCA

- Easy and Fast account opening with no minimum deposit

- Interest on uninvested funds (at XTB UK)

- Inactivity fee charged

- High conversion fee

- Does not hold a banking license

- Few minor account currencies accepted

- No safe two-step login option on mobile app and desktop platform

- Great trading platforms

- Outstanding research tools

- Fast and user-friendly account opening

Founded in 1996, Oanda is a pioneer in online forex trading, known for its competitive spreads and advanced trading tools. Serving millions of clients globally, Oanda offers a comprehensive suite of services that include forex, commodities, indices, and bonds trading.

Oanda’s platform caters to both individual traders and institutional clients, providing powerful API integration and real-time market data. With a strong emphasis on transparency and customer education, Oanda is ideal for traders who prioritize comprehensive market analysis and reliable trading execution. It’s especially suited for North American and Asian traders looking for a trusted and well-established broker.

- Great trading platform with top notch research tools

- Fast and user-friendly account opening with no minimum deposit

- First card withdrawal each month is free

- Low trading fees and No deposit fee

- Credit/Debit card available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

- Financial information is publicly available

- Convenient Mobile app with good search function

- User-friendly Desktop platform with clear fee report and workplace customizability

- Only FX and CFD available for most clients (Stocks only in EU)

- No stock exchange listing and banking background

- Inactivity fee

- High fee for wire withdrawals

- Does not hold a banking license

- Not listed on stock exchange

- Customer support is not 24/7

- No Touch/Face ID login for Mobile app

- No price alerts for Desktop Platform

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Low forex fees

- Great web and mobile platforms

- Advanced research and educational tools

Founded in 1989, CMC Markets is a leading global provider of online trading, known for its competitive pricing and advanced trading platforms. Serving thousands of clients with high daily trade volumes, CMC Markets offers a wide range of tradable assets, including forex, commodities, indices, and shares. The platform’s commitment to innovation and customer service has solidified its reputation as a reliable and efficient trading provider.

CMC Markets is particularly well-suited for European and Australian traders seeking a full-service brokerage with advanced tools. Its user-friendly platform and comprehensive educational resources make it accessible to both novice and experienced traders. Whether you’re looking to trade forex, commodities, or indices, CMC Markets provides the tools and support needed for successful trading.

- Low trading and non-trading fees

- No Deposit, Withdrawal and inactivity fees

- Regulated by top-tier financial authority

- Negative balance protection for clients under ASIC

- Credit/Debit card available

- Fast and fully digital account opening with no minimum deposit

- Customizable Desktop Platform with price alerts and clear fee report

- Great customer service

- Basic educational material

- Limited product selection

- No investor protection

- Not listed on stock exchange

- No minor account currencies accepted

- No two-step safe login/ No Touch or Face ID login in Mobile app

- Poorly designed Desktop Platform with no two-step safe login

Top Crypto Brokers for Australians

The Table below ranks the top crypto brokers you can use as a beginner crypto trader living in Australia.

- Low forex fees

- Great web and mobile platforms

- Advanced research and educational tools

Founded in 1989, CMC Markets is a leading global provider of online trading, known for its competitive pricing and advanced trading platforms. Serving thousands of clients with high daily trade volumes, CMC Markets offers a wide range of tradable assets, including forex, commodities, indices, and shares. The platform’s commitment to innovation and customer service has solidified its reputation as a reliable and efficient trading provider.

CMC Markets is particularly well-suited for European and Australian traders seeking a full-service brokerage with advanced tools. Its user-friendly platform and comprehensive educational resources make it accessible to both novice and experienced traders. Whether you’re looking to trade forex, commodities, or indices, CMC Markets provides the tools and support needed for successful trading.

- Low trading and non-trading fees

- No Deposit, Withdrawal and inactivity fees

- Regulated by top-tier financial authority

- Negative balance protection for clients under ASIC

- Credit/Debit card available

- Fast and fully digital account opening with no minimum deposit

- Customizable Desktop Platform with price alerts and clear fee report

- Great customer service

- Basic educational material

- Limited product selection

- No investor protection

- Not listed on stock exchange

- No minor account currencies accepted

- No two-step safe login/ No Touch or Face ID login in Mobile app

- Poorly designed Desktop Platform with no two-step safe login

- Free stock and ETF trading

- Seamless account opening

- Social trading

Established in 2007, eToro has revolutionized the online trading landscape with its innovative social trading platform. With over 20 million users in more than 100 countries, eToro allows traders to observe, copy, and learn from the strategies of experienced investors, making it an attractive option for beginners and seasoned traders alike.

eToro offers a wide range of tradable assets, including stocks, cryptocurrencies, commodities, and more. The platform’s user-friendly interface and unique CopyTrader system enable users to replicate the trades of top-performing investors, while its extensive educational resources help traders improve their skills and knowledge. eToro is particularly suited for social traders and those who prefer a community-driven approach to investing, making it popular in Europe and Asia.

eToro is an excellent choice for beginner traders due to its intuitive app and competitive fees.What sets eToro apart is its outstanding copy-trading feature, which surpasses similar services from other brokers. However, short-term traders might find its CFD fees less competitive. Hence, it is more preferable for traders with swing and position trading style in mind.

- Free stock and ETF trading

- Social trading & Low trading fees

- Negative balance protection

- Financial information is publicly available

- Credit/debit card available (in US & UK only debit card)

- Fast and Easy account opening with low minimum deposit

- Great Mobile app with Two-step safe login, Good search function, and Touch/Face ID login

- Web Trading platform is user-friendly with Two-step safe login and clear fee report

- $5 withdrawal fee

- Inactivity fee charged

- Only USD as base currency

- Customer support should be improved

- Does not hold a banking license

- Not listed on stock exchange

- Conversion fee for non-USD deposits

- Web Trading platform has limited customizability (for charts, workspace).

- Covers all trading styles

- Extremely low fees

- Supports all asset classes

Founded in 1978 by Thomas Peterffy, Interactive Brokers has grown into a global brokerage powerhouse, known for its low-cost trading and broad market access. With over 1.6 million client accounts and a daily trade volume exceeding 3 million, Interactive Brokers stands out with its advanced trading tools, including the IBKR Pro and Lite options, catering to both professional traders and retail investors.

Interactive Brokers offers a comprehensive suite of services, from equities and options to futures and forex, ensuring traders have diverse investment opportunities. The platform is also celebrated for its educational resources, making it perfect for traders who value thorough market analysis and sophisticated trading strategies. Whether you’re a seasoned trader or just starting, Interactive Brokers provides the tools and resources necessary for effective trading. It’s particularly well-suited for traders seeking low fees and extensive international market access.

- Low trading fees and margin rates

- Free stock and ETF trading for US clients

- No deposit and monthly inactivity fee

- First withdrawal is free each month

- Minimum deposit only for margin accounts

- Several account base currencies

- Listed on stock exchanges

- Negative balance protection

- Regulated by top-tier financial authorities

- Mobile app is User-friendly, good search function and Touch/Face login

- Desktop platform has a safe two-step login

- Average CFD and Forex fees

- Bank card not available

- Creating a new account is not user-friendly

- Limited order types (on Mobile app)

- No price alerts (on Mobile app and Desktop platform)

- Limited customizability for workspace (on Desktop platform)

- Great trading platforms

- Outstanding research tools

- Fast and user-friendly account opening

Founded in 1996, Oanda is a pioneer in online forex trading, known for its competitive spreads and advanced trading tools. Serving millions of clients globally, Oanda offers a comprehensive suite of services that include forex, commodities, indices, and bonds trading.

Oanda’s platform caters to both individual traders and institutional clients, providing powerful API integration and real-time market data. With a strong emphasis on transparency and customer education, Oanda is ideal for traders who prioritize comprehensive market analysis and reliable trading execution. It’s especially suited for North American and Asian traders looking for a trusted and well-established broker.

- Great trading platform with top notch research tools

- Fast and user-friendly account opening with no minimum deposit

- First card withdrawal each month is free

- Low trading fees and No deposit fee

- Credit/Debit card available

- Majority of clients belong to a top-tier financial authority

- Negative balance protection

- Financial information is publicly available

- Convenient Mobile app with good search function

- User-friendly Desktop platform with clear fee report and workplace customizability

- Only FX and CFD available for most clients (Stocks only in EU)

- No stock exchange listing and banking background

- Inactivity fee

- High fee for wire withdrawals

- Does not hold a banking license

- Not listed on stock exchange

- Customer support is not 24/7

- No Touch/Face ID login for Mobile app

- No price alerts for Desktop Platform

- Low forex fees

- Easy and fast account opening

- Free deposit and withdrawal

- Offers standard and raw spread accounts

IC Markets, also known as International Capital Markets, was founded in 2007 by Andrew Budzinski. It is headquartered in Sydney, Australia. The broker is well-regulated by top financial authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) of Seychelles. IC Markets offers a wide range of trading instruments, including Forex, CFDs, stocks, commodities, and cryptocurrencies. Over the years, it has grown to become one of the largest and most trusted brokers globally.

IC Markets is a top choice for traders mainly because of its low trading fees. Honestly, the very tight spreads are what keep their customers coming back to IC Markets, and their selection of currency pairs is also quite good. Beginners might find the MetaTrader platform a bit old-fashioned and hard to use, but experienced traders will appreciate its familiar features.

- Low forex fees & Low non-trading fees

- Free deposit and withdrawal (Credit/Debit card available)

- Offers standard and raw spread accounts

- Negative balance protection

- Long track record

- Several account base currencies

- Some restrictions apply to withdrawals

- Fast and digital account opening with low minimum deposit

- Convenient Mobile app with good search function and price alerts

- Customizable Desktop Platform with clear fee report & price alerts

- Limited product selection

- Slow live chat support

- No investor protection for non-EU clients

- High financing rate for CFDs

- Not listed on stock exchange

- Financial information is not publicly available

- No two-step safe login and No Touch/Face ID login on Mobile app

- Desktop Platform is poorly designed and has No two-step safe login

Final Words

Finding the right crypto trading broker is crucial for your trading success. By carefully analyzing the features, fees, and regulations of brokers, you can make an informed decision that suits your needs. Whether you’re in the US, UK, Canada, or Australia, there are excellent options available to help you find profits in the misty world of cryptocurrency trading. Remember, the right broker can make all the difference in your trading journey, so take no shortcuts when selecting your broker.

FAQ

It very much depends on your trading style and where you live, but in general, for US citizens Oanda is among the best. For Canadians it’s the Interactive Brokers, For UK citizens it’s eToro and for Australians it’s the CMC Markets.

The Best crypto broker mostly depends on the user preferences, but for US citizens, brokers like Oanda, tastytrade, Interactive Brokers, Alpaca Trading and Charles Schwab are among the best brokers.

The Best crypto broker mostly depends on the user preferences, but for Canadians, brokers like Interactive Brokers, CMC Markets, Oanda, AvaTrade and Forex.com are among the best brokers.

The best crypto broker mostly depends on the user preferences, but for UK citizens, brokers like eToro, XTB, Oanada, Interactive Brokers and CMC Markets are among the best brokers.

The best crypto broker mostly depends on the user preferences, but for Australians, brokers like CMC Markets, eToro, Interactive Brokers, Oanda and IC Markets are among the best brokers.