Last week’s market and economic data key points:

- US Stocks were sharply lower due to recession fear

- European and Japanese stocks closed sharply lower last week

- Nvidia 12.5%, Google 7% and Meta 3.5% dropped last week

- Broadcom stock drops on a weak outlook even with beating revenue

- Crude oil hits lowest levels since June 2023

- US 10-year Treasury note falls to 15-month low

- The U.S. unemployment rate slides at 4.2%

- The unemployment rate in Canada rose to 6.6%

- Trump promise to make US the global ‘Crypto Capital’ if re-elected

Table of Contents

Last Week’s Reports

Economic Reports

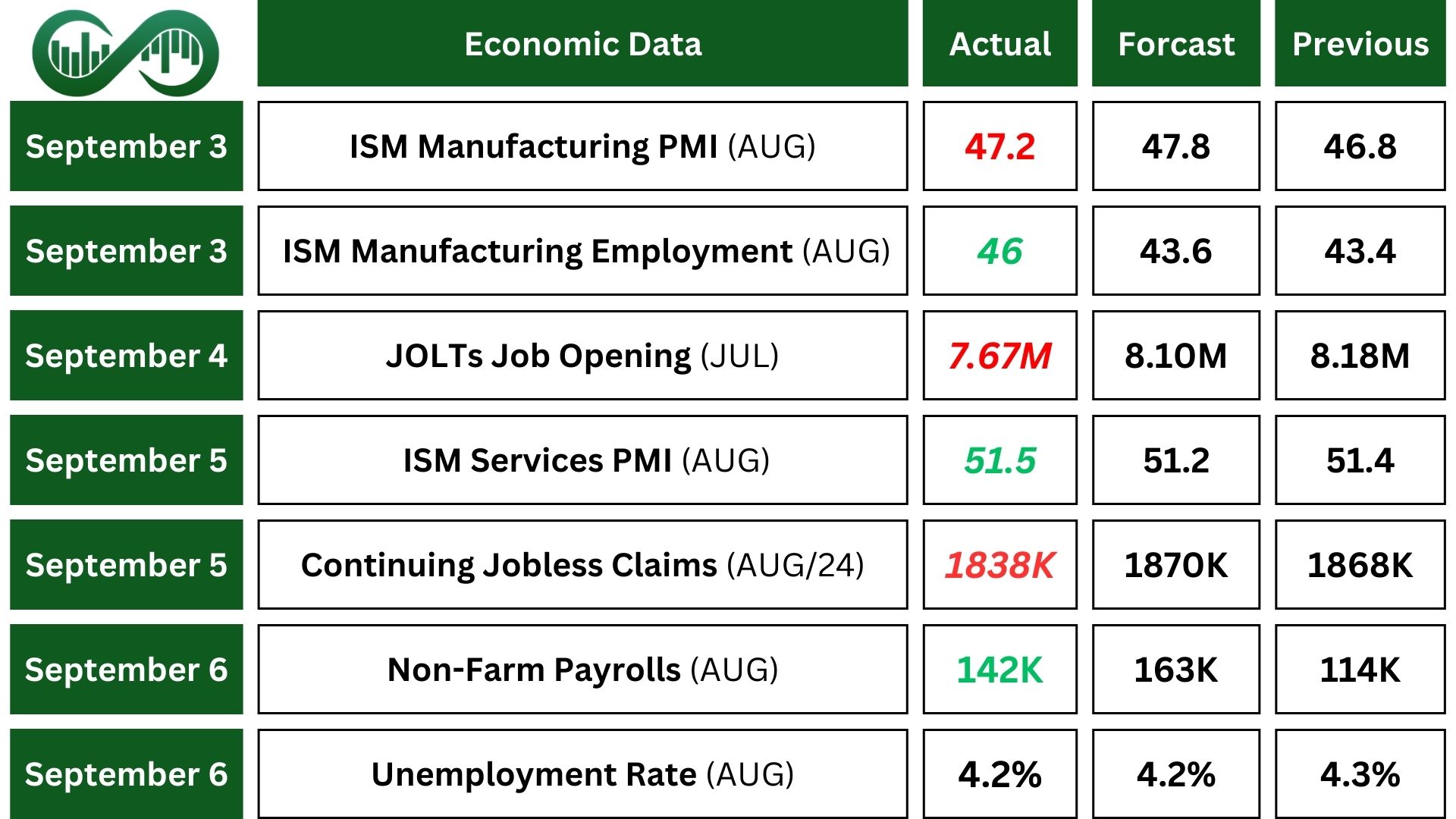

The ISM Manufacturing PMI edged higher to 47.2 in August but missed market expectations. This reflects the contraction in US factory activity in the last 22 months. Also, the result shows the weak momentum for manufacturing in the US economy.

The ISM Services PMI in the US edged higher to 51.5 in August, above market expectations. This reflects the positive momentum in activity for US service providers. New orders extended and reflected robust demand from clients in the services sector. In the meantime, employment levels edged marginally higher.

Also, the ISM’s price gauge accelerated further, ahead of market expectations, amid higher costs in construction services, electrical equipment, food, and labor.

Jobs Reports

The number of job openings fell in July, reaching the lowest level since January 2021. However, the number of job quits edged up in July. Also, the quits rate, a metric that measures voluntary job leavers as a proportion of total employment, was 2.1%.

US employers announced 75,891 job cuts in August which is the most for the month since 2009 when excluding the pandemic-induced crash in 2020. The result reflects the softening of the US labor market, strengthening the dovishness in the FOMC Sep 18.

Among different sectors, tech companies announced the most cuts. August’s surge in job cuts shows growing economic uncertainty and shifting market dynamics. Companies are facing a variety of pressures, from rising operational costs to concerns about a potential economic recession.

ADP Employment Change showed the US added 99K workers to their payrolls in August, well below forecasts. Figures showed the labor market continued to cool for the fifth straight month while wage growth was stable. The job market’s downward trend brought us to slower-than-normal hiring after two years of outsized growth.

The initial jobless claim in the US fell to 227,000 reaching a new 7-week low. Despite this decrease, the figure remained well above the averages seen earlier this year, although it remains historically tight. In the meantime, the continuous jobless claims rose to 1,838,000 in the previous week, which reduces week-to-week volatility.

The Unemployment rate in the United States eased to 4.2% in August from the 4.3% in July.

The Average hourly earnings for all employees in the US private increased 0.4%, to $35.21 in August. Non-Farm Payrolls added 142K jobs in August, more than July’s report but below forecasts.

Earning Reports

Copart

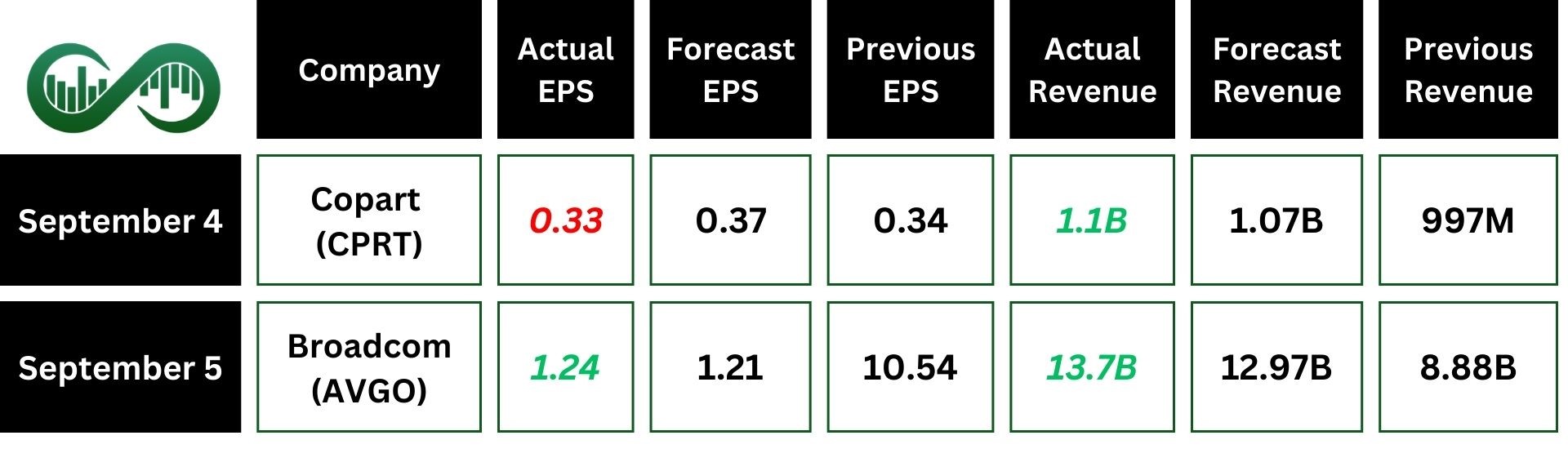

Copart (CPRT) shares were trading lower after the company reported its 4Q financial results after Wednesday’s closing bell.

The company reported earnings of 33 cents per share, which missed the estimates. Also, quarterly revenue came in at $1.1B.

For the fiscal year ending July 31, 2024, revenue, gross profit, and net income were $4.2B, $1.9B, and $1.4B. These represent an increase in revenue of 9.5%, an increase in gross profit of 9.8% and an increase in net income of 10.1%, from the same period last year.

Copart shares are down 5.9% last week to $49.46 after it missed estimates in earnings.

Broadcom

Broadcom (AVGO) reported 3Q financial results after the market closed on Thursday.

The company reported revenue of $13.072B, beating estimates. The semiconductor company reported earnings of $1.24 per share, beating estimates of $1.20 per share.

Total revenue was up 42% on a year-over-year. Broadcom generated $4.96B in cash from operations and $4.79B in free cash flow during the quarter.

Broadcom’s semiconductors are in a number of categories, including networking, broadband, server storage, wireless, and industrial. The chip designer has also become the leading player in the market for the high-end application-specific integrated circuits that are used for AI. It helps large companies, such as Alphabet’s Google unit, design custom chips for their AI initiatives.

Hock Tan, president and CEO of Broadcom said: “Broadcom’s 3Q results reflect continued strength in our AI semiconductor solutions and VMware. We expect revenue from AI to be $12B for fiscal year 2024 driven by Ethernet networking and custom accelerators for AI data centers,”

Broadcom’s board approved a quarterly cash dividend of 53 cents per share, payable on Sept 30 to shareholders of record as of Sept 19.

Also, Broadcom expects 4Q revenue of approximately $14B. The company anticipates next quarter adjusted EBITDA of approximately 64% of projected revenue.

However, Broadcom shares were down 12% last week due to this mixed outlook. Broadcom provided revenue guidance for the current quarter of $14B versus the $14.11B estimates.

Indices

Indices’ Weekly Performance:

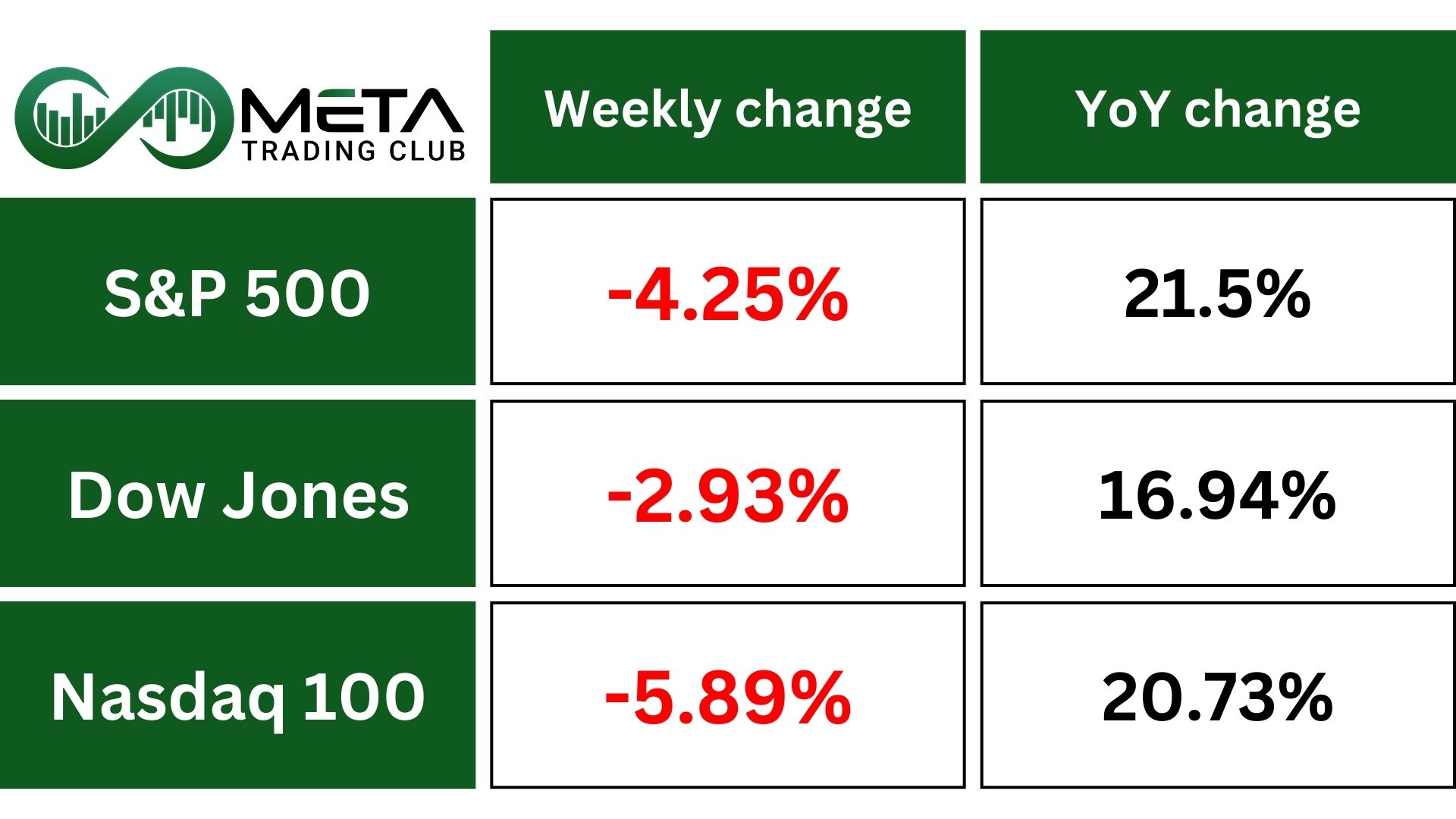

US stocks fell last week, weighed down by concerns over a slowing labor market and a tech selloff. The S&P 500 dropped 4.2%, the Dow Jones lost 2.9%, and the Nasdaq fell 5.89% and posted its steepest early-September decline since 2008.

As you can see below in the chart of SPX, the market has declined through September in the past 4 years.

Also, European stocks closed sharply lower, tracking losses on Wall Street and pressured by a global decline in risk sentiment amid growing concerns of a less-resilient US economy.

Stocks

Stock Market Sector’s Weekly Performance:

Source: Finviz

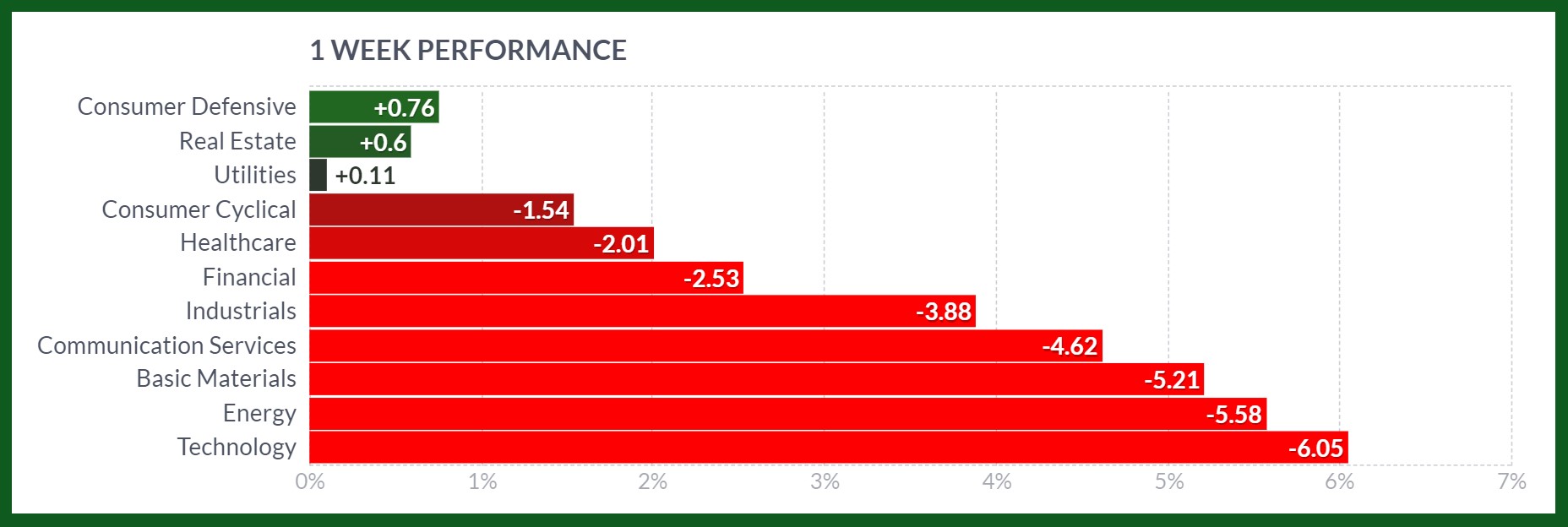

Most sectors dropped this week except Consumer Defensive, Real states and Utilities.

Technology and energy were the leading sectors for market fall with almost 6% drop.

Stock Market Weekly Performance:

Source: Finviz

Global selloff in risk assets as US recession fears were reignited by weak jobs data.

Big tech companies like Apple (-3.9%), Alphabet (-6.9%) and Meta (-3.4%) saw significant losses, with chipmakers such as Broadcom (-12.7%) and Nvidia (-12.5%) also faced sharp declines.

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

For the week, WTI oil prices experienced an 8% drop, booking their worst since October.

OPEC+ postponed its planned production increase of 180,000 barrels per day until December, which would have added about 2.2 million barrels per day to the market through the end of next year.

Meanwhile, recent economic data from China and the U.S. revealed weaknesses in their manufacturing sectors, raising fears of declining demand.

Additionally, potential increases in oil supply from Libya, due to political factions nearing an agreement, added downward pressure.

However, an unexpected large drawdown in U.S. crude inventories (down 6.9 million barrels) provided some relief.

Technically, Crude oil is reaching a strong 3-year support zone. If the price could break this support, new downward momentum is triggered.

Gold prices eased below $2,500 per ounce on Friday, pulling back from near its record high after mixed U.S. jobs data raised doubts about the size of the Federal Reserve’s upcoming interest rate cuts.

The US jobs report culminated a week of pessimistic labor market data, including downward surprises for the ADP report, the Challenger report, and the JOLTS.

Less restrictive monetary policy favors gold as they reduce the opportunity cost of holding non-interest-bearing bullion assets.

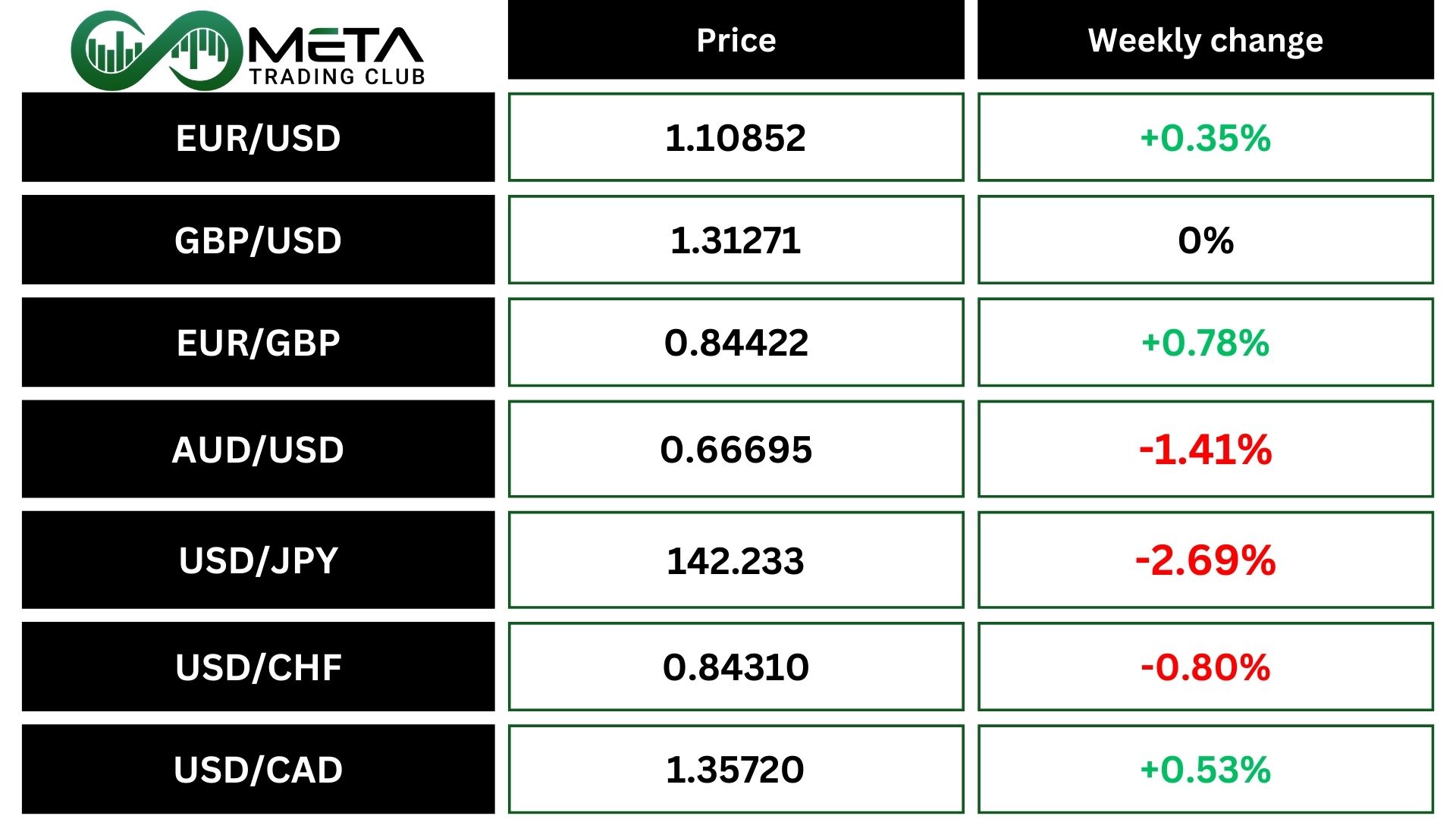

Forex

Weekly Performance of Major Foreign Exchange Pairs:

USD/JPY: The Japanese yen appreciated to below 143 per dollar, highest levels in a month as the Bank of Japan is expected to raise interest rates further amid persistent inflationary pressures and rising wages.

Bank of Japan policy makers recently indicated that they will adjust monetary settings further if their outlook for the economy and prices are realized, with markets pricing in another rate hike in December. On the other hand, the US Federal Reserve is widely expected to start cutting interest rates this month amid rising labor market risks and broader economic weakness.

USD/CAD: The Bank of Canada cut its key interest rate by 25bps to 4.25% in its September 2024 meeting, as expected, to mark the third consecutive 25 bps slash after having left the hiking cycle’s terminal rate of 5% for 10 months. The central bank noted that the extension of its cutting cycle was warranted as excess supply in the Canadian economy continued to put downward pressure on inflation.

The unemployment rate in Canada rose to 6.6% in August, the highest since October of 2021, and surpassing market expectations. The result indicates that Canada’s labor market continued to soften as predicted by the Bank of Canada’s Governing Council.

Bonds

The yield on the 10-year Treasury note fell under 3.7% (the lowest in over 15 months) as evidence of a softening labor market strengthened bets of multiple aggressive rate cuts by the Fed this year.

This drove FOMC member Christopher Waller to warn that the Fed must immediately respond with rate cuts, adding that the urgency for less restrictive rates may warrant a 50 bps slash to kick off the bank’s cutting cycle.

Consequently, investors piled on bets of 125 bps in Fed cuts this year, compared to 100 bps from the end of August. In the meantime, the yield on the 2-year note fell below that of the 10-year for the first time since 2021. This is a sign of a cooling economic outlook.

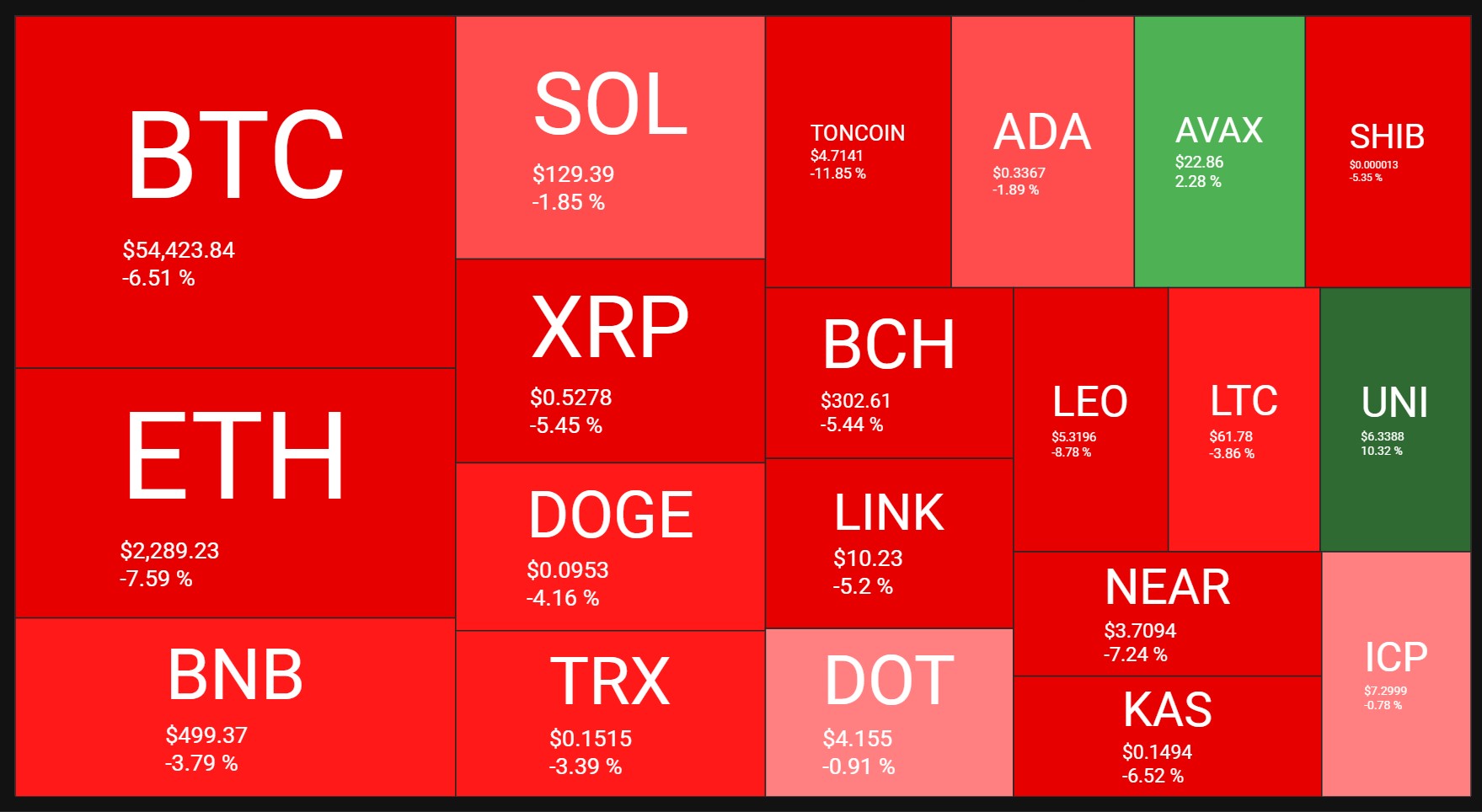

Crypto

Crypto Market Weekly Performance:

Source: quantifycrypto

For the week, Bitcoin and Ethereum prices experienced an 6.5% and 7.5% drop.

BTC is presently trading below its 200 EMA, indicating a medium- to long-term bearish trend.

The price is currently within a declining price channel, and this downward trajectory is anticipated to continue unless there is a notable change in market sentiment. The amount of $52,000, which is at the bottom of the declining channel, is the next important level to keep an eye on. An even more marked sell-off may occur if the price breaks this level and keeps falling.

The bearish view is further supported by decreasing volume, which indicates that bulls do not have enough strength to drive the price higher at this point.

A dearth of supportive market catalysts and institutional outflows seem to be the primary causes of the immediate selling pressure seen on Bitcoin.

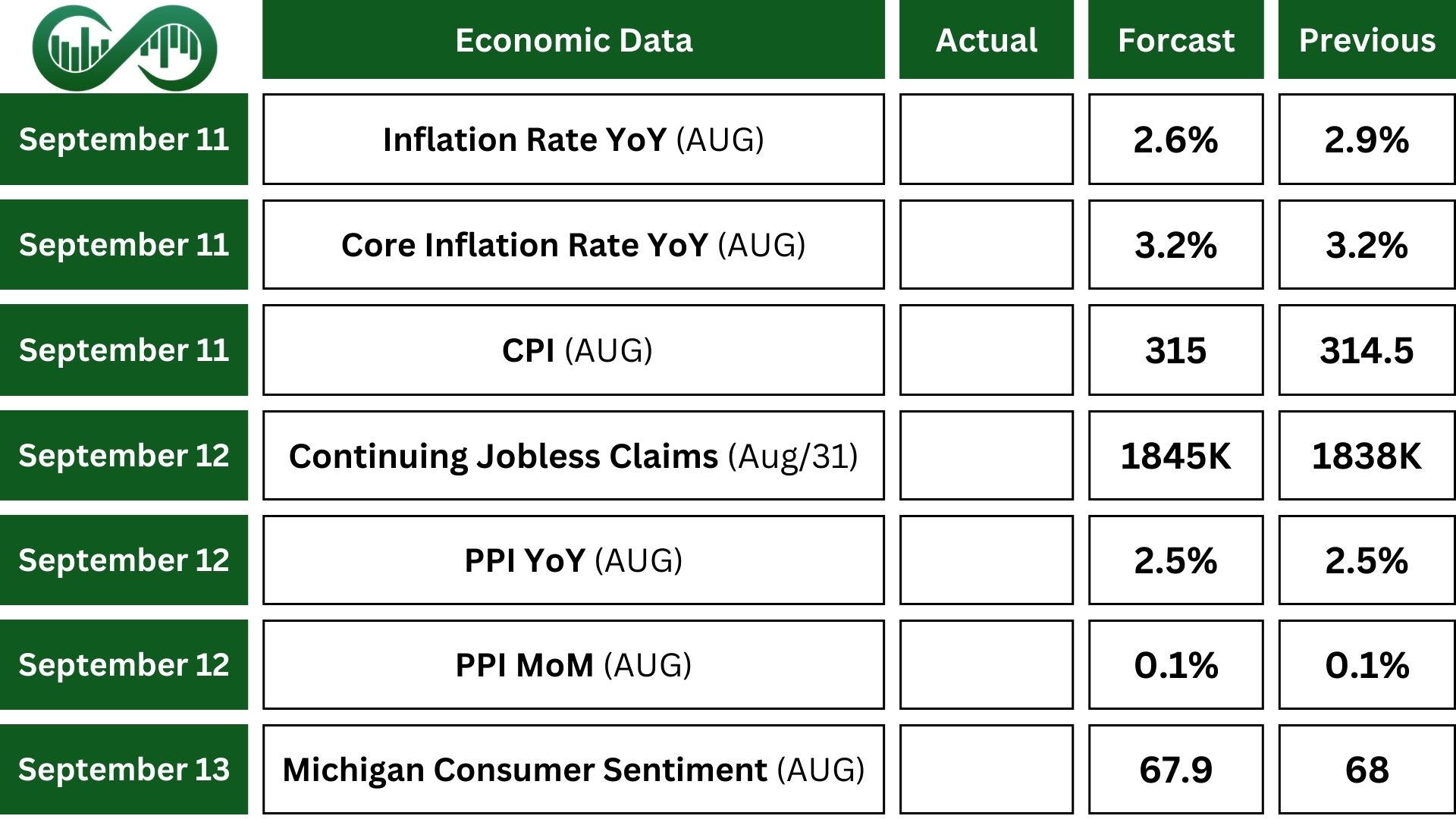

Next Week’s Outlook

Economic Events

This week all eyes will be on the August inflation data, with the annual rate expected to fall to 2.6%.

Month-over-month CPI is seen rising 0.2%. Also, the Producer price index is also on the radar, with markets anticipating a 0.1% month-over-month rise in both core and headline PPI.

Additional important data to follow include the preliminary figures for the Michigan consumer sentiment, export and import prices.

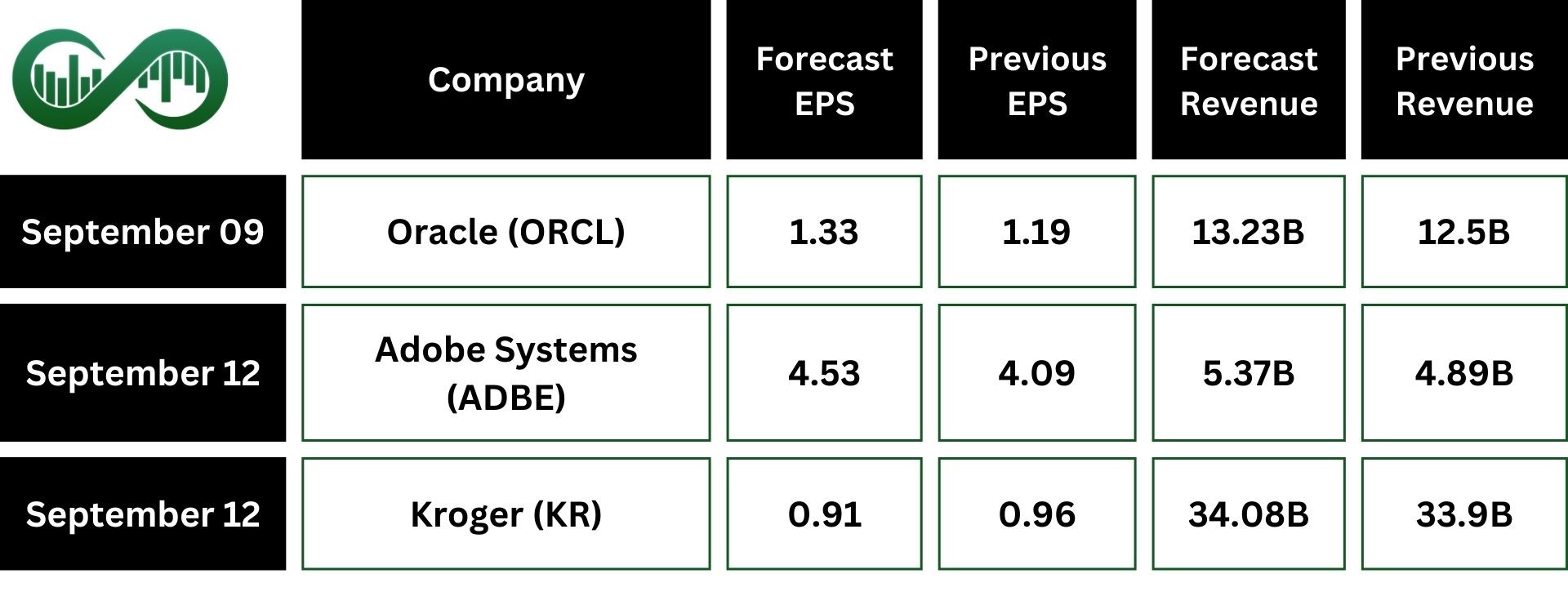

Earning Events

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.