Last week’s market and economic data key points:

- US consumer sentiment improved for the first time in 5-month

- US real GDP grew 3%

- PCE Price Index rose 0.2% in July

- Inflation expectations continued to drift lower

- Dow Jones leaps to a fresh all-time high

- Tech companies drag their peers lower

- Nvidia fell despite beating estimates in revenue and EPS

- Dell shares rose 3% as the revenue top estimates

- Salesforce stock advances after strong quarterly sales

- Super Micro Stock selloff on delayed annual report filing

- Bitcoin hash price hits new low

Table of Contents

Subscribe to Market Mornings Newsletter

Last Week’s Reports

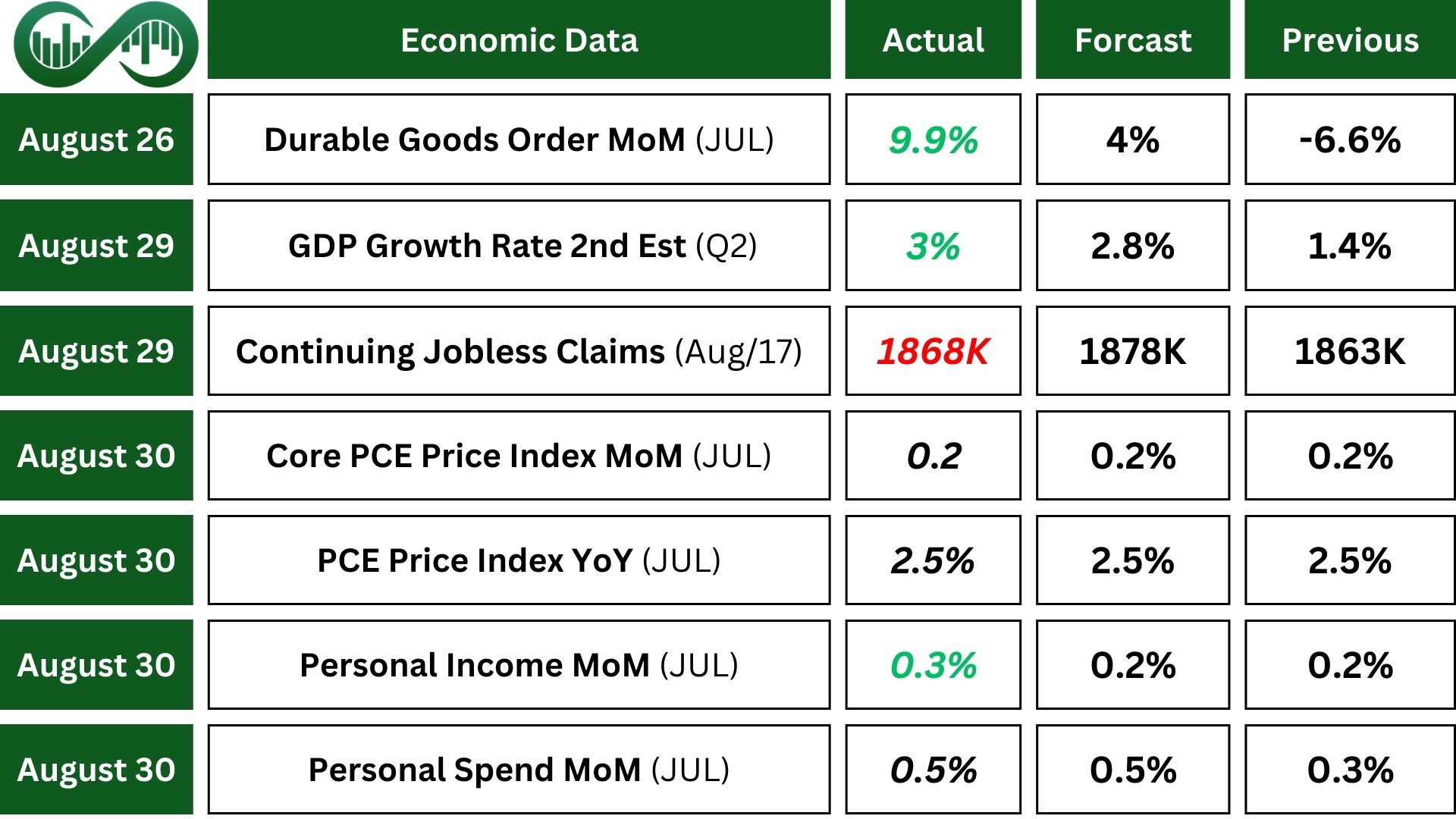

Economic Reports

New orders for manufactured durable goods in the US surged by 9.9% from the previous month. The result challenged the growing pessimism over manufacturing activity, suggesting the current slowdown may be temporary.

The 30-year mortgage rate with conforming loans decreased to 6.35%. This decrease amid market expectations of a Federal Reserve rate cut, though the extent remains uncertain due to recent signs of economic resilience. In the same period last year, the rate on a 30-year benchmark mortgage was 7.18%. Mortgage rates fell again last week due to expectations of a Fed rate cut.

Real gross domestic product (GDP) in the US grew at an annual rate of 3% in the second quarter of 2024, (up from 2.8% in the initial estimate and 1.4% in the first quarter). Showing that the economy is growing at an appropriate pace.

The US personal consumption expenditure (PCE) price index increased by 0.2% in July. The core PCE index, excluding food and energy, also rose 0.2%. Annually, the PCE inflation rate held steady at 2.5%. The core PCE price index is the Federal Reserve’s preferred gauge to measure underlying inflation.

Personal spending in the United States increased 0.5% from the previous month in July. US personal income rose by 0.3% from the previous month in July (up from a 0.2% increase in the previous month and above market forecasts). Showing that consumption in the economy grew at a steady pace.

The initial jobless claim in the US fell to 231,000. Despite this decrease, the figure remained well above the averages seen earlier this year, reinforcing the ongoing trend of a softening labor market. In the meantime, the continuous jobless claims rose to 1,868,000 in the previous week.

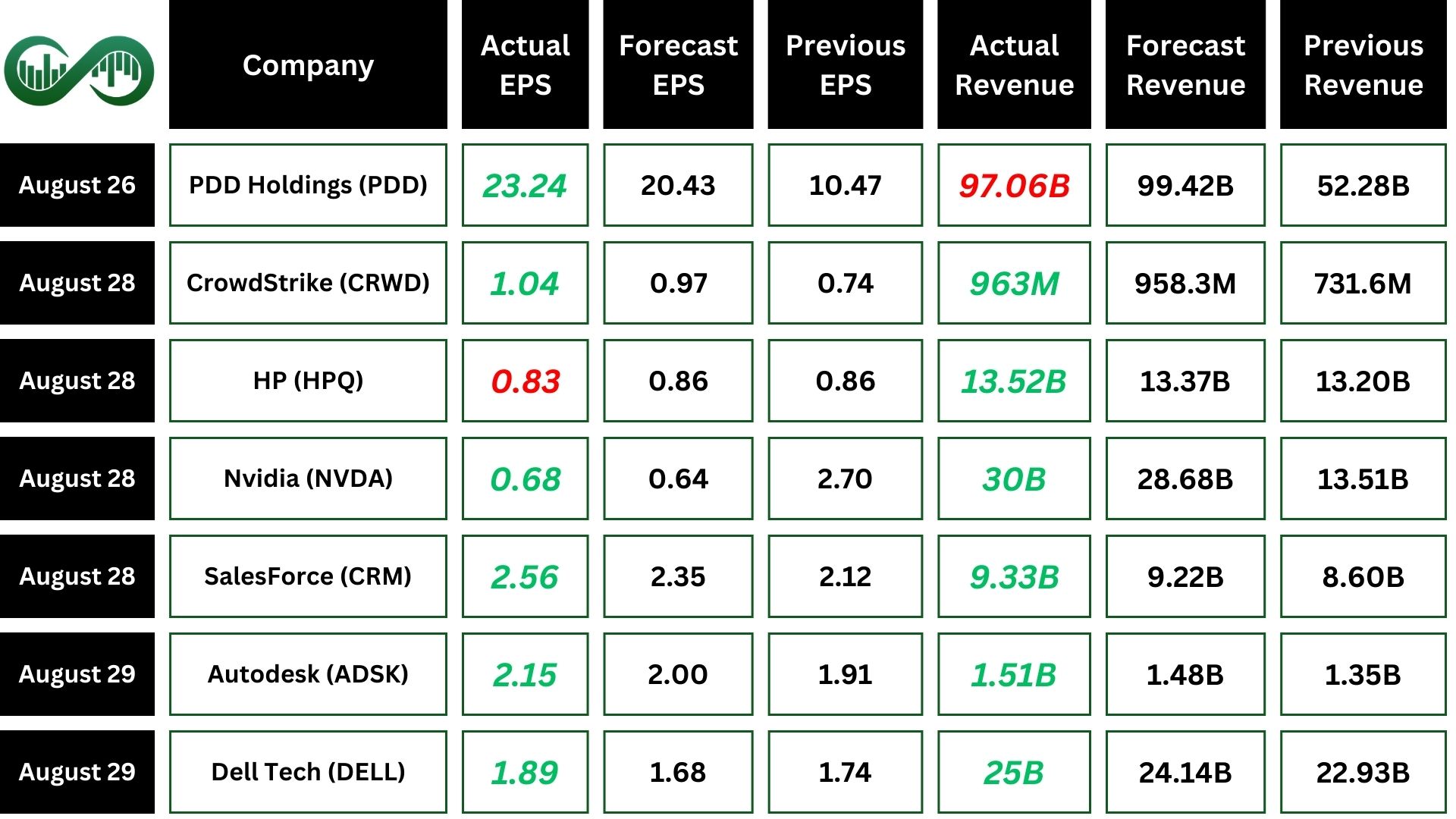

Earning Reports

Crowdstrike

For the quarter ended July 2024, CrowdStrike Holdings (CRWD) reported revenue of $963.87 million, up 31.7% over the same period last year. EPS came in at $1.04, compared to $0.74 in the last year.

CrowdStrike cut its annual revenue forecast, in a sign that demand for its cybersecurity products took a hit from last month’s global Windows outage caused by a faulty update from the company.

The company expects annual revenue of $3.90 billion.

Technically, the stocks had reached a cluster support $210, which the price bounced back from there. If good earnings continue the stock can see $350.

HP

HP (HPQ) reported $13.52 billion in revenue for the quarter ended July 2024, representing a YoY increase of 2.5%. EPS of $0.83 for the same period compares to $0.86 a year ago. With the EPS of $0.86, the EPS surprise was -3.49%.

Salesforce

Salesforce Inc (CRM) reported second-quarter revenue of $9.33 billion, beating the estimate of $9.23 billion. The enterprise cloud solutions company reported adjusted earnings of $2.56 per share, beating estimates of $2.36 per share.

Total revenue was up 8% in YoY. Operating margin rose 19.1%, and non-GAAP operating margin was 33.7%. Cash flow from operations was up 10% YoY.

“In Q2, we delivered strong performance across revenue, cash flow, margin and cRPO, and raised our fiscal year operating margin and cash flow growth,” said Marc Benioff, chair and CEO of Salesforce.

Salesforce is the only company with the leading apps, trusted data and agent-first platform to deliver this vision at scale and help companies realize the incredible benefits of AI.

Nvidia

Shares of AI juggernaut Nvidia (NVDA) sank about 8% last week, despite posting better than anticipated second quarter earnings Wednesday.

Nvidia reported adjusted earnings per share of $0.68 on revenue of $30 billion in its fiscal second quarter (both above estimates). This was a 122% increase in revenue from last year. Also, earnings rose 116% this year.

The company also provided third quarter revenue guidance of $32.5 billion. However, analysts were looking for $31.9 billion. (The company’s outlook is above Street estimates).

The stock fell as much as 6% in immediate reaction, but are up 140% so far this year.

The reason for last week’s decline was the company called for a negative impact in the next quarter because of export restrictions affecting sales to organizations in China and other countries.

“We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions,” Nvidia’s finance chief, Colette Kress, said in a letter to shareholders.

Technically, NVDA is resting in the consolidation area and made a lower high each time which shows slowing in stock’s momentum.

Dell

Dell Technology (PC and server maker) is picking up pace after mostly missing out on AI boom quarter after quarter. Sales in the server unit jumped 80%.

Dell stock (DELL) powered higher by as much as 3% in its first deals Friday after the company posted better-than-expected earnings and revenue figures. The company reported a revenue of $25.06 billion against $24.53 billion expected. Also, earnings arrived at $1.89 a share above forecasts.

Net income jumped 85% from a year ago. However, behind the good results was solid growth in the hottest corner of tech (artificial intelligence). Demand for AI-enabled servers hit $3.1 billion, up from $1.7 billion logged a year ago. Overall, the Servers and Networking revenue rose 80%.

”We are competing in all of the big AI deals and are winning significant deployments at scale,” operating chief Jeff Clark said on the earnings call. “Our AI momentum accelerated in Q2, and we’ve seen an increase in the number of enterprise customers buying AI solutions each quarter,” he added.

Shares of Dell are up by a hefty 53% in 2024, valuing the firm at just under $80 billion.

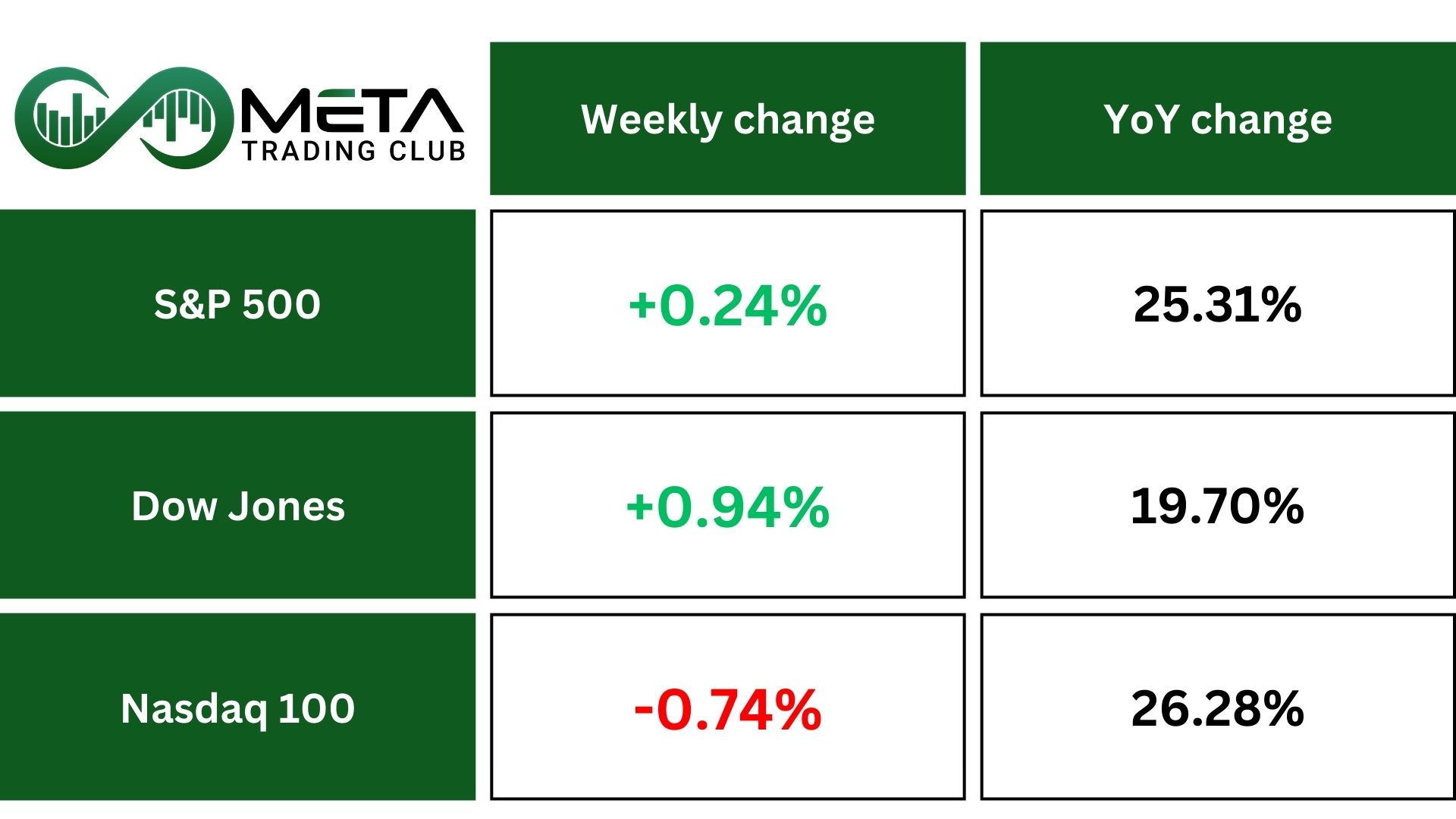

Indices

Indices’ Weekly Performance:

The Dow Jones Industrial Average (DJI), extended its record closing run Friday as markets evaluated the Federal Reserve’s preferred inflation gauge.

The Dow rose 0.94%, while the Nasdaq 100 fell 0.72% despite Friday’s rise and the S&P 500 advanced 0.24% this week.

US markets will be closed Monday for Labor Day. As the US is getting excited to break for the Labor Day holiday weekend, the Dow is showing a monthly gain of 1.8%. The S&P 500 is up 2.3% and the Nasdaq 100 is higher by 1% for the same time span.

Technically, if S&P 500 could break the all-time high resistance 5,670, then probably the index can surge to 5,800.

Stocks

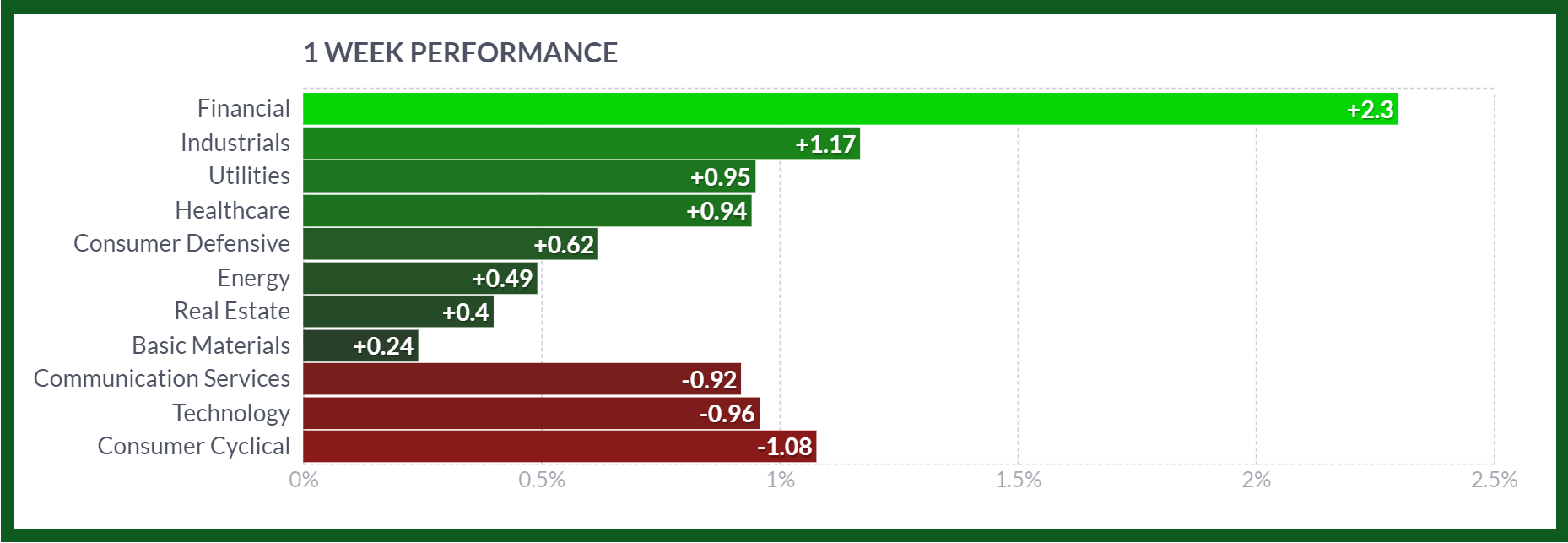

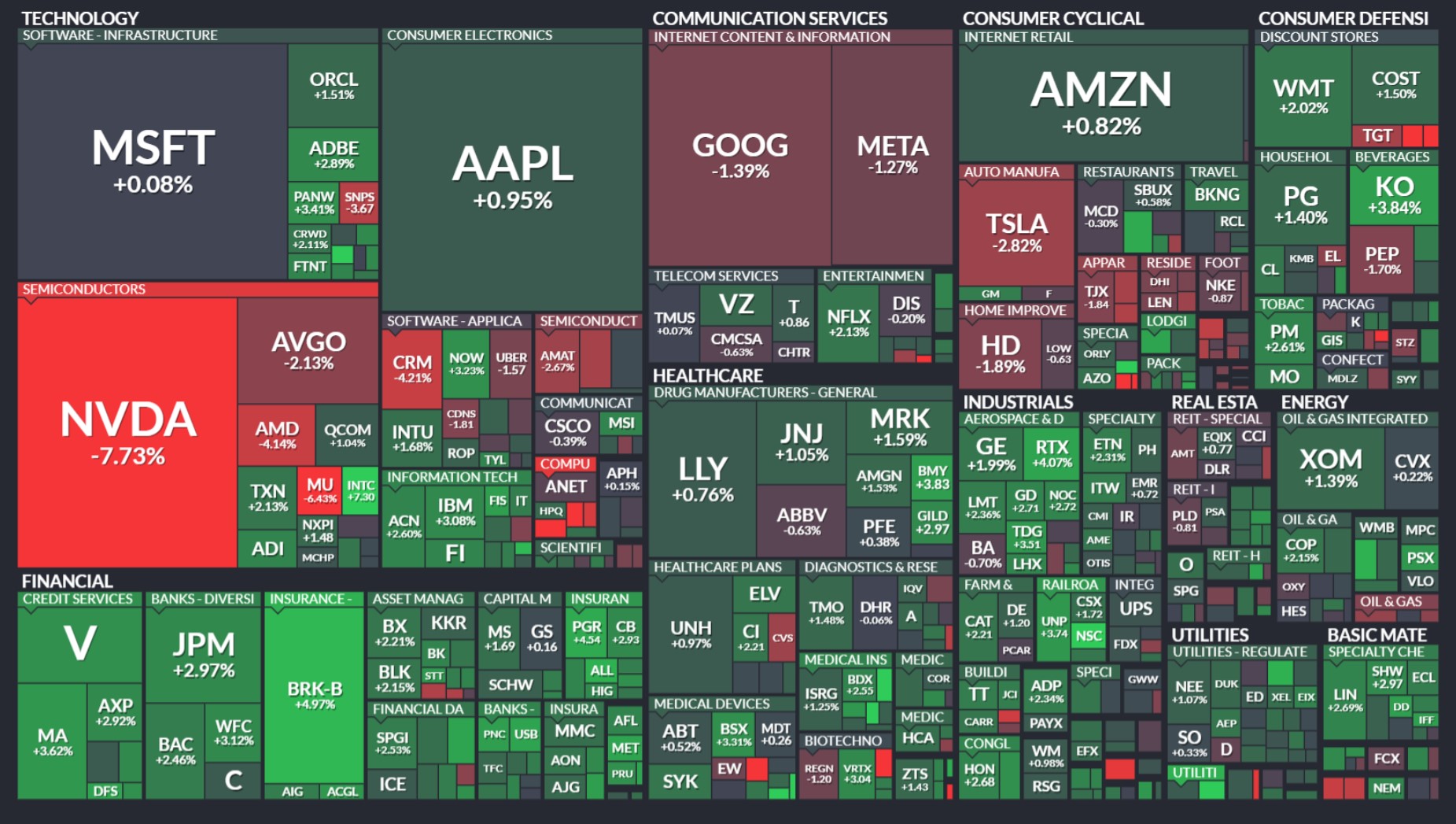

Stock Market Sector’s Weekly Performance:

Source: Finviz

Most sectors notched gains except technology, communication services and consumer cyclical.

Financial was the leading sector with a 2.3% rise. Also, industrials, utilities and the health care sector followed the gains of the week.

Stock Market Weekly Performance:

Source: Finviz

Intel (INTC) shares jumped 7.3% last week and was one of the top gainers on the S&P 500. The chipmaker is working with investment bankers Morgan Stanley and Goldman Sachs as it faces challenges.

Separately, Intel and International Business Machines (IBM) said Thursday they signed a partnership to install Intel’s Gaudi 3 artificial intelligence accelerators on IBM Cloud. IBM shares closed 3% last week.

MongoDB (MDB) was the best performer on the Nasdaq, up 18% last week. The database software maker late Thursday lifted its full-year outlook. The move was prompted by better-than-expected fiscal second-quarter results and improving consumption trends.

Super Micro Computer (SMCI) appears to have a chronic issue with expectation management. The AI server maker failed to report its preliminary data on time, leading to a whopping 23% hit to its stock. On Wednesday, shares fell 19% after Super Micro had the audacity to tell investors that it would be delayed as it needed more time to do the paperwork.

Super Micro stock has erased 37% of its valuation this month and is down more than 62% from its record high of nearly $1,200 in March.

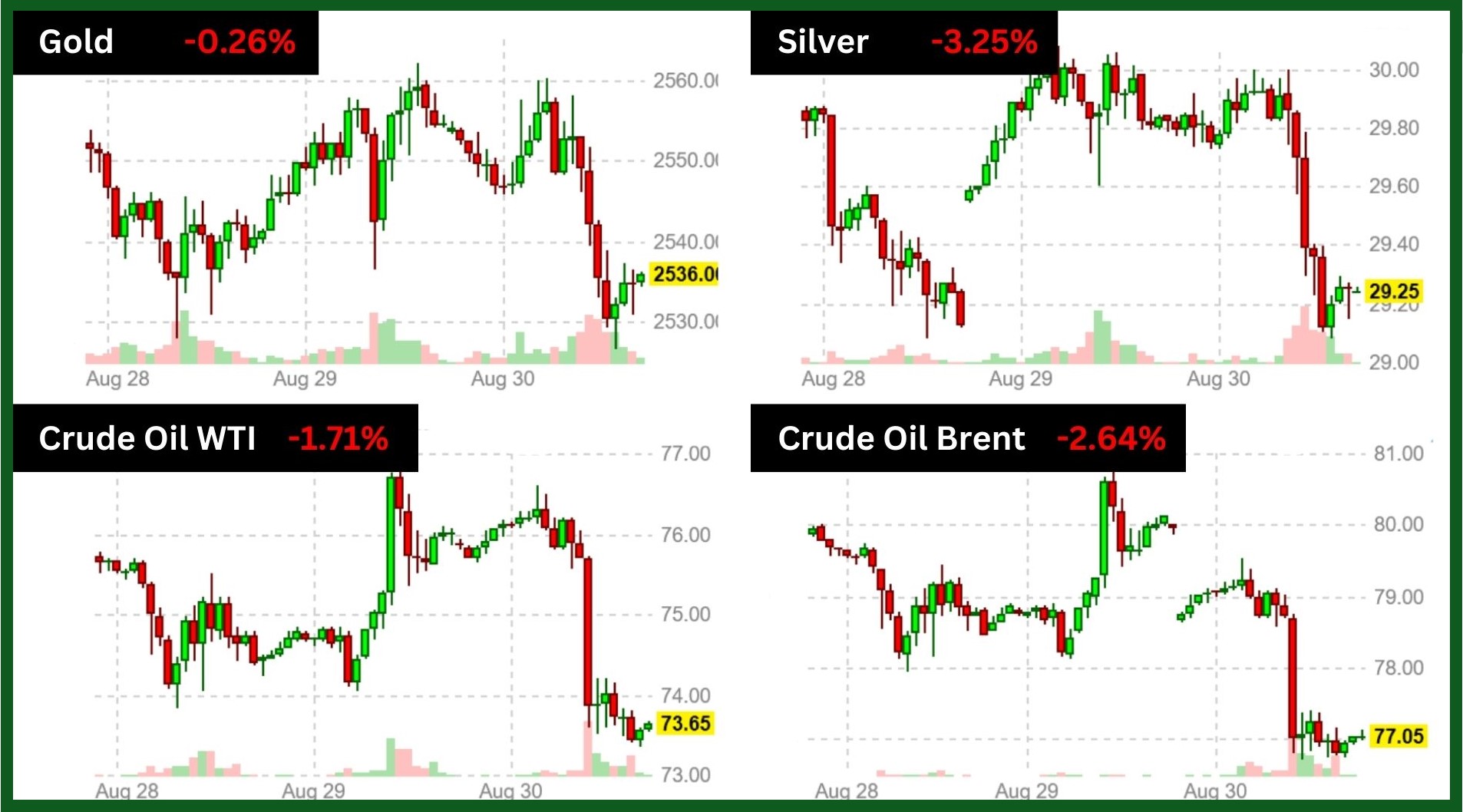

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

WTI crude declined by 3.5% to settle at $73.5 per barrel last week as investors factored in the likelihood of a rise in OPEC supply starting in October. OPEC+ is expected to move forward with a planned oil output hike despite recent Libyan outages and production cuts by some members to offset overproduction.

Libya’s eastern government recently shut down all oil fields, halting production and exports, which had briefly driven oil prices to a near two-week high on August 26.

On the data front, crude inventories in the US are at their lowest since January, with Cushing, Oklahoma stockpiles at their lowest since November.

Oil booked its second monthly drop this year, with Goldman Sachs and Morgan Stanley lowering price forecasts due to weak demand from China, the world’s largest importer.

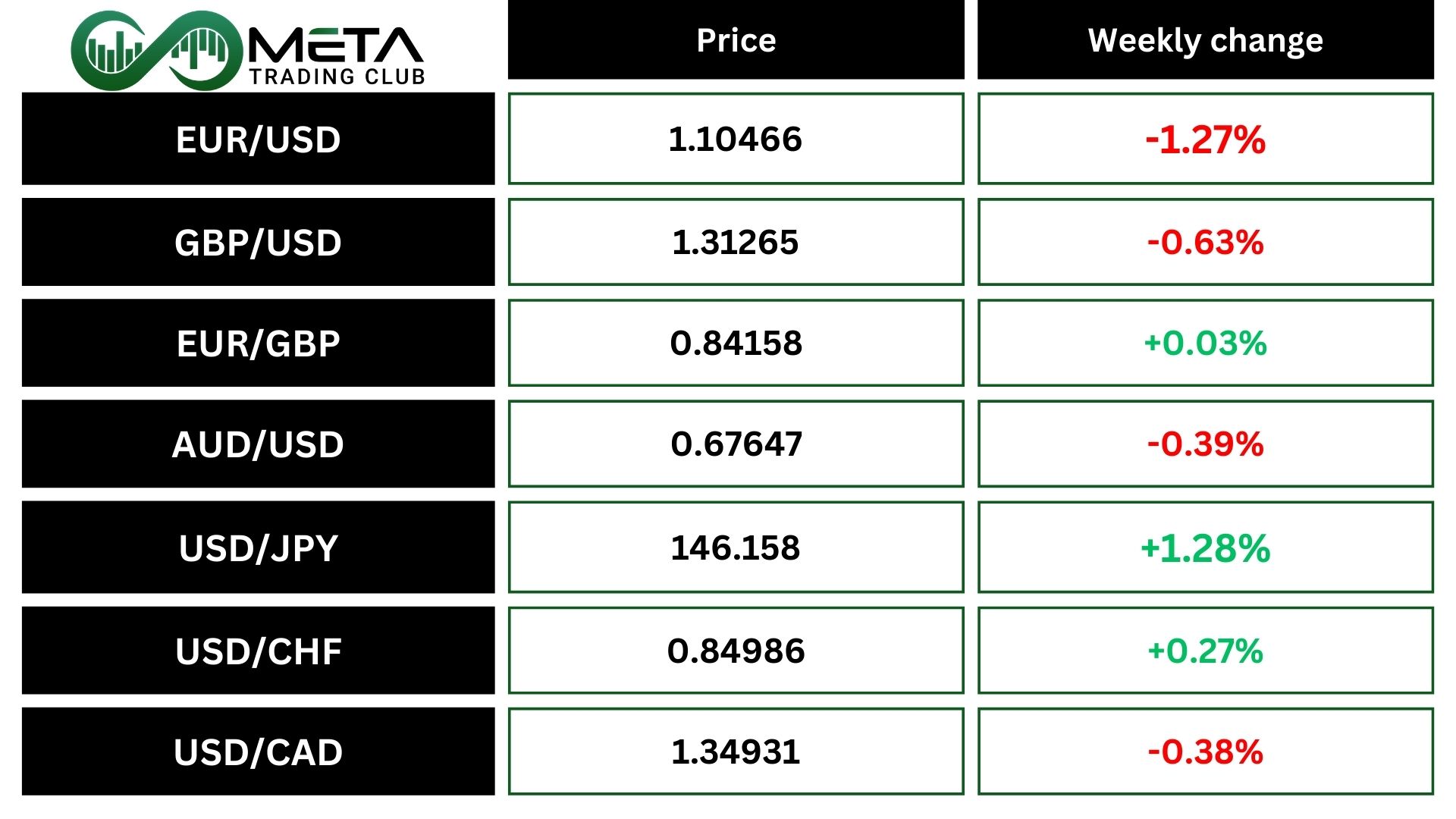

Forex

Weekly Performance of Major Foreign Exchange Pairs:

USD/JPY: The core consumer price index (CPI) for Tokyo in Japan rose 2.4% (accelerating for the fourth consecutive month and exceeding market expectations for a 2.2% rise). That was also the highest reading in six months, reinforcing a hawkish outlook on Bank of Japan monetary policy. The central bank raised interest rates from near-zero levels at the July meeting and signaled willingness to hike rates further. BOJ officials also said recently that they will adjust policy further if the economy and prices continue on the current track.

EUR/USD: The annual inflation rate in the Eurozone fell to 2.2% from 2.6% in the earlier month. The result contrasted from a series of months with stickier inflation above the 2.5%, indicating some progress towards the ECB’s 2% target and aligning with a backdrop that favors interest rates by the central bank.

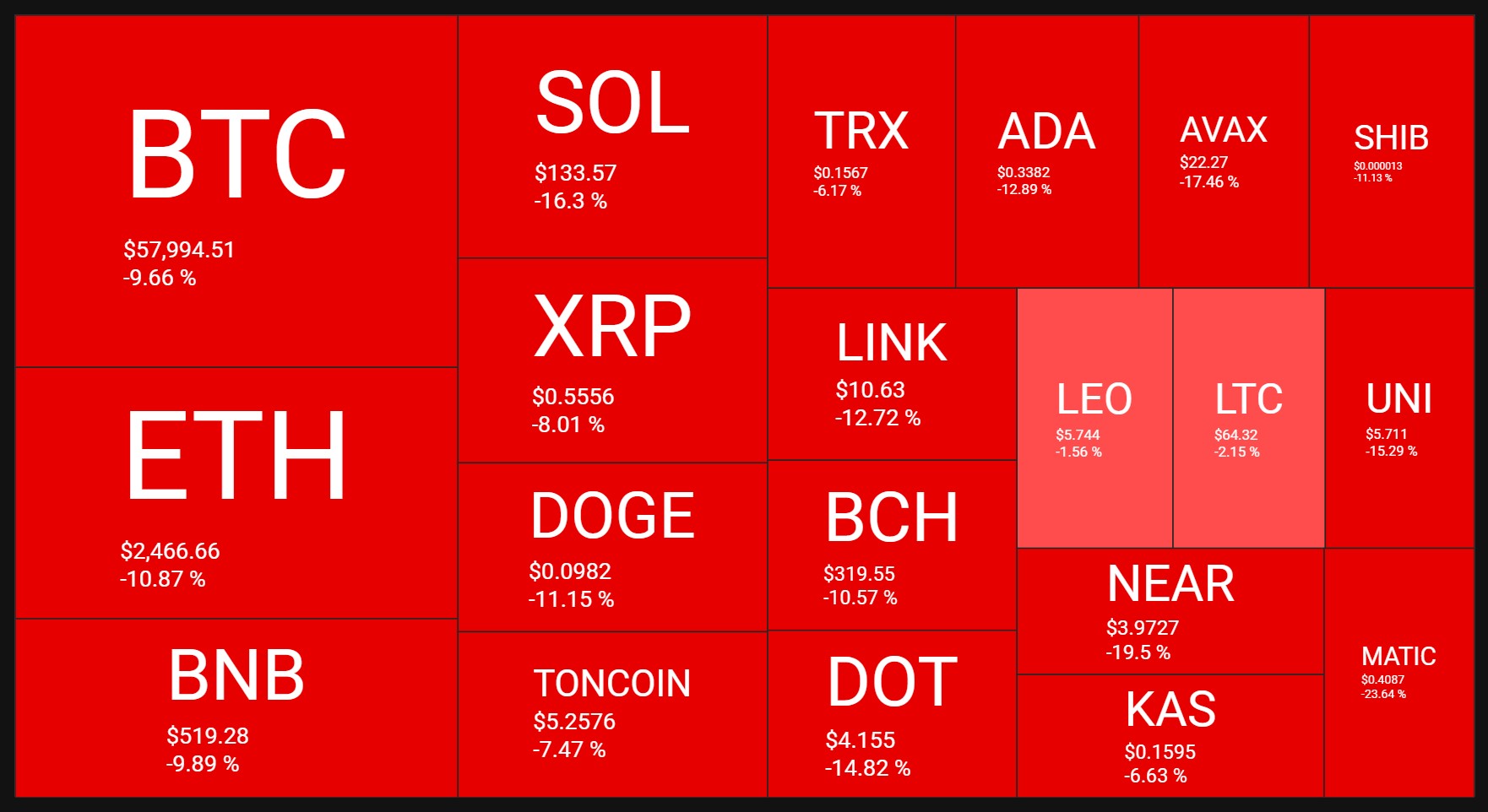

Crypto

Crypto Market Weekly Performance:

Source: quantifycrypto

The price of Bitcoin failed to capitalize on its recent momentum over the past week, losing its hold above $60,000 yet again in August.

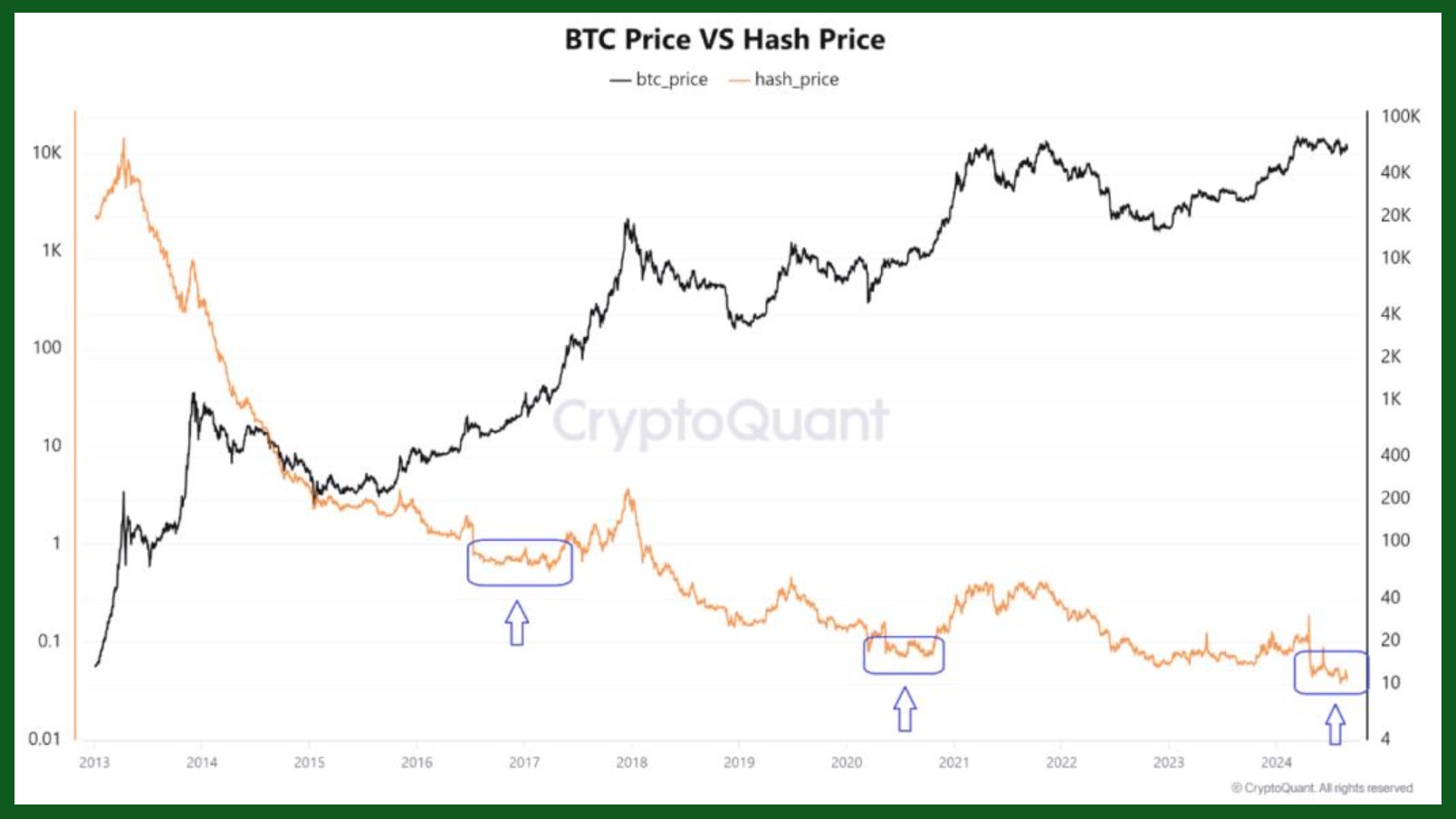

Bitcoin’s hash price hits a new low. The hash price measures the daily revenue generated by BTC miners per terahash per second (TH/s). This metric is calculated by dividing the total daily revenue of miners by the network hash rate. The hash price basically estimates miners’ profit based on the computational power they contribute to the network.

The chart above demonstrates the relationship between the Bitcoin price and the hash price. The highlighted sections in the chart indicate periods where the Hash Price dropped to lower levels, corresponding to times when Bitcoin prices were also at or near their lowest points.

Next Week’s Outlook

Economic Events

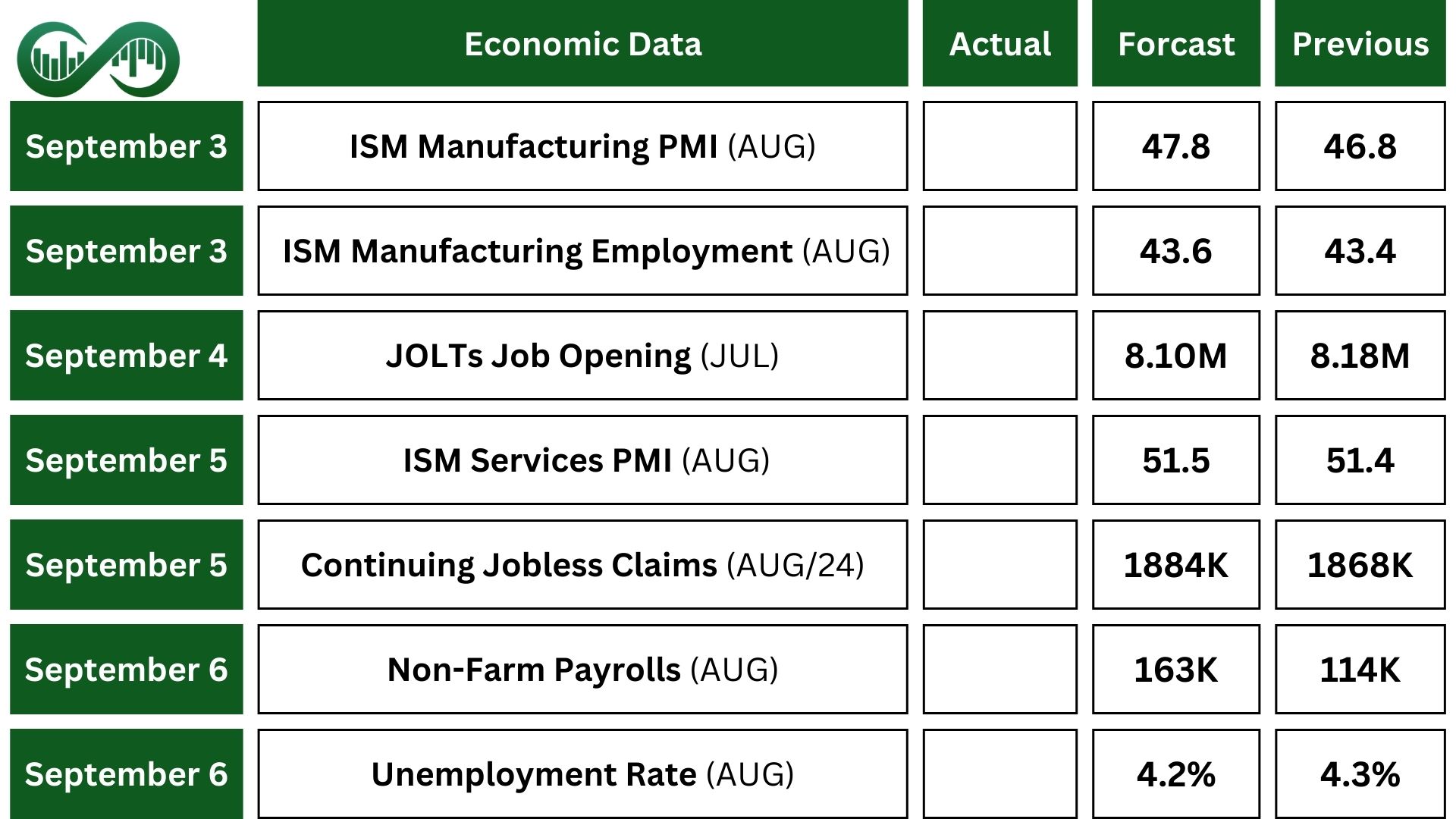

This week, the economic data report includes the ISM Manufacturing PMI and ISM Services PMI.

Other data scheduled to be released next week include Non-Farm Payrolls and Unemployment rate on Friday.

Earning Events

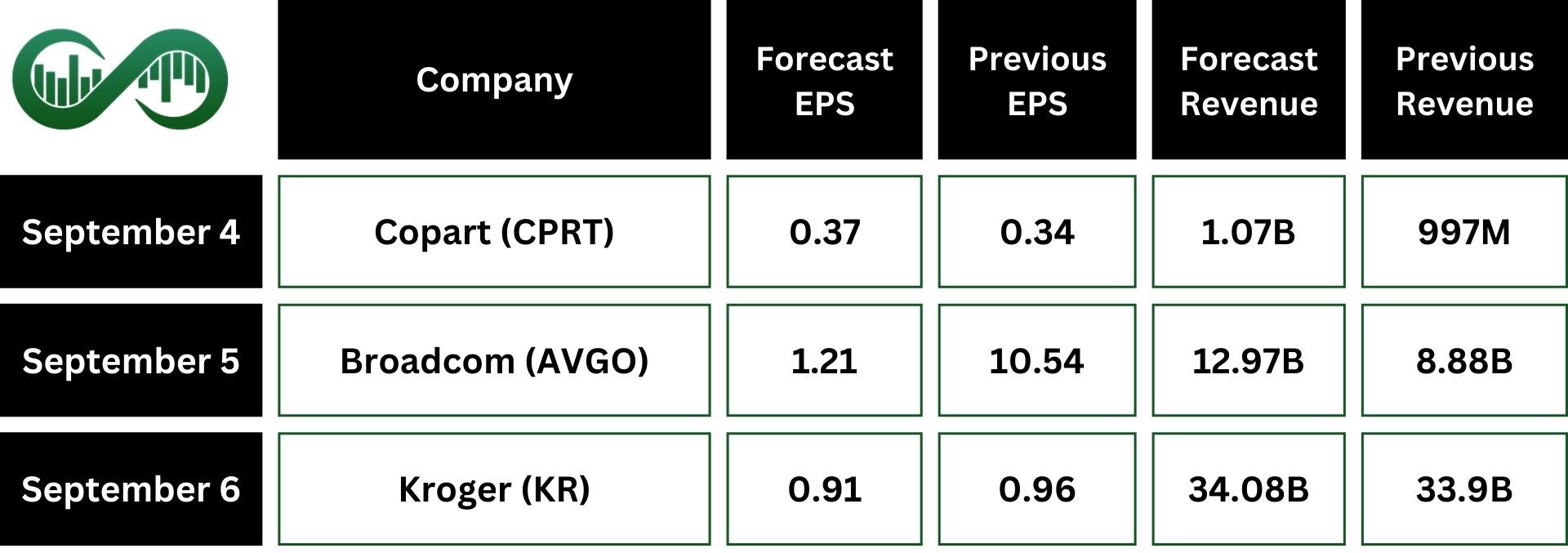

Earnings reports coming this week include Q4 reports of Copart, Q3 reports of Broadcom and Q2 report of Kroger.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.