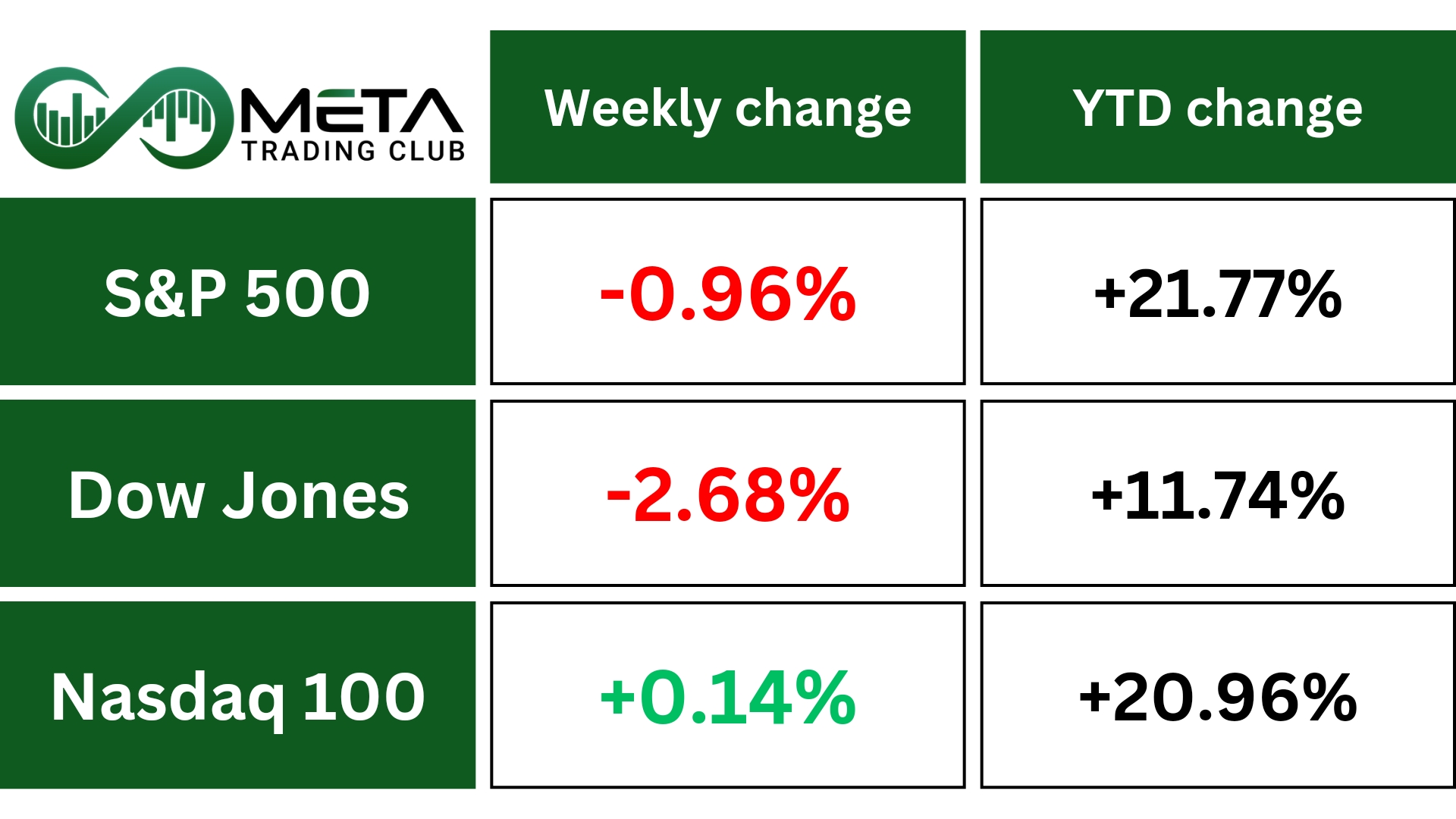

Last week’s market and economic data key points:

- S&P 500 fell 0.96%, Dow plunged 2.68%

- Tesla surged 22% after strong earnings, adding $150 billion in market capitalization

- Philip Morris gained 8% on strong performance in smoke-free products

- Canada cut interest rates by 50 bps to 3.75%, making mortgages cheaper

- US Durable Goods Orders decreased by 0.8% in September

- Michigan Consumer Sentiment revised higher to 70.5 in October

- Crude oil prices remained flat around $75 per barrel amid geopolitical risks

- Bitcoin fell from the top of descending channel

- Dollar strengthened, Euro fell to a 3-month low at 0.92 USD, Yen weakened further

Table of Contents

Last Week’s Reports

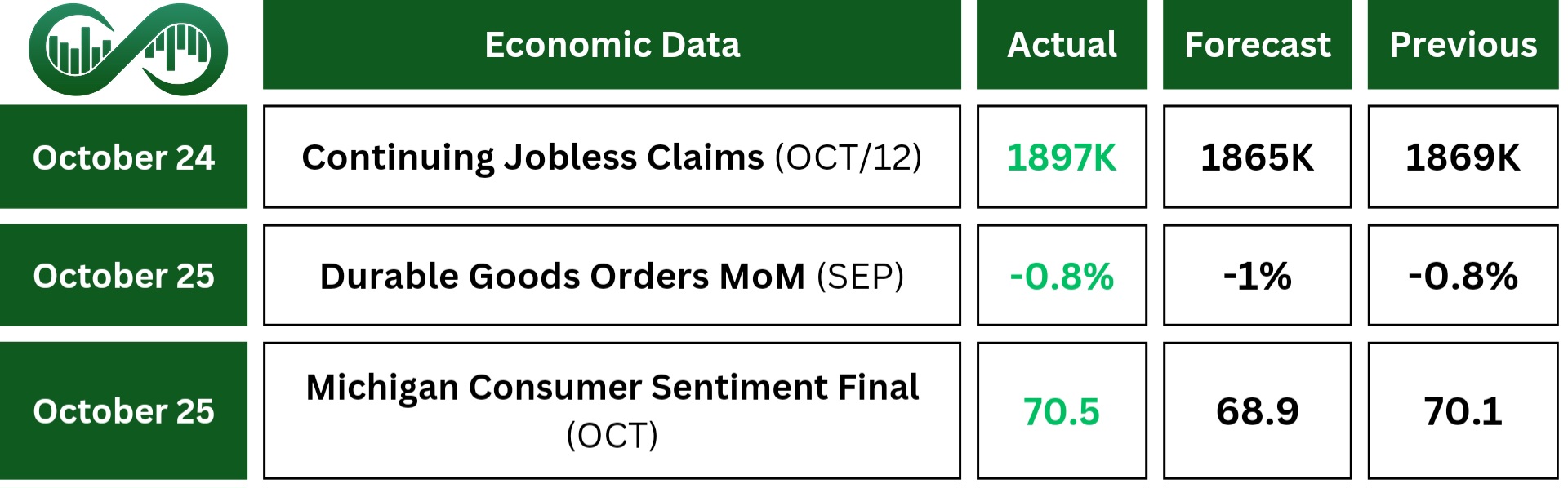

Economic Reports

In September 2024, durable goods orders in the U.S. dipped by 0.8%, slightly better than the anticipated 1% decline. This data comes against the backdrop of the ongoing Boeing strike, which significantly impacted overall orders. Also, political uncertainties, especially around the upcoming election, continue to influence business sentiment and order flows.

In October 2024, the University of Michigan’s consumer sentiment index was revised higher to 70.5, marking the highest level in six months and reflecting a third consecutive month of increases. This uplift was driven by modest improvements in buying conditions for durables, partly due to easing interest rates.

Year-ahead inflation expectations were revised down to 2.7% from an earlier estimate of 2.9.

Also, the five-year inflation outlook was confirmed at 3%, down from a near one-year high of 3.1% in September.

The upcoming election looms large over consumer expectations, with shifting sentiments about the potential presidential outcomes.

This rise in consumer sentiment and adjustments in inflation expectations suggest a cautious optimism among consumers, tempered by economic and political uncertainties.

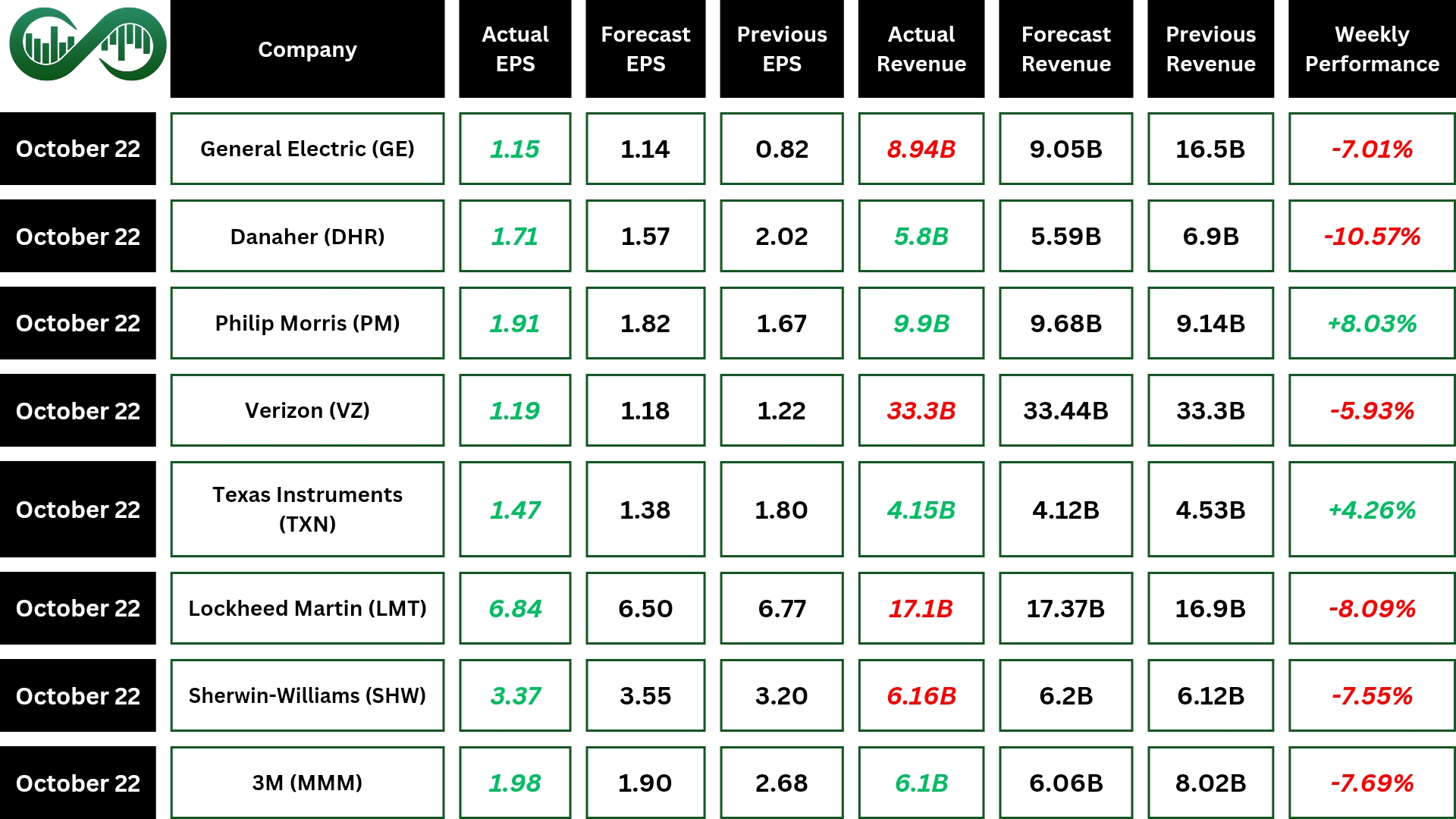

Earning Reports

GE Aerospace

In Q3 2024, GE Aerospace (GE) reported a 6% increase in revenue to $8.943 billion, slightly below expectations. Also, the company’s adjusted EPS rose by 25% to $1.15, surpassing forecasted.

The most significant factor released was the 28% surge in total orders, driven by strong demand across its segments.

Despite these positive results, GE’s stock fell by 7% this week due to concerns over supply chain constraints and margin pressures.

Danaher

Danaher (DHR) Q3 2024 earnings revealed a revenue of $5.8 billion, surpassing expectations and an adjusted EPS of $1.71, exceeding expectations of $1.57.

However, the company’s stock fell by 10% due to concerns over a projected low-single-digit decline in non-GAAP core revenue for the full year.

The most significant news released during the earnings was the continued positive momentum in the bioprocessing business, which saw high single-digit sequential order growth.

Philip Morris International

In Q3 2024, Philip Morris International (PM) reported a revenue of $9.9 billion, surpassing the forecasted $9.57 billion, and an adjusted EPS of $1.91, exceeding expectations.

The most significant report in the earnings was the 14.2% organic growth in net revenues from smoke-free products, driven by strong demand for IQOS and ZYN.

In addition, the company’s stock surged by 8% due to investor optimism about the company’s transition towards smoke-free products and its strong performance across all regions.

General Motors

General Motors (GM) reported strong Q3 2024 earnings, with revenue reaching $48.8 billion, surpassing forecasts of $44.7 billion. Also, the company’s earnings per share (EPS) came in at $2.96, well above the forecasts.

The most notable factor in the earnings was the 15.5% increase in EBIT-adjusted earnings, reaching $4.1 billion.

Following the earnings release, GM’s stock surged by 4.9%.

Tesla

Tesla (TSLA) Q3 2024 earnings report revealed a revenue of $25.18 billion, slightly below the forecasted $25.4 billion. Also, the company’s earnings per share (EPS) came in at $0.62, surpassing estimates.

The most significant factor released during the earnings was the positive gross margin achieved by the Cybertruck production for the first time.

Following the report, Tesla’s stock surged by 22%, marking its best day since 2013.

Coca-Cola

In Q3 2024, Coca-Cola (KO) reported a revenue of $11.9 billion, slightly above the forecasts, and an adjusted EPS of $0.77, surpassing expectations.

Despite these positive results, Coca-Cola’s stock fell by 5% due to concerns over sluggish demand in some international markets and unfavorable foreign currency translations

IBM

In Q3 2024, International Business Machinery (IBM) reported a revenue of $15.0 billion, slightly below the forecasted $15.07 billion. Also, the company’s adjusted EPS was $2.30, in line with expectations.

The most significant news released in the earnings was the 10% growth in software revenue, driven by a re-acceleration in the Red Hat business.

IBM’s stock fell by 7% due to weaker-than-expected consulting and infrastructure revenue.

Boeing

In Q3 2024, Boeing (BA) reported a revenue of $17.8 billion, slightly below the forecasted $17.94 billion. Moreover, the company posted a significant GAAP loss of $9.97 per share and a core (non-GAAP) loss of $10.44 per share.

The most significant issue of the earnings was the ongoing strike by the International Association of Machinists and Aerospace Workers (IAM), which has significantly impacted operations.

So, Boeing’s stock fell by 5.93% due to the substantial losses and ongoing labor disputes.

S&P Global

In Q3 2024, S&P Global (SPGI) reported a revenue of $3.6 billion, surpassing the forecasts, and an adjusted EPS of $3.89, exceeding expectations.

There was an 83% increase in transaction revenue within the Ratings division.

Despite these positive results, S&P Global’s stock fell by 6.5% due to concerns over increased expenses and challenges in the financial services sector.

Indices

Indices’ Weekly Performance:

The S&P 500 appears to have formed a short-term peak at 5878.46, suggesting possible consolidation ahead. A deeper pullback to the 55-day EMA, currently at 5679.09, is possible. However, the bullish outlook remains intact as long as the resistance-turned-support at 5669.67 holds.

The long-term uptrend targets the 6000 mark or the 61.8% projection. On the flip side, bearish divergence in both the daily MACD and RSI could indicate medium-term topping if 5669.67 breaks, leading to a deeper correction towards channel support at 5445 or even further to structural support at 5119.26.

Stocks

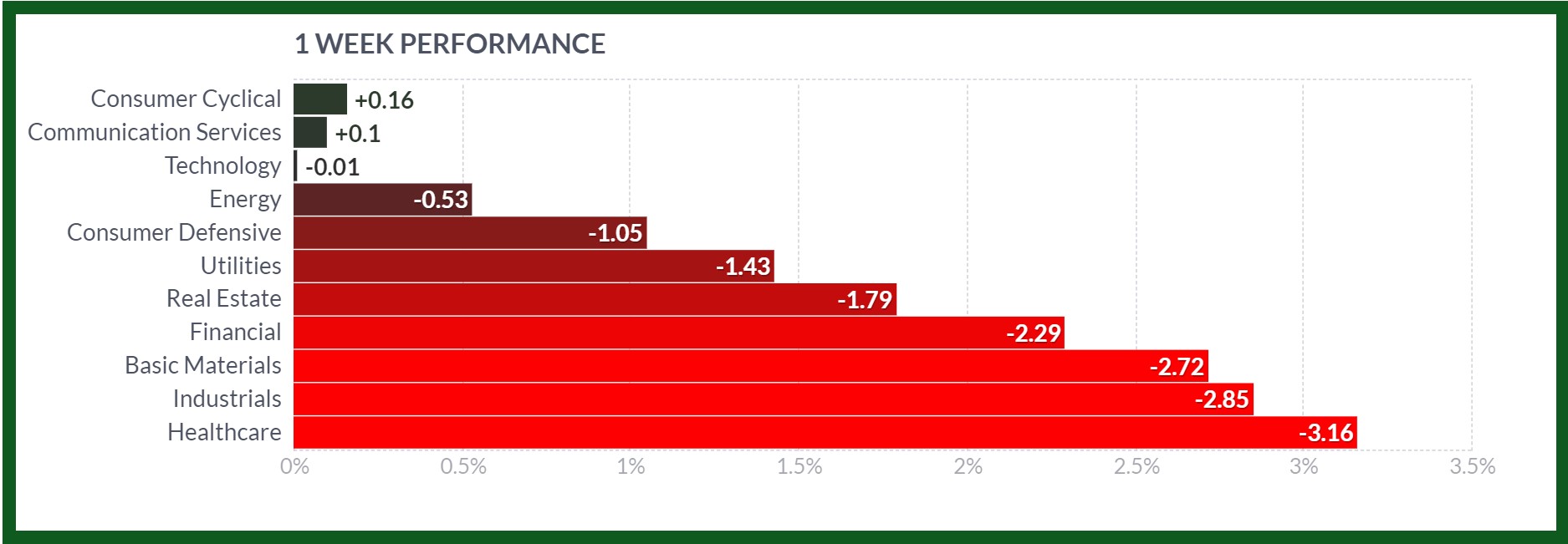

Stock Market Sector’s Weekly Performance:

Source: Finviz

This week, the sector performance was varied, with both gains and losses across different industries:

- Consumer Cyclical and Communication Services: These were the only sectors to post gains this week, albeit modest ones, at +0.16% and +0.1% respectively.

- Technology: Was nearly flat, showing a slight decline of -0.01%, indicating stability amid broader market volatility.

- Energy: Dropped by -0.53%, reflecting ongoing fluctuations in crude oil prices and oil demand.

- Consumer Defensive, Utilities, Real Estate: Experienced moderate declines, indicating a shift in investor sentiment towards higher-risk sectors.

- Financial and Basic Materials: Saw significant drops of -2.29% and -2.72% respectively, potentially due to concerns over interest rates and global economic uncertainties.

- Industrials and Healthcare: Were the hardest hit, with declines of -2.85% and -3.16%, suggesting sector-specific challenges and broader market pressures.

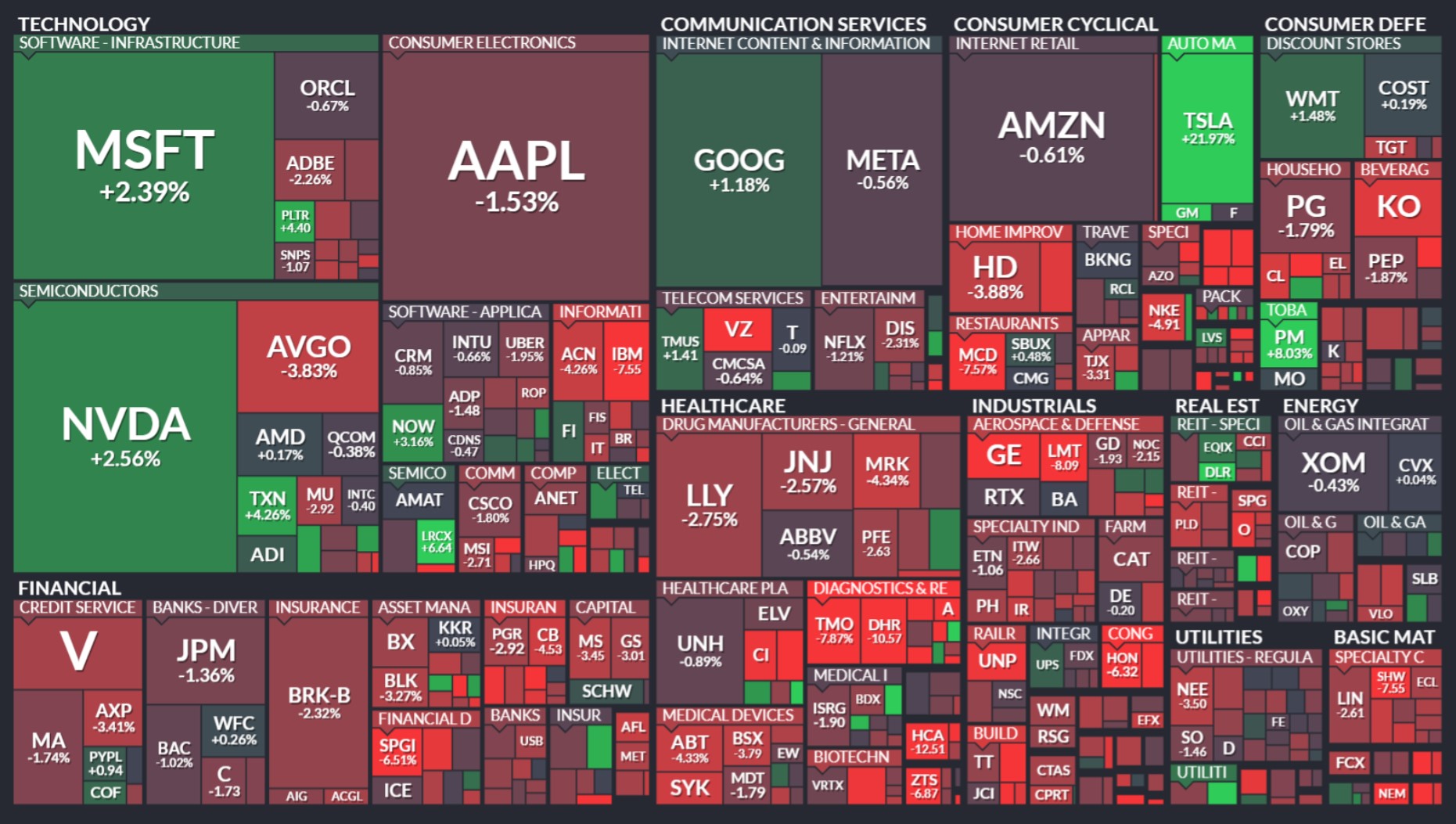

Stock Market Weekly Performance:

Source: Finviz

Top 10 Gainers in the S&P 500

This week, the S&P 500 saw some significant movements among its constituents. Here are the top 10 gainers, ranked by their weekly performance:

- Tesla, Inc. (TSLA): Tesla surged 21.97% on strong quarterly results and investor optimism about future growth.

- Molina Healthcare Inc (MOH): Molina gained 12.84%, driven by solid earnings and positive guidance, reflecting strong operational execution.

- Tapestry, Inc. (TPR): Tapestry rose 11.26% on better-than-expected earnings and robust sales growth in the luxury fashion sector.

- Digital Realty Trust, Inc. (DLR): Digital Realty increased 10.37% due to rising demand for data center services.

- Philip Morris International Inc (PM): Philip Morris saw an 8.16% gain, attributed to strong earnings and developments in alternative tobacco products.

- lululemon athletica inc. (LULU): Lululemon climbed 7.27% on strong quarterly sales and a positive growth outlook.

- GE Vernova Inc. (GEV): GE Vernova’s stock rose 7.25% due to positive earnings and strategic business initiatives.

- Palantir Technologies Inc. (PLTR): Palantir increased 6.77%, fueled by robust demand for its data analytics platform.

- ResMed Inc. (RMD): ResMed’s stock gained 6.43% on strong sales in its sleep apnea and respiratory care products.

- Labcorp Holdings Inc. (LH): Labcorp saw a 5.90% increase, driven by strong quarterly earnings and positive market sentiment.

Commodity

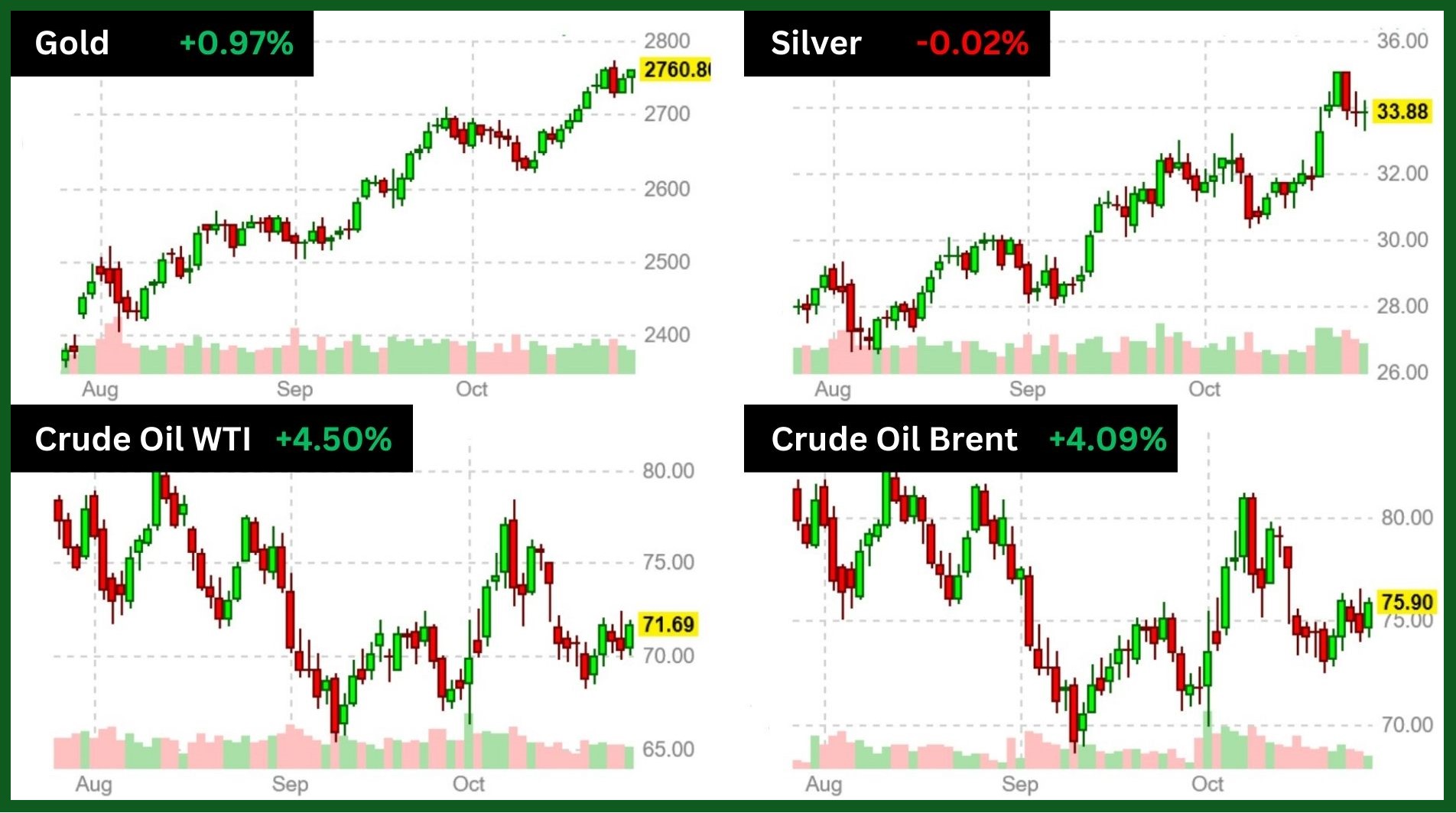

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

Gold‘s record-breaking rally paused as profit-taking emerged ahead of the November 5 elections, driven by rising bond yields and a stronger dollar.

Silver, which recently surged past key resistance at $32.50, also faced profit-taking after hitting a 12-year high.

Over the past year, gold and silver have seen unprecedented gains of 31% and 38%, respectively, with only minor corrections.

The future pace of this rally depends on the election outcome, which could impact global trade relations, the dollar, government spending, and U.S. debt levels. However, the long-term outlook remains positive due to concerns over fiscal instability, safe-haven demand, and geopolitical tensions.

Silver needs to hold $32.50 while gold looks for support at $2,685, $2,666, and $2,600.

The geopolitical tensions in the Middle East, especially the potential for an Israeli attack on Iran, are certainly keeping crude oil prices on edge. On the other hand, demand concerns from China and the upcoming U.S. elections are adding to the uncertainty.

Also, OPEC+ decisions to potentially add more barrels to the market could also influence price

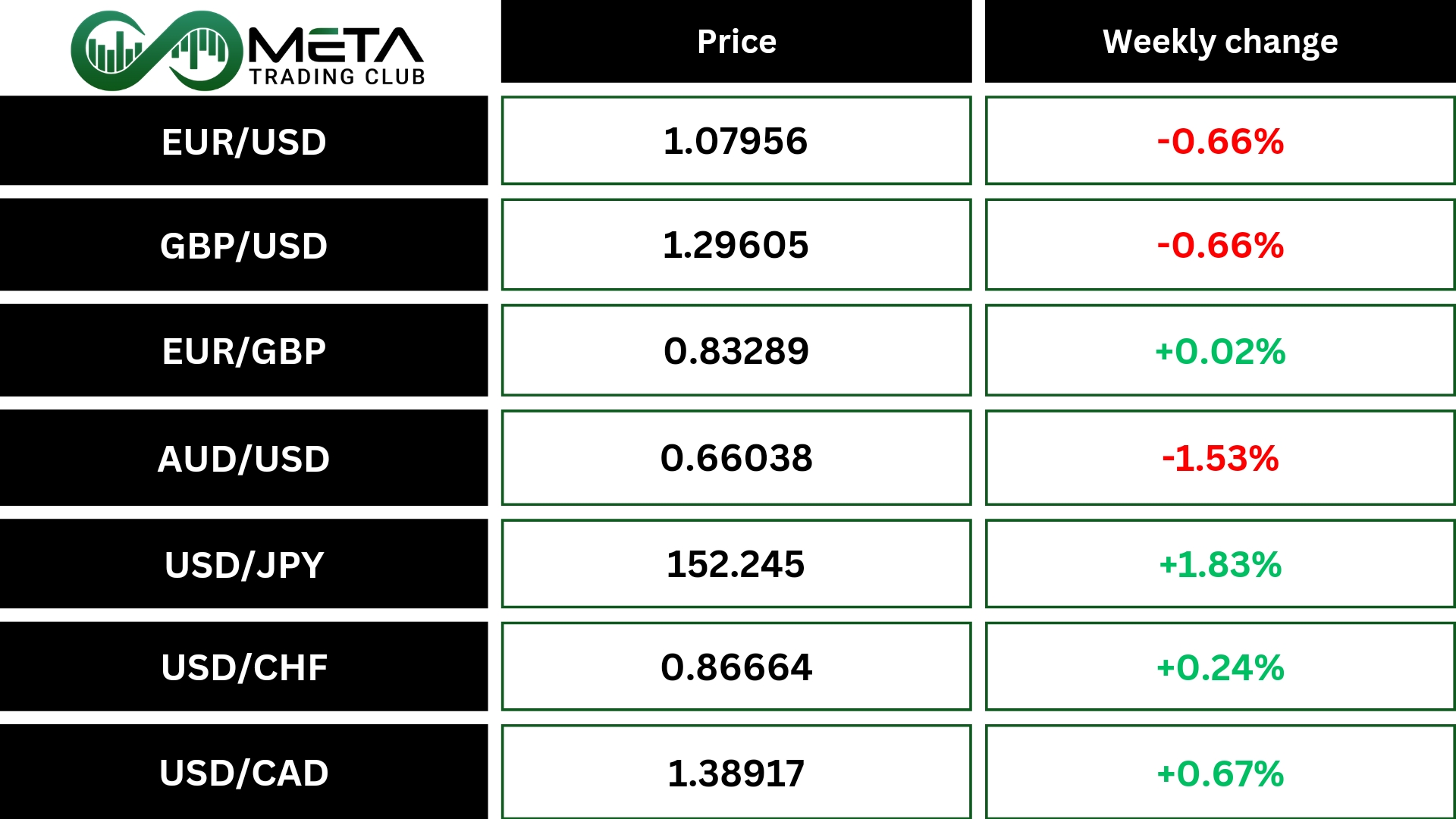

Forex

Weekly Performance of Major Foreign Exchange Pairs:

The Dollar emerged as the clear winner in currency markets last week, with the Dollar Index surging past key resistance levels. This came as investors exercised caution ahead of the upcoming US presidential election.

Meanwhile, the Japanese Yen suffered a significant selloff, ending as the worst-performing major currency due to political uncertainty and weak regional stock performance. This uncertainty also weighed heavily on Nikkei, which saw significant declines.

The Euro showed resilience despite discussions about monetary easing in the ECB.

The Canadian Dollar and Swiss Franc were former currencies last week. However, their strength was modest but couldn’t match the Dollar’s dominance.

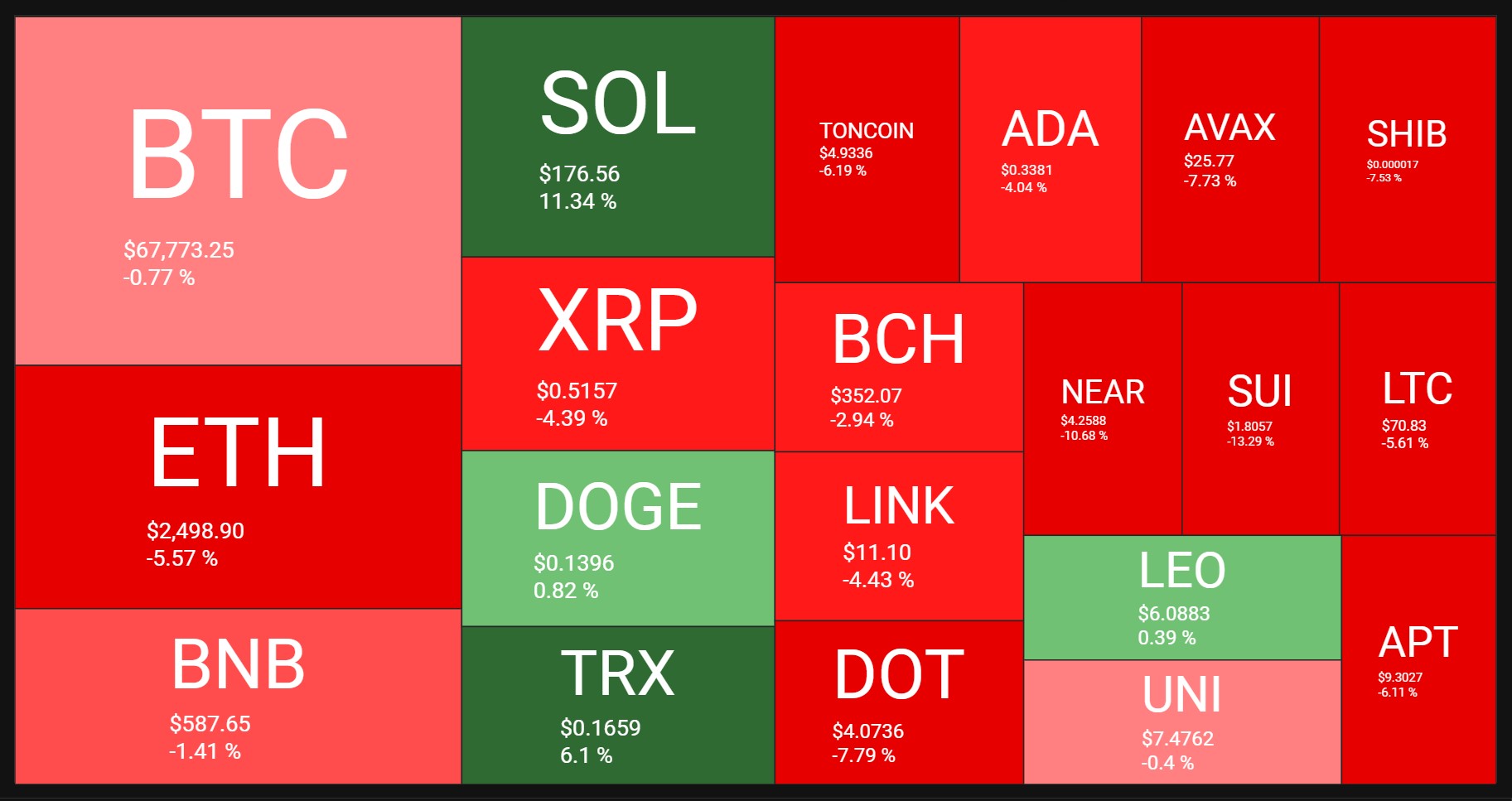

Crypto

Crypto Market Weekly Performance:

Source: quantifycrypto

Bitcoin has struggled to close above the critical $70,000 mark, leading to $50 million in long liquidations after a recent 2% price decline. This marks the largest losses for long traders in the past two weeks. Despite the setback, market sentiment remains bullish, with many traders holding their positions, reflecting confidence in Bitcoin’s potential for further gains. The volatility highlights the challenges in maintaining price support, but the resilience of long traders suggests that market confidence is largely intact.

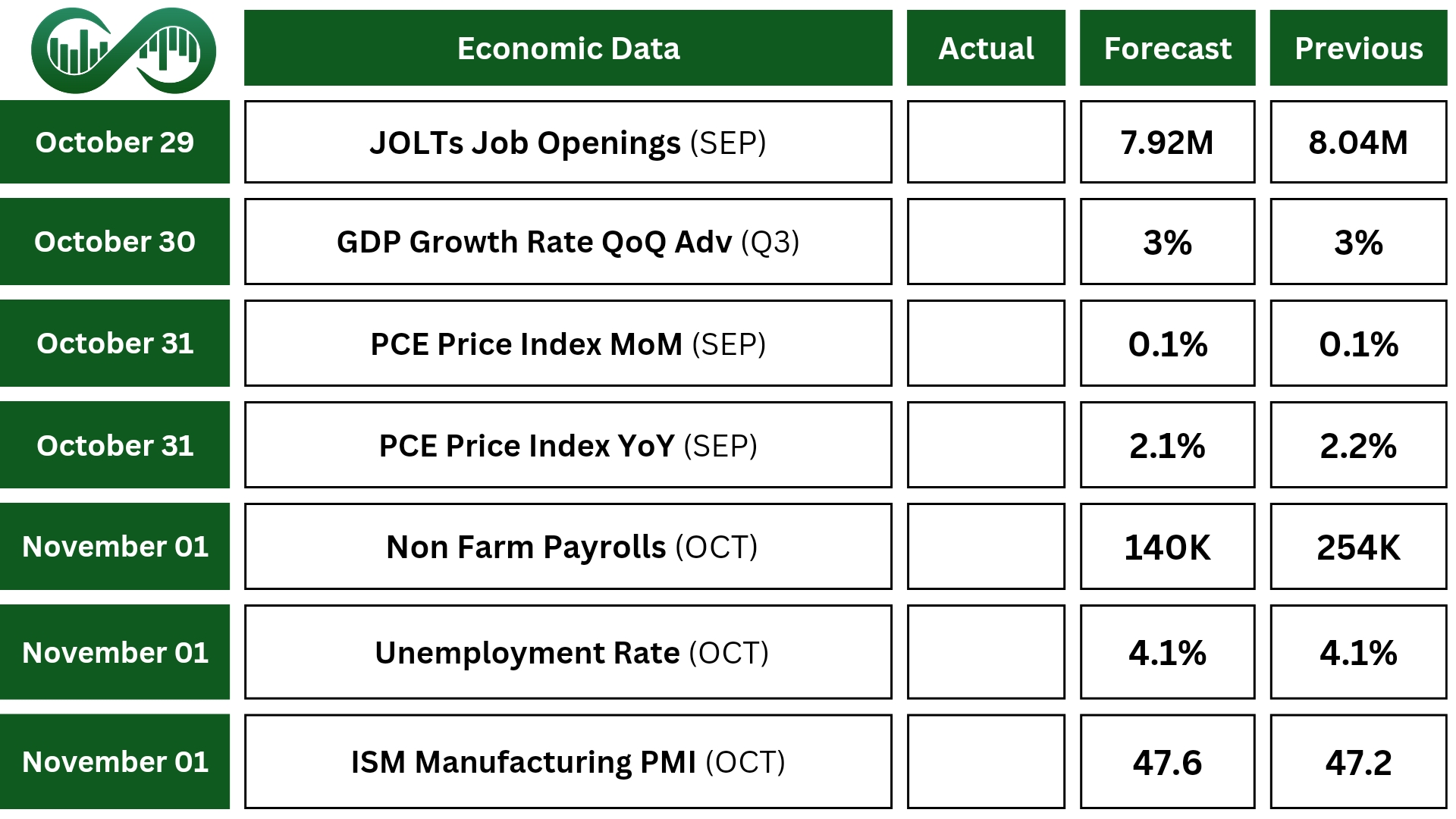

Next Week’s Outlook

Economic Events

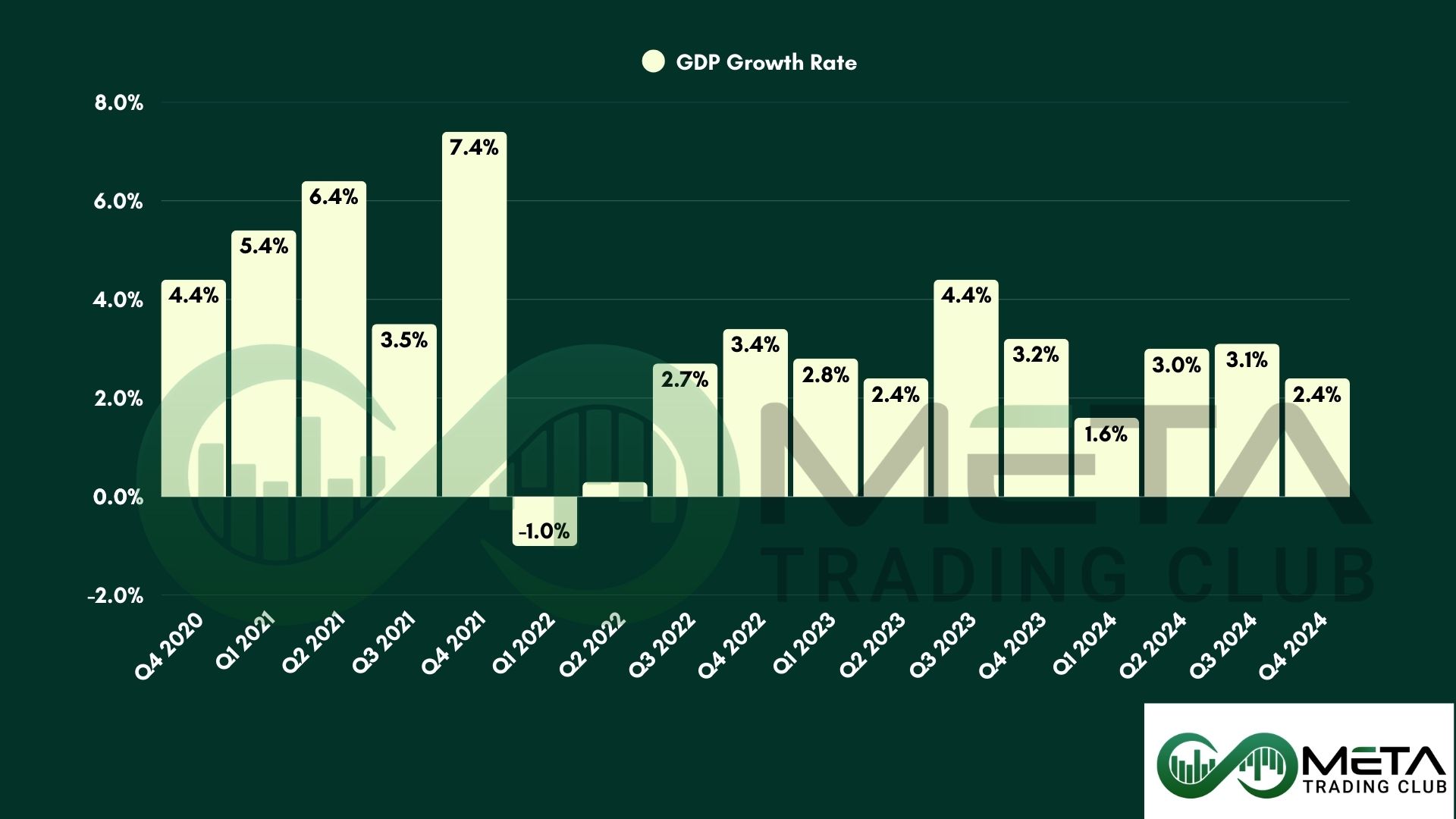

In the US, GDP, labor and PCE data will be taking center stage.

The advance estimate for Q3 GDP is anticipated to show the economy grew by 3%, matching Q2, fueled by robust consumer spending. The PCE report is expected to show an acceleration in both consumer income and spending in September while core PCE prices likely increased at a faster 0.2%.

Also, the nonfarm payrolls are expected to grow by 140K in October, significantly lower than September’s figure, influenced by Hurricane Milton and the Boeing strike.

The unemployment rate likely steadied at 4.1% while wages growth is expected to slow to 0.3%. The ISM Manufacturing PMI is forecasted to remain in contraction, with a slight improvement in the pace of decline.

Other reports include JOLTs Job Openings, ADP Employment Change, Challenger Job Cuts.

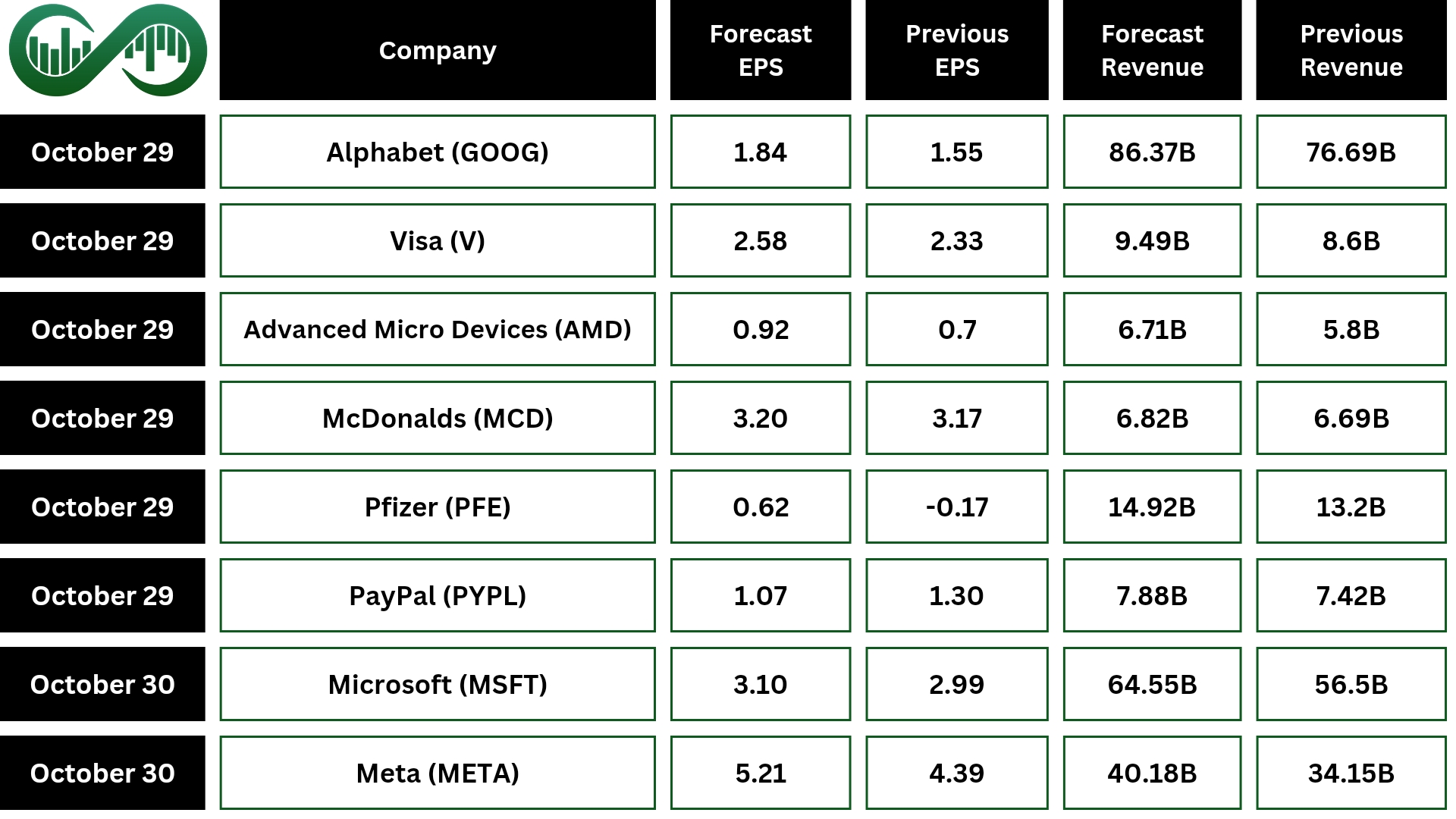

Earning Events

On the earnings front, next week will mark a pivotal phase as mega cap results are due from five of the ‘Magnificent 7’ Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta (META), Alphabet (GOOG), and Visa (V), Advanced Micro Devices (AMD), McDonald’s (MCD), Eli Lilly, AbbVie, Caterpillar, Amgen, Mastercard, Merck, Comcast, Exxon Mobil and Chevron.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.