Last week’s market and economic data key points:

- Fed Chair Powell said ‘time has come’ to cut interest rates

- Indexes up: Dow 1.27%, S&P 500 1.45%, Nasdaq 1.09%

- S&P 500 closes higher after Fed dovish signal on rate cuts

- Target rose 11% after strong earnings

- WTI oil rises 2.5%, but books weekly loss

- Silver ends the week 3.50% higher

- Euro, sterling, Japanese yen post gains

- Dollar slides to 2024 low due to dovish prospects

- Toncoin (TON) falls by 15% following telegram CEO’s arrest

Table of Contents

Last Week’s Reports

Economic Reports

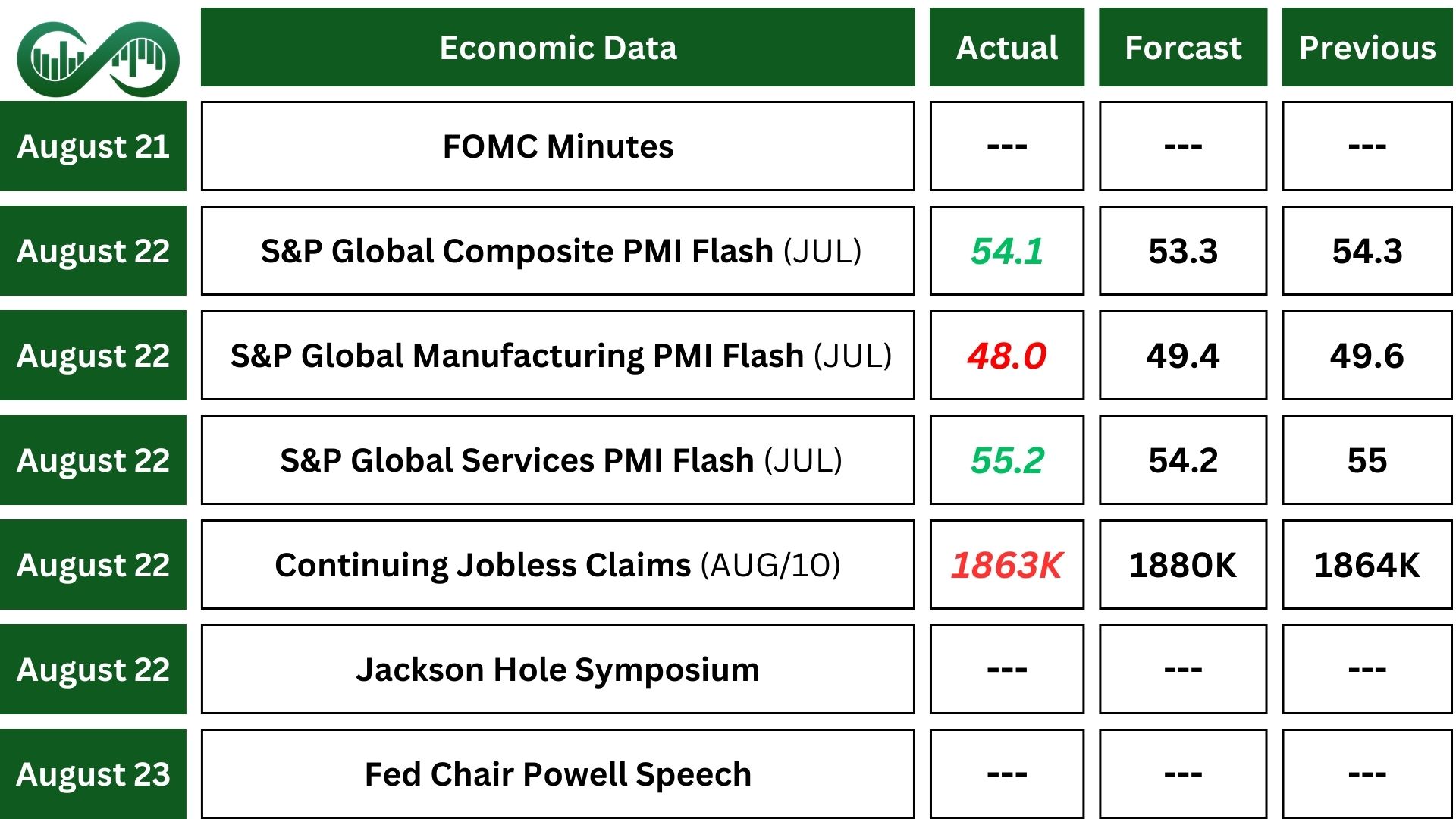

The S&P Global US Composite PMI fell slightly to 54.1 in August above market expectations of 53.5, flash data showed. This indicates that US business activity continues to grow, marking 19 consecutive months of expansion. Despite the slower pace, the growth remains strong, particularly in the service sector, which saw solid and increased expansion.

In contrast, manufacturing output declined at its fastest rate, contributing to employment challenges, as hiring nearly stalled in manufacturing and slowed in the service sector due to difficulties in finding workers. Inflation showed some positive signs, with prices for goods and services rising at their slowest pace since June 2020, although input costs remain high.

The initial jobless claim in the US rose to 232,000 (a three-week high). The increase held initial claim counts well above their averages from earlier this year, consolidating the trend of a softening labor market outlined by the July jobs report, backing bets that the Federal Reserve will turn dovish and deliver rate cuts in every decision remaining this year. In the meantime, the continuous jobless claims fell to 1,863,000 in the previous week.

Jackson Hole Symposium

Federal Reserve Chairman Jerome Powell gave a strong dovish signal that the central bank will cut its interest rate soon during his speech at the Jackson Hole Economic Symposium.

The Chairman noted that the US labor market is cooling quickly following the softer jobs report from July and the downward revision to payrolls this week. “We do not seek or welcome further cooling in labor market conditions,” Powell said.

Powell also noted that the FOMC has gained further confidence that inflation is slowing to the central bank’s 2% target, warranting a clear view that it is time to adjust monetary policy to less restrictive conditions.

It was the dovish shift that market participants have been waiting for. The Fed is clearly turning to the dovish camp and Powell has made it crystal clear that soon will be the start of multiple rate cuts coming the remainder of this year.

Earning Reports

Target (TGT) stock rose nearly 11% Wednesday on better-than-expected Q2 results. The Minneapolis retailer on Wednesday reported earnings of $2.57 a share, up from $1.80 a share, a year earlier, and ahead of the $2.18 a share that analysts were expecting.

Revenue rose 2.7% to $25.45 billion, ahead of the $25.19 billion Wall Street was looking for, while comparable sales rose 2%.

Target said it expects third-quarter earnings of $2.10 to $2.40 a share, with comparable sales flat to up 2%.

Workday (WDAY) beat quarterly revenue expectations and announced a $1 billion stock buyback plan, sending shares of the human resources software firm up 12.5%, the biggest percentage gainer on the Nasdaq.

Indices

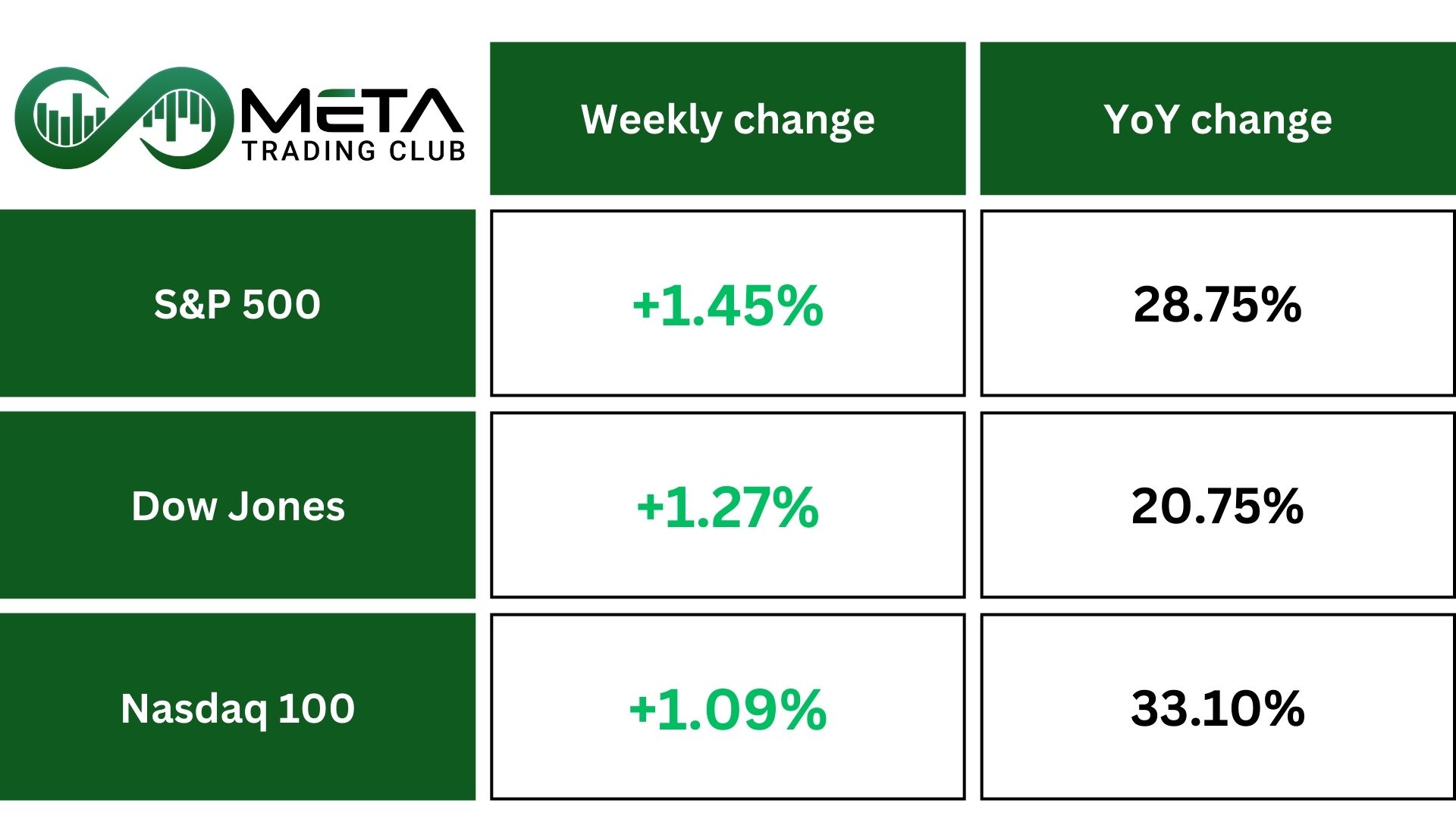

Indices’ Weekly Performance:

Major indexes logged their best two-week stretch of the year. The Nasdaq is up 6.8% in the period, while the S&P 500 gained 5.4%. The Dow rose 4.2%.

S&P 500 climbs second straight week adds 1.4% as Fed Chair Powell says “the time has come” to lower interest rates in the Jackson Hole speech and shows Fed has been shifting to dovish prospects.

Technically, if S&P 500 could break the all-time high resistance 5,670, then probably the index can surge to 5,800.

The Toronto Stock Exchange, Canada’s largest stock market closed at a record high on Friday, spurred by rising commodity prices and Federal Reserve Chair Jerome Powell’s dovish comments the central bank is ready to begin cutting interest rates, which would limit divergence with the Bank of Canada, which is already on rates cut path and is expected to skip even further along it in September.

Stocks

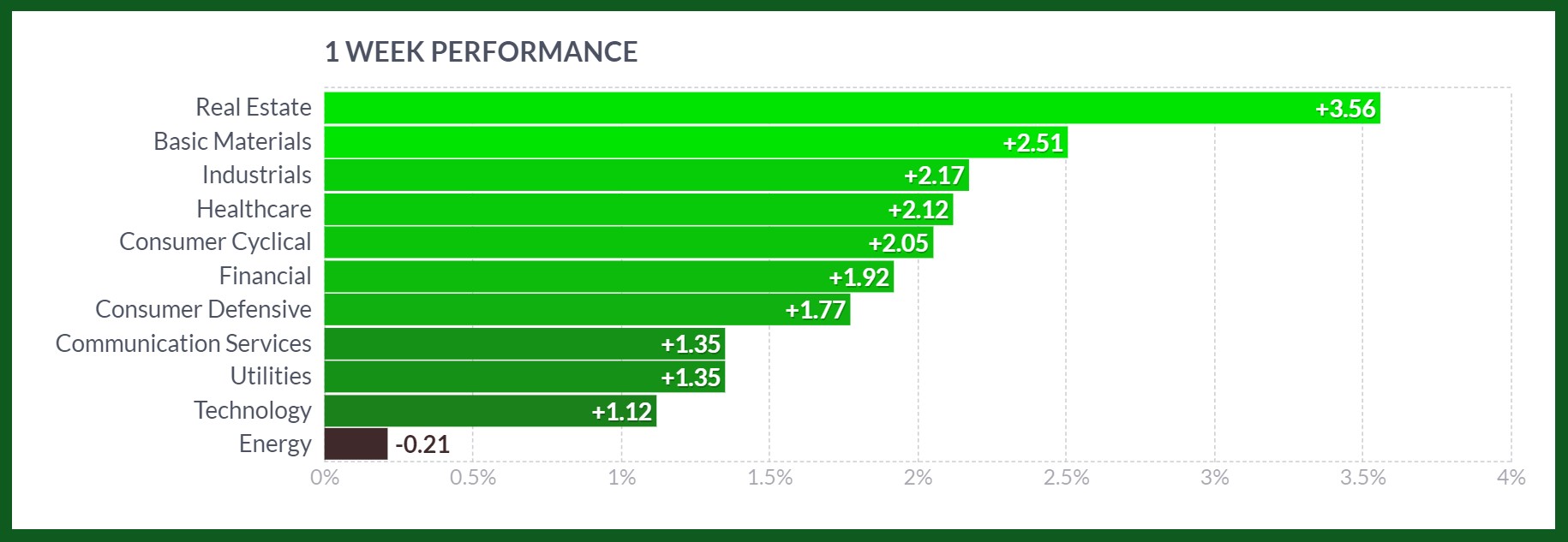

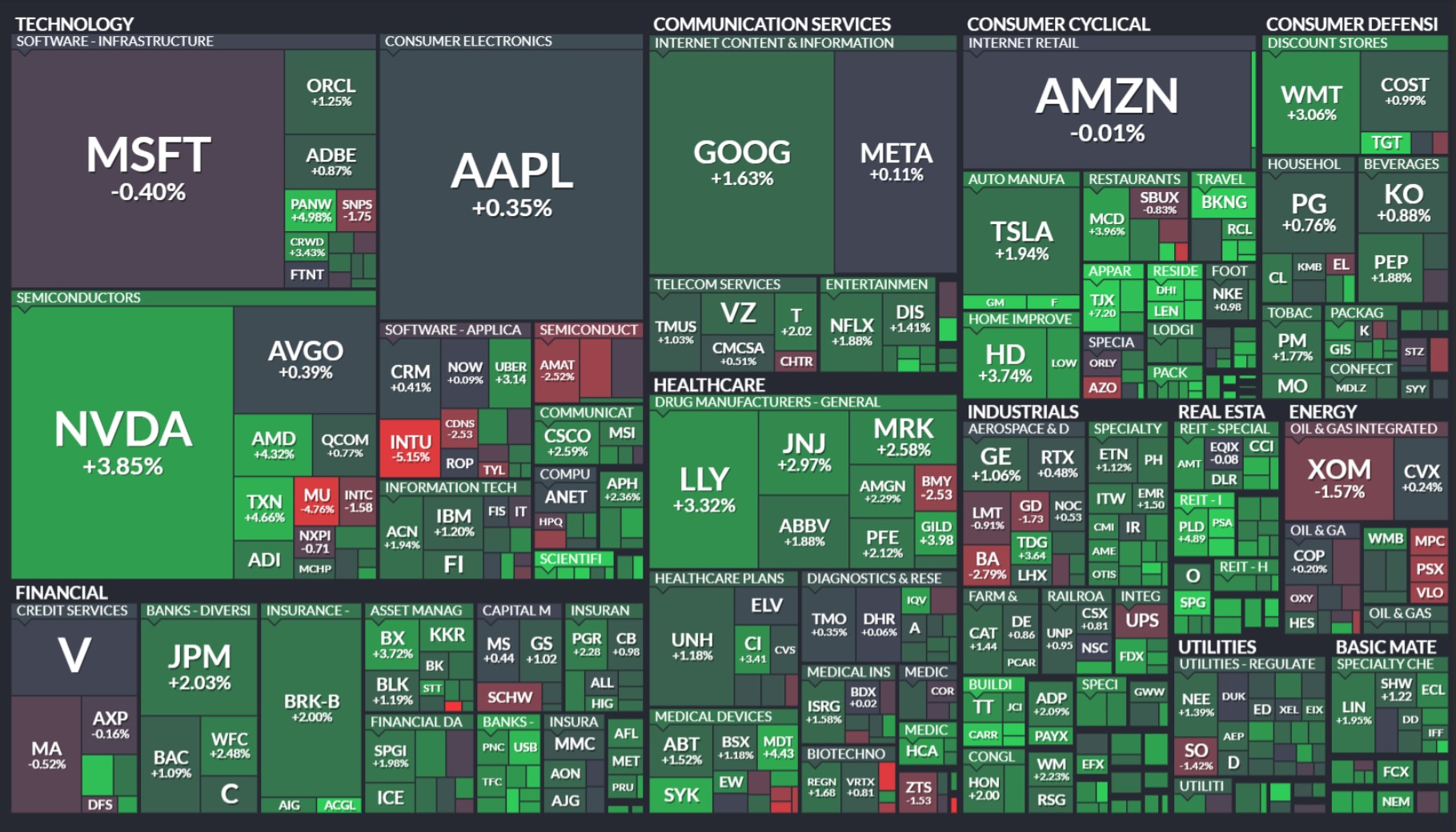

Stock Market Sector’s Weekly Performance:

Source: Finviz

All U.S. stock sectors jumped after the release of Powell’s dovish prepared remarks.

Real estate was the leading sector with a gain of 3.5%. Also, the basic materials and industrials sector followed the gains of the week while energy slides.

Stock Market Weekly Performance:

Source: Finviz

U.S. stocks closed sharply higher after Federal Reserve Chair Jerome Powell bolstered expectations that the central bank will begin cutting interest rates in September.

Heavyweight growth stocks Nvidia (NVDA) gained 4% and Tesla (TSLA) added 2%.

Commodity

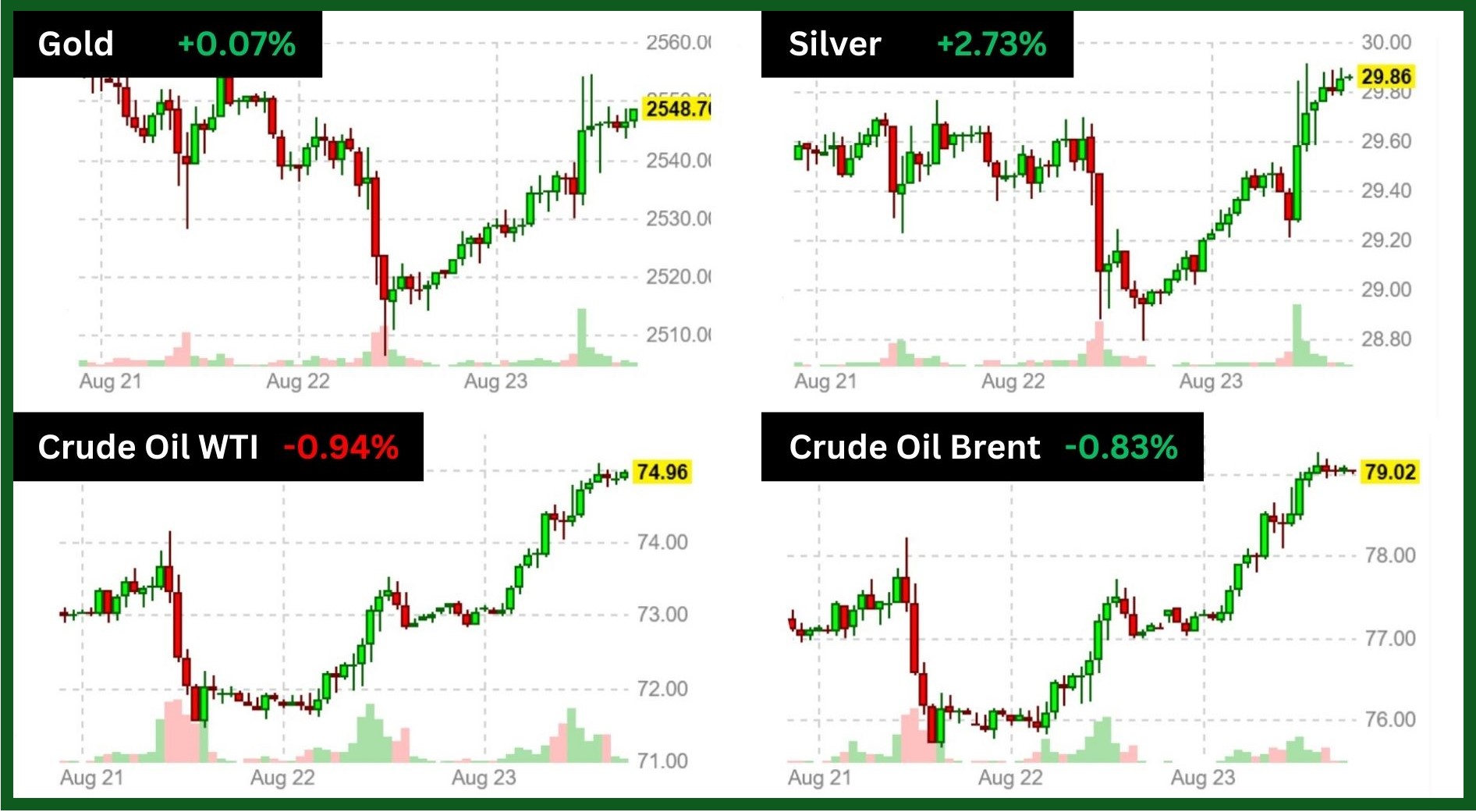

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

Gold just hit a fresh all-time record high of $2,531 an ounce, for a gain of 22% since year to date. Over the same period, the S&P 500 indexes have risen 18%. Gold has done better than over one year.

WTI crude oil futures advanced 2.5% to settle at $74.8 per barrel on Friday, following remarks by Federal Reserve Chair Jerome Powell, suggesting the central bank is ready to cut interest rates.

Lower interest rates typically stimulate economic growth, which boosts oil demand.

However, despite Friday’s gains, oil prices declined more than 2% for the week due to concerns about slowing energy demand.

Among the batch of data pointing to lower fuel demand, the newest S&P PMI showed that US manufacturing activity fell more than expected in August. This added to signs of lower fuel demand from other top energy consumers. Also, industrial production slowed, and ship-tracking data pointing to lower fuel deliveries in China during July.

As you can see in the chart below, WTI has been stocked in a consolidation triangle for over 15 months.

Silver (XAGUSD) rose nearly 2.7% to $29.8 per ounce for the week.

India’s silver imports are on course to nearly double this year due to rising demand from solar panel and electronics makers and as investors the idea that maybe silver metal will give better returns than gold.

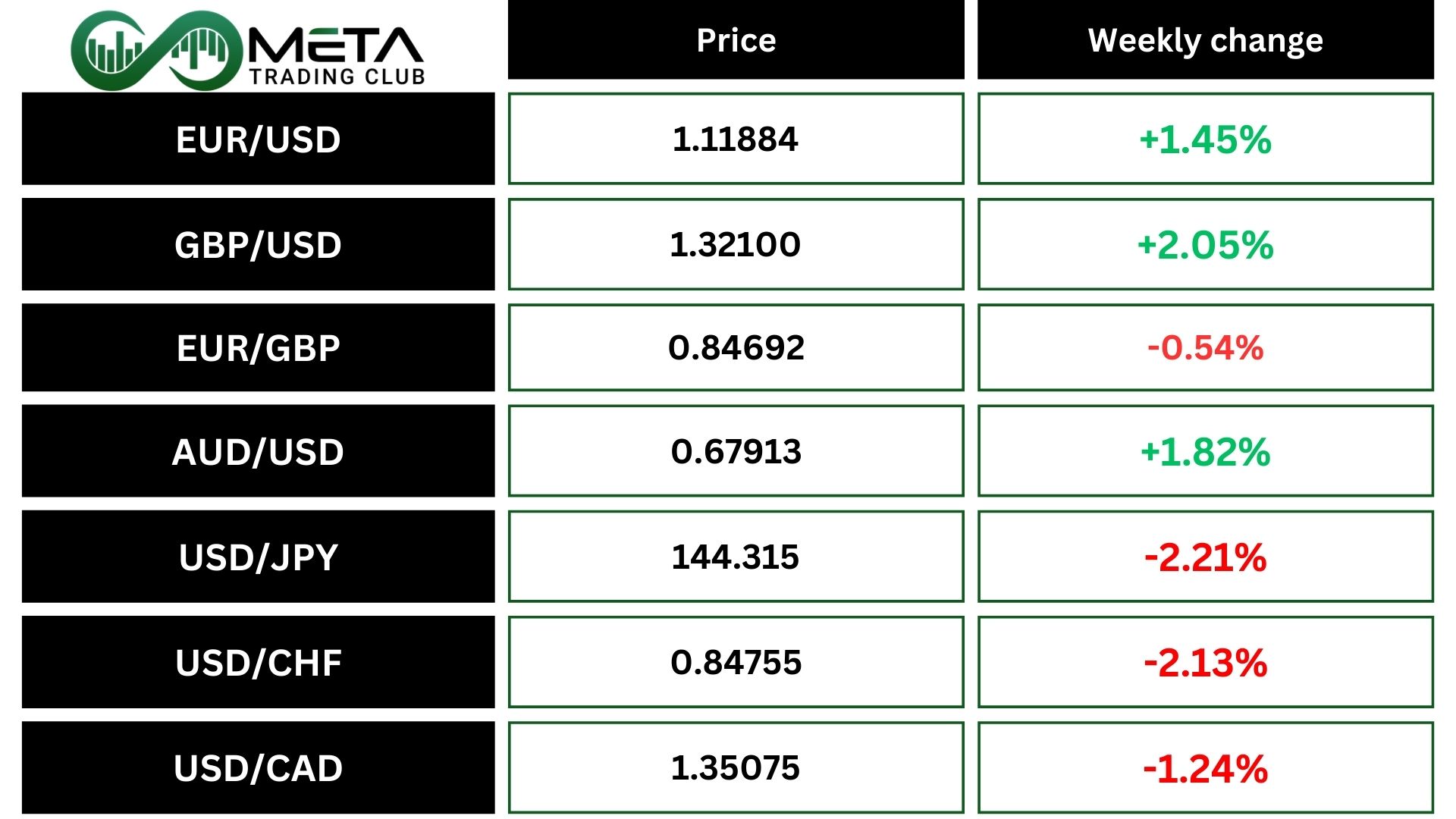

Forex

Weekly Performance of Major Foreign Exchange Pairs:

Sterling (GBPUSD) extended its bull run early Friday, hitting a fresh 2024 high of $1.3130. The powerful rally is into its seventh straight day, but big things are coming to test the sterling’s dominant surge.

USD/JPY: Bank of Japan Gov. Kazuo Ueda reaffirmed that he is open to more interest-rate increases, clearing up doubts about the central bank’s intention to continue on its path of policy normalization.

The BOJ governor’s comment fueled rate-hike expectations, causing the yen to strengthen against the dollar. The yen reached as strong as 145.30 to the dollar during Friday trading in Tokyo, compared with 146.30 before Ueda’s testimony.

The dollar index (DXY), dropped to its lowest level of the year, making way for rival currencies to move into the spotlight and realize some gains. The greenback’s index slipped under 101 against a basket of six currencies and bottomed out at 100.90.

The dollar has been in a steady downfall over the past two months. After a peak at more than 106 in late June, a steep drop has erased roughly 5% of the buck’s valuation against its peers.

What’s behind the dollar’s fall?

Interest rate expectations. With lower rates, comes a lower dollar. Generally, when borrowing costs go down, they take with them the value of the local currency as it yields less on deposits and becomes an unattractive place for businesses and consumers to park their cash. Instead, they start looking for alternatives in stocks, commodities or competing currencies.

Crypto

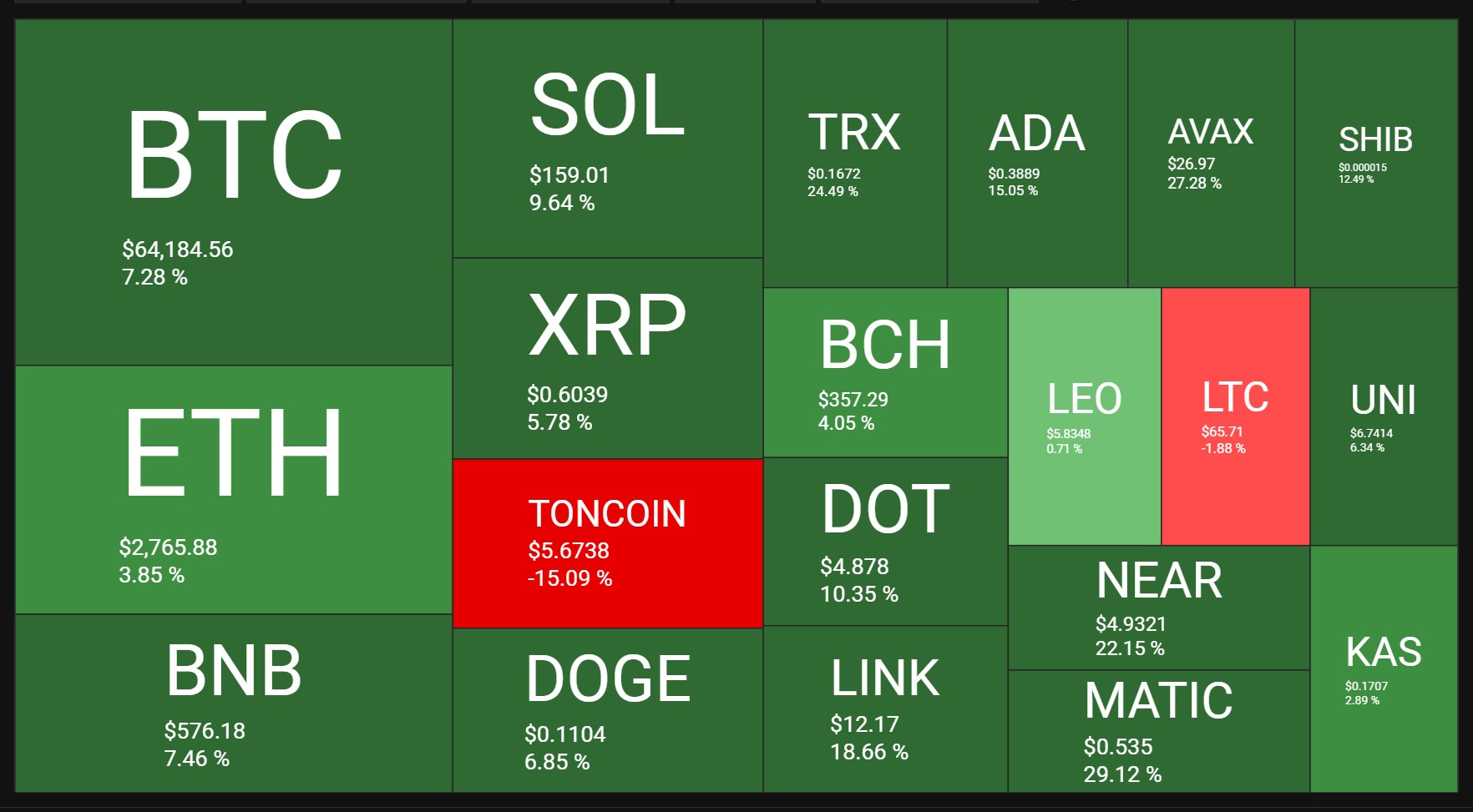

Crypto Market Weekly Performance:

Source: quantifycrypto

Telegram founder and CEO Pavel Durov was arrested at the Le Bourget airport in France after alighting from his private jet.

Durov, a 39-year-old Russian-born Emirati, has been reportedly detained due to a “lack of control” on Telegram which French authorities believe has fostered the growth of criminal activities on the messaging app. So far, this arrest has drawn much criticism from the tech community including many crypto users who have described such action as the French government attempting to force censorship on a free social media platform.

Source: image

Toncoin, the native token of The Open Network (TON) and a cryptocurrency integrated with the Telegram app recorded a 18% decline in market price following news of Durov’s arrest.

As earlier stated, TON has been one of the most profitable assets in 2024. According to data from CoinMarketCap, TON gained by over 240% in the first six months of 2024 achieving an all-time high of $8.24, alongside a placement in the top 10 cryptocurrencies based on market cap.

Next Week’s Outlook

Economic Events

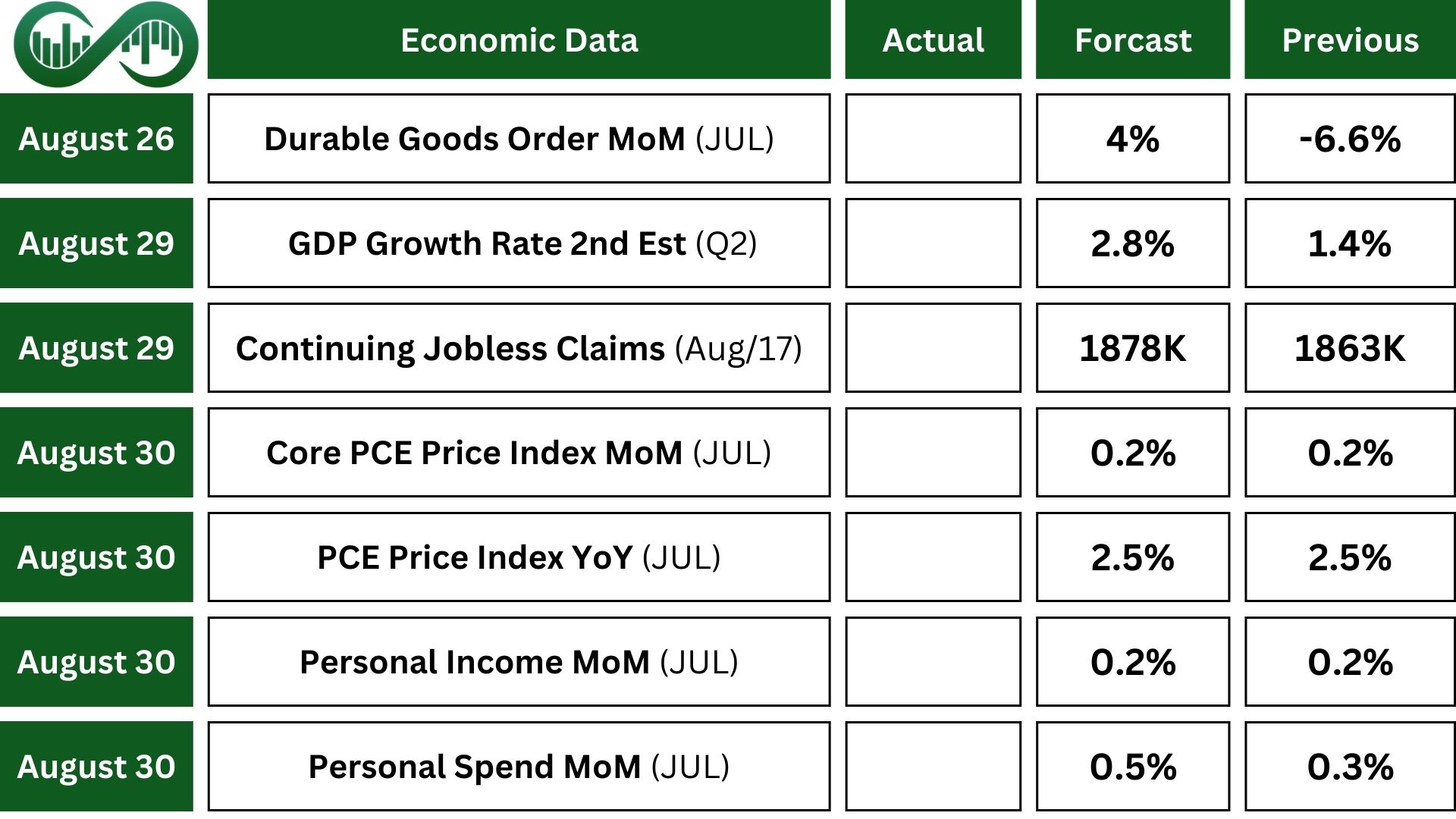

This week, the data-dependent Fed will have a raft of economic indicators to consider ahead of its September rate decision. These include the Commerce Department’s revised second-quarter GDP and Personal Consumption Expenditures (PCE) report, which includes the Fed’s preferred inflation yardstick, the PCE price index.

Other data scheduled to be released next week include July durable goods orders on Monday, August consumer confidence on Tuesday, July pending home sales on Thursday and August consumer sentiment on Friday.

Earning Events

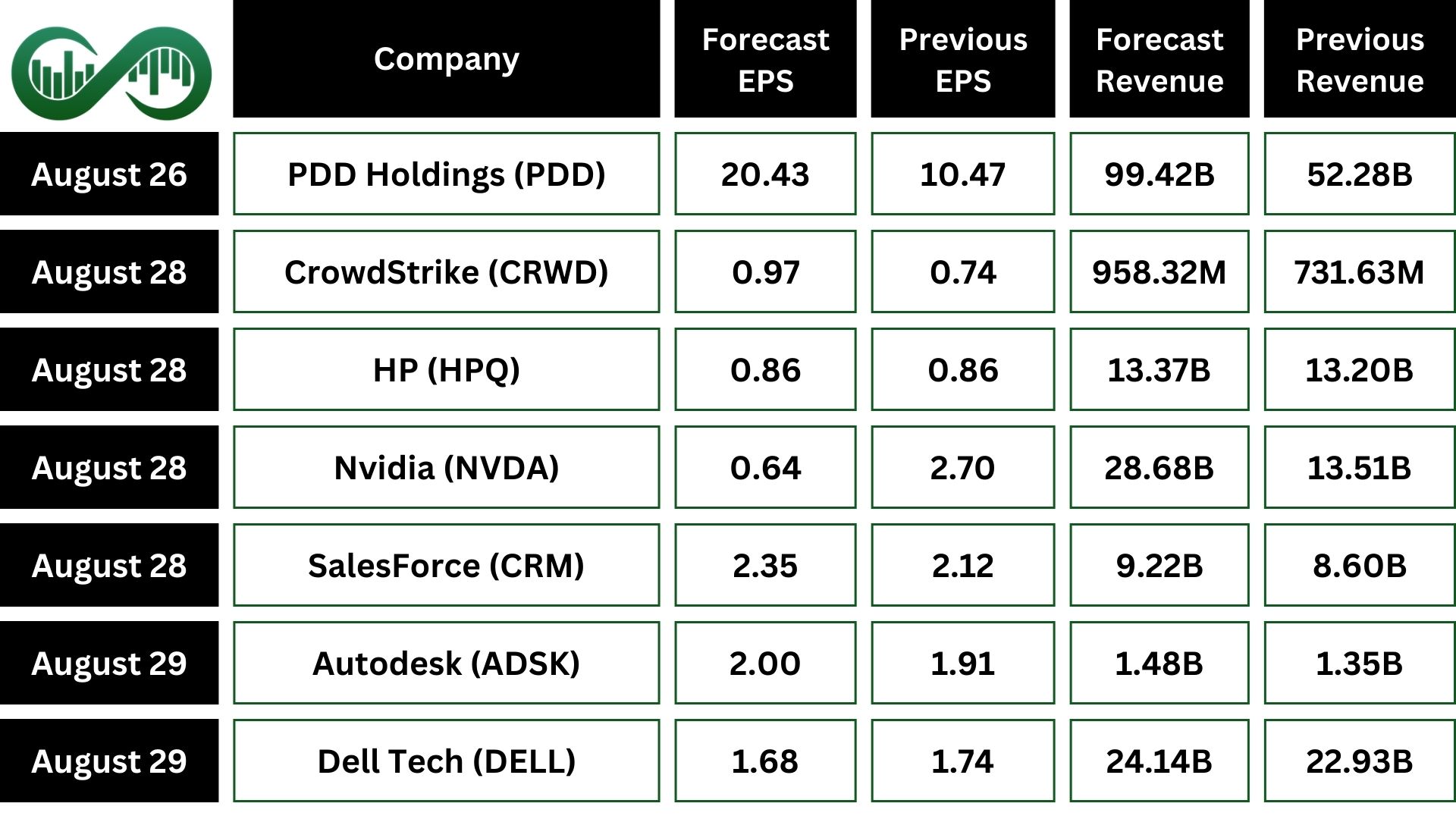

The earnings season will come to its end with reports from mega cap Nvidia and Salesforce and large caps PDD Holding, CrowdStrike, HP and Dell Technology.

Nvidia’s reports quarterly results on Wednesday after the market close, probably moving the market, one way or the other.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.