The past week was filled with critical economic data releases and central bank decisions that significantly influenced global financial markets. Investors closely monitored inflation figures, interest rate announcements, and other key economic indicators to gauge the economic landscape and adjust their strategies accordingly. As we move into the upcoming week, market participants will continue to focus on additional inflation data, consumer sentiment, and industrial production figures, among other crucial economic reports.

Table of Contents

Economic Calendar Review

Past Week

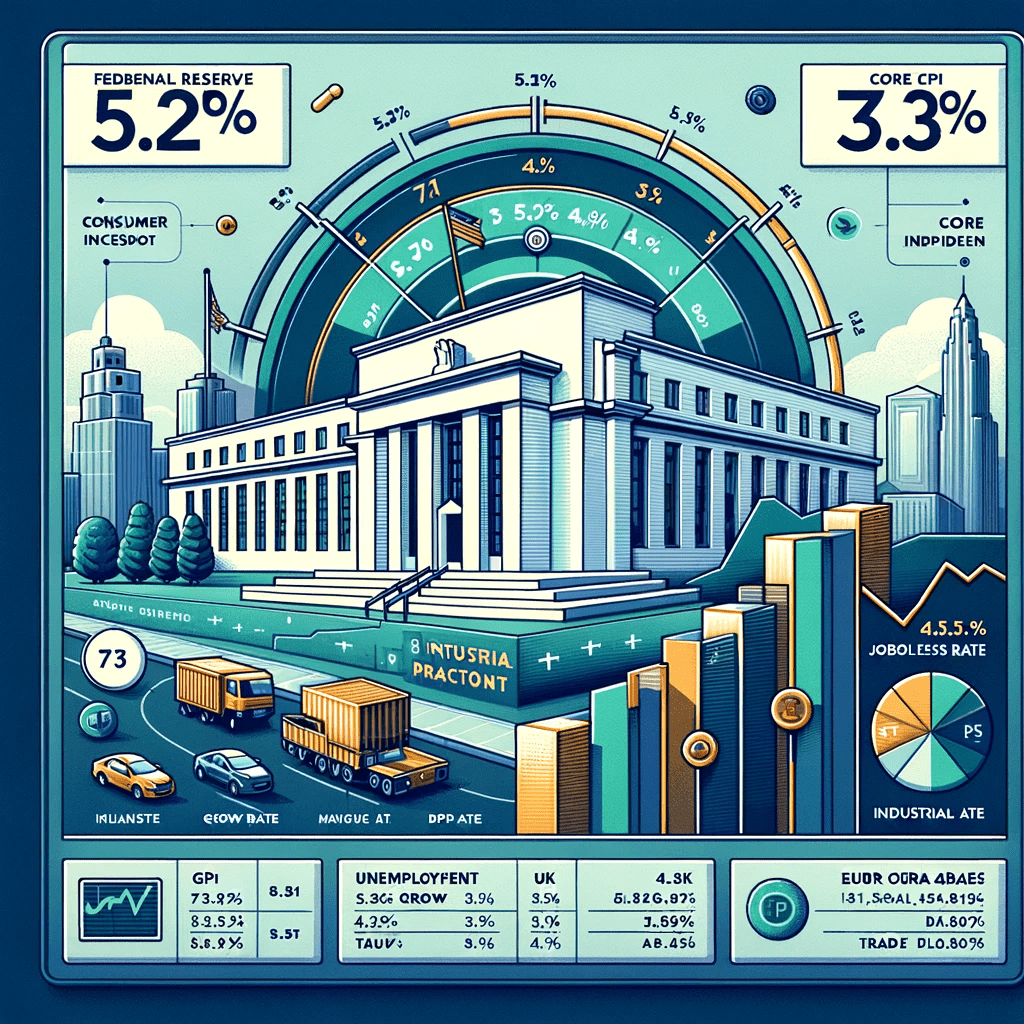

Federal Reserve Decision: The Federal Reserve kept the federal funds target range at 5.25%-5.5%, with the market’s attention sharply focused on the central bank’s economic projections and statements for any indications of future rate cuts.

Inflation Data: The Consumer Price Index (CPI) for May showed an annual inflation rate of 3.4%, unchanged from the previous month, while the core inflation rate edged down to 3.5%, marking a fresh three-year low. The headline CPI increased by 0.2% month-over-month, with the core CPI steady at 0.3%.

Michigan Consumer Sentiment Index: The preliminary reading for June came in at 73, up from 69.1 in May, reflecting improved consumer confidence.Key economic indicators such as April’s GDP growth rate, unemployment rate, and industrial production figures were released. The UK’s economy showed signs of stalling in April after three months of growth, with the jobless rate steady at 4.3%.

Industrial production data for the Euro Area were notable, alongside trade balance reports for the Euro Area.

Upcoming Week

Producer Price Index (PPI): The PPI for May will be closely watched to assess the inflationary pressures at the producer level.

Retail Sales: May’s retail sales data will provide insights into consumer spending trends.

Fed Press Conference: Following the interest rate decision, the Fed’s press conference will be scrutinized for any hints on future monetary policy direction.

US10Y

The yield on the US 10-year Treasury note surged by more than 12 basis points to 4.42% on Friday, rebounding sharply from a two-month low of 4.27% seen in the prior session. This uptick was largely driven by a robust jobs report, which reinforced a hawkish outlook for the Federal Reserve. The US economy added 272,000 jobs in May, significantly surpassing market expectations and underscoring the labor market’s resilience amidst prolonged restrictive interest rates. This strong labor market data supports the case for a potentially lower magnitude of rate cuts by the Fed this year, should inflation remain above the central bank’s target.

S&P 500

US equities ended the week on a mixed note. The S&P 500 closed 0.1% lower on Friday, below its all-time high of 5,374. The Nasdaq retreated by 0.2%, and the Dow Jones lost 87 points, as the strong jobs report reduced concerns about an economic slowdown but also raised the possibility of delayed Fed rate cuts. Nonfarm payrolls increased by 272,000 in May, well above the 185,000 estimate and April’s 175,000 gain. This robust labor market data led to a sharp drop in the odds for a Fed easing in September, from 68% to 55%. Financial, industrial, and tech sectors led gains, while real estate, materials, and utilities lagged. Among megacap stocks, Microsoft, Nvidia, and Meta each lost 0.1%, Amazon declined by 0.3%, and Alphabet dropped by 1.3%, while Apple rose by 1.5%. For the week, the S&P 500 gained 1.1%, the Nasdaq jumped by 1.6%, and the Dow added 0.5%.

Foreign Exchange Market (FOREX)

EURUSD

The euro depreciated to $1.083 against a strengthening dollar, influenced by reduced expectations for multiple Fed rate cuts following a robust jobs report. In Europe, the ECB decreased key interest rates by 25 basis points as anticipated but adopted a cautious approach towards additional cuts. Officials acknowledged persistent price pressures and projected inflation to exceed targets well into the following year, keeping interest rates at a sufficiently tight level until inflation reaches the desired 2%. President Lagarde emphasized during the post-decision press conference that the ECB is not committing to a specific rate trajectory and future actions will be based on incoming data.

GBPUSD

The British pound fell to $1.273 on Friday, retreating from a three-month peak earlier in the week. The decline was due to reduced expectations for Federal Reserve interest rate cuts in response to a strong jobs report. Additionally, the Bank of England is expected to maintain rates at 5.25% on June 20th, the highest level since 2008. Despite recent declines in British inflation, it has not dropped as much as anticipated, lowering the possibility of multiple BoE rate reductions. Uncertainties surrounding the early July general election have also impacted the economic outlook.

Commodity

GOLD

Gold prices extended earlier losses to trade below $2,320 per ounce on Friday, reaching the lowest level in a month. This decline was pressured by hawkish expectations for the Federal Reserve and evidence of lower central bank buying in Asia. The robust US jobs report, with an addition of 272,000 jobs in May, bolstered the labor market’s strength and increased the likelihood of delayed rate cuts by the Fed. Additionally, the People’s Bank of China paused its aggressive gold-buying spree in May, further contributing to the downward pressure on gold prices. Despite these factors, geopolitical tensions and the potential for future rate cuts continue to support the price of gold.

Silver

Silver prices sank below $29.4 per ounce, retreating sharply from the 11-year high of $32 touched on May 28th. This decline was in line with a broader sell-off in precious metals, driven by strong US economic data that supported a hawkish Fed outlook. The halt in gold buying by the People’s Bank of China also negatively impacted silver prices. However, strong domestic demand in China, highlighted by the connection of the world’s largest solar farm in northwestern Xinjiang, provided some support.

WTI

WTI crude futures declined by around 2% to $75.5 per barrel this week, marking the third consecutive week of losses. The decline was driven by increasing expectations that borrowing costs could remain elevated for an extended period, negatively impacting the demand outlook. The robust US jobs report, indicating a strong labor market, supported a hawkish stance from the Federal Reserve. Concerns over a potential supply surplus were heightened earlier in the week following the latest OPEC+ decision, which extended most supply cuts into 2025 but also announced plans to phase out some voluntary output cuts from eight member countries starting in October.

BTC

Bitcoin defied bearish predictions in May and began June with a bullish surge. This upswing was attributed to recent US economic data showing lower-than-anticipated labor market figures, fueling speculation that the US economy is cooling and paving the way for a potential Federal Reserve interest rate cut in September. Anticipating a weakening US dollar, institutions have been increasing their allocation of risky assets, including Bitcoin. This trend is reflected in the high demand for spot Bitcoin ETF products throughout the week. However, despite 19 consecutive days of positive inflows into Bitcoin ETFs, the price remains trapped within the $67,000-$71,000 range. If Bitcoin can establish stability above $71,350, it could potentially propel towards new highs, with the next resistance level around $77,500. However, strong employment figures from upcoming data releases could strengthen the US dollar and weaken Bitcoin.

Upcoming Week Outlook

The upcoming week will be pivotal with several key economic data releases. In the US, investors will closely monitor the PPI, retail sales, and the Michigan consumer sentiment index for further insights into the economic outlook. Globally, attention will focus on Japan’s interest rate decision and Australia’s NAB business confidence index. Central bank decisions and inflation data will continue to be significant drivers of market movements, with any indications of future monetary policy adjustments being closely scrutinized.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.