During the past week, the major U.S. stock indices surged to unprecedented levels. The Dow Jones Industrial Average made headlines by surpassing the 40,000 mark for the first time. Simultaneously, the S&P 500 Index and Nasdaq Composite also reached record highs. This bullish trend was largely fueled by waning concerns over inflation and interest rates, which in turn benefited growth stocks as investors placed a lower implied discount on their future earnings.

Economic Events:

A significant factor supporting market sentiment was the release of the Labor Department’s April consumer price index (CPI) on Wednesday. The CPI figures matched or slightly fell below expectations, contrasting with the hotter-than-expected figures of the previous three months. Headline inflation increased by 0.3% in April, slightly under expectations, while core inflation (excluding food and energy) rose by 0.3%, as predicted. Inflation pressures remained concentrated in services, particularly in transportation services, which increased by 0.9% over the month and 11.2% over the past year.

Thursday’s retail sales report also influenced investor sentiment, with some interpreting negative economic news as positive for stocks and inflation outlooks. Retail sales were flat in April, against a consensus forecast of a 0.4% increase, and revised March’s sales growth from 0.7% to 0.6%. The data suggested a reduction in consumer discretionary spending, evidenced by a 1.2% decline in sales from non-store (primarily online) retailers, while sales at restaurants and bars continued to moderate and even declined slightly when accounting for higher prices (retail sales figures are not adjusted for inflation).

These unexpected inflation and growth data points led to a midweek decrease in the yield on the 10-year U.S. Treasury note, reaching its lowest level in over a month, as bond prices and yields move inversely. The tax-exempt municipal bond market managed another week of heavy new issuance, which generally saw strong demand. The busy primary issuance calendar and uncertainty preceding the midweek inflation data appeared to limit secondary market activity.

In the investment-grade bond market, spreads initially widened but tightened later in the week. Issuance was predominantly in short-term bonds, with few being oversubscribed. High-yield bonds benefited from favorable rate movements, with increased trade volumes following the positive inflation data. Funds below investment-grade experienced positive inflows.

The leveraged loan market remained largely unchanged as it absorbed the slightly lower-than-anticipated CPI figures and the weaker retail sales report. Most primary market transactions were focused on refinancing or repricing.

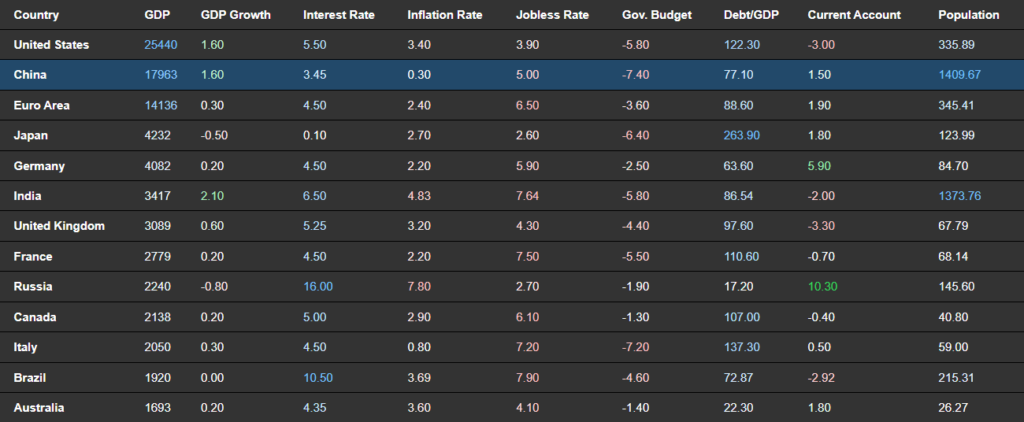

Source : tradingeconomy

Gold (XAUUSD):

Gold prices surged past $2,400 per ounce on Friday, setting a new record high. This increase was driven by heightened expectations of Federal Reserve interest rate cuts, robust central bank purchases, and safe-haven demand. Early indicators of a slowdown in U.S. consumer inflation and stagnant retail sales have given the Fed more flexibility to consider monetary easing. While policymakers have not yet officially altered their stance, markets are already anticipating the first rate reductions in 2024. Lower interest rates enhance the appeal of non-yielding assets like gold.

Additionally, heightened geopolitical tensions have contributed to the rise in gold prices. Clashes between Israel and Hamas militants in northern Gaza and southern Rafah, along with the ongoing war in Ukraine, have bolstered bullion demand. The upward trend was further supported by strong central bank buying, particularly by China, as it seeks to reduce its reliance on the U.S. dollar. For the week, gold was on track for a second consecutive gain, increasing by 1.8%.

Since the beginning of 2024, gold has risen by $351.66 per troy ounce, or 17.05%, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, gold reached an all-time high of $2,431.55 in April 2024.

Indices:

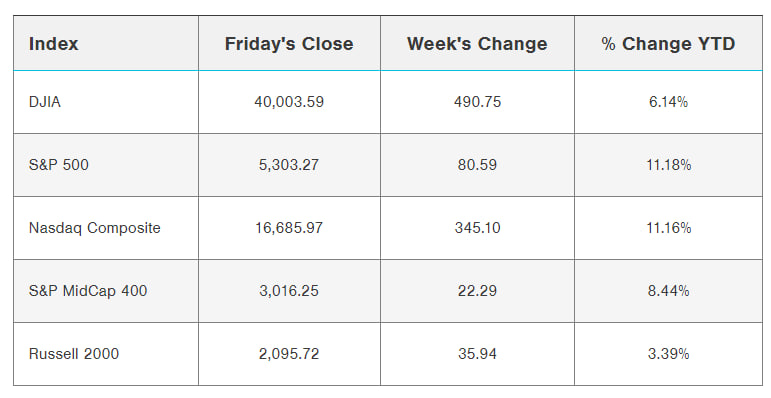

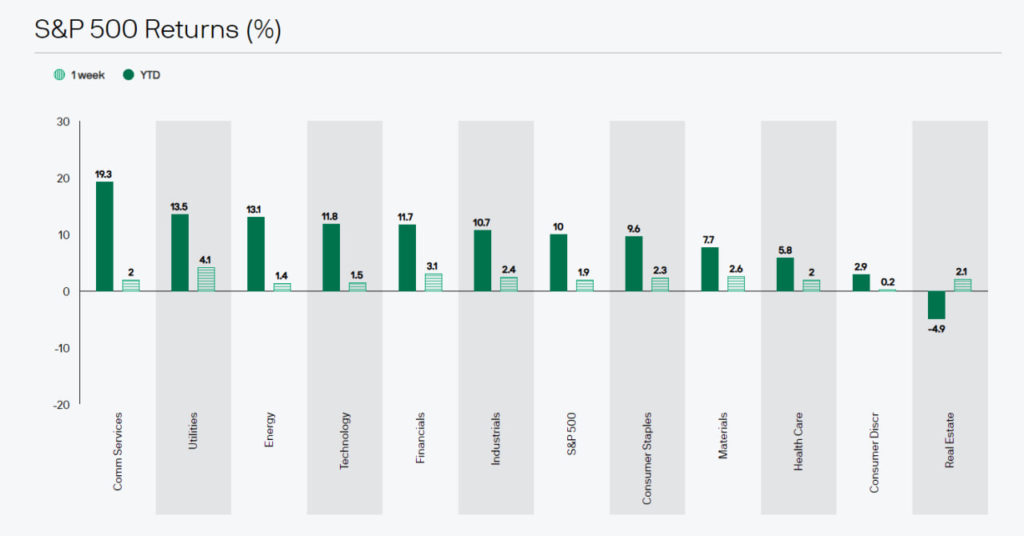

The Dow Jones Industrial Average rose by 135 points, closing at a new record high of 40,003. The S&P 500 edged up by 0.1%, while the Nasdaq finished slightly lower. Interest rates and inflation remain at the forefront of market discussions, with investors scrutinizing economic data and Fed officials’ statements for any hints of rate changes.

On the corporate front, shares of Walmart and Caterpillar increased by 1% and 1.5%, respectively, contributing to the Dow’s rise. Reddit shares surged 10% following the announcement of a content partnership with OpenAI. In contrast, meme stocks continued their decline for the third consecutive session, with GameStop falling by 19.7% and AMC dropping by 5.2%.

For the week, the S&P 500 gained 1.4% and the Nasdaq advanced 1.9%, both marking their fourth consecutive winning week, a first since February. The Dow also recorded its fifth positive week in a row, with a 0.9% gain for the period.

Source : jpmorgan

Sp500

US100

US30

Bitcoin (BTC):

Cryptocurrency prices soared on Friday, with Bitcoin surging back near $67,000. Institutional investors injected hundreds of millions of dollars into spot Bitcoin ETFs over the past week, which could propel Bitcoin towards its record highs as early as next week.

More than 600 investment firms disclosed significant spot Bitcoin ETF holdings this past week. This list included major banks and hedge funds, such as Morgan Stanley, JPMorgan Chase, Wells Fargo, and UBS. Collectively, these institutions own $3.5 billion worth of Bitcoin ETFs. Millennium Management emerged as the largest investor, with $1.9 billion invested.

Millennium’s holdings include $844.2 million in the BlackRock iShares Bitcoin Trust , $806.7 million in the Fidelity Wise Origin Bitcoin Fund , and $202 million in the Grayscale Bitcoin Trust. Additionally, the firm invested $45 million in the ARK 21Shares Bitcoin ETF and $44.7 million in the Bitwise Bitcoin ETF .

US Crude Oil WTI :

WTI crude futures rose above $79 per barrel on Friday, poised to end the week with gains. This upward movement was supported by recent declines in U.S. crude oil inventories and increased optimism that the U.S. Federal Reserve will reduce interest rates this year. Data from the Energy Information Administration (EIA) showed that U.S. crude stockpiles fell by 2.508 million barrels last week, marking the second consecutive week of declines and surpassing forecasts of a 1.362 million barrel draw.

Additionally, April’s data indicated a slowdown in U.S. consumer inflation, enhancing expectations for Fed rate cuts that could stimulate economic growth and boost energy demand. Conversely, the International Energy Agency (IEA) lowered its global demand growth forecast for this year by 140,000 barrels per day, bringing it to 1.1 million barrels per day.

Meanwhile, the latest report from OPEC revealed that member countries exceeded their production cap by 568,000 barrels per day in April. Despite this, OPEC maintained robust demand projections of 2.25 million barrels per day for 2024 and 1.85 million barrels per day for 2025.

Weekly Outlook:

Looking ahead, investors will continue to monitor inflation data and Federal Reserve communications for hints on monetary policy changes. The potential for rate cuts could further influence both equity and commodity markets, driving continued interest in growth stocks and non-yielding assets like gold, which has surged past $2,400 per ounce amid geopolitical tensions and strong central bank purchases.

Wishing everyone a profitable week ahead with the Meta Trading Club!

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.