Unlike stocks, bonds don’t give you ownership rights. They represent a loan from the buyer (you) to the issuer of the bond. When you buy a treasury bond, you’re providing a loan to the bond issuer. Although the issuer has agreed to pay you interest and return your money on a specific date in the future. The global bond market is actually larger by market capitalization than the equity market. In 2023, global stock markets were valued at $109 trillion, while global bond markets were worth $133 trillion. In this article we are going to learn about understanding of bonds and the different types of bonds.

Table of Contents

What are Bonds?

Bonds are fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed interest rate for a specified period.

Also, a bond is a debt security in which borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time.

When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation. In return, the issuer promises to pay you a specified rate of interest during the life of the bond and to repay the principal of the bond after a period of time.

Terminology of Bonds

The language of bonds can be a little confusing so there are terms that are important to know. An indenture is a binding contract between an issuer and bondholder that outlines the characteristics of the bond. It typically includes:

Coupon

This is the interest rate paid by the bond. In most cases, it won’t change after the bond is issued. Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the bond’s maturity date.

Face value

This is the amount the bond is worth when it’s issued, also known as “par value“. Most bonds have a face value of $1,000. Additionally, A bond’s face value is also the basis for calculating interest payments due to bondholders. However, most commonly bonds have a par value of $1,000.

Maturity

The date on which the bond issuer returns the money lent to them by bond investors. Also, bonds have short, medium or long maturities.

Price

This is the amount the bond would currently cost on the secondary market. However, several factors play into a bond’s current price, but one of the biggest is how favorable its coupon is compared with other similar bonds.

Many if not most bonds are traded after they’ve been issued. In the market, bonds have two prices: bid and ask. Also, the bid price is the highest amount a buyer is willing to pay for a bond, while the ask price is the lowest price offered by a seller.

Yield

The yield is the rate of return on the bond while the coupon is fixed. Yield is a measure of interest that takes into account the bond’s fluctuating changes in value. However, there are different ways to measure yield, but the simplest is the coupon of the bond divided by the current price. Yield is variable and depends on a bond’s price in the secondary market and other factors.

Duration risk

This is a measure of how a bond’s price might change as market interest rates fluctuate. If experts suggest that a bond will decrease 1% in price for every 1% increase in interest rates. So, the longer a bond’s duration, the higher exposure its price has to changes in interest rates.

Rating

Ratings agencies assign ratings to bonds and bond issuers, based on their creditworthiness. Bond ratings help investors understand the risk of investing in bonds. Investment-grade bonds have ratings of BBB or better.

Example of Treasury Bond

For better understanding, let’s dive into a treasury bond example:

Mark decides to diversify his investment portfolio by purchasing a 20-year treasury bond. The bond has a face value of $10,000 and the coupon rate (annual interest rate) is now 5.5%. Mark buys the bond during the initial auction.

Details of his investment:

- Mark invests $10,000 in the bond.

- The bond pays semiannual interest (every six months).

- The annual interest payment is calculated as: 10,000*0.055=550$

- Mark receives $275 every six months as interest.

- At maturity (after 20 years), Mark gets back the $10,000 face value.

What are bond ratings?

Major rating agencies like Moody’s Investors Service (Moody’s) and Standard & Poor’s (S&P) issue a credit rating for bonds. Bond ratings represent the rating agencies’ opinion of the issuer’s creditworthiness and ability to repay its debt, based on its financial position, management, and other factors.

The ratings are the opinion of the agency. They are not a guarantee of credit quality, probability of default, or recommendation to buy or sell. Ratings reflect a current assessment of an issuer’s creditworthiness and do not guarantee performance now or in the future. Issuers rated below investment grade are expected to have a greater risk than those with investment grade credit ratings.

What types of bonds are there?

There are three main types of bonds:

1. Corporate Bonds

They are debt securities issued by private and public corporations. Some common types of corporate bonds include:

Investment-grade

These bonds have a higher credit rating and imply less credit risk than high-yield corporate bonds.Investment-grade corporate bonds are issued by companies with credit ratings of Baa or by Moody’s and BBB by S&P or above that. Therefore, they have a relatively low risk of default.

Furthermore, companies issue corporate bonds to raise capital for a number of reasons, such as expanding operations, purchasing new equipment, building new facilities, or just for general corporate purposes.

The issuing company is responsible for making interest payments (usually semiannually, but sometimes monthly or quarterly) and repaying the principal at maturity. Investment-grade corporates carry a higher risk of default than treasury bonds and municipal bonds, and therefore offer a slightly higher yield.

High yield

These bonds have a lower credit rating, implying higher credit risk, than investment-grade bonds. So, they offer higher interest rates in return for the increased risk.

High-yield corporates are issued by companies with credit ratings of Ba1 or below by Moody’s and BB+ or below S&P. Respectively, they have a relatively higher risk of default. They are also called “junk bonds.” To compensate for that added risk, they tend to pay higher rates of interest than those of their higher-quality peers.

2. Municipal Bonds

These bonds called “munis,” are debt securities issued by states, cities, counties and other government entities. Types of “munis” include:

General obligation bonds

Refers to bonds issued by a state or local government that are payable from either an issuer’s general fund or specific taxes (usually property tax). The precise source and priority of payment for general obligation bonds may vary among issuers depending on applicable state and local laws. General obligation bonds issued by local governments are often payable only from property taxes while general obligation bonds issued by states are often said to entail the full faith and credit (and in many cases the full taxing power) of the issuer.

Revenue bonds

Instead of taxes, these bonds are backed by revenues from a specific project or source, such as highway tolls or lease fees. Some revenue bonds are “non-recourse,” meaning that if the revenue stream dries up, the bondholders do not have a claim on the underlying revenue source.

Conduit bonds

Governments sometimes issue municipal bonds on behalf of private entities such as non-profit colleges or hospitals. These “conduit” borrowers typically agree to repay the issuer, who pays the interest and principal on the bonds. If the conduit borrower fails to make a payment, the issuer usually is not required to pay the bondholders.

3. U.S. Treasuries

The U.S. Department of the Treasury issues these bonds on behalf of the U.S. government. Additionally, they carry the full faith and credit of the U.S. government, making them a safe and popular investment.

U.S. treasury bonds are considered among the safest available investments because of the very low risk of default. Unfortunately, this also means they have among the lowest yields, even if interest income from treasury bonds is generally exempt from local and state income taxes.

Types of U.S. Treasury debt include:

Treasury Bills: Short-term securities maturing in a few days to 52 weeks. Also, they are sold for less than their face value but pay their full face value at maturity. The interest earned is the difference between the purchase price and the par value at maturity.

Notes: Longer-term securities maturing within ten years. Treasury notes are issued with maturities of two, three, five, seven, or ten years and pay interest every six months.

Bonds: Long-term securities that typically mature in 30 years and pay interest every six months. Treasury bonds are issued with 20- and 30-year maturities and pay interest every six months.

TIPS: Treasury Inflation Protected Securities (TIPS) are notes and bonds whose principal is adjusted based on changes in the Consumer Price Index (CPI). TIPS pay interest every six months and are issued with maturities of 5, 10, and 30 years.

4. Mortgage-Backed Securities

Mortgage-backed securities are created by pooling mortgages purchased from the original lenders. Investors receive monthly interest and principal payments from the underlying mortgages. These securities differ from traditional bonds in that there isn’t necessarily a predetermined amount that gets redeemed at a scheduled maturity date.

Bondholders receive monthly payments that are made up of both interest and part of the principal as borrowers pay back their loans. These payments can vary from month to month and create irregular cash flows. Additionally, prepayment of mortgages can cause mortgage-backed securities to mature early, cutting short an investor’s income stream.

5. Emerging Market Bonds

International emerging market bonds (EM bonds) are issued by a government, agency, municipality, or corporation domiciled in a developing country. These investments typically offer higher yields to reflect the elevated risk of default, which can stem from underlying factors such as political instability, poor corporate governance, and currency fluctuations. The asset class is relatively new compared with other sectors of the bond market. EM bonds may be denominated in local currency, U.S. dollars, or other hard currencies.

6. Preferred Securities

Preferred securities are considered a hybrid investment, as they share the characteristics of both stocks and bonds. Like bonds, they generally have fixed par values (often just $25) and make scheduled coupon payments. Preferred securities often have very long maturities, or no maturity date at all, meaning they are “perpetual”, but they can generally be redeemed by the issuer after a certain amount of time has passed.

Like stocks, however, preferred securities generally rank below an issuer’s bonds, and their dividends are often (but not always) discretionary. While a missed payment by a bond generally triggers a default, that’s not necessarily the case with preferred securities, although it varies by issue. Given the increased risks and their complex characteristics, preferred securities tend to offer relatively high yields.

What are the benefits and risks of bonds?

Bonds can provide a means of preserving capital and earning a predictable return. Bond investments provide steady streams of income from interest payments prior to maturity.

The interest from municipal bonds generally is exempt from federal income tax and also may be exempt from state and local taxes for residents in the states where the bond is issued.

As with any investment, bonds have risks. These risks include:

- Credit risk: The issuer may fail to timely make interest or principal payments and thus default on its bonds.

- Interest rate risk: Interest rate changes can affect a bond’s value. If bonds are held to maturity the investor will receive the face value, plus interest. Although if sold before maturity, the bond may be worth more or less than the face value. Rising interest rates will make newly issued bonds more appealing to investors because the newer bonds will have a higher rate of interest than older ones. To sell an older bond with a lower interest rate, you might have to sell it at a discount.

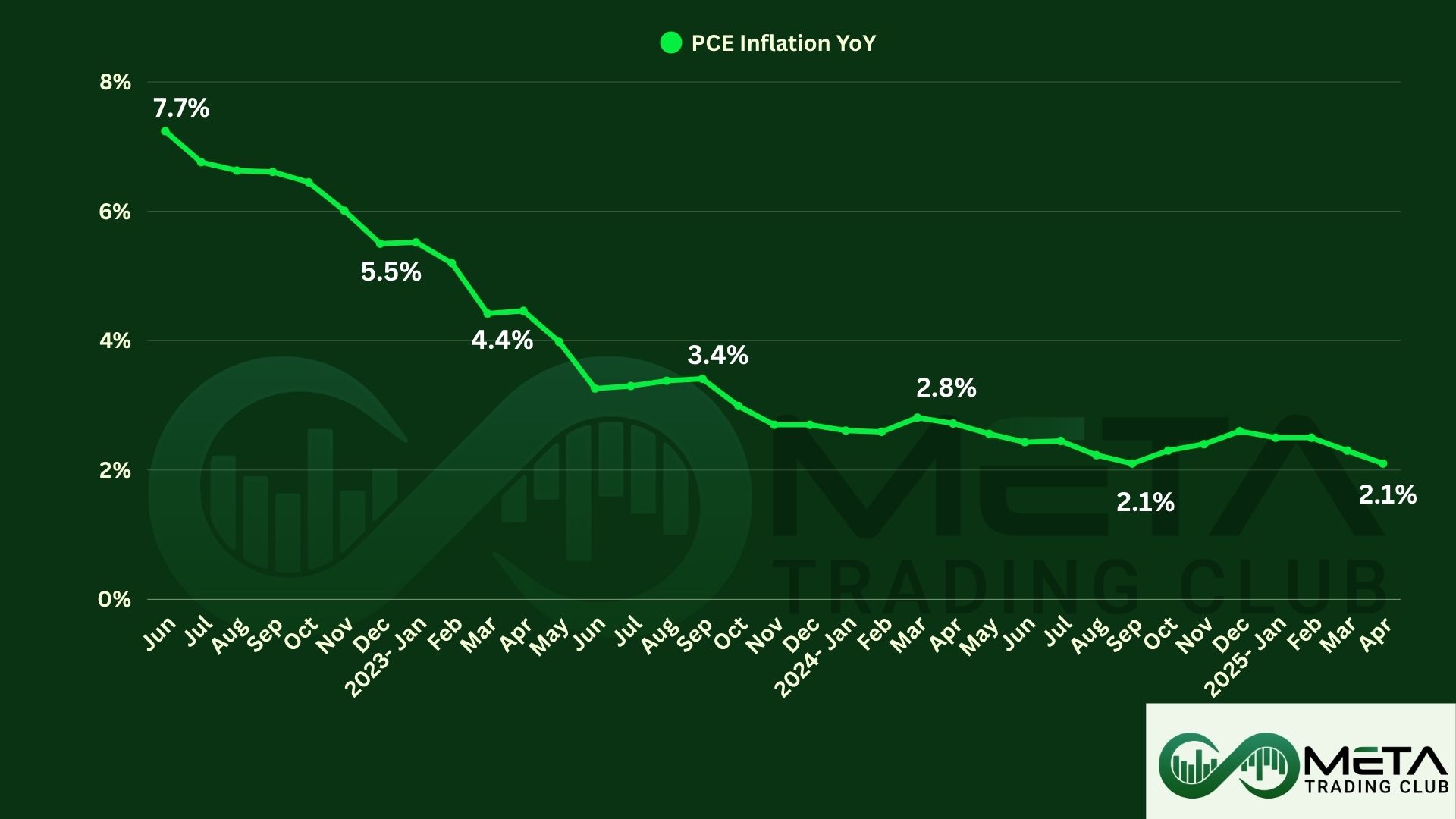

- Inflation risk: Inflation is a general upward movement in prices. Inflation reduces purchasing power, which is a risk for investors receiving a fixed rate of interest.

- Liquidity risk: This refers to the risk that investors won’t find a market for the bond, potentially preventing them from buying or selling when they want.

- Call risk: The possibility that a bond issuer retires a bond before its maturity date, something an issuer might do if interest rates decline, much like a homeowner might refinance a mortgage to benefit from lower interest rates.

Conclusion

U.S. government treasury bonds, as well as those issued by highly stable governments around the world, tend to be popular investments that are deemed to carry low risk of default. Such bonds share most of the same characteristics as corporate debt, except for the level of default probability, and in some cases taxation.

Bonds are low risk and low return investment. Therefore, if you are interested in learning to earn high returns and trade in high-risk markets, you should participate in the MTC incubator program.

FAQs

- What is bond in simple words?

Unlike stocks, bonds don’t give you ownership rights. They represent a loan from the buyer (you) to the issuer of the bond. - How exactly does a bond work?

When you buy bonds, you’re providing a loan to the bond issuer, who has agreed to pay you interest and return your money on a specific date in the future. - What is the general meaning of bond?

A bond is a debt security. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. - Is a bond a loan?

Yes, a bond is essentially a loan that an investor makes to the issuer of the bond. The issuer promises to pay back the face value on a certain date as well as regular interest, sometimes called coupon payments. - What is an example of a bond?

Mark decides to diversify his investment portfolio by purchasing a 20-year treasury bond. The bond has a face value of $10,000 and the coupon rate (annual interest rate) is now 5.5%. Mark buys the bond during the initial auction. In Addition, Mark receives $275 every six months as interest. At maturity (after 20 years), Mark gets back the $10,000 face value.