If you’re thinking about investing your money, you’ve probably heard about the Federal Reserve, commonly known as the Fed, and its influence on financial markets. In this article, we’ll explore how the Fed affects stocks, cryptocurrency, and other investments. We want to make this topic easy to understand while maintaining a professional tone.

What is the Federal Reserve, and How Does it Impact Stocks?

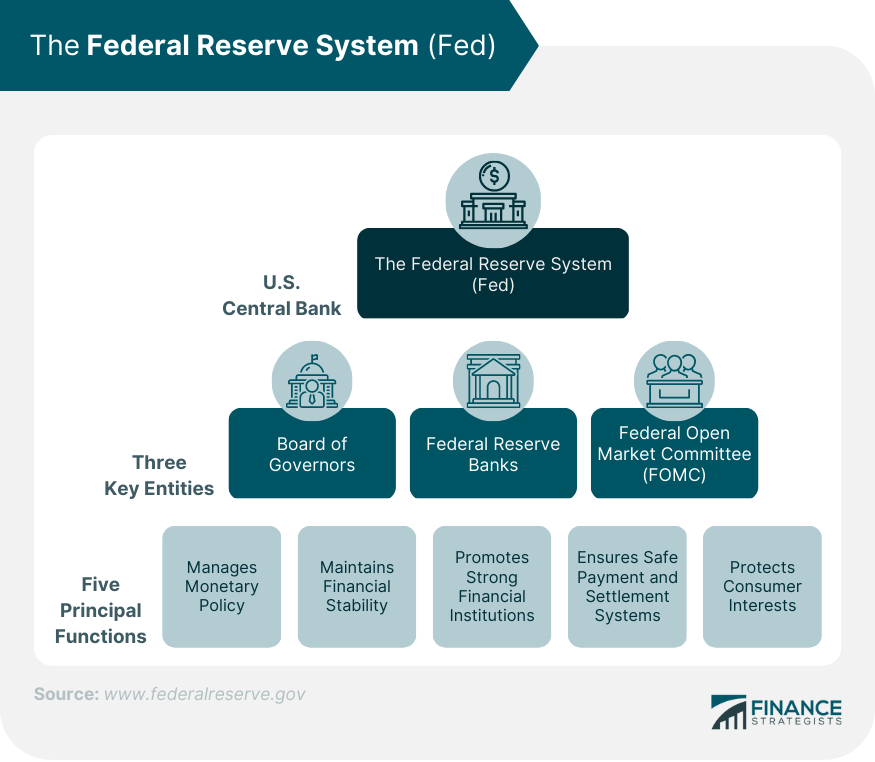

To understand the Fed’s influence, let’s start with the basics. The Federal Reserve System is a complex structure made up of twelve regional reserve banks. These banks play a crucial role in shaping monetary policy, which in turn affects the stock market and the broader economy.

Knowing the Fed’s structure and its decision-makers is important to grasp how its actions can impact your investments.

What is the Federal Open Market Committee (FOMC)?

The Federal Open Market Committee (FOMC), a key part of the Fed, makes decisions about monetary policy. It consists of appointed Fed board members and regional Fed presidents and has a significant influence on interest rates and liquidity in the financial system.

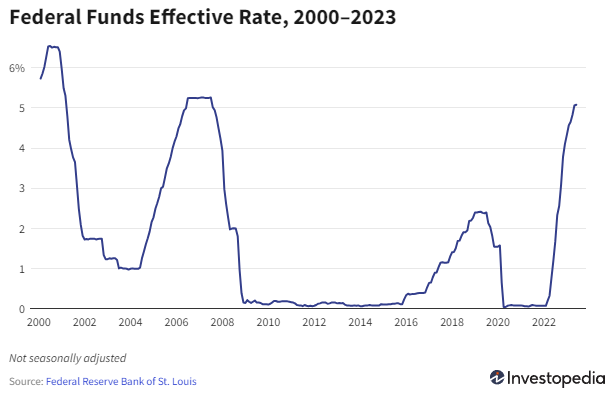

Interest rates, a tool of the Fed, indirectly affect the stock market. When the Fed adjusts interest rates, it can lead to economic changes that impact stock prices. Additionally, the Fed controls liquidity by buying and selling assets, which can influence economic growth.

How Do Fed Actions Impact the Stock Market?

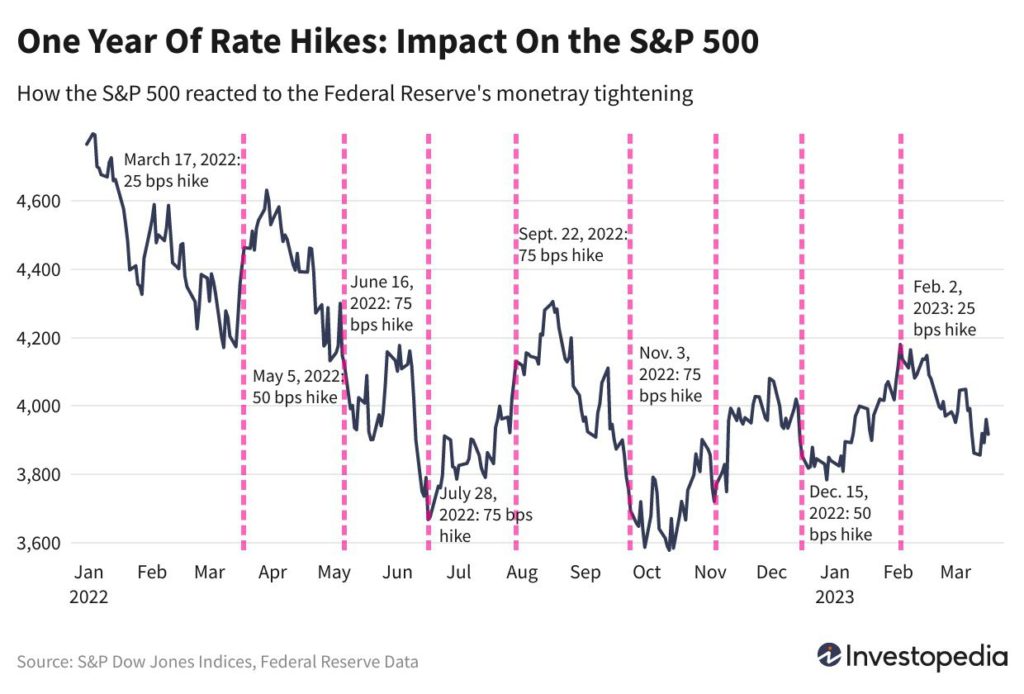

Understanding how the Fed’s actions affect the stock market is vital for investors. Generally, when the Fed raises interest rates or reduces liquidity, it can slow economic growth and cause stock prices to drop. On the flip side, rate cuts or increased liquidity tend to boost stock prices.

However, the stock market often reacts to the Fed’s statements and signals about the future, so it’s important to pay attention to what the Fed plans to do next.

How Do Interest Rates Influence the Stock Market?

Interest rates and the stock market have a complex relationship. When interest rates go up, stock prices usually go down. This is because higher interest rates make it more expensive for companies to borrow money, which can hurt their profits and stock prices.

The Federal Funds rate, controlled by the Fed, plays a crucial role in this relationship. Rising rates make borrowing more expensive, affecting consumer spending and business profits. Lower rates, on the other hand, encourage spending and investment, driving stock prices higher.

Stocks, Interest Rates, and Economic Trends

What Happens When Interest Rates Rise?

Rising interest rates can have widespread effects on stocks. Companies face higher borrowing costs, which can lead to reduced consumer spending and lower business profits. Some industries, like finance, may benefit from higher interest rates.

What Happens When Interest Rates Fall?

Conversely, lower interest rates can stimulate economic growth by making borrowing cheaper. This can boost corporate profits and, in turn, stock prices. However, companies reliant on cheap debt for growth may face challenges when rates rise.

Market Expectations and Reactions

Market expectations regarding the Fed’s actions can drive market reactions, sometimes more significantly than the actual events themselves. Markets often anticipate changes, and deviations from these expectations can lead to increased volatility.

Which Stocks Perform Well When Interest Rates Rise?

During interest rate hikes, industries that don’t rely heavily on low-cost debt may perform better. Companies that don’t need a lot of external financing can thrive. The financial industry often benefits from higher rates.

How the Fed Influences Stocks, Cryptocurrency, and Other Investments

Cryptocurrency and risky stocks are sensitive to the Fed’s actions, especially rate hikes. Recent market behavior, however, suggests that investors may be growing less concerned about interest rate increases.

Cryptocurrency investors have witnessed significant volatility, with digital asset prices responding to reduced liquidity and rate hike announcements. Some have turned to crypto as a hedge against potential future rate hikes.

How to Adjust Your Investment Strategy in a Rising Rate Environment

In a situation where rates are rising, and there’s uncertainty in the market, having a well-thought-out investment strategy is crucial. Long-term investors are advised to stay on course, maintain diversified portfolios, and see market volatility as an opportunity to buy quality investments at lower prices.

Conclusion

Understanding the Federal Reserve’s role, its impact on interest rates, and how these factors influence the stock market, cryptocurrency, and your investments is essential for any investor. By keeping an eye on the Fed’s actions and expectations, you can navigate the complex financial world with confidence and make informed decisions for your financial future. Remember that, in investing, taking a long-term perspective often leads to success, even in changing economic conditions.