Table of Contents

Long Straddle Strategy

How It Works

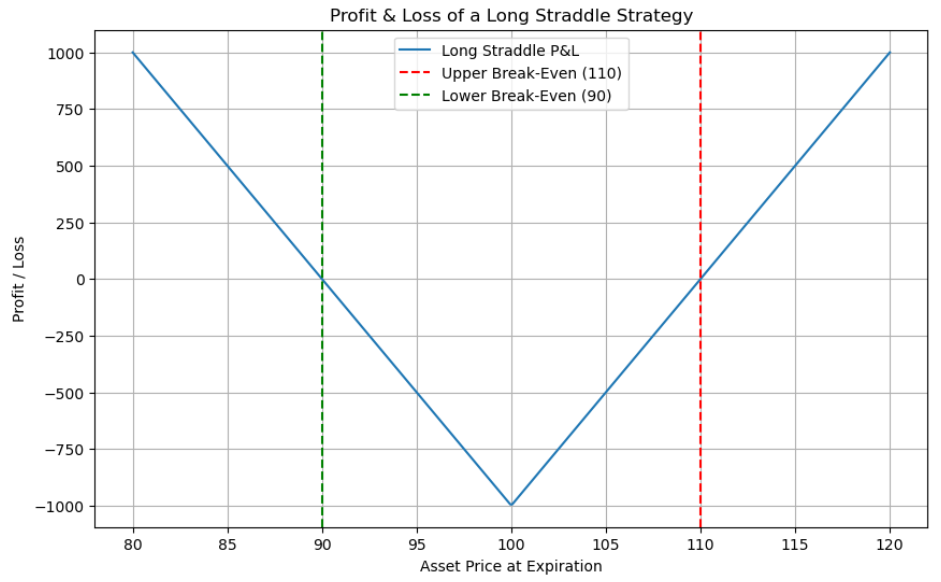

A long straddle strategy involves buying both a call and a put option on the same underlying asset. These options have the same strike pricing and expiration dates. This dual buy allows the investor to profit from major price swings in the asset, whether they go up or down.

Objective

The primary purpose of using a long straddle is to profit from the expectation of a significant price movement in the underlying asset, particularly when the direction of the move is unknown. Investors may choose this technique when market circumstances indicate volatility or when important news or events are predicted to trigger sharp price fluctuations.

Risk and Rewards

The long straddle strategy has the potential for endless returns because the investor can profit from both an increase in the asset’s price (by the call option) and a decrease in the asset’s price (via the put option). This dual potential is consistent with the speculative nature of expecting large price fluctuations without committing to a certain direction.

However, the investor’s maximum loss is limited to the total price paid for both the call and put options. This loss occurs when the price of the underlying asset remains consistent and does not move beyond the strike price in either direction, resulting in both options becoming worthless.

Thus, the cost of entering a long straddle can be seen as the price for the opportunity to profit from volatility.

You can see that there are two breakeven points in the P&L graph above. When the stock makes a significant move in one direction or the other, this method starts to pay off. The investor simply cares that the stock moves in a way that exceeds the total premium they paid for the options, regardless of the direction it moves in.

Long Strangle Strategy

How It Works

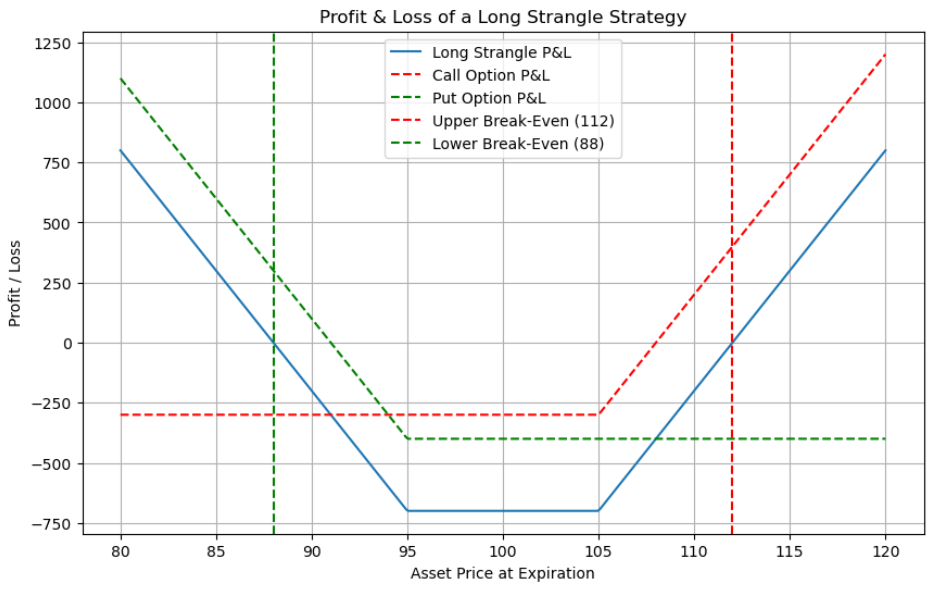

A long strangle strategy is an investor purchasing both a call and a put option for the same underlying asset, with the same expiration date but different strike prices. The call option is acquired out-of-the-money (OTM), which means that its strike price is higher than the asset’s current price, while the put option is also purchased OTM, with a strike price lower than the asset’s current price. This arrangement is intended to profit from a substantial price change in either direction.

Objective

The basic goal of the long strangle strategy is to profit from a significant price movement in the underlying asset without having to forecast the direction of the move. This method is especially attractive in cases where

an upcoming event is expected to cause significant volatility in the asset’s price, such as an earnings announcement or a regulatory decision that could impact the company’s value.

Risk and Rewards

A long strangle has a limitless profit potential if the underlying asset’s price moves dramatically. The call option enables the investor to profit from a fast increase in the asset’s price, whereas the put option gives gains if the asset’s price falls significantly.

The primary risk with this strategy is the entire premium paid for both options. If the price of the underlying asset does not change sufficiently to make either the call or the put option lucrative, both options may expire worthless, resulting in a loss equivalent to the initial investment in the option premiums. However, because both options are purchased OTM, a long strangle is often less expensive than a long straddle.

which involves at-the-money (ATM) options. This lower cost makes the long strangle an attractive option for investors looking to speculate on volatility while minimizing their upfront investment.

Take note of how the orange line in the P&L graph above represents the two break-even positions. When there is a substantial shift in the stock price, either up or down, this technique starts to pay off. The investor simply cares that the stock moves sufficiently to put one or both options in the money; they don’t care which way the stock goes. It must exceed the entire premium that the investor spent on the construction.