Options strategies can be basic or sophisticated, with one or many option contracts and, in some cases, the underlying asset. These tactics are intended to mitigate risk, speculate on volatility, and profit from specific market conditions.

Short Call

Investors that want to profit from a drop in volatility or in the price of the underlying asset use the short call options strategy. Selling (or “writing”) a call option without possessing the underlying asset is the goal of this tactic. Because of the possibility for infinite loss in the event of a negative market move, it is seen as a more sophisticated and dangerous approach. Here is a summary of its goals, methods of operation, and associated risks and benefits.

How It Works

Offering to Buy: In this approach, the investor offers to buy a call option, which gives the buyer the opportunity to acquire the underlying asset at a given strike price prior to the option’s expiration.

Premium Collection: The call option buyer pays a premium to the seller. Whichever way the option contract ends, the seller keeps this premium.

Deliverables: In the event that the buyer exercises the option, the seller of the call assumes the liability to deliver the underlying asset at the strike price. If the seller does not already own the underlying asset, there is a high risk involved (this is referred to as a “uncovered” or “naked” call).

Objective

Gaining the premium that the option buyer has paid is the main objective of selling a short call. The seller expects the option to expire worthless and to keep the entire premium in the event that the price of the underlying asset falls below the strike price by the time of expiration. When an investor has a neutral to pessimistic opinion on the underlying asset, they frequently employ this technique.

Risk

Potential for Infinite Losses: The main danger associated with short calls is the possibility of infinite losses. The seller might have to purchase the underlying asset at the higher market price in order to sell it to the option holder at the lower strike price if the asset’s price increases noticeably above the strike price.

Margin Requirements: Selling uncovered calls usually requires a sizable margin or cash collateral because of the high risk of loss, which can tie up investor resources.

Assignment Risk: In the event that the buyer exercises the option, the seller may also be required to provide the underlying asset before the expiration date. This is known as the early assignment risk.

Rewards

Premium Income: Collecting the premium is the obvious and instant benefit of using a short call strategy. The seller realizes this premium as profit if the price of the underlying asset stays below the strike price until expiration.

Profit in a Range of Market Conditions: The technique can turn a profit in the event that the price of the underlying asset falls, stays the same, or even rises to the strike price (less the premium paid).

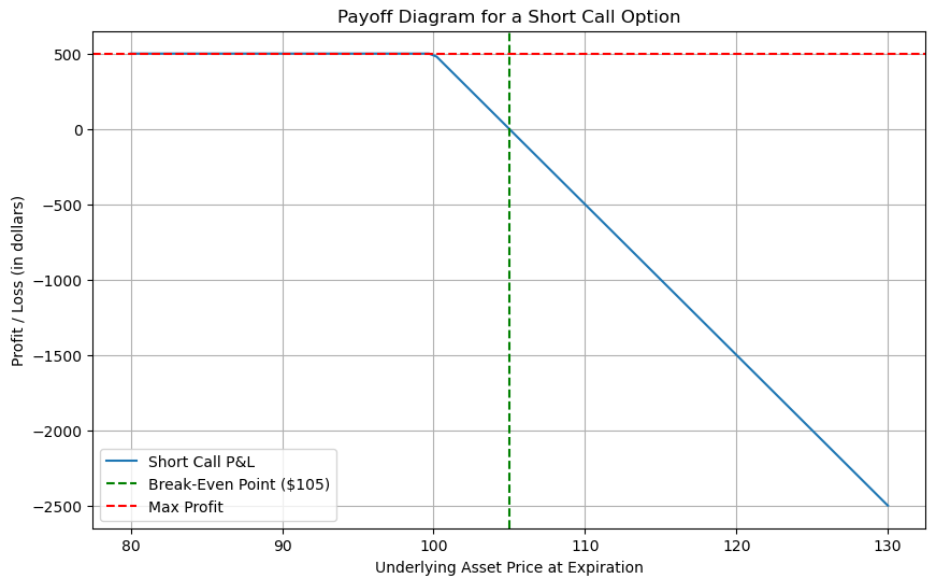

The risk associated with selling naked options is shown by the payoff diagram for a short call. The amount of credit obtained at the time the call is sold determines the maximum profit potential. If the price of the underlying asset rises, though, the risk is uncapped.

The maximum profit possibility is $500, for instance, if a $100 strike short call option is sold for $5.00. Above the break-even threshold, the greatest loss is ambiguous. The break-even price of $105 is equal to the strike price plus the premium earned. The position will lose money if the underlying stock price is higher than the break-even threshold when it expires.

Short Put

In the short put options strategy, an investor sells a put option, assuming the risk that, should the buyer exercise the option before or at expiration, the investor will have to purchase the underlying asset at the option’s strike price. Investors who are neutral or moderately positive about the underlying asset and want to receive premium income may use this approach to either profit from the option expiring worthless or as a means of acquiring the asset at a reduced price.

How It Works

Selling a Put Option: The put buyer pays the investor a premium when the investor sells a put option. The put seller receives this premium as advance payment.

Purchase Obligation: Should the buyer choose to exercise the option, the seller selling the put is required to purchase the underlying asset at the strike price. This often occurs when the underlying asset’s market price drops below the strike price.

Premium as Profit: The seller hopes to keep the premium as profit if the put option expires worthless (the underlying asset’s price remains above the strike price).

Objective

The short put strategy seeks to make money by selling put options and keeping the premiums. It represents a wager that, prior to the option expiring, the price of the underlying asset will not fall noticeably below the strike price. Taking into account the premium obtained, this method may also allow an investor to purchase the underlying asset at a price that they find favorable.

Risk

Limited Profit Potential: The premium obtained upon selling the put option is the maximum profit that may be made from a short put. However much the price of the underlying asset rises, there is no chance for further profit beyond this premium.

Possibility of Significant Loss: The put seller may be required to purchase the underlying asset at the strike price, which would be greater than the current market price, if the asset’s price falls far below the strike price. The greatest loss, because the price of the underlying asset cannot fall below zero, is theoretically equal to the put’s strike price minus the premium received.

Margin Requirements: Selling puts requires having enough capital in the account to cover the potential purchase of the underlying asset if the put is exercised. This margin requirement can tie up capital that might be used elsewhere.

Rewards

Premium Income: The primary benefit is obtaining premium income without having to make a sizable initial investment. This approach can be especially attractive when the market is flat or marginally positive and the price of the underlying asset is rising, rendering the option worthless at expiration.

Purchasing Desired Stocks at Lower Prices: Selling puts may enable investors to purchase the underlying asset at a potential lower net price (strike price less premium received).

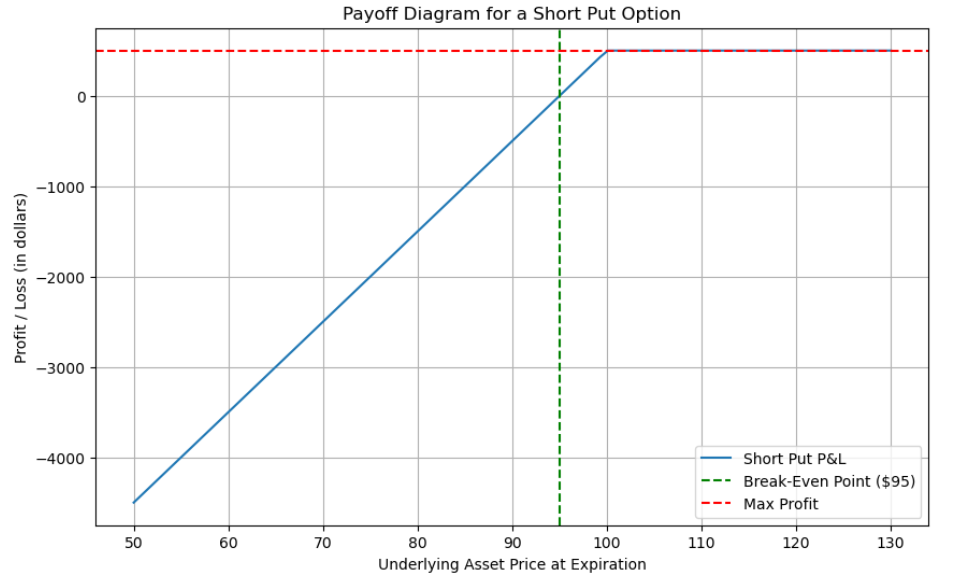

The risk associated with selling naked options is shown by the payoff diagram for a short put. The maximum profit that can be made while selling a put option is determined by the credit obtained. Until the stock price hits zero, the danger is uncertain.

The maximum profit potential, for instance, is $500 if a short put option with a $100 strike price is sold for $5.00. If the break-even point is reached, the maximum loss is unknown. The $95, or break-even price, is equal to the strike price less the premium collected. The position will lose money if the underlying stock price is lower than the break-even mark when it expires.