The Producer Price Index (PPI) measures the average change over time in the prices that domestic producers receive for their goods and services. Also, it’s a key indicator of inflation at the wholesale level, reflecting price changes from the perspective of the seller rather than the consumer.

The Bureau of Labor Statistics (BLS) releases the Producer Price Index (PPI) report monthly, providing crucial insights into the average change over time in the selling prices received by domestic producers for their goods and services. The report is typically released around the 12th of each month at 8:30 AM Eastern Time. It includes data on various industry classifications, commodity classifications, and the Final Demand-Intermediate Demand (FD-ID) system. These offer a comprehensive view of price changes across different sectors. This data is essential for economists, policymakers, and businesses to understand inflationary trends and make informed decisions.

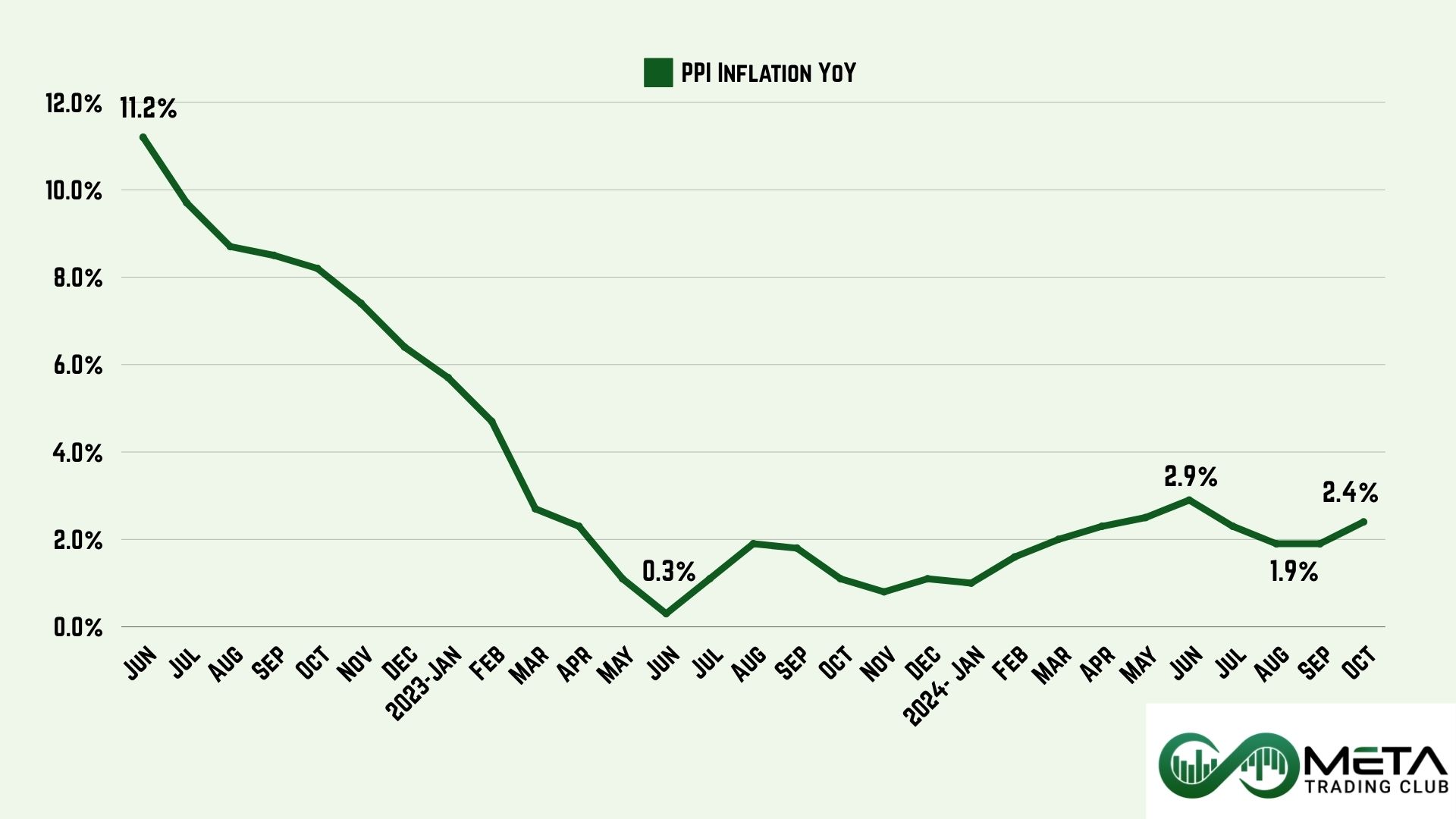

October Producer Price Index

In October, the Producer Price Index (PPI) for final demand increased by 0.2% on a seasonally adjusted basis, following a 0.1% increase in September and a 0.2% rise in August. Over the past 12 months, the unadjusted final demand index rose by 2.4%.

Key highlights include:

- Final Demand Services: The index rose by 0.3%, driven primarily by final demand services excluding trade, transportation, and warehousing. Increases were noted in portfolio management (+3.6%), machinery and vehicle wholesaling, airline passenger services, and other sectors.

- Final Demand Goods: Prices inched up by 0.1%, with a 0.3% rise in final demand goods excluding foods and energy. However, energy and food prices declined by 0.3% and 0.2%, respectively.

- Core PPI: Excluding foods, energy, and trade services. Also, the index increased by 0.3% in October and 3.5% over the last 12 months.

Overall, the report indicates moderate inflationary pressures in both goods and services sectors for October.

Image Source: U.S. Bureau of Labor Statistics

Impacts of October PPI Data On Market

Economists and analysts have revised their economic forecasts slightly upward, considering the recent PPI data as a sign of a growing economy. This positive indicator suggests that modestly increasing producer prices could lead to more optimistic projections for GDP growth and corporate earnings.

The slight increase in the Producer Price Index (PPI) showed that inflation pressures are easing, which made investors feel more positive. As a result, it suggested that the Federal Reserve might not need to cut interest rates.