Procter & Gamble (P&G) is a big company that makes products we use every day. It started in 1837 and was created by William Procter and James Gamble. Today, P&G sells its products in over 180 countries and has many famous brands like Tide, Pampers, Gillette, Pantene, Oral-B, and Olay. They make things for beauty, grooming, health care, cleaning, and baby care.

P&G focuses a lot on new ideas and being good to the environment. They work on reducing waste, using renewable energy, and saving water. The P&G also helps communities with projects and supports diversity. The company is known for doing well financially and making a positive impact on people’s lives around the world.

P&G Fiscal Q3 2025

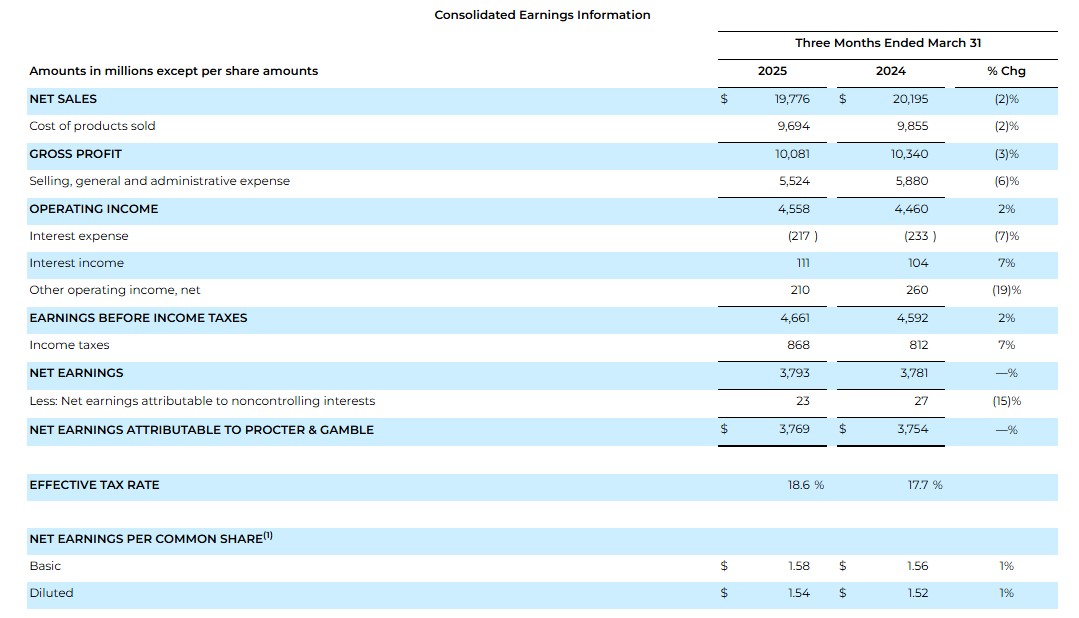

P&G (PG) reported net sales of $19.8 billion for the third quarter of fiscal year 2025, reflecting a 2% decline compared to the previous year.

Organic sales increased by 1%, driven mainly by higher pricing, while mix and organic volume had a neutral impact.

Diluted and core net earnings per share increased by 1% to $1.54, with currency-neutral core EPS rising by 3%.

Segment Performance:

- Beauty: Organic sales rose by 2%. Personal Care organic sales grew significantly due to innovation, but Hair Care remained unchanged, and Skin Care experienced slight declines.

- Grooming: Organic sales increased by 3%, supported by volume growth and higher pricing in key regions like Latin America, Europe, and North America.

- Health Care: Organic sales climbed 4%, with Oral Care showing modest growth and Personal Health Care achieving high single-digit growth.

- Fabric and Home Care: Organic sales remained flat; Home Care experienced slight declines due to volume drops.

- Baby, Feminine, and Family Care: Organic sales decreased by 1%, impacted by volume declines, although some favorable mix effects partially offset the losses.

Cash Flow and Shareholder Returns:

- P&G generated $3.7 billion in operating cash flow and $3.8 billion in net earnings.

- The company achieved a 75% adjusted free cash flow productivity rate and returned $3.8 billion to shareholders via dividends and share buybacks.

- P&G announced its 69th consecutive annual dividend increase, maintaining 135 years of consistent dividend payments.

Guidance

In the third quarter of fiscal year 2025, net sales amounted to $19.8 billion, marking a two percent decline compared to the previous year.

Organic sales, which exclude the effects of foreign exchange as well as acquisitions and divestitures, rose by one percent, primarily due to higher pricing. Sales mix and organic volume had a neutral effect on overall sales during the quarter.

Board Statements

Jon Moeller, Chairman of the Board, President, and CEO reported that the company achieved modest organic sales and EPS growth during the quarter despite operating within a challenging and volatile consumer and geopolitical environment. He highlighted that the organization is adapting its near-term outlook to align with underlying market conditions while maintaining confidence in the long-term growth potential of its brands and the markets it serves.

Moeller reiterated the company’s dedication to its integrated growth strategy, which emphasizes a focused product portfolio within daily use categories that drive brand choice through performance. This strategy encompasses superiority across various dimensions such as product performance, packaging, brand communication, retail execution, and consumer and customer value, as well as a commitment to productivity, constructive disruption, and fostering an agile and accountable organizational structure.

Additionally, the CEO affirmed that the company continues to invest in superior innovation across price tiers to enhance consumer value and stimulate category growth.

Impact on the Market

Procter & Gamble’s (PG) earnings had mixed effects on its stock. Shares fell by 4% in the morning session after the release due to revenue missing expectations and a lowered full-year EPS forecast. Investors reacted negatively to the 2% drop in net sales despite the 1% growth in organic sales.

The decline reflects concerns over the company’s cautious outlook for fiscal 2025. However, P&G stressed its focus on long-term growth strategies, including innovation and strong shareholder returns, which could help regain investor confidence in the future.