Strike Price

The strike price is an important concept in options trading since it establishes the predetermined price at which an option contract can be executed. Essentially, it is the price at which the option holder can purchase (in the case of a call option) or sell (in the case of a put option) the underlying asset or security. The strike price is important because it determines whether exercising the option will benefit the holder financially.

For Call Options

Buying a Call Option: When you buy a call option, you gain the right to buy the underlying asset at the strike price. If the asset’s market price increases over the strike price, you can use your option to acquire it at the lower, agreed-upon price and potentially sell it for a profit at the current market price.

For Put Options

When you buy a put option, you are obtaining the right to sell the underlying asset at the specified price. If the asset’s market price falls below the strike price, exercising your option permits you to sell it at the higher, agreed-upon price, which can be useful if you want to reduce losses or benefit from the slide.

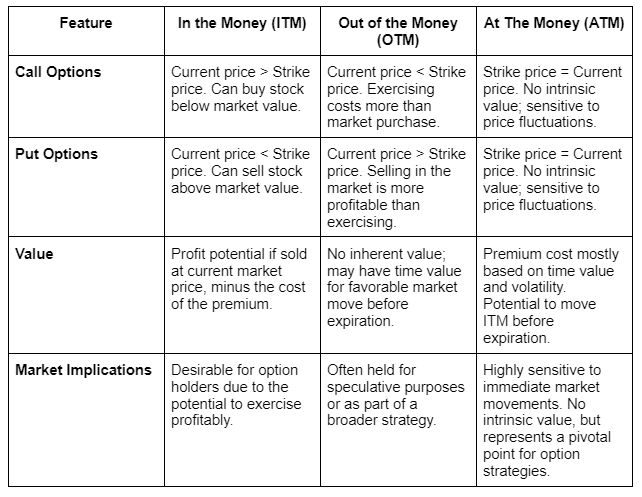

Options Moneyness

In the Money (ITM)

Call Options: An ITM call option indicates that the underlying stock’s current price is higher than the option’s strike price. This scenario benefits the option holder since they can acquire the stock at a cheaper price than the current market value, potentially resulting in a profit if sold at the current market price.

Put Options: An ITM put option indicates that the underlying stock’s current price is lower than the option’s strike price. This permits the option holder to sell the stock at a higher price than its current market value, potentially resulting in a profit.

Being ITM does not ensure a profit due to the option’s premium. The overall profitability must account for the cost of the premium paid to purchase the option.

Out of the Money (OTM)

Call Options: An OTM call option exists when the stock’s current price is less than the strike price. If an option expires in this situation, it is worthless since exercising the option to buy the stock would cost more than buying the stock directly from the market.

Put Options: An OTM put option occurs when the stock’s current price exceeds the strike price. Similarly to the OTM call option, exercising this option would be less advantageous than selling the stock on the open market, making the option worthless at expiration if it remains OTM.

OTM options may not have inherent value, but they may nevertheless have time value depending on the potential that the market would move favorably before expiration.

At The Money (ATM)

Both Call and Put Options: An option is ABM when its strike price equals the underlying stock’s current price. While ABM options have no intrinsic value (as there is no incentive to exercise the option over trading the stock directly in the market), they are sensitive to fluctuations in the underlying asset’s market price. The premium’s cost is mostly determined by the underlying asset’s time value and volatility, with the option having the potential to move ITM before expiration.

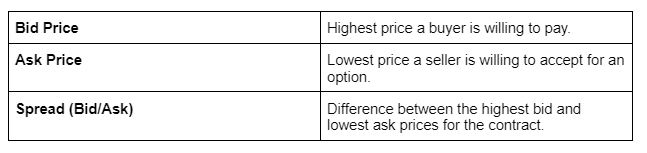

Bid/Ask Price

Bid Price: This is the highest price a buyer is willing to pay for a certain option. It represents the market’s desire for that particular choice.

Ask Price: In contrast, this is the lowest price at which a seller is willing to sell the option, representing the supply side.

Spread refers to the difference between bid and ask prices. A narrower spread typically signals a more liquid market for the option, making it easier for traders to enter or exit positions at prices close to their target.

Holder and Writer

Holder: The purchaser of an option contract who gains the right, but not the duty, to buy (call) or sell (put) the underlying asset at the predetermined strike price. The holder pays the premium to enter this position.

Writer: The option contract’s seller, who agrees to buy or sell the underlying asset if the holder exercises the option. The writer receives the premium as payment for taking on this risk.

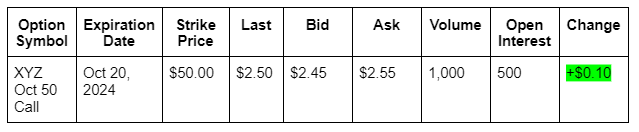

Option Symbol: A unique identification for the option, which frequently includes the underlying asset (XYZ), expiration month (October), strike price (50), and type (Call).

Expiration Date: The last day the option may be exercised. In this scenario, October 20th, 2024. After this date, the option becomes worthless.

Strike Price: The price at which the holder can buy (call) or sell (put) the underlying asset. Here, $50.00.

Last: The option’s last traded price. The most recent transaction occurred at $2.50 per share (options contracts typically represent 100 shares).

Bid: A bid is the highest price that a buyer is willing to pay for an option. If you’re selling the option, this applies to you. Currently $2.45.

Ask: Ask for the lowest price that a seller is ready to accept for the option. If you buy the option, you will most likely pay this amount. Now priced at $2.55.

Volume: Volume is the number of contracts traded during the trading session. considerable volume may imply considerable interest or liquidity in the option. Here, 1,000 contracts were traded.

Open Interest: Open Interest refers to the total amount of outstanding contracts that have not been settled. This option currently has 500 open contracts, indicating interest and liquidity.

Change: The change in the option’s price since the previous day’s closure. A +$0.10 change implies that the option price has risen by this much since the previous trading session.

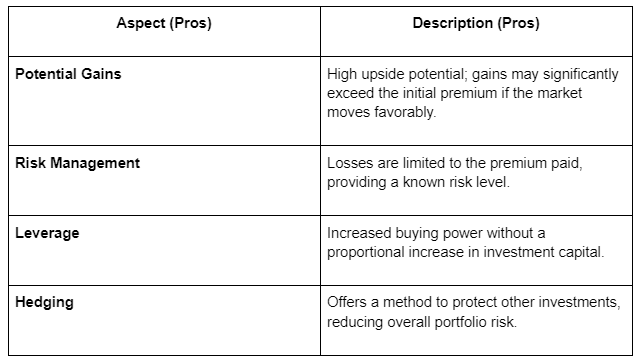

Pros and Cons of Options Trading

Pros

Options entail a lower initial expenditure (the premium) than purchasing or selling the underlying asset outright. This can offer leverage, resulting in a potentially large return on investment.

Downside Protection:

Purchasing options can provide protection against losses in other portfolio positions. For example, purchasing put options to protect against a drop in stock value.

Flexibility:

Options allow you to profit from both upward and downward market movements without having to fully invest in the underlying asset. They can also be utilized in a variety of combinations to develop strategies tailored to distinct market perspectives and risk tolerances.

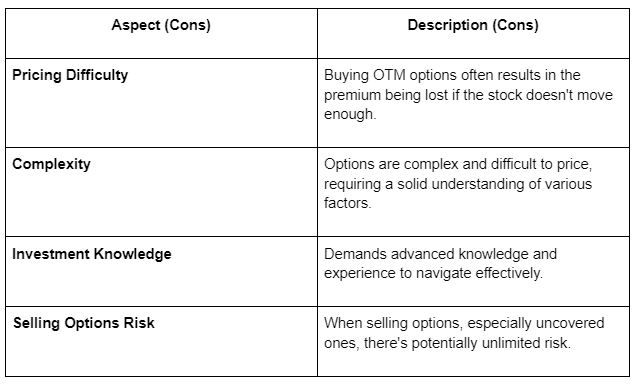

Cons

Increased Risk for Sellers:

Option writers face potentially unlimited losses, particularly when trading uncovered (naked) positions. If the market goes strongly against the position, the risk may outweigh the premium obtained.

Complexity:

Options can be sophisticated financial products that require a significant learning curve. Understanding options pricing, the Greeks, and how various factors such as volatility and time decay influence option value is critical.

Risk of Loss:

While the premium paid for purchasing options reduces the buyer’s risk, the full amount can still be lost if the option expires worthless. This is a common outcome for many options traders, especially those who bet on short-term market changes.

Meta Trading Club is a leading educational platform dedicated to teaching individuals how to trade and invest independently. Through comprehensive educational programs, personalized mentorship, and a supportive community, Meta Trading Club empowers traders to navigate financial markets with confidence and expertise.