If you are a trader who is new to options, I recommend reading Beginners Guide to Options. Then come back here to learn how to trade with 4 basic option trading strategies.

Options trading is buying or selling options contracts. Whether you buy or sell depends on how you think a stock will perform over a specific period of time. Also, options trading is popular with traders for a number of reasons. Certain options trading strategies can potentially limit the risk of loss, protect trade position against market volatility, or turn a profit. Stay with us with step-by-step trading options process.

Table of Contents

What is Options Trading?

Options trading is the practice of buying or selling options contracts. These contracts are agreements that give the holder the choice to buy or sell a collection of underlying securities at a set price by a specific date.

Options trading also involves two parties: the holder (buyer) and the writer (sometimes called the seller). Holders are traders who purchase contracts, while writers create them. The holder pays the writer a premium for the right to sell or buy a stock by a certain date. This premium is usually a fee per share, and it’s also the maximum a holder can lose if the contract expires worthless.

Options trading is appealing because it can allow a holder to make a bet on how a stock will perform without risking more than their initial premium. And though that might sound simple, the strategies involved in options trading can be complex. There are many other rules, risks and exceptions involved.

Success in options trading requires a strong understanding of options vocabulary, jargon and key concepts. Also, to even get started, you’ll often need to sign an agreement and prove to your broker that you know what you’re doing. We discussed basic concepts in the beginner’s guide to option article and here we are going to learn intermediate concepts in options.

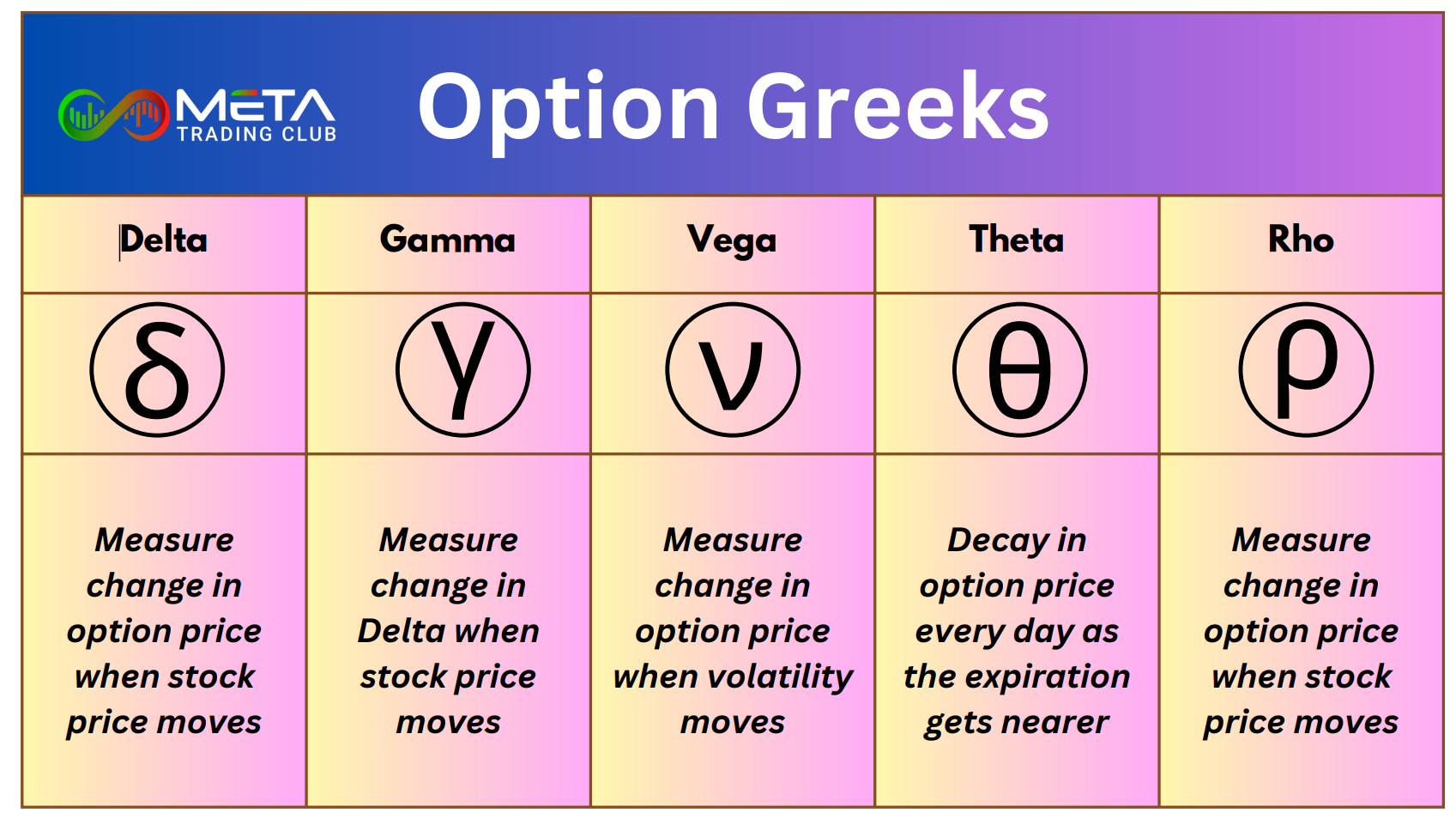

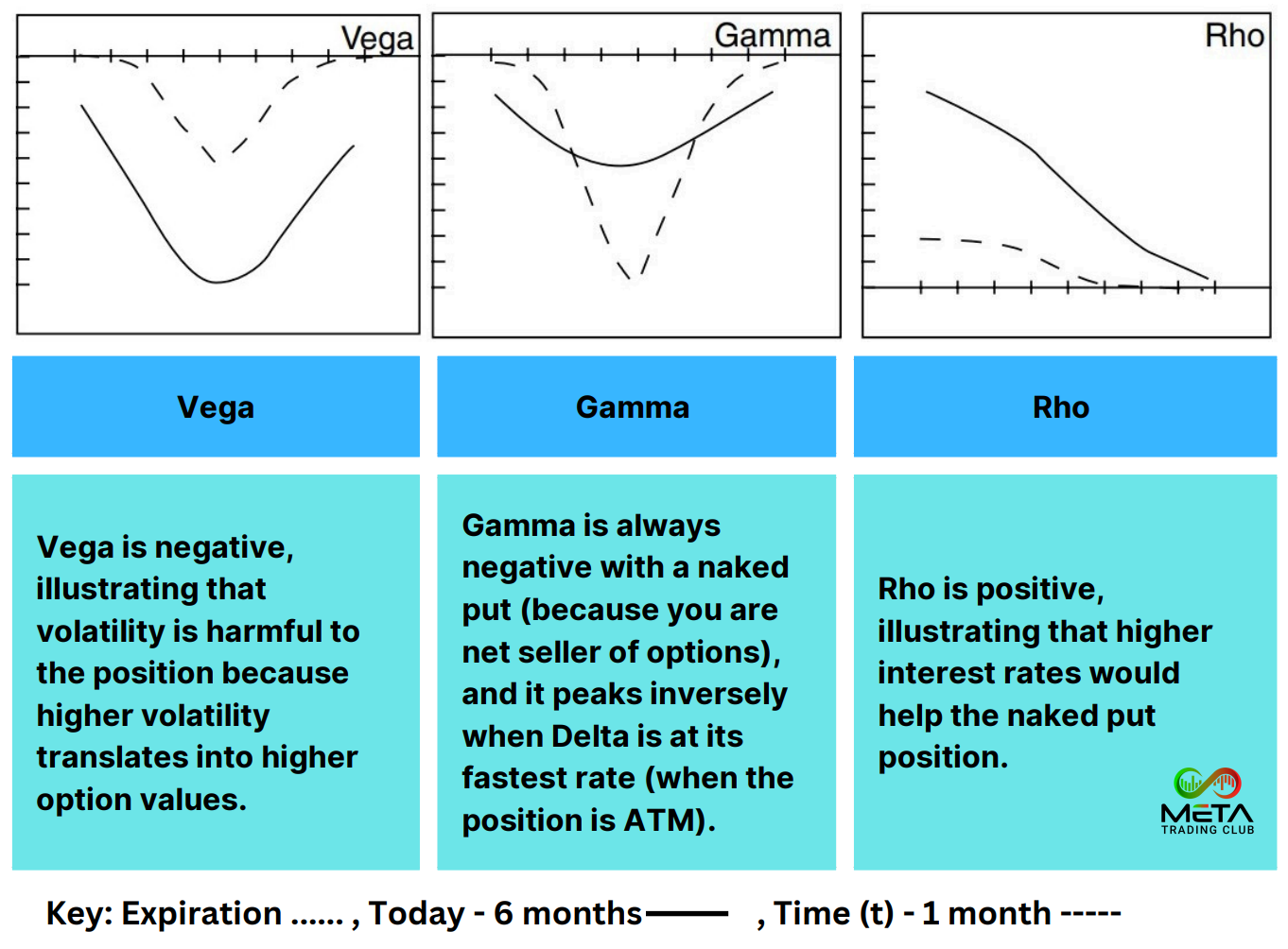

Option Greeks

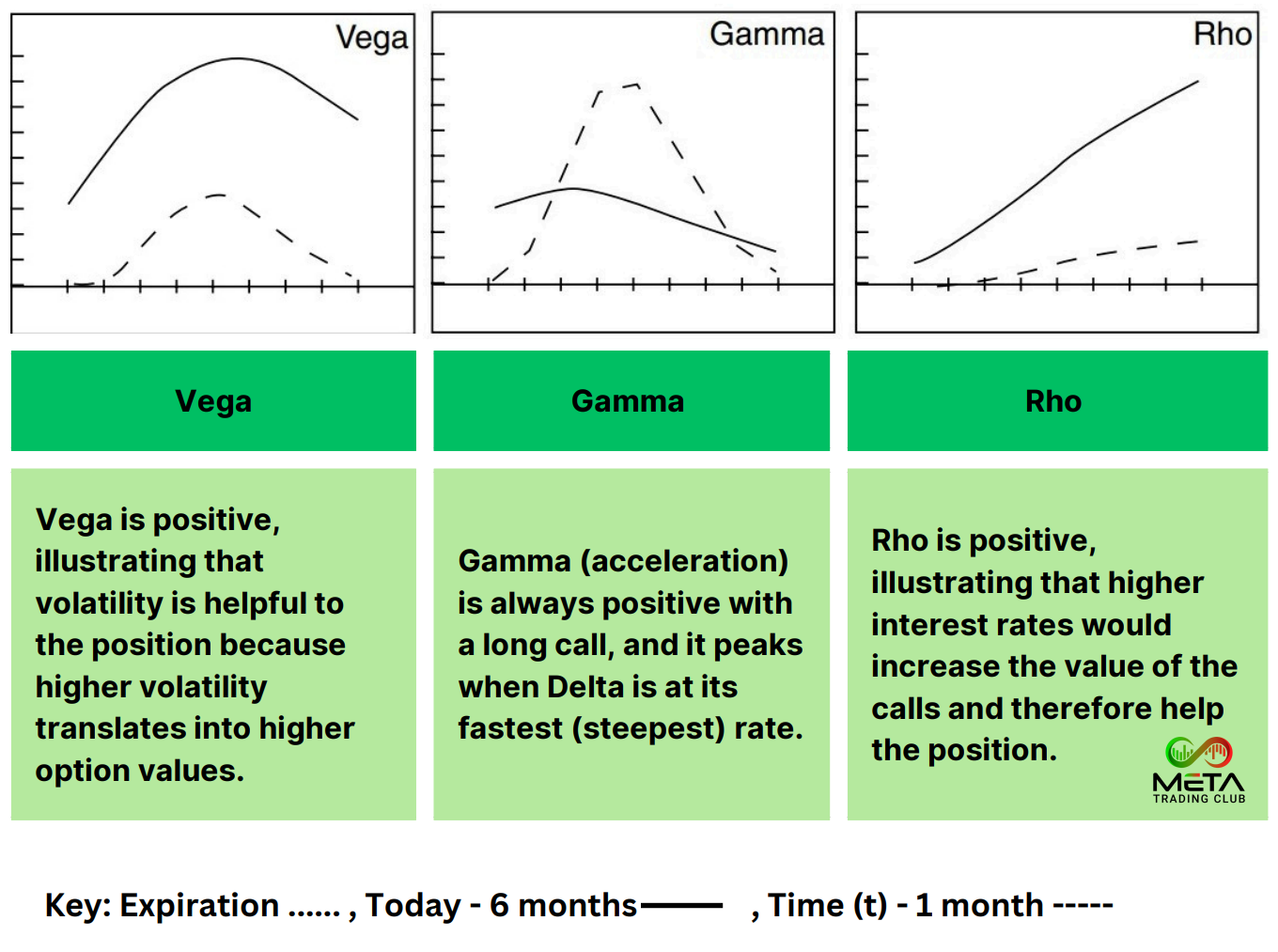

Knowledge of options Greek is essential to making informed trading decisions. Option Greeks are the variables that measure the change in volatility, time to expiry and price fluctuations of the underlying asset, which impacts the value of options. They help traders identify new opportunities and emerging trends. Vega, Delta, Gamma, Theta and Rho are the main option Greeks.

1. Vega

Volatility is the key driver of options price. Vega measures the sensitivity of option premium to changes in the underlying asset’s volatility. Therefore, the higher the volatility, the greater the chance of changes in premium and vice versa. For at-the-money option Vega is the highest because any change in volatility thereon will sharply move the premium up or down. It starts to taper when the option keeps getting in-to-money or out-of-money.

2. Delta

Delta is by far the most important and, thus, widely used Greek option. However, it quantifies the sensitivity of option prices to changes in underlying asset prices. A call option, for example, has a delta of 0.70. If the underlying asset’s price rises by $1, the option trading price rises by $0.70. Moreover, a higher delta indicates greater sensitivity to changes in the value of the underlying asset. The delta of call options ranges between 0 and 1. Although, put options have a negative delta ranging from 0 to -1.

3. Gamma

Among the least used option Greeks to formulate options strategies, Gamma shows how the Delta of an option will change for a one-point move in the underlying asset. At-the-money options have a higher Gamma, while it is lower for in and out-of-the-money options.

4. Theta

Because options have an expiration date, time is essential when making money through options. Also, the premium has a built-in time value. The value of the option premium decreases with each passing day or week. As the expiry date approaches, the rate of decay accelerates. This is referred to as time decay and is quantified by the option Greek –Theta. Theta is highest for at-the-money options and lowest for deep-in-the-money options.

5. Rho

Rho measures the rate at which the price of an option will change in response to a change in interest rate. For example, if a call option has a Rho of 1.0, a 1% increase in interest rate will increase the option price by 1%.

How Does Options Trading Work?

When you trade options, you’re essentially placing a bet on if a stock will decrease, increase or remain the same in value; how much it will deviate from its current price; and in what time those changes will occur.

Based on those parameters, you can choose to enter into a contract to buy or sell a company’s stock. The most basic types of contracts are what options traders refer to as calls and puts.

After you’re locked in a contract, you can proceed in a few ways: You can exercise your right to buy or sell, you can resell your contract to another party, or you can elect for your contract to expire worthless. To recap:

- Holders purchase contracts. They can exercise their right to sell or buy the underlying stock before the contract expires. If they bet on a stock’s trajectory correctly, there’s potential for unlimited gains. If the contract expires worthless, the holder will, at most, lose their initial investment.

- Sellers, or writers, of contracts can make a profit off of the premiums they charge buyers. But they’re also liable for selling or buying the underlying stock at the strike price should the market move against their favor. This also means that in certain circumstances, losses can be unlimited.

Unlike stocks, options trades involve finite contract dates, which means that you don’t get the benefit of time to see if your trade will eventually move in the direction, you want it to move. So, options traders need to be armed with a certain level of confidence and knowledge about the stock market to make informed decisions.

Options Trading Example

Let’s run through a simple example of buying a call option. We’ll look at the setup, payoffs, contract size, moneyness, and how premium affects profits and the break-even point.

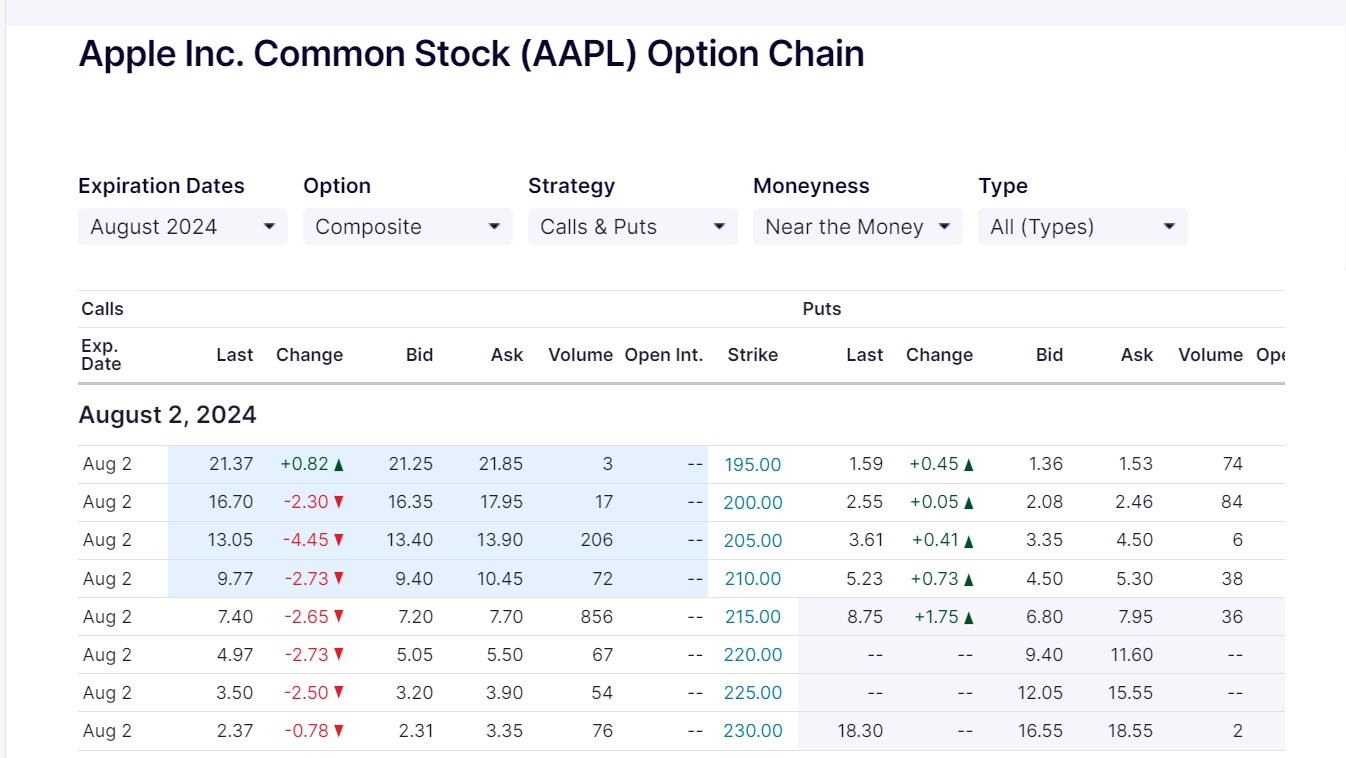

You believe Apple’s stock will rise above $230 in the near future. So, you buy 5 call options with a strike price of $230 expiring on August 2nd. Also, each contract costs 2$, and the contract size is 100. So, these 5 contracts cost you $1000.

Each option contract gives you the right to buy 100 Apple shares for $23,000 until August. Since you bought 5 contracts, you have the right to buy 500 Apple shares for $115,000 ($230 for each share).

Currently, Apple trades at $214. Your call option is OTM, which means it has no intrinsic value. The $2 you paid in premium is purely extrinsic value.

Source: Nasdaq

We want the price of Apple to rise so your call options expire ITM.

ITM Scenario

Apple now trades at $250.

- Did you make money? Yes, you made money. Your call option is ITM and has an intrinsic value of $20. This means, you now have the right to pay $230 for an asset worth $250. So, you exercise all 5 call options and buy 500 shares for $115,000. Also, You can then go to the market and sell your 500 Apple shares for $250 each, for a total of $125,000.

- Who’s selling them to you? The holder of the short position on your calls, that is, the person who sold you the contracts. They are obliged to hold their end of the deal and take the loss.

- How much did you make? $10,000. But remember, you paid $1,000 for the 5 contracts in the first place. Your net profit is $9,000, or $18 a share.

The profit profile takes the $2 premium cost into account. This is why the break-even point is $232.

ATM Scenario

If the call expired and Apple traded for $232, your option has an intrinsic value of $2. You can exercise your right to buy 500 shares for $230 and sell them for $232 immediately after on the market, making a gain of $1,000. However, $1,000 is exactly what you paid for the 5 calls, so your net profit is $0.

OTM Scenario

If, at the time of expiration, Apple trades below 225, your loss is the premium you paid for the call option. That $1,000 is gone, and you won’t get them back. The seller of the call is happy.

The Four Basic Option Trading Strategies

Now, we are going to explain long call option and short call option trading in detail.

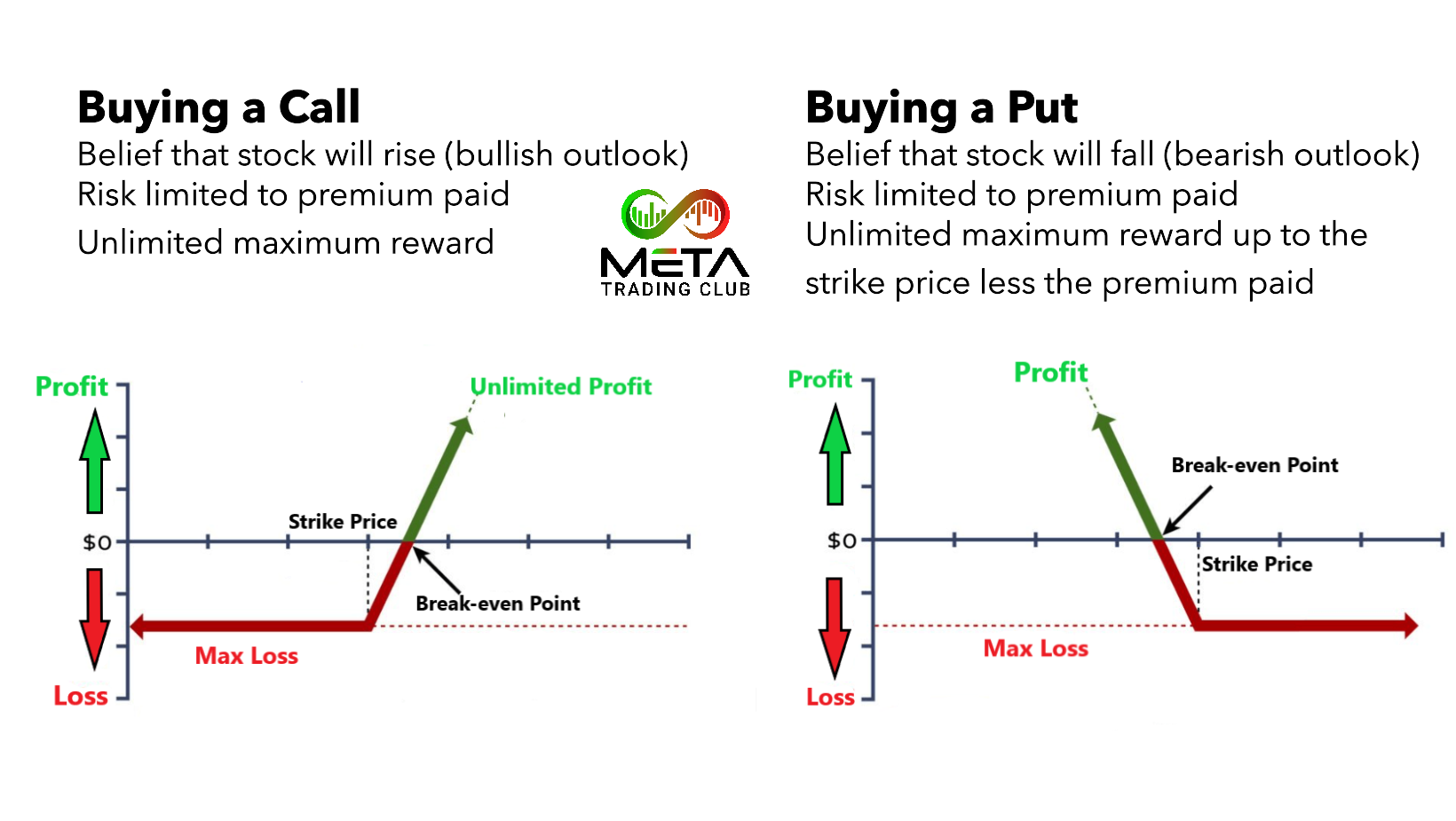

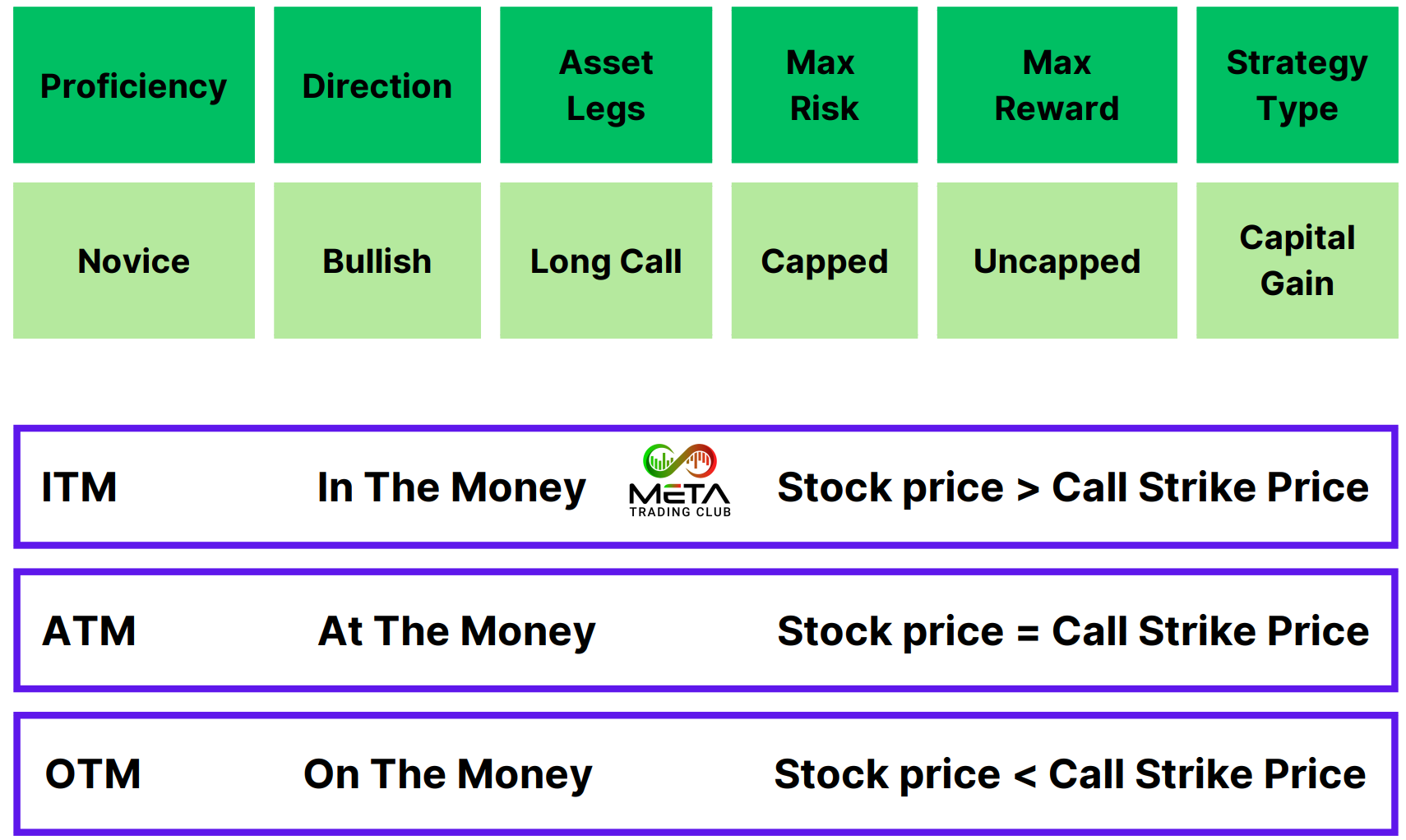

Long Call Option Trading Strategy

Buying a call is the most basic of all option trading strategies. For many people, it constitutes their first options trade after gaining experience buying and selling stocks. Calls are easy to understand.

When you buy a call option, you’re hoping that the underlying share price will rise. A call option is a type of financial contract that gives the buyer the right, but not the obligation, to buy a stock at a specified price (strike price) within a specific time period (expiry date).

Before buying the call option, consider these factors and then open your position.

- Remember that for option contracts in the U.S., one contract is for 100 shares. So when you see a price of $1.00 for a call, you will have to pay $100 for one contract.

- Manage your position according to the rules defined in your Trading Plan. If you don’t have any yet, visit Meta Trading Club.

- If the stock falls below your stop loss, then exit by selling the calls.

- Do ensure that you give yourself enough time to be right; this means you should go at least six months out.

Steps to Trading a Long Call

- Outlook: With a Long Call, your outlook is bullish. You expect a rise in the underlying asset price. Try to ensure that the trend is upward and identify a clear area of support.

- Appropriate Time Period to Trade: At least three months, preferably longer, depending on the particular circumstances.

- Selecting the Stock: Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

- Selecting the Option: Choose options with adequate liquidity; open interest should be at least 100, preferably 500.

- Strike: Look for either the ATM or ITM (lower) strike below the current stock.

- Expiration: Give yourself enough time to be right; remember that time decay accelerates exponentially in the last month before expiration, so give yourself a minimum of three months to be right, knowing you’ll never hold into the last month. That gives you at least two months before you’ll need to sell. Longer would be better, though.

- Exiting the Trade: Exiting the position by selling the calls you bought! Sell your long options before the final month before expiration if you want to avoid the effects of time decay.

- Mitigating a Loss: Use the underlying asset or stock to determine where your stop loss should be placed.

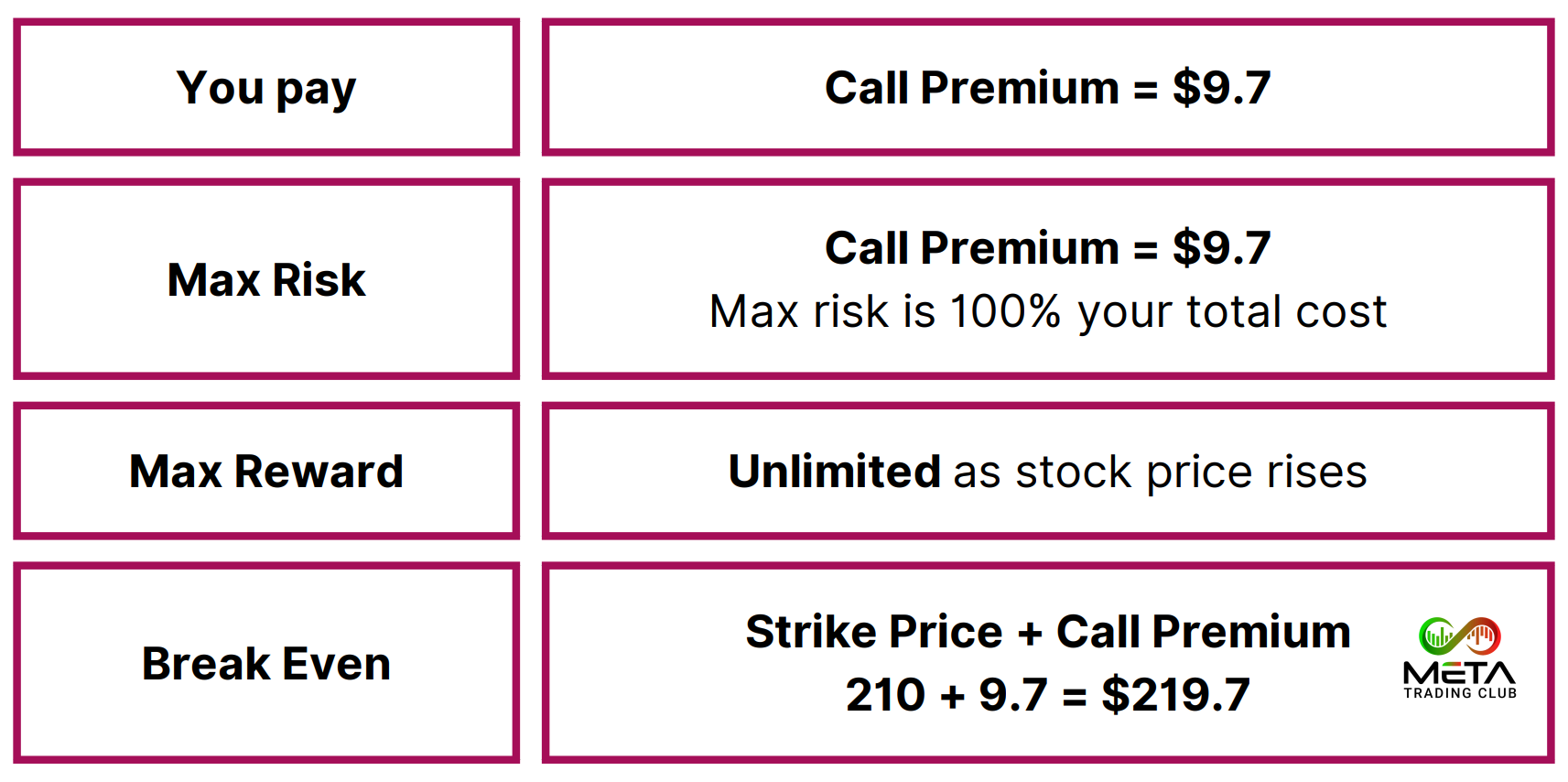

Net Position

This is a net debit transaction because you pay for the call option.

- Your maximum risk is capped to the price you pay for the call.

- Your maximum reward is uncapped.

Risk Profile

- Maximum Risk: [Call premium]

- Maximum Reward: [Uncapped]

- Breakeven: [Call strike + call premium]

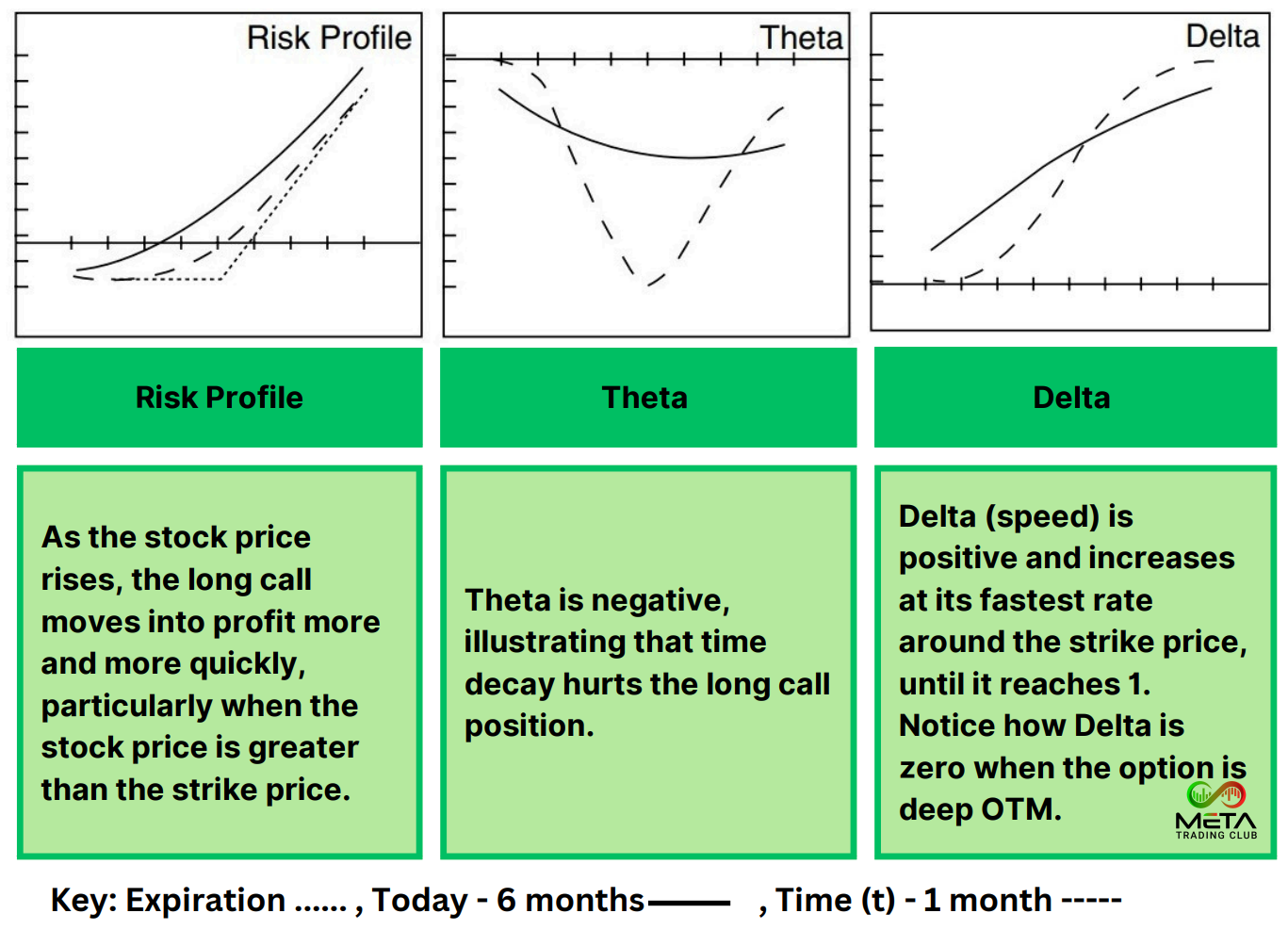

Greeks

Advantages

- Cheaper than buying the stock outright.

- Far greater leverage than simply owning the stock.

- Uncapped profit potential with capped risk.

Disadvantages

- Potential 100% loss if the strike price, expiration dates, and stock are badly chosen.

- High leverage can be dangerous if the stock price moves against you.

Example

Apple is trading at $214 on June 13, 2024

Buy (strike below the current stock) the August 2024 $210 strike call for $9.7

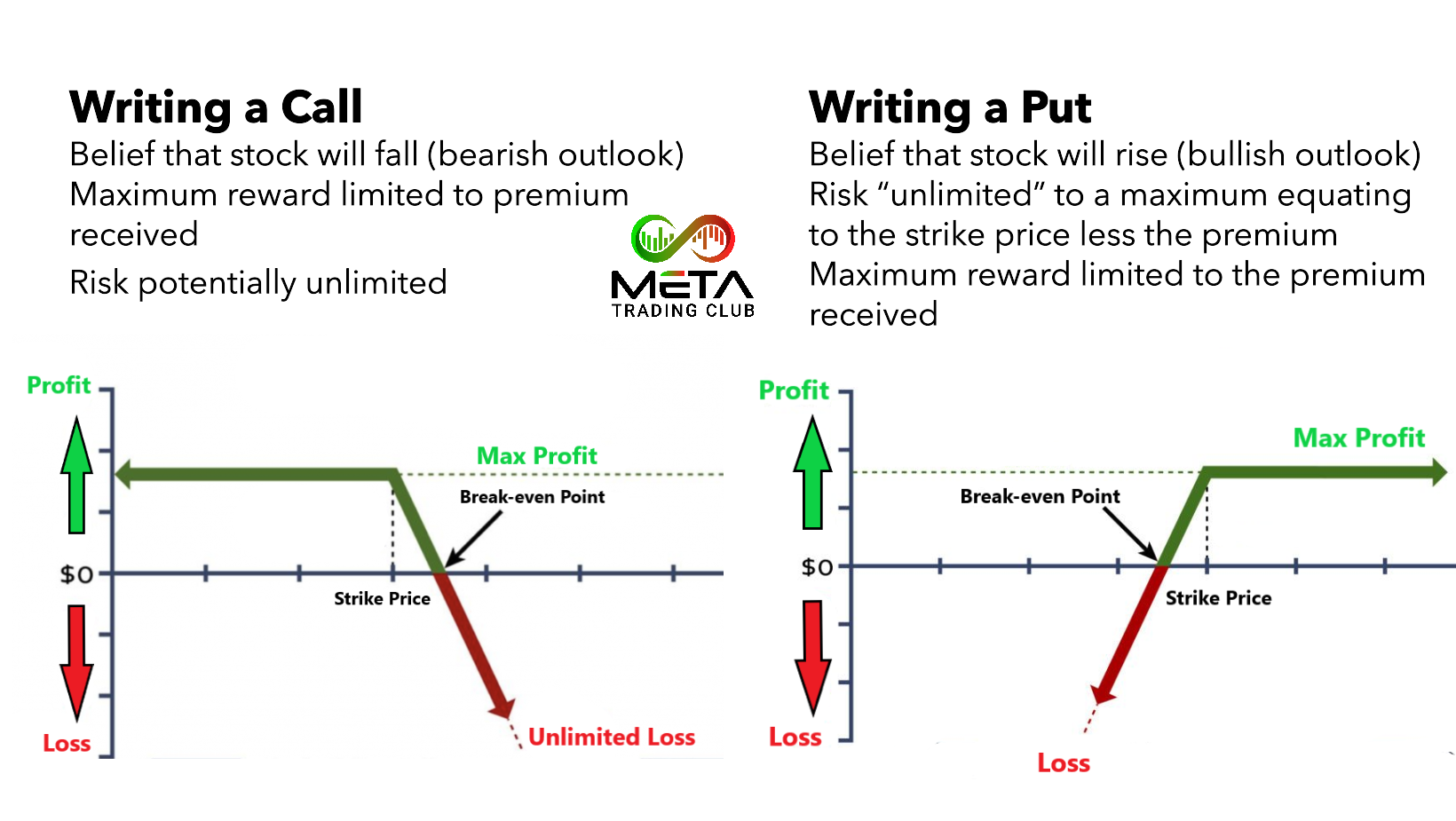

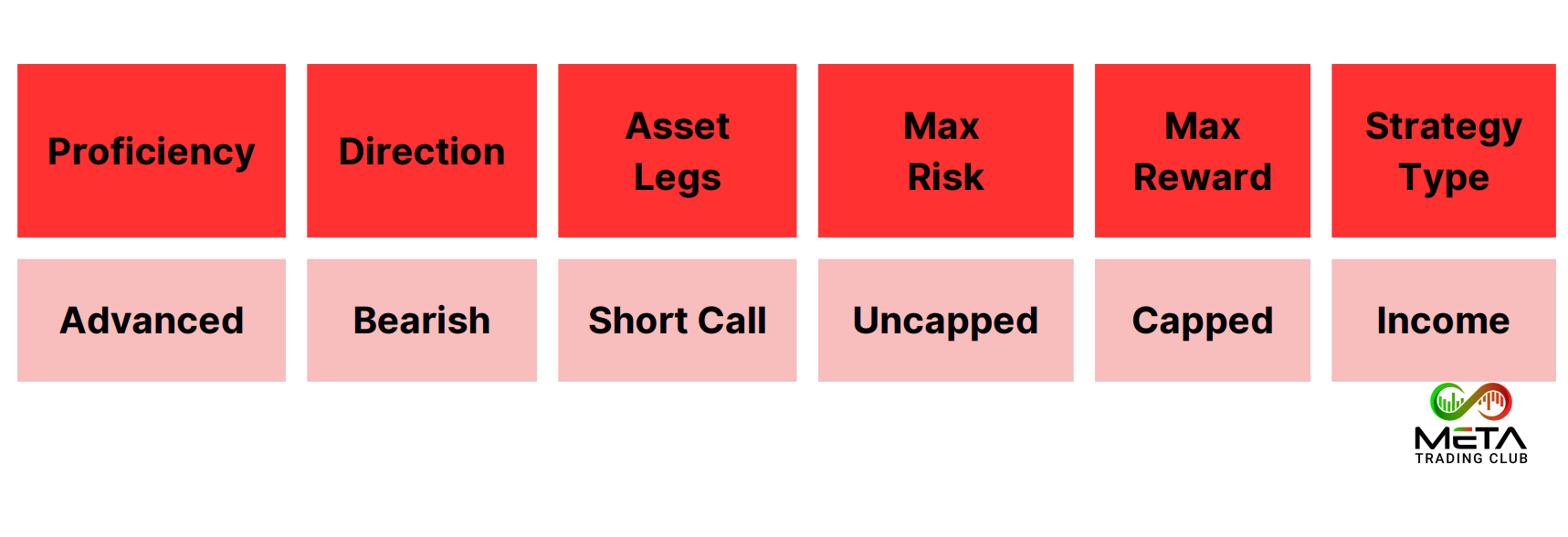

Short Call Option Trading Strategy

Although simple to execute, shorting a call (without any form of cover) is a risky strategy, hence its categorization as an advanced strategy. A Short Call exposes us to Unlimited risk if the stock rises meteorically, and brokers will only allow experienced options traders to trade the strategy in the first place.

A call is an option to buy, so it stands to reason that when you buy a call, you’re hoping that the underlying share price will rise. If you’re selling or shorting a call, it’s therefore logical that you’d want the stock to do the opposite (fall).

Before shorting the call option, consider these factors and then open your position.

- Remember that for option contracts in the U.S., one contract is for 100 shares. So when you see a price of $1.00 for a call, you will receive $100 for one contract.

- Try to ensure that the trend is downward or range bound and identify a clear area of resistance.

- Manage your position according to the rules defined in your Trading Plan. Find out your suitable one in the MTC incubator program.

- Hopefully the stock will decline or remain static, allowing your sold option to expire worthless so you can keep the entire premium.

- If the stock rises above your stop loss, then exit the position by buying back the calls.

- Give yourself as little time as possible to be wrong because your maximum risk is uncapped.

- Time decay is helpful to your naked sold option, so take advantage of the maximum time erosion. Maximum time decay (or theta decay) occurs in the last month before the option’s expiration, so it makes sense to sell one-month or less options only.

Steps to Trading a Short Call

Sell the call option with a strike price higher than the current stock price.

- Outlook: With a Long Put, your outlook is bearish. You are expecting a fall in the stock price; you are certainly not expecting a rise in the stock. To pick up short-term premium income as the stock develops price weakness.

- Appropriate Time Period to Trade: One month or less.

- Selecting the Stock: Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

- Selecting the Option: Choose options with adequate liquidity; open interest should be at least 100, preferably 500.

- Strike: Look for OTM strikes above the current stock price.

- Expiration: Give yourself as little time to be wrong. Remember that your short position exposes you to uncapped risk, and that time decay accelerates exponentially (in your favor when you’re short) in the last month before expiration, so only short the option with a maximum of one month to expiration, preferably less.

- Exiting the Position: Buy back the options you sold or wait for the sold option to expire worthless (if the underlying stock falls and stays below the strike price) so that you can keep the entire premium.

- Mitigating a Loss: Use the underlying asset or stock to determine where your stop loss should be placed.

Net Position

This is a net credit transaction because you are receiving a premium for the call.

- Your maximum risk is uncapped.

- Your maximum reward is capped to the price you receive for the call.

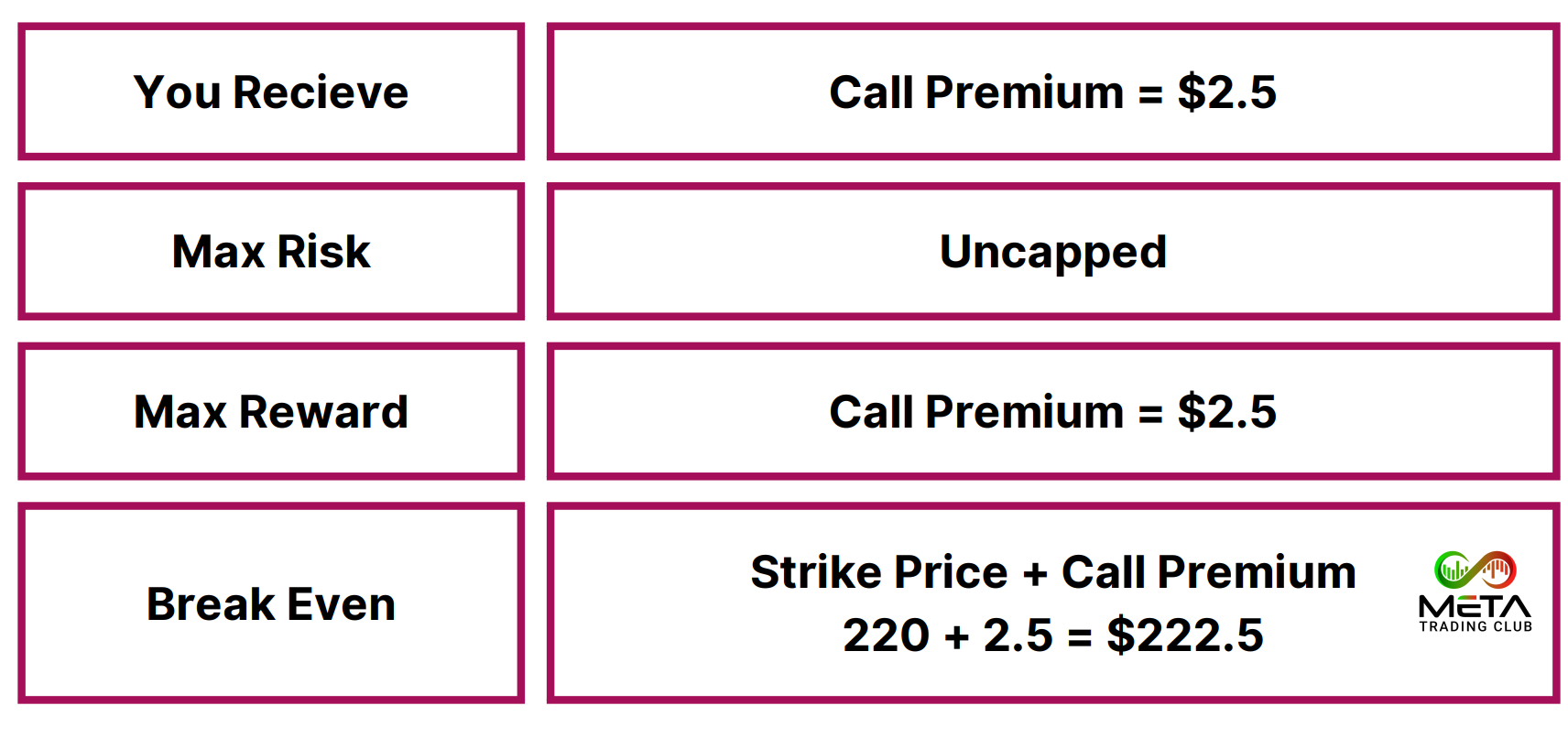

Risk Profile

- Maximum Risk: [Uncapped]

- Maximum Reward: [Call premium]

- Breakeven: [Call strike + call premium]

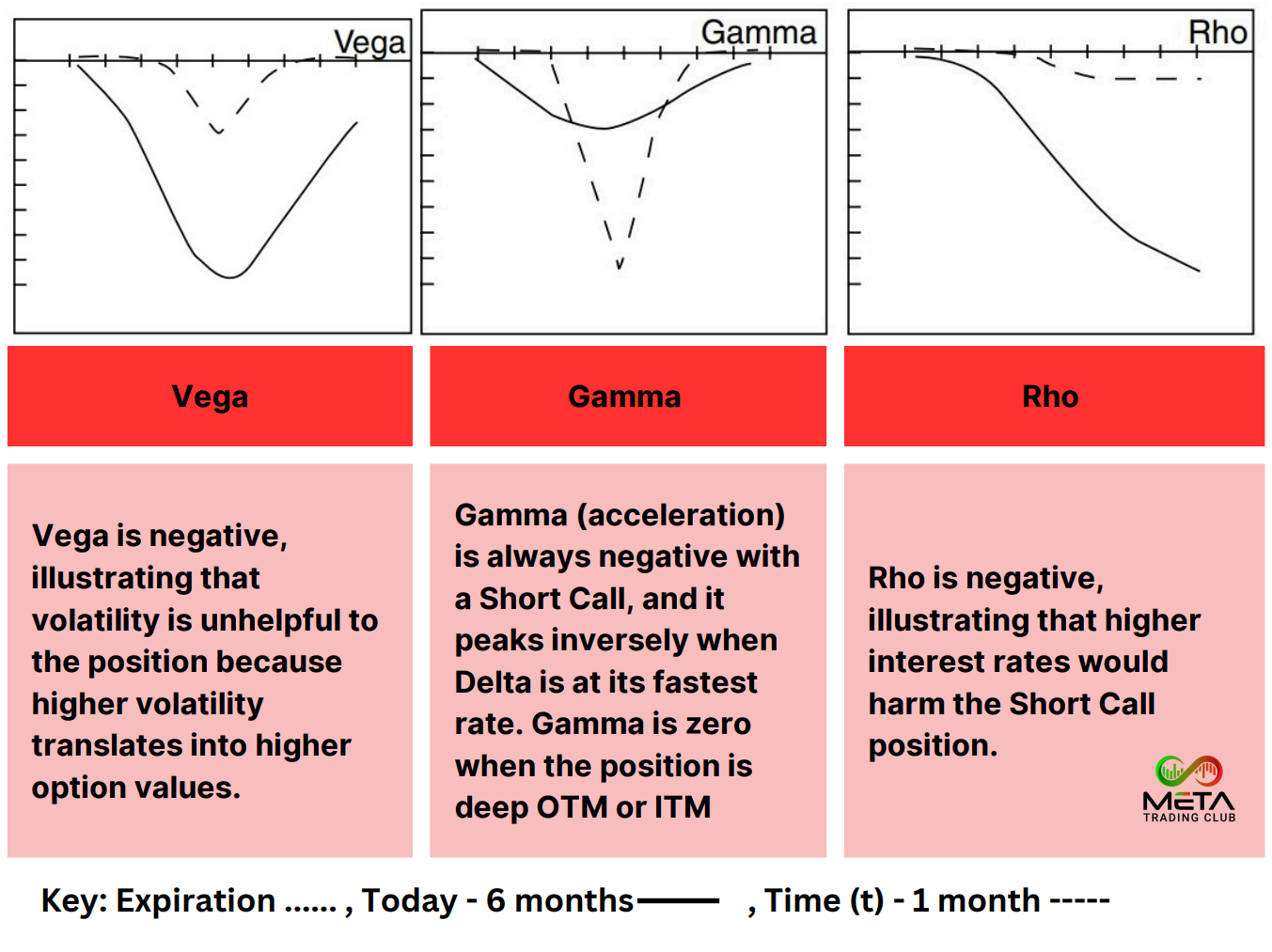

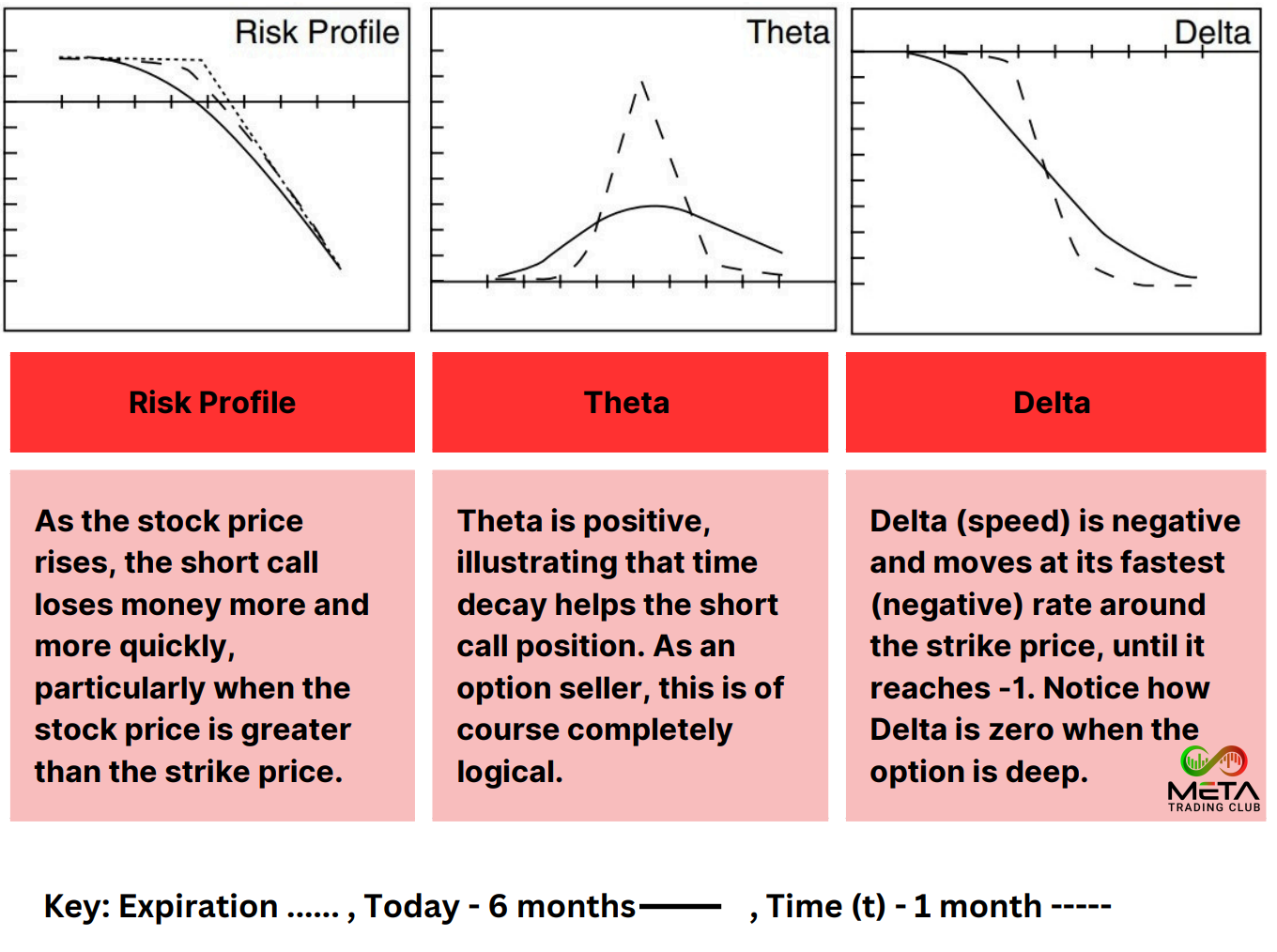

Greeks

Advantages

- If done correctly, you can profit from falling or range bound stocks in this way.

- This is another type of income strategy.

Disadvantages

- Uncapped risk potential if the stock rises.

- A risky strategy that is difficult to recommend on its own.

Example

Apple is trading at $214 on June 13, 2024

Sell (strikes above the current stock price) the July 2024 $220 strike call for $2.5

Long Put Option Trading strategy

Buying a put is the opposite of buying a call. A put is an option to sell. When you buy a put, your outlook is bearish.

Before buying the put option, consider these factors and then open your position.

- Remember that for option contracts in the U.S., one contract is for 100 shares. So when you see a price of $1.00 for a put, you will have to pay $100 for one contract.

- Try to ensure that the trend is downward and identify a clear area of resistance.

- Manage your position according to the rules defined in your Trading Plan. If you want to have a suitable trading plan, Book a Free Call.

- Sell your long options before the final month before expiration if you want to avoid the effects of time decay.

- If the stock rises above your stop loss, then exit by selling the puts.

Steps to Trading a Long Put

- Outlook: With a Long Put, your outlook is bearish. You expect a fall in the underlying asset price.

- Appropriate Time Period to Trade: At least three months, preferably longer depending on the particular circumstances.

- Selecting the Stock: Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

- Selecting the Option: Choose options with adequate liquidity; open interest should be at least 100, preferably 500.

- Strike: Look for either the ATM or ITM (higher) strike above the current stock.

- Expiration: Give yourself enough time to be right; remember that time decay accelerates exponentially in the last month before expiration, so give yourself a minimum of three months to be right, knowing you’ll never hold into the last month. That gives you at least two months before you’ll need to sell. Longer would be better, though.

- Exiting the Trade: Sell the puts you bought!

- Mitigating a Loss: Use the underlying asset or stock to determine where your stop loss should be placed.

Net Position

This is a net debit transaction because you pay for the put option.

- Your maximum risk is capped to the price you pay for the put.

- Your maximum reward is uncapped until the stock falls to zero, whereupon the maximum profit is the strike price less what you paid for the put.

Risk Profile

- Maximum Risk: [Put premium]

- Maximum Reward: [Put strike – put premium]

- Breakeven: [Put strike – put premium]

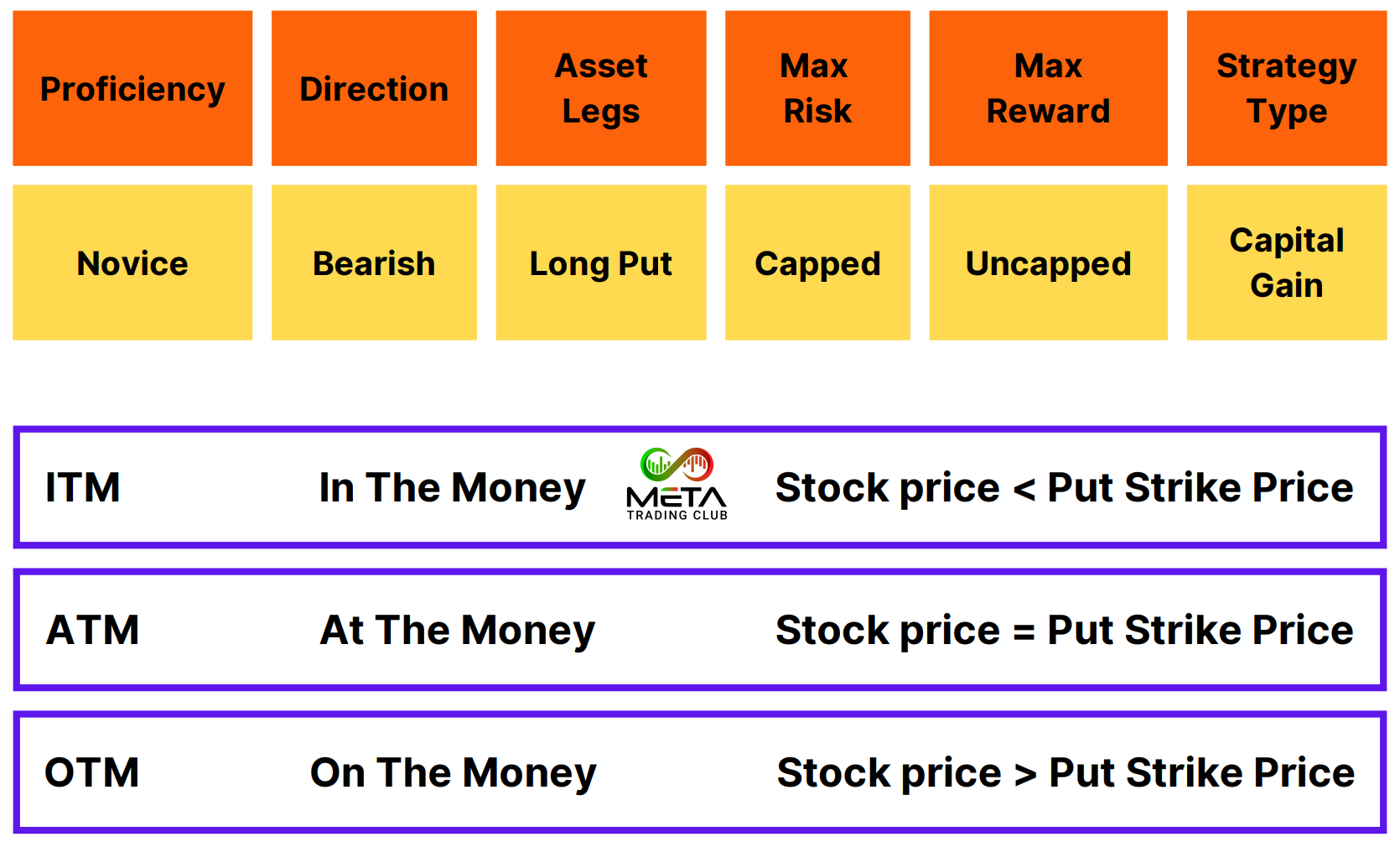

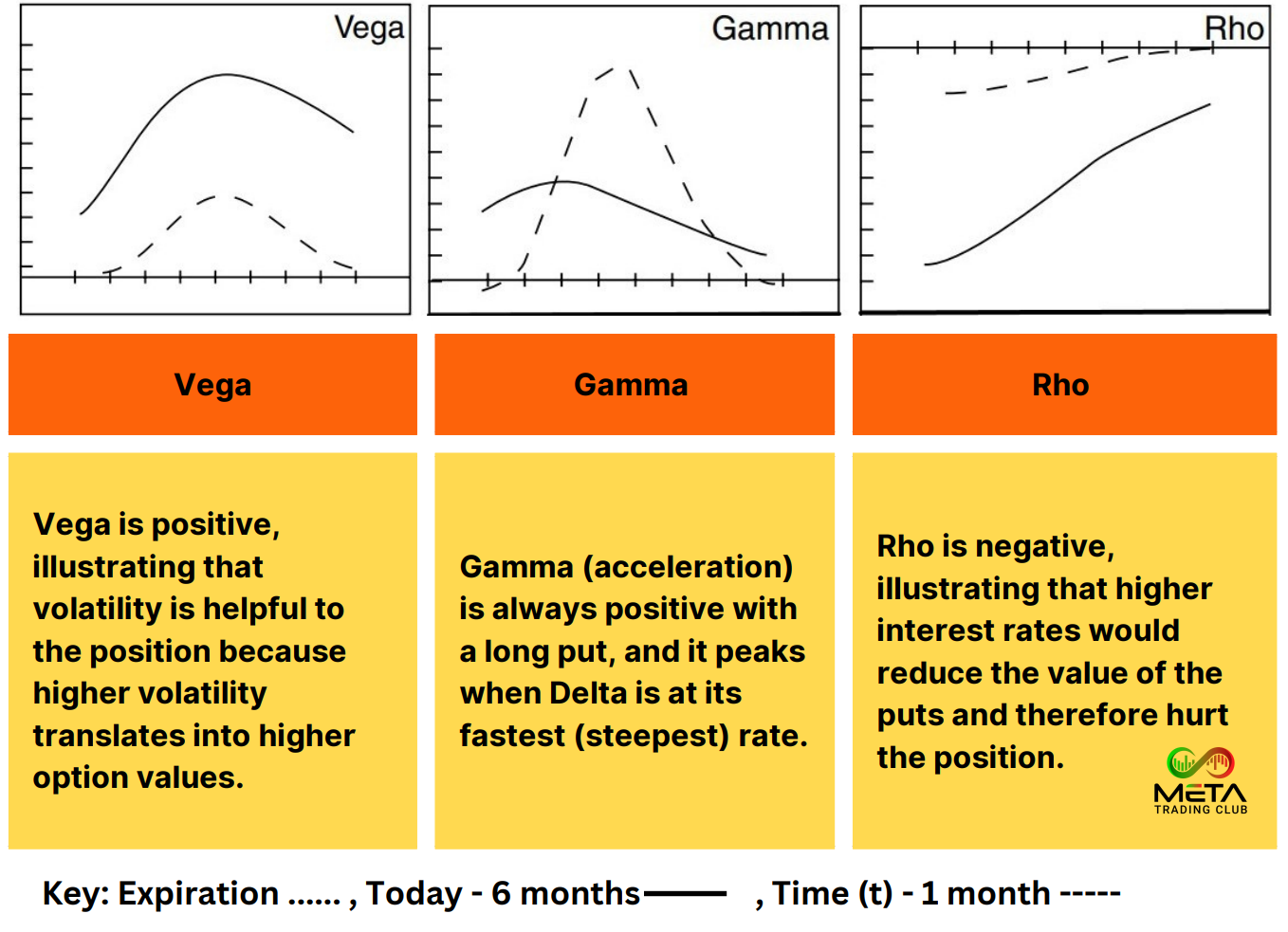

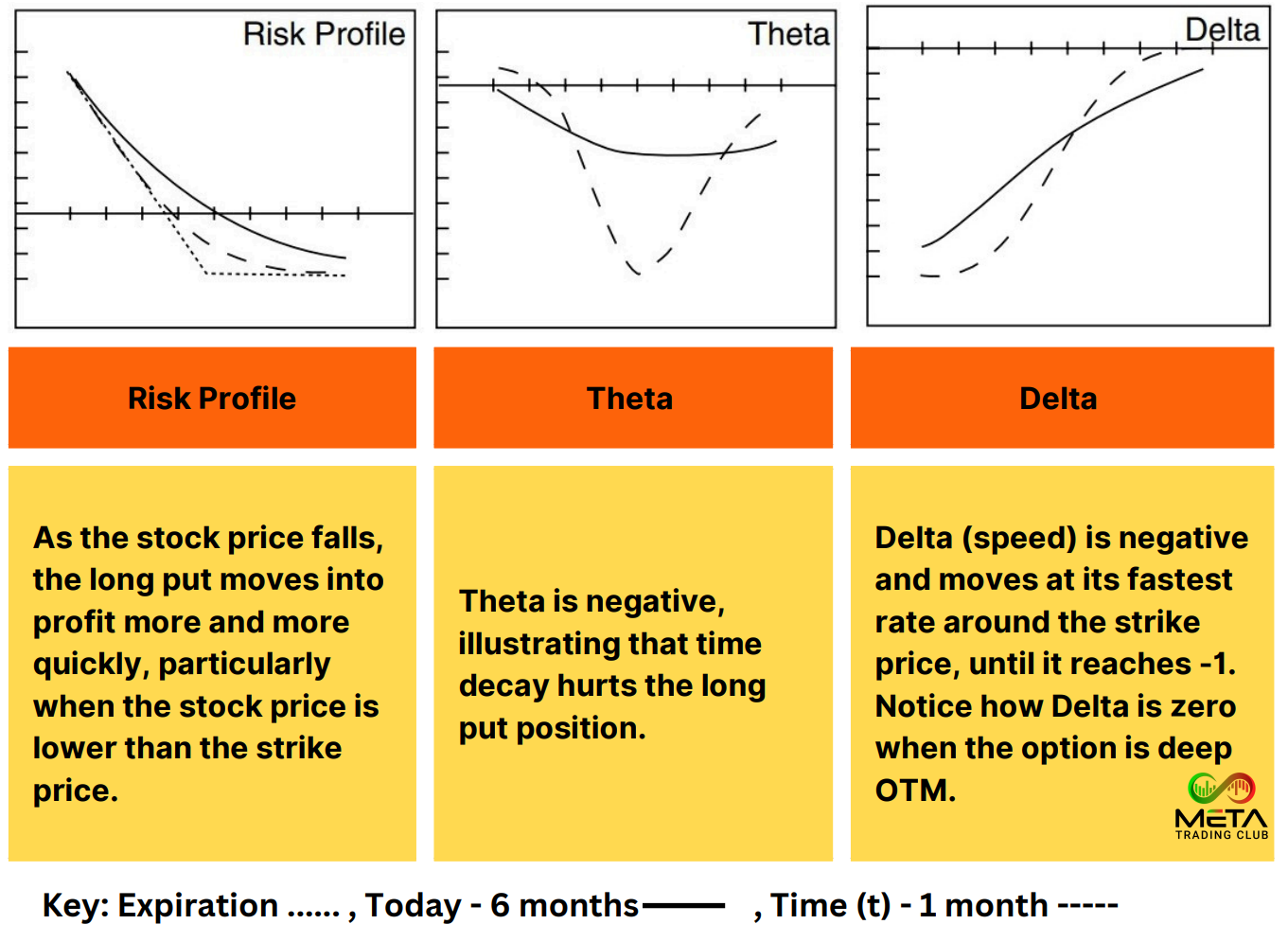

Greeks

Advantages

- Profit from declining stock prices.

- Far greater leverage than simply shorting the stock.

- Uncapped profit potential with capped risk.

Disadvantages

- Potential 100% loss if the strike price, expiration dates, and stock are badly chosen.

- High leverage can be dangerous if the stock price moves against you.

Example

Apple is trading at $214 on June 13, 2024

Buy (strike above the current stock) the August 2024 $220 strike put for $9.9

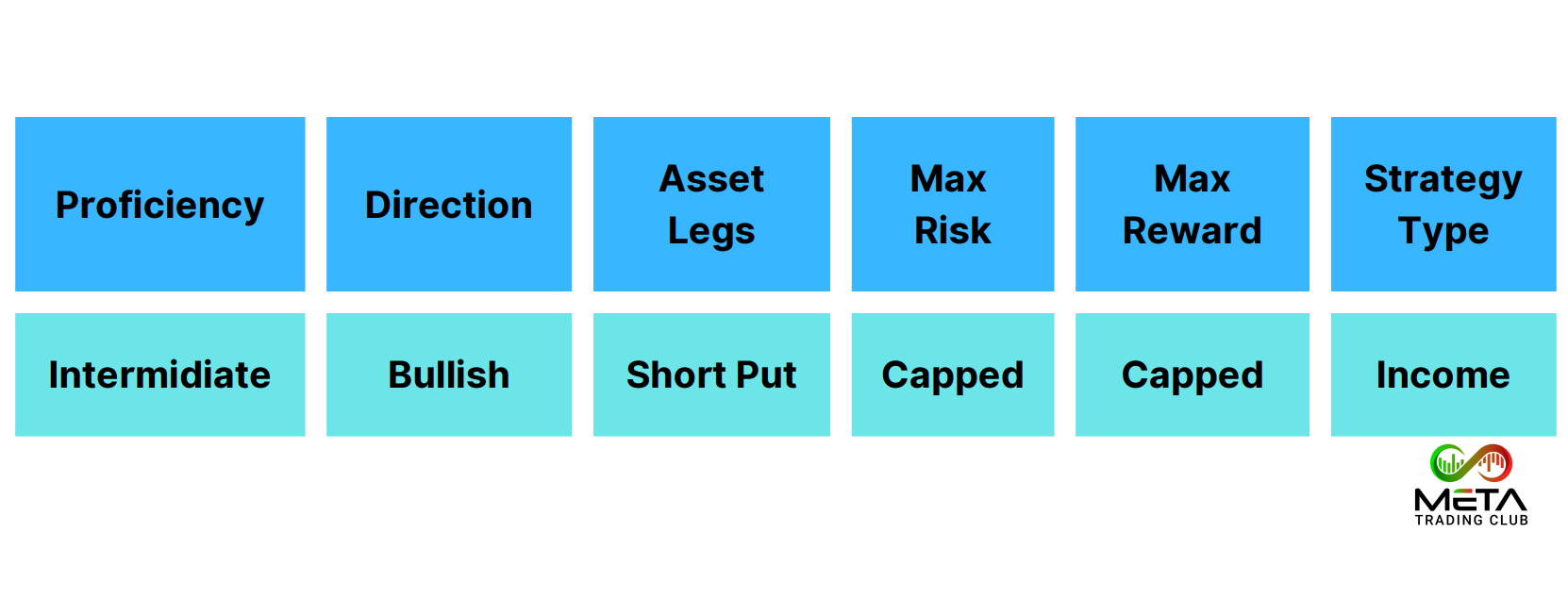

Short Put Option Trading Strategy

Selling a put is a short-term income strategy. A put is an option to sell. When you sell a put, you have sold someone the right to sell. As the stock falls, you may be obligated to buy the stock if you are exercised. Therefore, only sell puts Out of the Money and on stocks you’d love to own at the strike price (which is lower than the current stock price).

Before shorting the put option, consider these factors and then open your position.

- Remember that for option contracts in the U.S., one contract is for 100 shares. So, when you see a price of $1.00 for a put, you will receive $100 for one contract.

- Try to ensure that the trend is upward (or sideways) and identify a clear area of support.

- Manage your position according to the rules defined in your Trading Plan.

- Hopefully the stock will rise or remain static, allowing your sold option to expire worthless so that you can keep the entire premium.

- If the stock falls below your stop loss, then exit the position by buying back the puts.

Steps to Trading a Short (Naked) Put

Sell the put option with a strike price lower than the current stock price.

- Outlook: With short put your outlook is bullish. Means you are expecting the stock to rise or stay sideways at a minimum.

- Appropriate Time Period to Trade: One month or less.

- Selecting the Stock: Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

- Selecting the Option: Choose options with adequate liquidity; open interest should be at least 100, preferably 500.

- Strike: Look for OTM (lower strike) options, below the current stock price.

- Expiration: Give yourself as little time to be wrong; remember that your short position exposes you to uncapped risk (until the stock falls to zero) and that time decay accelerates exponentially (in your favor when you’re short) in the last month before expiration, so only short the option with a maximum of one month to expiration, preferably less.

- Exiting the Position: Buy back the options you sold or wait for the sold puts to expire worthless so that you can keep the entire premium.

- Mitigating a Loss: Use the underlying asset or stock to determine where your stop loss should be placed.

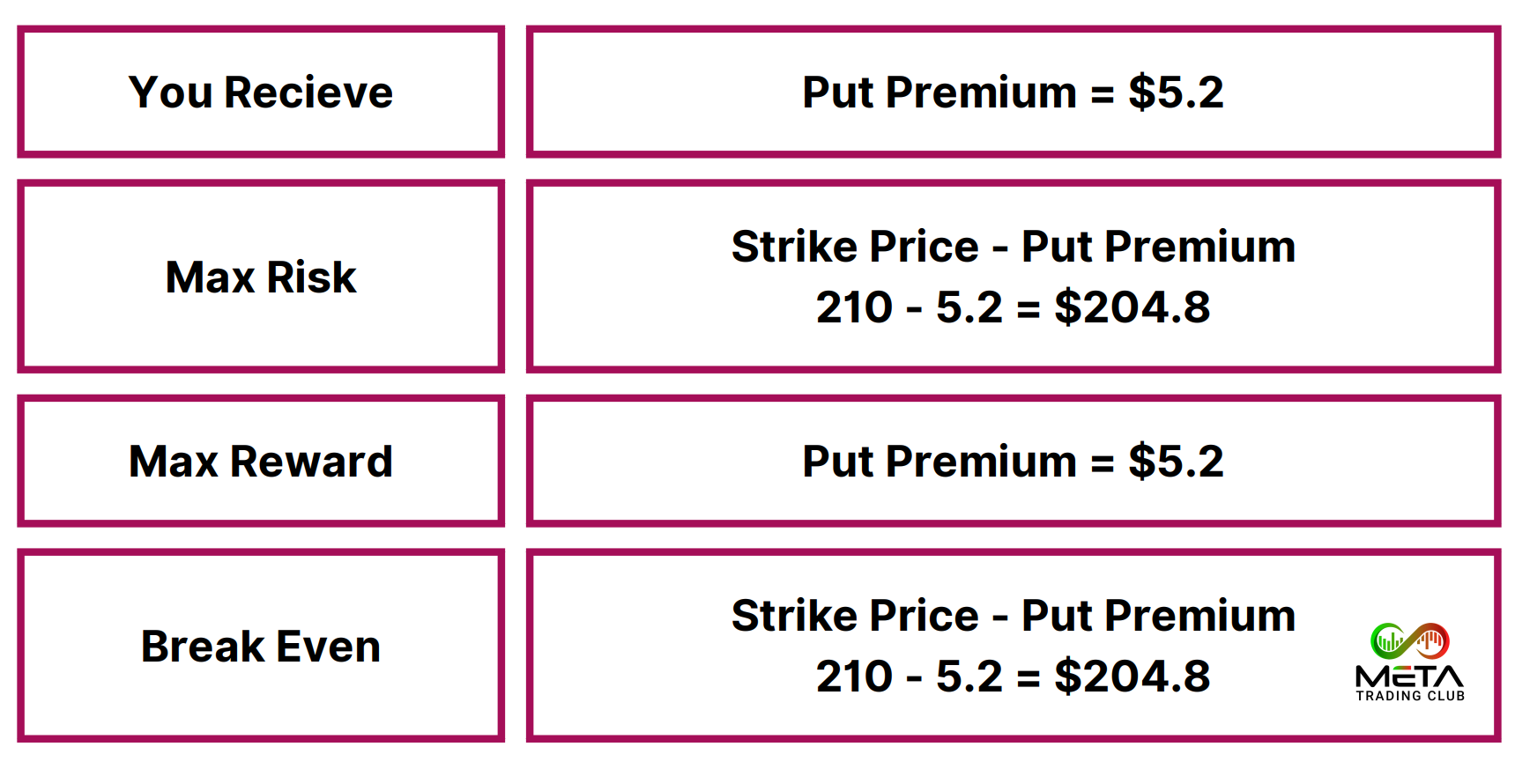

Net Position

This is a net credit transaction because you receive a premium for selling the put.

- Your maximum risk is the put strike price less the premium you receive for the put. This is considered a high-risk strategy.

- Your maximum reward is limited to the premium you receive for the option. Time decay works with your naked sold option. To take advantage of the maximum rate of time decay, sell the put in the last month before the option’s expiration.

Risk Profile

- Maximum Risk: [Put strike – put premium]

- Maximum Reward: [Put premium]

- Breakeven: [Put strike – put premium]

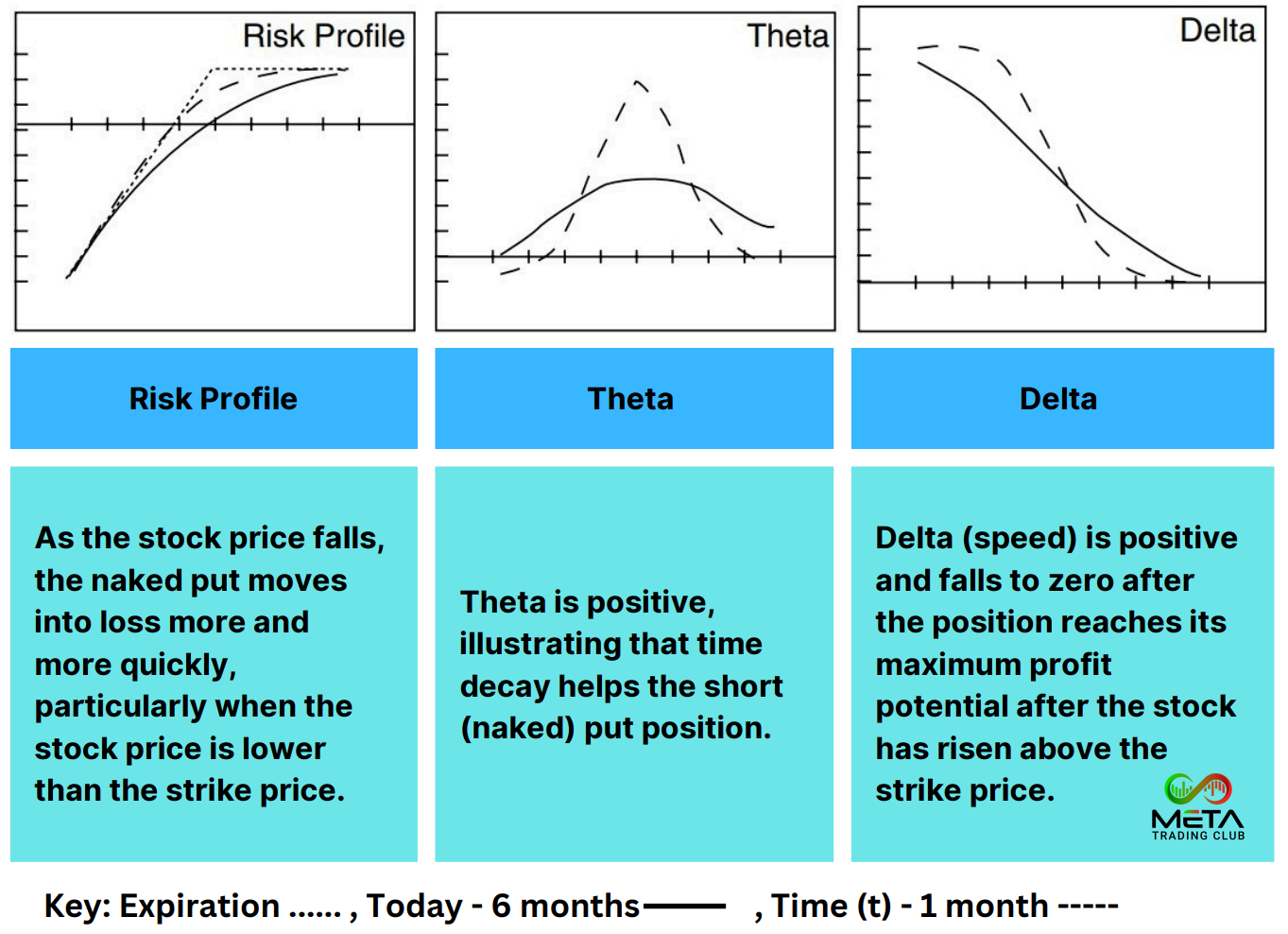

Greeks

Advantages

- If done correctly, you can use Naked Puts to gain a regular income from rising or range bound stocks.

- The Naked Put is an alternative way of buying a stock at a cheaper price than in the current market. This is because if you’re exercised, you’re obligated to buy stock at the low strike price, having already received a premium for selling the puts in the first place.

Disadvantages

- Naked Puts expose you to uncapped risk (as the stock falls to zero) if the stock falls.

- Not a strategy for the inexperienced. You must only use this strategy on stocks you’d love to own at the put strike price you’re selling at. The problem is that if you were to be exercised, you’d be buying a stock that is falling. The way to avoid this is to position the put strike price around an area of strong support within the context of a rising trend. A Fibonacci retracement point would be the type of area you’d use to position your naked put strike well below the current stock price.

Example

Apple is trading at $214 on June 13, 2024

Sell (strike below the current stock price) the July 2024 $210 strike Put for $5.2

Final Words

In conclusion, option trading is a strategic financial instrument that offers traders the opportunity to profit from market movements without the full financial commitment of direct stock ownership. It provides a hedge against market volatility and allows for a range of strategies, from conservative to highly speculative. However, the complexity and inherent risks associated with options require a thorough understanding of the market and a disciplined approach to risk management.

FAQs

- How do I start options trading?

Learn the basics of options trading, assess your financial situation, select a brokerage firm that supports options trading, develop a strategy that includes what types of options you plan to trade, understand the tax Implications and enjoy trade. - Can you trade options with $100?

Yes, it is possible to trade options with $100, but there are a few considerations to keep in mind. While there is no legal minimum capital requirement to start trading options, the amount of capital you have can limit the types of trades you can execute and your overall strategy. - Can you trade options for a living?

Trading options for a living is possible, but it requires a significant amount of skill, experience, capital and option trading strategies. - Are options safer than stocks?

Options are not inherently safer than stocks; they are different financial instruments with their own risks and benefits. Options can provide leverage, which means they can offer greater potential returns compared to stocks, but this also comes with higher risk. - Is option trading worth it?

Whether option trading is worth it depends on the individual’s investment goals, risk tolerance, and market knowledge. Options can be a powerful tool for hedging, speculating, or generating income, but they also carry risks and complexities that may not be suitable for all traders.