Netflix is a global streaming giant that revolutionized the entertainment industry. Founded in 1997 by Reed Hastings and Marc Randolph, the company initially started as a DVD rental service before transitioning to an online streaming platform in 2007. Netflix offers a vast library of movies, TV shows, documentaries, and original content, catering to a diverse audience worldwide.

With over 282 million subscribers globally as of Q3 2024, Netflix continues to lead the streaming market. The company’s success is fueled by its investment in original programming, producing hit series as well as critically acclaimed films. Netflix’s ability to adapt to changing viewing habits and its focus on high-quality, engaging content have cemented its position as a dominant player in the entertainment industry. The company also continues to innovate with new features and services, such as its growing advertising business and local content production in various regions, ensuring a dynamic and evolving streaming experience for its subscribers.

Netflix Fiscal Q3 2024

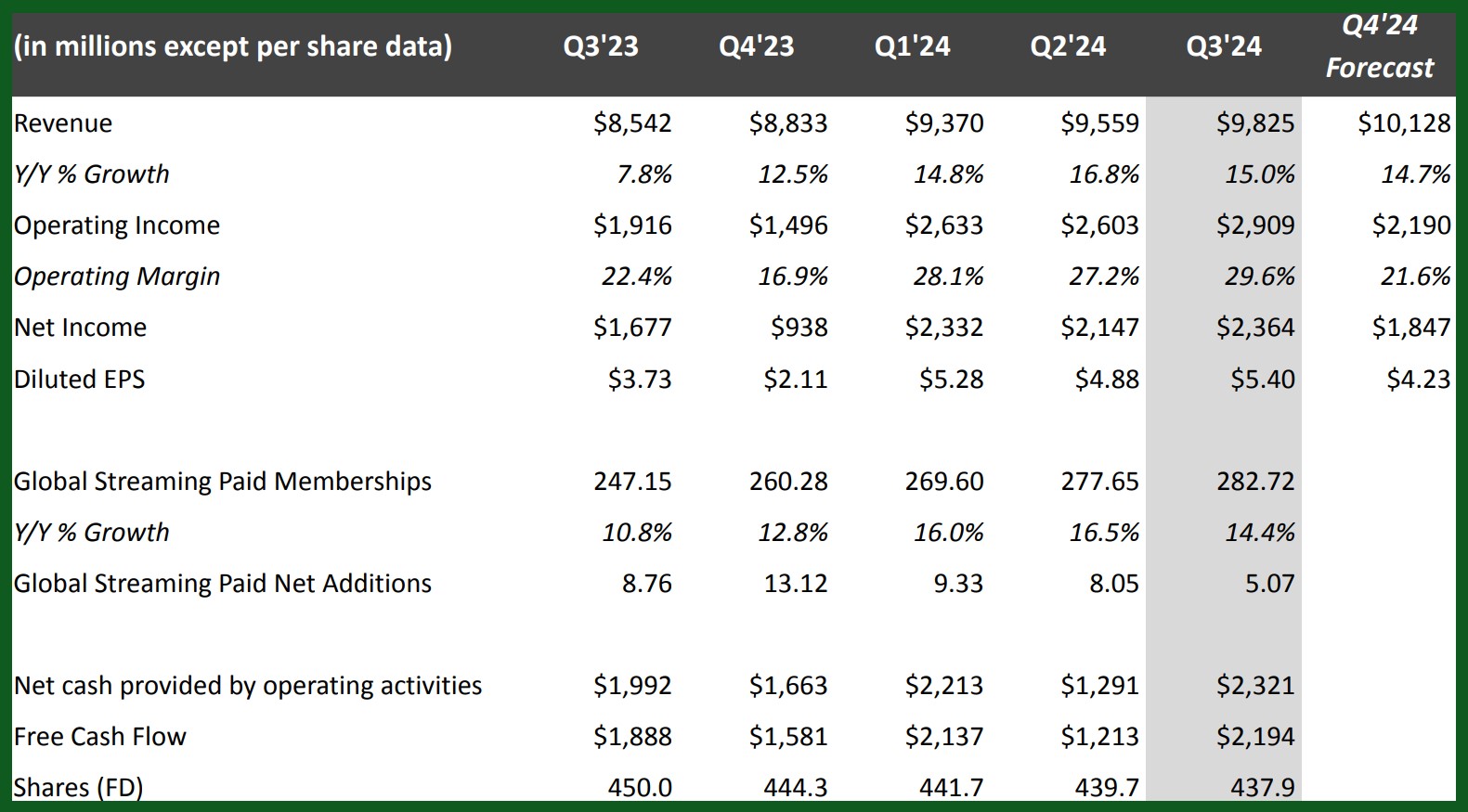

Netflix’s Q3 2024 earnings report released strong growth and positive financial performance.

Netflix Q3 revenue increased by 15% (or 21% on a foreign exchange), surpassing forecast by 1%.

Also, average paid memberships grew by 15% year over year, with paid net additions of 5.1 million compared to 8.8 million in Q3 2023.

Moreover, ARM (Average Revenue per Member) remained flat year over year but increased by 5% on a foreign exchange currency.

Highlights of Netflix Q3 Earnings:

- UCAN (United States and Canada): Revenue increased by 16% year over year. This is driven by 10% growth in average paid memberships and 5% growth in ARM.

- EMEA (Europe, Middle East, and Africa): Revenue grew by 16% year over year. Also, consistent with the increase in average paid memberships.

- APAC (Asia-Pacific): Revenue growth rate of 19% year over year. This is leading all regions, supported by a strong local content slate in Japan, Korea, Thailand, and India.

- LATAM (Latin America): Revenue rose by 9% year over year. Despite a slight decline in paid net ads due to recent price changes and a softer content slate.

- Operating Income: Increased by 52% year over year to $2.9 billion, with an operating margin of 30%, improving by seven percentage points compared to the year-ago quarter.

- EPS (Earnings Per Share): EPS amounted to $5.40, up 45% year over year, including a $91 million loss from F/X, primarily related to Euro-denominated debt remeasurement.

Netflix’s strong performance in Q3 2024 reflects its continued growth and market leadership in the streaming industry.

Guidance for Q4 2024:

For Q4 2024, Netflix forecasts a 15% revenue growth, or 17% on a F/X neutral basis. The company expects paid net additions to be higher in Q4 than in Q3 2024 due to normal seasonality and a strong content slate. They project a Q4 operating margin of 22%, which is a five-percentage point improvement year-over-year.

Full Year 2024 Guidance:

- Revenue Growth: Expected to grow 15% year-over-year, at the high end of the prior 14%-15% expectation.

- Operating Margin: Now forecasted to be 27%, up from the previous forecast of 26%, representing a six-percentage point increase compared to the full year 2023.

This guidance reflects Netflix’s confidence in continuing its robust growth trajectory into the next quarter and beyond.

Board Statements

During Netflix’s Q3 2024 earnings call, Co-CEO Ted Sarandos emphasized why Netflix continues to hold an edge over YouTube. He highlighted Netflix’s commitment to investing in premium content to boost viewer engagement, calling it “the best place for premium stories because we’re the home to the best storytellers.” He pointed out that while Netflix and YouTube compete for viewers’ time, their strengths differ significantly.

Co-CEO Greg Peters added that Netflix is crucial for consumers seeking high-quality movies and TV shows and for creators needing partners to share the risks of big creative projects. He cited ambitious projects like “A Hundred Years of Solitude” and “Senna” as examples of what Netflix can achieve, which might not be possible under YouTube’s model.

This highlights Netflix’s strategy to capture high-impact moments, enhance engagement, and target the 80% of TV time not covered by them and YouTube. Their strong Q3 results and move into live sports show a shift to more diverse content to meet viewer demands.

Impact on the Market

Netflix’s Q3 2024 earnings report had a positive impact on the market. The company’s stock (NFLX) price rose 10% following the announcement. This increase was driven by Netflix surpassing Wall Street’s expectations for both revenue and subscriber growth.

The strong financial performance and positive revenue outlook boosted investor confidence, leading to the stock’s upward movement.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.