Throughout history, financial markets have served as a reflective mirror of all economic dynamics and events in reverse. In the past week, global markets witnessed intricate transformations that influenced their speed and direction. From political upheavals to economic data releases, various factors have played pivotal roles in sustaining this dynamic world.

One of the most significant events impacting financial markets was the release of earnings reports by major corporations. Companies such as Tesla, Google, Microsoft, Meta, Exxon Mobil, and Chevron were among the key players that unveiled their financial performances in the past week.

Another factor influencing market sentiment was the resolution of geopolitical tensions between Iran and Israel, a region of geopolitical sensitivity. While the geopolitical landscape has witnessed some alleviation, the residual impact on gold prices, stock markets, and riskier assets remains a topic of interest.

Looking ahead, investors are keenly anticipating earnings reports from prominent companies in the coming week. Notable names include Apple, Amazon, Alibaba, PayPal, Coca-Cola, AMD, McDonald’s, and Mastercard. These earnings releases are expected to provide valuable insights into the health and trajectory of various sectors.

Economic Events:

A substantial amount of data was available for market digestion in the past week, particularly on the economic front. This included an advanced assessment of Q1 GDP and persistent inflation figures. Despite the advanced Q1 GDP report indicating a slowdown in quarterly output (1.6% in Q1 compared to 3.4% in Q4 and 4.9% in Q3), the decline was primarily driven by exports and trade data. However, the Atlanta Federal Reserve’s GDPNow estimate for Q2 GDP, released recently, stands at a healthy 3.9%.

Highlighted below are some key points from the week:

- The S&P Global US Manufacturing PMI declined to 49.9 from 51.9 in March, marking a four-month low. Similarly, the S&P Global US Services PMI decreased to 50.9 from 51.7 in March, representing a five-month low.

- Initial Jobless Claims saw a 5K drop from the previous week to a seasonally adjusted 207K, below the 215K economists had anticipated, indicating a tight labor market.

- Q1 GDP: The advanced reading came in at 1.6%, well below the expected +2.5%, primarily due to weakness in trade and exports data. Personal Income (current dollar and disposable) both increased, while personal savings declined. Of greater significance to the markets, the Q1 “core” Personal Consumption Index, excluding food and energy components, rose to +3.7%, significantly higher than the 2.0% gain in the previous quarter and above the +3.4% economists had forecasted.

- The Atlanta Fed GDPNow current expectation (nowcast) for Q2 GDP was reported at 3.9% (quarter-over-quarter, annualized).

- Personal Consumption Expenditures (PCE) Prices: Both headline and core figures came in at +0.3%, aligning with expectations. On a 12-month basis, headline PCE increased to 2.7% from the previous month’s year-over-year reading, while core PCE remained unchanged at 2.8%.

- Bond yields saw a gradual increase during the week, driven by inflation data that exceeded expectations. Yields on two-year Treasuries reached a five-month high of 5.025% yesterday but have since eased to the current level of 4.991% (note: 5.20% is the cycle high for the two-year). Yields on the 10-year (TNX) also hit a fresh five-month high of 4.737% but are currently at 4.663%, possibly aided by in-line PCE data. The bond market continues to anticipate higher rates for longer periods, driven by persistent inflation data, with equity investors showing resilience as long as economic data remains strong.

- Market expectations regarding potential Fed rate cuts have gradually diminished throughout the year. The Bloomberg probability of a June rate cut decreased from 18% last Friday to 12% this week, and the probability for July stands at 36%, down from 48% last Friday. Based on the 65% threshold (representing the approximate line in the sand for a Fed action, either a hike or a cut, over the past nine years or so), September appears to be the first meeting where a Fed cut is anticipated.

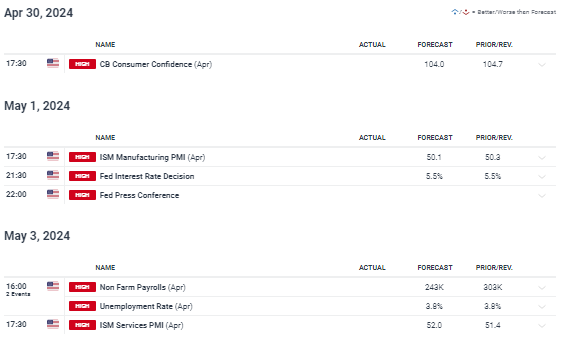

The week ahead promises to be highly eventful for the US dollar, featuring significant events such as an FOMC meeting and the release of the April jobs report, among other key data releases. Investors will find little respite with the flurry of data on the US agenda.

The focal point of attention in the first half of the week will be the Federal Reserve’s policy decision on Wednesday. Previously, there was speculation that the May meeting would solidify the path to a rate cut in June. However, recent data showing higher-than-expected inflation and employment figures have pushed expectations for a rate cut further into the future, with September now seen as a more likely timeframe.

With no updated FOMC projections accompanying the May decision, investors will closely watch Chair Powell’s press briefing for any hints on the timing of potential policy easing. Despite some investors hoping for a summer rate cut, recent commentary from Fed officials suggests a willingness to stay on pause for a while longer, although the majority still anticipate some easing later in the year. Powell is expected to emphasize patience while hinting at the possibility of future rate cuts.

Investors will scrutinize Powell’s confidence in inflation decreasing substantially in the coming months, which would allow for policy loosening. A somewhat more hawkish tone from Powell could reignite the US dollar’s upward trend.

In the absence of fresh signals from the Fed, attention will turn to Friday’s nonfarm payrolls report, where analysts anticipate job additions of around 210k in April, with the unemployment rate forecasted to remain at 3.8%. Wage increases will be closely monitored, as any acceleration in average hourly earnings could trigger concerns about diminishing rate cut expectations.

Source : Dailyfx

Earnings:

Recalling last week’s blog, readers may remember a forecast for this week labeled as a “breakout,” defined as a move of 2.0% or more, either upwards or downwards, in the S&P 500 (SPX) by today. As of the time of writing, the SPX has surged by 2.63% for the week, validating the accuracy of this forecast. This gain is particularly impressive considering that at one point yesterday, the SPX was down over 1.5% following the GDP report (although subsequently recovering). Moreover, the SPX rallied despite bond yields hitting fresh five-month highs earlier in the week. Therefore, it appears that the primary driver behind this week’s bounce was technically oversold conditions.

Recall that last Friday saw indiscriminate selling in tech stocks (e.g., SMCI -20%, ARM -14%, NVDA -9%), while the SPX hovered around 30 on the Relative Strength Index (RSI), indicating technically oversold territory. Another contributing factor to the bullish sentiment this week was the impressive earnings results from mega-cap tech companies. Despite META’s sharp drop due to raised expense guidance, the announcement seemed to boost stock prices in companies poised to benefit from increased AI spending (e.g., NVDA, SMCI, AMD, etc.). Additionally, Microsoft (MSFT) reported a beat/raise with 31% Azure revenue growth (exceeding the 28% estimate), and Alphabet (GOOGL) delivered a beat/raise along with its first-ever dividend and a $70B stock buyback plan.

Looking ahead, several potential market-moving events are scheduled for next week: the Treasury’s Quarterly Refunding estimates on Monday; key tech/AI earnings from AMZN, AMD, and SMCI after the bell on Tuesday; AAPL earnings after the bell on Thursday; and the monthly employment data on Friday. While last month’s Nonfarm Payrolls Report exceeded economists’ estimates and stocks responded positively, it remains uncertain whether good news will continue to be interpreted positively given the market’s recent sensitivity to yield volatility. Technically, although we’ve partially recovered from recent losses, most major indices are still hovering just below their respective 50-day Simple Moving Averages (SMAs).

Considering these factors, confidence in forecasting next week’s market direction is somewhat limited. The trajectory of yields and key earnings reports are crucial variables. Nevertheless, anticipation is for “choppy sideways consolidation” with a “slightly bullish” bias. However, a firm rejection at the 50-day SMA on the SPX/NDX/COMPX early next week could signal bearish confirmation and bring selling pressure back into play.

Alphabet :

Meta :

Tesla :

Below are the earnings reports scheduled for next week:

Monday (Apr. 29): ON Semiconductor Corp. (ON), Domino’s Pizza (DPZ), NXPI Semiconductors NV (NXPI), Welltower Inc. (WELL), MicroStrategy Inc. (MSTR), SBA Communications Corp. (SBAC)

Tuesday (Apr. 30): Eli Lilly & Co. (LLY), Coca-Cola Co. (KO), McDonald’s Corp. (MCD), Amazon.com Inc. (AMZN), Advanced Micro Devices (AMD), Stryker Corp. (SYK), Starbucks Corp. (SBUX), Super Micro Computer Inc. (SMCI)

Wednesday (May 1): Mastercard Inc. (MA), Pfizer Inc. (PFE), Automatic Data Processing (ADP), CVS Health Corp. (CVS), Qualcomm Inc. (QCOM), DoorDash Inc. (DASH)

Thursday (May 2): Linde PLC (LIN), ConocoPhillips (COP), Apple Inc. (AAPL), Amgen Inc. (AMGN), Booking Holdings Inc. (BKNG), Coinbase Global Inc. (COIN)

Friday (May 3): Hershey Co. (HSY), Cheniere Energy Inc. (LNG), Cboe Global Markets Inc. (CBOE)

Source :Earningwhispers

Gold (XAUUSD):

The week ahead promises to be eventful for the US dollar, with an FOMC meeting and the April jobs report scheduled, alongside a slew of other US data releases that will keep traders busy.

The highlight of the first half of the week will be the Federal Reserve’s policy decision on Wednesday. Initially, there were expectations that the May meeting would confirm a June rate cut. However, given recent data showing higher-than-expected inflation and employment figures, the likelihood of a cut before September has diminished.

Indices :

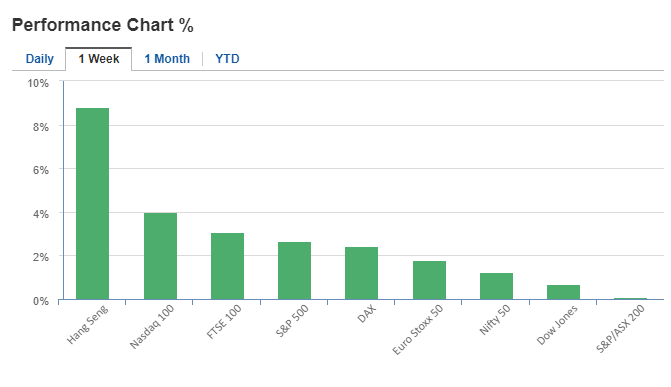

In the chart below, you can observe the performance of indices, with the Hang Seng index ranking first, and next, due to the earnings reports of mega-cap companies active in the technology sector, Nasdaq stocks took the second position.

Source : Investing

The performance of indices and important supply and demand levels are indicated in the charts below.

Us500:

Us30:

Us100:

Bitcoin (BTC):

Currently, Bitcoin is hovering around its equilibrium price. It seems that Bitcoin has completed its accumulation phase according to the Wyckoff theory, and now it’s time for smart money to re-engage and push the asset’s price back into its previous trend. Therefore, an increase in bullish momentum in the first step could potentially propel Bitcoin towards the $66,500 range.

US Crude Oil WTI :

During the past week, oil saw demand within the trading range of $81.50. Currently, the anticipated scenario for oil is that if it surpasses the threshold of $84.15, we might expect an increase in demand up to $85.90. However, any indication of a price decline and its supply could lead to a price drop towards the $81.50 range.

Future Week Outlook:

The past week witnessed significant market shifts, driven by a combination of corporate earnings releases and geopolitical developments. Despite initial expectations for a June rate cut, recent economic indicators have pushed potential Fed actions further into the future. Looking ahead, attention will focus on upcoming earnings reports, particularly from tech giants, along with key economic data releases and the Federal Reserve’s policy decision. The forex market may see increased risk-taking, while oil prices could be impacted by geopolitical tensions. Investors should remain vigilant and adjust their strategies accordingly to navigate the dynamic market landscape.

Considering the mentioned topics and potential scenarios in each asset class, it is essential to re-evaluate the capital allocation percentage and choose the best options based on risk-to-reward ratios, market conditions, and probabilities. Wishing everyone a profitable week ahead with the Meta Trading Club!

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.