The financial markets experienced significant activity yesterday, with key movements driven by anticipation of today’s critical US inflation data and the Federal Reserve’s interest rate decision. Gold saw a modest recovery, oil prices continued to rise, US equities reached new highs, and the euro weakened due to increasing political instability in Europe. Meanwhile, the yen held steady ahead of important US economic updates, and Bitcoin remained stable.

Table of Contents

Inflation and the Federal Reserve

Today’s primary focus is on US inflation data, which could significantly impact market movements. Lower-than-expected inflation figures might provide a positive boost to markets, while higher readings could induce volatility. Current estimates predict a slight reduction in monthly CPI to 0.1% and a year-on-year core CPI decrease by 0.1%. Goldman Sachs has projected a 0.25% increase in monthly Core CPI for May. The Federal Reserve is anticipated to maintain the current interest rates, but the latest dot plot will reveal future rate cut expectations.

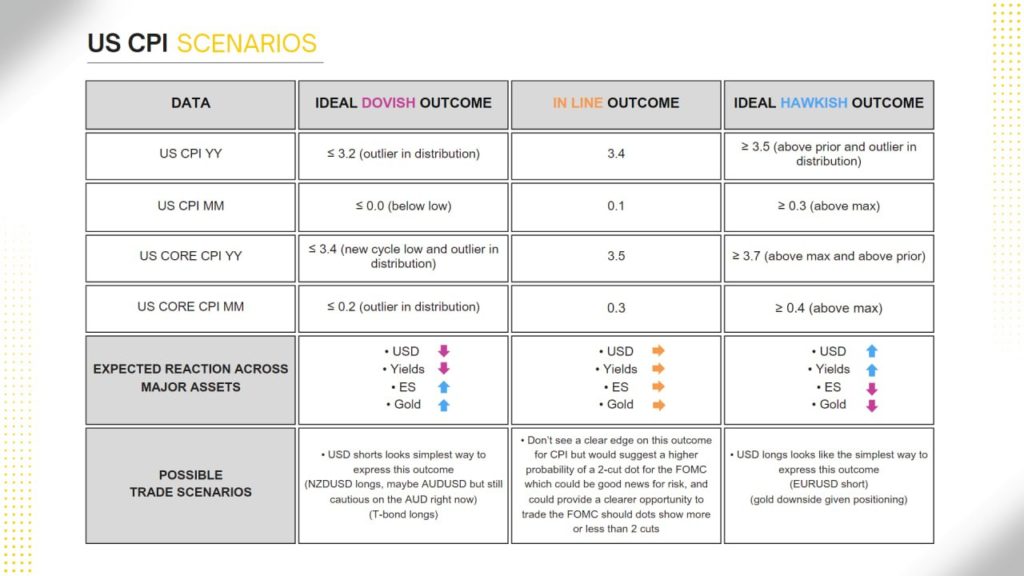

Based on various scenarios, here are the potential market reactions:

Ideal Dovish Outcome:

- US CPI YoY: ≤ 3.2%

- US CPI MoM: ≤ 0.0%

- US Core CPI YoY: ≤ 3.4%

- US Core CPI MoM: ≤ 0.2%

- Expected Reactions: USD weakens, bond yields fall, equities rise, gold prices increase.

In Line Outcome:

- US CPI YoY: 3.4%

- US CPI MoM: 0.1%

- US Core CPI YoY: 3.5%

- US Core CPI MoM: 0.3%

- Expected Reactions: USD remains stable, bond yields unchanged, equities steady, gold prices steady.

Ideal Hawkish Outcome:

- US CPI YoY: ≥ 3.5%

- US CPI MoM: ≥ 0.3%

- US Core CPI YoY: ≥ 3.7%

- US Core CPI MoM: ≥ 0.4%

- Expected Reactions: USD strengthens, bond yields rise, equities decline, gold prices decrease.

US Market Highlights:

US stock indices achieved new record highs, driven by a strong 10-year Treasury auction and a significant surge in Apple shares, buoyed by AI developments. The S&P 500’s advance was supported by declining yields. However, regional banks faced pressure due to concerns over commercial real estate loans. The US Dollar Index (DXY) remained strong, influenced by inflation and Fed-related uncertainties.

European Markets:

European equities were pressured by political tensions in France. The CAC 40 dropped to its lowest level since February, and the EUR/USD pair was poised to test the 1.07 support level. Political instability in France and budget deficits contributed to market uncertainty, widening yield spreads between German and French bonds.

Gold and Silver

Gold prices rose by 0.25%, continuing to recover from a sharp drop triggered by robust US employment data and reduced gold purchases by China’s central bank. Investors are cautious ahead of the CPI report and the Fed’s interest rate decision. Today’s economic updates will significantly influence gold prices, with potential volatility expected around the release times.

Oil Markets:

WTI and Brent crude prices increased, reflecting an improved global demand outlook. The US Energy Information Administration (EIA) revised its global oil demand growth forecast for 2024, and OPEC maintained a positive demand outlook. US crude inventories declined more than expected, further supporting oil prices.

Bond Market:

The yield on the US 10-year Treasury note remained steady around 4.4%, with markets awaiting the CPI report and the Federal Open Market Committee (FOMC) decision. A robust auction indicated strong demand for 10-year notes. Investors are focused on the Fed’s economic projections and future interest rate cuts.

Forex:

The euro weakened to a six-week low due to rising political risks in Europe. The Japanese yen held steady as investors awaited key US economic data. The British pound showed little movement as weak economic data increased the likelihood of a Bank of England (BoE) rate cut.

Bitcoin:

Bitcoin prices remained stable as investors closely monitored today’s US inflation data for any potential impacts on risk assets. Higher-than-expected inflation could lead to a stronger dollar, putting downward pressure on Bitcoin prices. Conversely, lower-than-expected inflation might weaken the dollar, potentially boosting Bitcoin.

Analytical Insights:

- US Inflation Data and Market Impact:

- Lower-than-expected inflation: Likely to boost stocks, lower bond yields, and weaken the US dollar.

- Higher-than-expected inflation: Could result in stock market declines, rising bond yields, and a stronger dollar.

- Federal Reserve’s Role:

- The Fed’s statements and projections will be crucial, with today’s inflation data holding more significance than the Fed’s rate decision itself.

- The Fed’s dot plot and economic projections will provide insights into the future path of interest rates.

- Political and Economic Tensions:

- In Europe, political instability in France has widened yield spreads and weakened the euro.

- In the US, positive sentiment from strong tech sector performance contrasts with underlying stress in the banking sector.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.