On May 30, 2024, financial markets experienced various fluctuations. Gold moved aimlessly, stock indices were significantly negative, oil saw a substantial correction to around $77, and Bitcoin took a sharply bearish turn.

Economic Events:

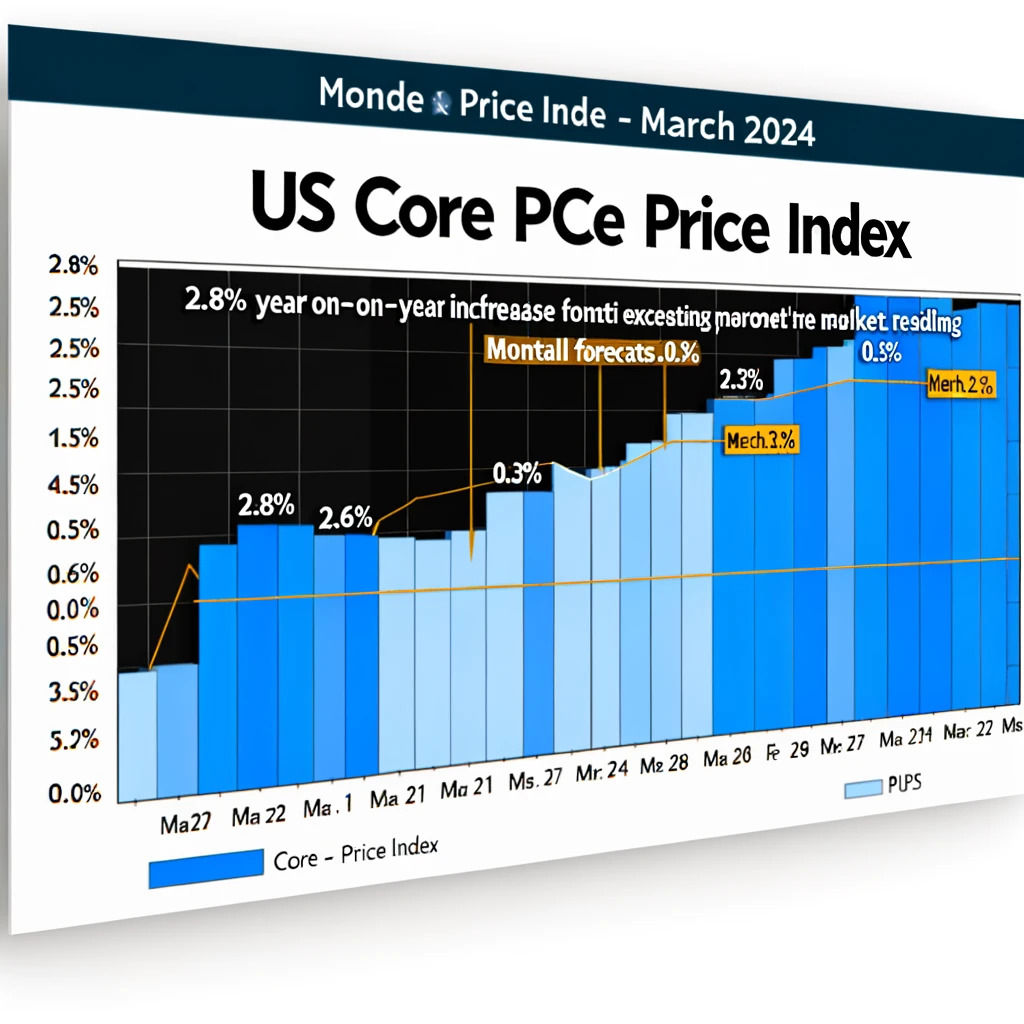

The US core PCE price index, the Federal Reserve’s preferred inflation measure, rose by 2.8% year-on-year in March 2024, marking the lowest increase since March 2021 but exceeding market forecasts of 2.6%. On a monthly basis, core PCE prices increased by 0.3% in March, consistent with February’s reading and market expectations.

Gold (XAUUSD):

Gold edged lower, holding around $2,340 per ounce on Friday, following slight gains in the previous session, as investors awaited the US PCE inflation report due later in the day. The Fed’s preferred inflation measure is expected to align with the CPI, indicating no acceleration in inflation. This outlook was supported by recent data showing a downward revision in the headline and PCE price indices. Renewed expectations for Fed interest rate cuts followed recent data revealing that US GDP growth was below earlier estimates, and corporate profits unexpectedly declined. Initial unemployment claims rose recently but stayed above this year’s average, suggesting a softening labor market. Gold is set to rise for the fourth consecutive month, increasing by 2.5%, and rebounding by 0.4% for the week.

S&P500:

US stock futures edged lower on Friday as investors braced for the US PCE price index report for April, the Federal Reserve’s preferred inflation gauge. In extended trading, Dell Technologies tumbled 18% despite better-than-expected quarterly results. MongoDB plunged 26%, while cloud security firm Zscaler and apparel retailer Gap rallied 16% and 23%, respectively. In regular trading on Thursday, the Dow fell 0.86%, the S&P 500 lost 0.6%, and the Nasdaq Composite dropped 1.08%, driven by a nearly 20% slump in Salesforce shares, marking its worst day since 2004. Other mega-cap tech names also declined as investors took profits in leading stocks, including Nvidia (-3.8%), Microsoft (-3.4%), and Amazon (-1.5%). Only two of the 11 S&P sectors ended lower, namely technology and communication services, while real estate, utilities, and materials stocks outperformed the market.

EURUSD:

The euro was steady at $1.086 in the last week of May, remaining below the two-month high of $1.088 touched on May 15th as markets continued to assess the monetary policy outlook for the European Central Bank. The EU-harmonized inflation gauge for Germany slightly exceeded expectations for May, rebounding to 2.8%. While the upside surprise was not significant enough to jeopardize the ECB’s widely expected rate cut next week, concerns linger that disinflation could slow, and stronger growth highlighted by May’s PMIs raised uncertainty over whether the ECB can afford looser monetary policy in the third quarter. Meanwhile, hawkish signals from Fed members further trimmed expectations of a US rate cut by the third quarter, pressuring the currency pair.

GBPUSD:

The British pound edged below $1.275, pulling back from the two-month high of $1.28 touched on May 27th as some support for the greenback countered the strong momentum for the sterling stemming from a hawkish BoE. Fed members indicated that the funds rate will only be cut after multiple months of lower inflation, raising the bar for looser policy and lifting the US dollar. However, delayed cut bets for the BoE limited the pullback. Although the annual inflation rate in the UK eased to 2.3%, nearing the Bank’s 2% target, the reading exceeded forecasts of 2.1%. Investors now favor the BoE’s first rate cut in September instead of June. The likelihood of a rate cut in June was also diminished by PM Sunak’s surprise announcement of a general election in early July. While the BoE emphasized its independence, previous accusations of political interference made markets more comfortable positioning for a September cut.

USDJPY:

The Japanese yen appreciated past 157 per dollar, rebounding from four-week lows as a broad selloff in risk assets triggered safe-haven buying for the currency. The yen also found support from rallying domestic yields, with Japan’s benchmark 10-year yield reaching 1.1% this week for the first time since July 2011. Earlier this week, Bank of Japan board member Seiji Adachi stated that the central bank may raise interest rates if sharp falls in the yen lead to further inflation. Latest data showed that Tokyo’s core inflation rate accelerated to 1.9% in May from 1.6% in April, but remained below the BOJ’s 2% target. Externally, the yen found some support late in the week as a downward revision in US first-quarter GDP data revived hopes for US rate cuts, although a recent run of strong economic data and hawkish remarks from Federal Reserve officials clouded the outlook.

Bitcoin (BTC):

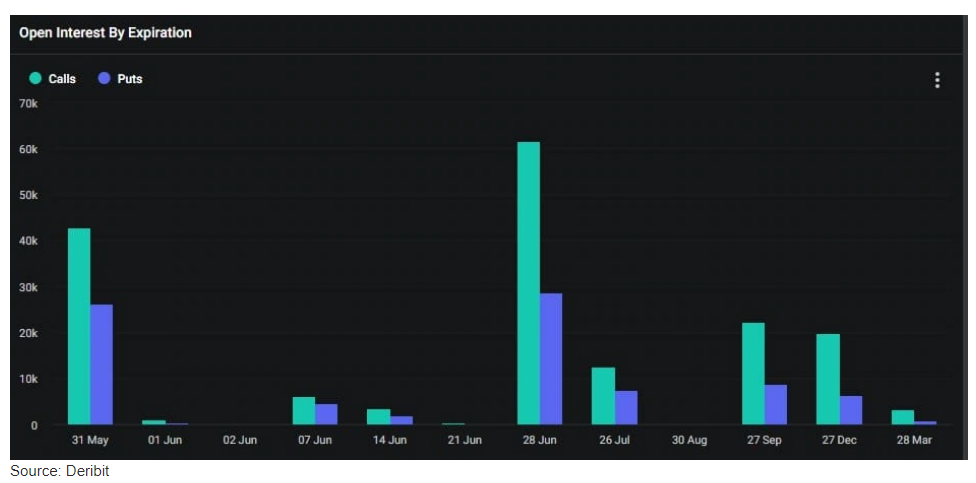

The put/call ratio for Bitcoin options is 0.61, indicating more calls (or long contracts) expiring than puts (or shorts). The max pain point, where most losses occur, is around $65,000, $3,500 lower than current spot prices.

There is significant open interest at long positions, including strike prices at $70,000, $75,000, $80,000, and even $100,000, with open interest at $886 million. On the short side, the $60,000 strike price has the most open interest at $519 million, suggesting that derivatives traders remain bullish on Bitcoin and expect higher prices.

The total notional value for all outstanding BTC options contracts is a substantial $19 billion. Additionally, there are around $3.7 billion in notional value Ethereum contracts expiring today, with 910,000 contracts showing a put/call ratio of 0.84, indicating a more balanced view between long and short sellers compared to BTC contracts.

Ethereum futures aggregated open interest has been near all-time high levels this week at around $17 billion, driven by speculation around the spot ETF decision. While spot markets rarely react significantly to options expiry events, today’s expiration is notable. Total cryptocurrency market capitalization has remained relatively flat at $2.68 trillion. Bitcoin inched up 1.2% on the day to trade at $68,489 at the time of writing, whereas Ethereum slightly declined to $3,751.

Brent:

Brent crude futures fell toward $81.5 per barrel on Friday, sliding for the third straight session as demand-side uncertainties continued to weigh on oil markets. Revised data on Thursday showed that the US economy grew at a lackluster 1.3% annual pace in the first quarter, lower than advance estimates of 1.6%. A Federal Reserve official also expressed concern about upside risks to inflation and called for caution in adjusting policy, dampening hopes for US interest rate cuts. Meanwhile, EIA data showed that US crude inventories fell by 4.2 million barrels last week, compared with expectations for a 1.9 million barrel draw. However, US gasoline stockpiles rose by 2 million barrels last week despite forecasts for a 400,000-barrel draw, indicating weak demand ahead of the Memorial Day weekend. Investors now look ahead to the OPEC+ meeting on Sunday, where it is expected to extend supply cuts into 2025.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.