Yesterday, following Nvidia’s earnings report that significantly exceeded expectations, we saw the release of PMI data and a strengthening of the dollar. However, it’s worth noting that these positive data points may not be sufficient to drive the market in a new direction. The market’s focus remains on the anticipated first step in the Federal Reserve’s rate-cutting process, expected in the coming months. While the PMI data may temporarily pause the dollar’s depreciation, the overall outlook for the dollar remains negative, given the likelihood of upcoming easing policies from the Fed.

Table of Contents

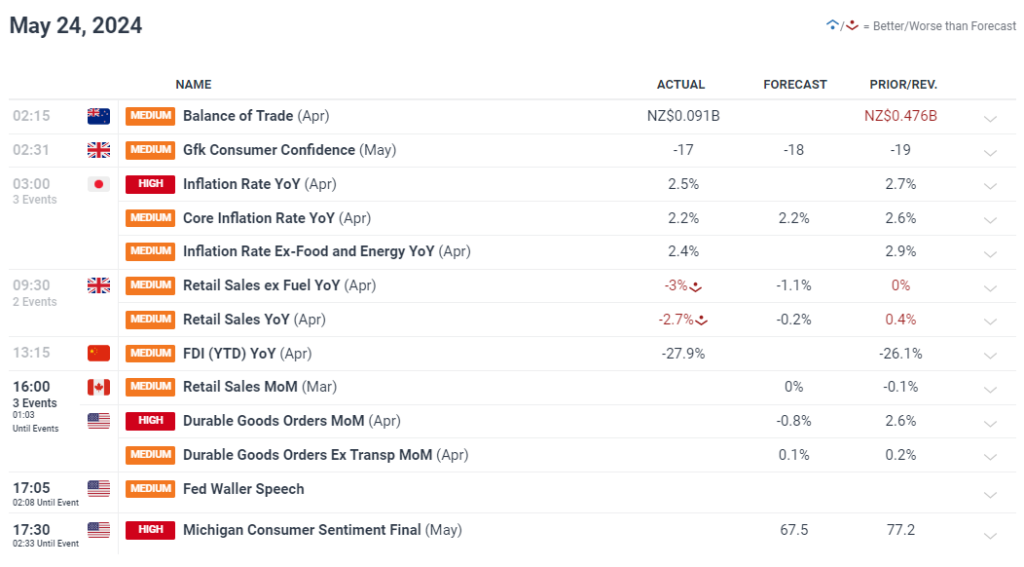

Economic Events:

Yesterday, PMI data from the SP Global Institute was released, with both the services and manufacturing sectors surpassing market expectations. The market’s reaction was positive, though likely temporary. Nvidia’s impressive earnings report could continue to drive indices to new heights. Today’s key data point to watch is the durable goods orders report.

Source : Dailyfx

Indices and Stocks:

The US stock market, after reaching a new peak, saw a decline, returning to a fair price range. US stock futures steadied on Friday after major averages faced heavy selling pressure in the previous session, with the Dow experiencing its worst session in over a year. In extended trading, Intuit dropped over 6% following weak guidance for the current quarter. On Thursday, the Dow fell 1.53%, marking its worst day since March 2023, while the S&P 500 and Nasdaq Composite declined by 0.74% and 0.39%, respectively. The unexpectedly strong US PMI data has raised concerns that interest rates could remain elevated for some time. Mega-cap tech names suffered significant losses, including AMD (-3.1%), Tesla (-3.5%), Apple (-2.1%), Amazon (-1.1%), and Alphabet (-1.6%). Meanwhile, Nvidia surged 9.3% on strong earnings and revenue driven by AI chip demand. Boeing, however, dropped 7.6% after its CFO projected negative free cash flow and ongoing production challenges affecting aircraft deliveries in the second quarter.

Gold (XAUUSD):

Gold prices dropped to around $2,330 per ounce on Friday, nearing two-week lows and on track for the first weekly drop in three weeks. This decline comes as investors reduced their expectations for Fed rate cuts following recent US economic data. On Thursday, S&P Global’s flash PMI readings for May indicated accelerating business activity in the US. Additionally, fewer Americans filed for unemployment claims than expected, signaling labor market strength. The Fed’s May meeting minutes revealed concerns about persistent inflation, with several officials suggesting a possible rate hike if inflation continues to rise. Over the week, gold is set to decline by 3.4%.

Foreign Exchange Market (FOREX):

The Euro rose above $1.083, rebounding from a recent one-week low, as recent data suggested the ECB might implement fewer rate hikes this year. Negotiated pay surged by 4.7% compared to a year ago in the first quarter, nearing record levels seen in Q3 2023, prompting an inflation warning for the ECB. Additionally, PMI readings indicated that private sector activity grew the most in a year in April, with faster increases in new orders and employment. As a result, investors are now pricing in only 60bps of ECB rate cuts this year. Meanwhile, in the US, recent FOMC meeting minutes and comments from Fed officials suggest a hawkish stance, indicating that interest rates will remain elevated due to concerns about slow disinflation progress.

Ethereum (ETH):

Ethereum’s breakout is likely to continue, potentially reaching the $3,800 region based on the previous downtrend and the falling triangle pattern’s measurement. Resistance is expected around the Fibonacci 0.786 level, translating to $3,830. Conversely, the closest support lies at Fibonacci 0.618, or $3,630. The SEC is set to announce its final verdict on VanEck’s application for the first ETH ETF. A positive decision is expected to trigger immediate bullish sentiment. If Ethereum breaks past the $3,800 resistance, it could potentially climb toward the Fibonacci expansion zone of $4,400-$4,800. The $4,090-$4,100 range could act as intermediate resistance on this upward trajectory.

US Crude Oil WTI :

WTI crude futures fell below $77 per barrel on Friday, hitting a three-month low and facing a weekly drop of more than 3%, driven by demand concerns and rising US stockpiles. Stronger US PMI data diminished expectations for Federal Reserve rate cuts, negatively impacting the US economic outlook and energy demand. Some Fed officials have indicated a willingness to raise rates if inflation spikes, as noted in the latest FOMC minutes. EIA data showed an unexpected increase in US crude inventories last week, with supplies at Cushing, Oklahoma reaching their highest levels since July. However, a positive note on US gasoline demand, which hit its highest levels since November, offered some support to oil prices ahead of the US summer driving season. Market participants are now focusing on the rescheduled OPEC+ meeting on June 2, where potential output cut extensions by major producers to address global oversupply concerns will be closely watched.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.