Economic Events:

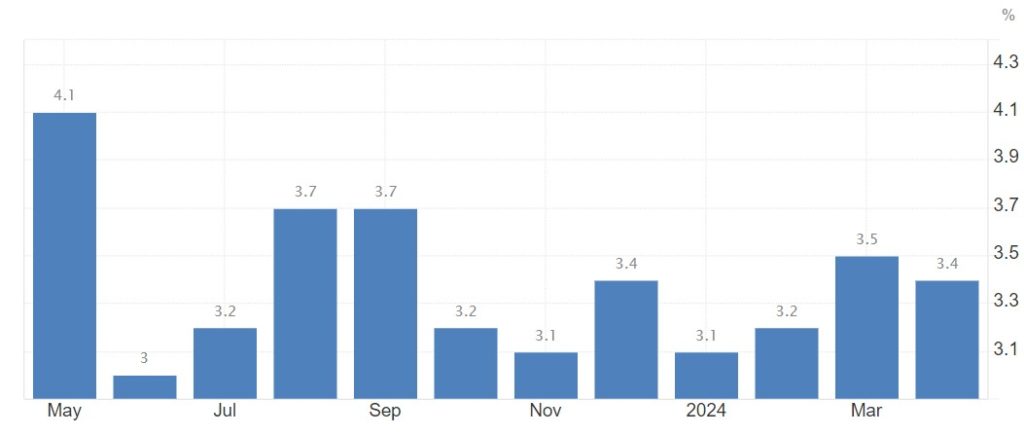

The U.S. dollar fell against major currencies yesterday as the CPI data indicated a continued downtrend in inflation for April, reinforcing expectations of a Fed rate cut. The annual CPI rates dropped to 3.4% and 3.6% for headline and core, respectively, matching forecasts, but the monthly headline rate was slightly below expectations. This, along with flat retail sales, bolstered rate cut bets, with a 25bps cut fully priced in for September. Today, focus shifts to initial jobless claims and speeches from Fed officials, including Bostic, Mester, and Harker. Traders are keen to see if the job market weakness extends into May and to hear Fed officials’ reactions to the CPI data.

U.S. Bureau of Labor Statistics

Gold (XAUUSD):

Yesterday, the U.S. dollar weakened following the release of CPI data, with the Dollar Index dropping by 1.30%. This decline boosted gold prices, which saw increased demand after geopolitical tensions eased. Gold’s fair price found support at a lower level, but the key resistance is at $2,395. Central banks have renewed their gold purchases, similar to a previous period that triggered a significant upswing. It remains to be seen if the recent CPI data will provide enough momentum for gold to break through the upper resistance level.

S&P500:

Yesterday, stocks closed higher as implied volatility levels dropped sharply following the CPI report release. The report aligned with expectations, showing no significant change in inflation trends. Core CPI has maintained an annualized growth rate of 4.0% over the past 19 months, and the latest data did little to alter this trajectory. If the trend continues, the core CPI year-over-year rate may rise again by June, potentially reaching around 4% by August. Market movements were driven by the unwinding of hedging flows, leading to a decrease in implied volatility across indices.

Foreign Exchange Market (FOREX):

The Australian dollar continued to climb on Wednesday, with AUD/USD rising by 0.24% to trade at 0.6642 during the European session at the time of writing.

Australian wages increased less than expected in the first quarter, indicating that inflationary pressures might be easing.

The wage price index rose by 0.8% quarter-on-quarter in Q1, down from a revised 1% in Q4 2023 and below the market forecast of 0.9%. This marks the smallest gain since Q4 2022. On an annual basis, wage growth dipped to 4.1%, compared to 4.2% in the fourth quarter and the market expectation of 4.2%.

The slowdown in wage growth could suggest that wage demands have peaked, which might lead to a reduction in inflation over the year. The Reserve Bank of Australia has forecasted that inflation, currently at 3.6%, will not return to the 2-3% target range until 2025, and markets do not anticipate a rate cut before November. However, these projections may change if inflation decreases more rapidly than expected.

Bitcoin (BTC):

Bitcoin, along with other risk assets, surged yesterday following the release of a better-than-expected inflation report for April by the U.S. Bureau of Labor Statistics.

If the bullish momentum continues, it could indicate the end of the correction and potentially lead to a push towards the all-time high, currently just below $74,000.

It is relatively uncommon for markets to respond so positively when final readings align closely with market expectations. However, this reaction is notable given the broader context of the last four inflation reports, which consistently exceeded forecasts. This latest report breaks that trend, contributing to the market’s enthusiastic response.

The market is clearly optimistic that, although the inflation target remains distant, we are unlikely to see a return to an upward trend in the near future. This also delays the possibility of extreme scenarios involving further interest rate hikes by the Fed. Currently, the probability of a first 25-basis-point cut in September has slightly increased and is now just above 50%.

US Crude Oil WTI :

The International Energy Agency (IEA) unexpectedly reduced their demand forecast for this year by 140,000 barrels per day, primarily due to weak demand from Europe. However, for next year, they predict a demand increase of 1.2 million barrels per day, slightly higher than their previous forecast. The IEA believes the oil market will be more balanced overall in 2025 and notes that if OPEC’s voluntary production cuts remain in place, global oil supplies could still rise by 1.8 million barrels per day compared to a 580,000 barrel increase in 2024.

The IEA attributes the expected supply increase to a significant rise in offshore oil storage. However, this data appears to contradict other reports showing a dramatic decline in offshore oil storage in recent weeks. This discrepancy raises the question of whom to believe: Bloomberg or the IEA? Bloomberg reported that floating oil storage has hit its lowest level since February 2020, dropping to 55.92 million barrels as of May 10. This represents an 11% decrease in just one week.

The IEA stated, “Global oil inventories surged by 34.6 million barrels in March, as oil on water reached a new post-pandemic high. On-land stocks fell by 5.1 million barrels to their lowest level since at least 2016, with total OECD stocks declining by 8.8 million barrels to a 20-year low, while non-OECD inventories increased for the first time since November. According to preliminary data, global oil stocks rose further in April.”

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.