Yesterday, following the Federal Reserve meeting, markets prepared themselves for the release of the NFP data today. Apple Inc. published its earnings report. The Japanese yen strengthened as the dollar-yen exchange rate reached the 160 range. The oil market was under pressure due to the pricing in dollars and the release of US oil inventories. Bitcoin, which has been in a bearish trend since the halving event, continued to maintain its downward momentum. The indices showed relatively good performance towards the end of the day and closed positively.

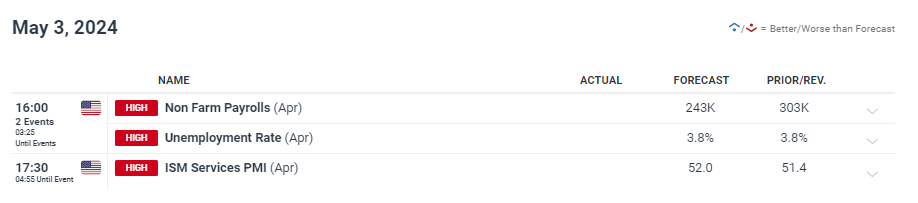

Economic Events:

The highly anticipated U.S. labor market report is scheduled for release on Friday, with forecasts indicating that the largest economy in the world added jobs at a slower yet steady pace last month.

Economists predict that April’s nonfarm payrolls will total 238,000, a decrease from the 303,000 added in March. Meanwhile, the unemployment rate is expected to remain steady at 3.8%, matching the previous month. The growth rate of average hourly earnings is also forecasted to stay at 0.3% month-on-month.

The Federal Reserve has been aiming to moderate labor demand as part of its tightening cycle, with the hope that this moderation will alleviate upward pressure on inflation. Consequently, the ongoing strength in the job market has influenced Fed officials to refrain from implementing interest rate cuts that were initially anticipated earlier this year.

Analysts at ING emphasized that the forthcoming data will be “a significant event for markets,” testing the durability of “more optimistic speculations regarding Fed rate cuts” following the central bank’s recent policy decision earlier this week.

Source : Dailyfx

Earnings:

Apple’s revenue fell in the opening three months of the year, but still topped analysts’ downbeat projections, sending shares in the iPhone maker higher in extended hours trading on Thursday.

The California-based company posted quarterly total revenue of $90.75 billion, a 4% decrease compared to the year-ago period but above expectations of $90.32B, according to Investing.com data.

In greater China, a market that has been a central focus for investors, sales fell 8% to $16.37B, amid rising competition from smartphone rivals in the country. Analysts had forecast revenue in China falling to $15.25B.

Sales of the iPhone device, which makes up about half of total revenue, declined to $45.96B from $51.33B a year earlier, but that just missed estimates of $46B.

Apple also announced a $110B stock buyback program and hiked its dividend by 4% to $0.25 a share, a move that could bolster investor support and trust.

Source : EarningsWhispers

No significant earnings report is expected to be released for the final day of the week, with markets primarily focusing on the NFP report.

Gold (XAUUSD):

Gold continues to fluctuate within the reasonable price range of $2296, and if selling pressure increases, it could drop to around $2225. The NFP report has the greatest impact on the gold market. If employment figures are better than expected, the likelihood of the first interest rate cut being pushed back increases, potentially strengthening the dollar and raising real interest rates, which would lead to a decline in gold prices. Conversely, if the data is unfavorable for the labor market, there is a possibility of an earlier reduction in interest rates to prevent a potential recession in the country.

NQ100:

U.S. futures saw gains on Friday as investors absorbed earnings reports from tech giant Apple and awaited the latest monthly U.S. labor market data.

the Dow futures contract had risen by 214 points or 0.6%, S&P 500 futures had increased by 9 points or 0.2%, and Nasdaq 100 futures had climbed by 74 points or 0.4%.

On Thursday, all major indices on Wall Street moved higher, supported by remarks on interest rates from the Federal Reserve earlier in the week, indicating a potential shift towards dovishness. Fed Chair Jerome Powell mentioned that while persistent inflation has reduced the likelihood of an immediate rate cut, it was “unlikely” for the central bank to raise borrowing costs again.

The Nasdaq Composite, which is heavily weighted towards technology stocks, performed the best among the major averages, partly due to better-than-expected quarterly sales and profits from Qualcomm . Shares in the chipmaker surged by more than 9%.

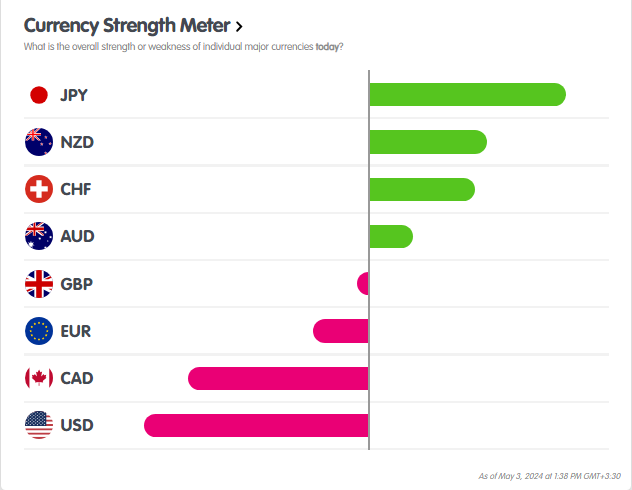

Foreign Exchange Market (FOREX):

As mentioned in the previous report, the yen faced intense selling pressure after reaching the 160 exchange rate level. The likelihood of Japan exiting negative interest rates has increased significantly. This policy shift is fueling a strong yen appreciation.

The Dollar Index has also experienced significant downward pressure, which aligns with the current scenario considering the strength of currencies. The continued weakening of the dollar could exacerbate the downward momentum towards the yen.

Source : Babypips

Bitcoin (BTC):

Bitcoin, after experiencing significant downward momentum and breaking a crucial support level, is currently retesting the support range, which is now acting as resistance. Since substantial support is not readily apparent, there is a possibility of a severe decline towards the $52,000 range.

US Crude Oil WTI :

With the release of the SPR inventory report in the United States, it appears that demand for oil has significantly decreased for the time being. The situation in China and its demand should be closely monitored, as it is one of the primary price drivers for oil. The next support level for oil would be around $77.42 per barrel.

Meta Trading Club also wishes you a happy and prosperous weekend!

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.