J.P. Morgan Chase & Co. is based in New York City. It is a leading global financial services firm with a history dating back to 1799. The company offers services like consumer and commercial banking, investment banking, financial transaction processing, and asset management.

With assets totaling $3.9 trillion and operations in over 100 countries, J.P. Morgan serves millions of customers. This includes individuals, corporations, institutions, and government clients.

The firm is dedicated to excellent client service, integrity, and employee growth. J.P. Morgan is a major player in the financial industry, driving global innovation and progress.

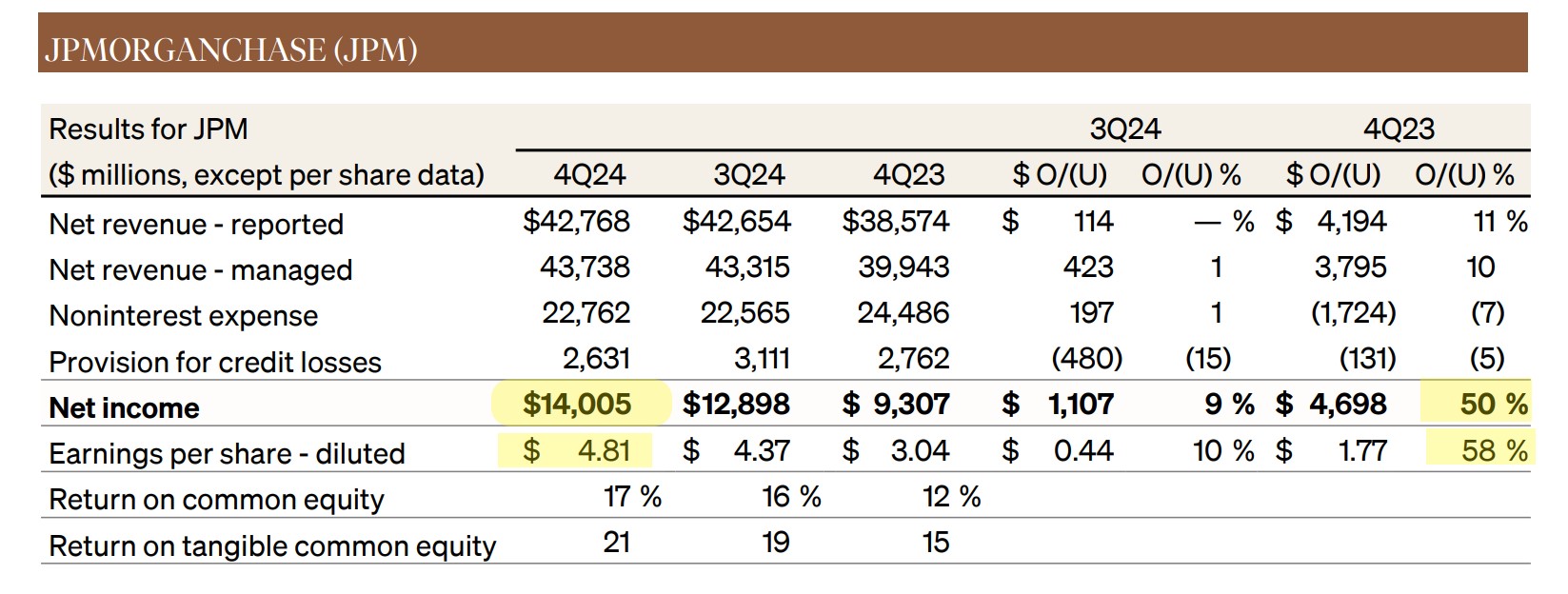

JPMorgan Fiscal Q4 2024

JPMorgan Chase & Co (JPM) reported fourth-quarter 2024 earnings, with net income reaching $14 billion, a 50% YoY increase.

Also, report earnings per share (EPS) of $4.81, surpassing expectations.

The bank’s total revenue climbed to $43.7 billion, above the forecasts and marking a 10% increase year over year.

Earnings Highlights:

- Revenue: Reported revenue was $42.8 billion (10% increase), with managed revenue of $43.7 billion.

- Expenses: Total expenses were $22.8 billion (down 7%).

- Credit Costs: $2.6 billion in credit costs, including $2.4 billion in net charge-offs and a $267 million net reserve build.

- Loans and Deposits: Average loans increased by 2% year-over-year (YoY) and 1% quarter-over-quarter (QoQ).

- Investment Banking Fees: Increased by 49% YoY and 9% QoQ.

- Markets Revenue: Increased by 21% YoY, with Fixed Income Markets up 20% YoY and Equity Markets up 22% YoY.

- ROE: 34% for the full year 2024.

- Assets Under Management (AUM): $4.0 trillion, up 18% YoY.

Board Statements

Jamie Dimon, Chairman and CEO of JPMorgan, announced strong Q4 results with $14.0 billion in net income. Investment banking fees were up 49%, and market revenue increased 21%. Payment revenue hit a record $18.1 billion for the year, and nearly 2 million new checking accounts were opened. Asset and Wealth Management saw a 21% rise in management fees and record revenue of $5.8 billion, with $486 billion in client asset net inflows.

Dimon stressed the need for balanced regulation to promote growth while keeping banks safe. The firm has $547 billion in loss-absorbing capacity and $1.4 trillion in cash and marketable securities. He noted the resilience of the U.S. economy, with low unemployment and healthy consumer spending, but warned of inflation risks and complex geopolitical conditions.

Impact on the Market

Following JPMorgan Chase’s impressive Q4 2024 earnings report, the company’s stock saw a positive market reaction. Investors were encouraged by the strong financial results, including a net income of $14 billion which reports 50% YoY increase.