The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve System responsible for overseeing the nation’s open market operations. This includes making key decisions about interest rates and the growth of the United States money supply. The FOMC meets several times a year to discuss and set monetary policy, aiming to achieve maximum employment, stable prices, and moderate long-term interest rates.

FOMC Meeting on September 18, 2024

On September 18 the FOMC decided to cut interest rates by 50 basis points (0.5%). This decision marks the first rate cut in four years, following a period of high rates aimed at controlling inflation. The rate cut is intended to stimulate economic growth by making borrowing cheaper for consumers and businesses. Lower interest rates can lead to increased spending and investment, which in turn can help boost economic activity

Overall, the FOMC’s rate cut aims to support continued economic expansion and mitigate any signs of an economic slowdown. By making borrowing more affordable, the Fed hopes to encourage spending and investment, which are crucial for sustaining economic growth.

Impact of Rate Cut on Economy

The impact of this rate cut will be felt across various sectors. For consumers, it means lower interest rates on mortgages, auto loans, and credit cards, making borrowing more affordable. For businesses, reduced borrowing costs can lead to increased investment and expansion efforts. However, savers might see lower returns on their savings accounts and fixed-income investments due to the reduced interest rates.

Recently, inflation has shown signs of cooling, approaching the Fed’s 2% target. This improvement in inflation metrics, coupled with some indicators of an economic slowdown, prompted the FOMC to reduce the federal funds rate. The goal of this rate cut is to stimulate economic activity by making borrowing cheaper, thereby encouraging spending and investment.

Additionally, the stock market often reacts positively to rate cuts, as lower borrowing costs can boost corporate profits and investor confidence. However, savers might see lower returns on savings accounts and fixed-income investments due to the reduced interest rates.

Economic Projection

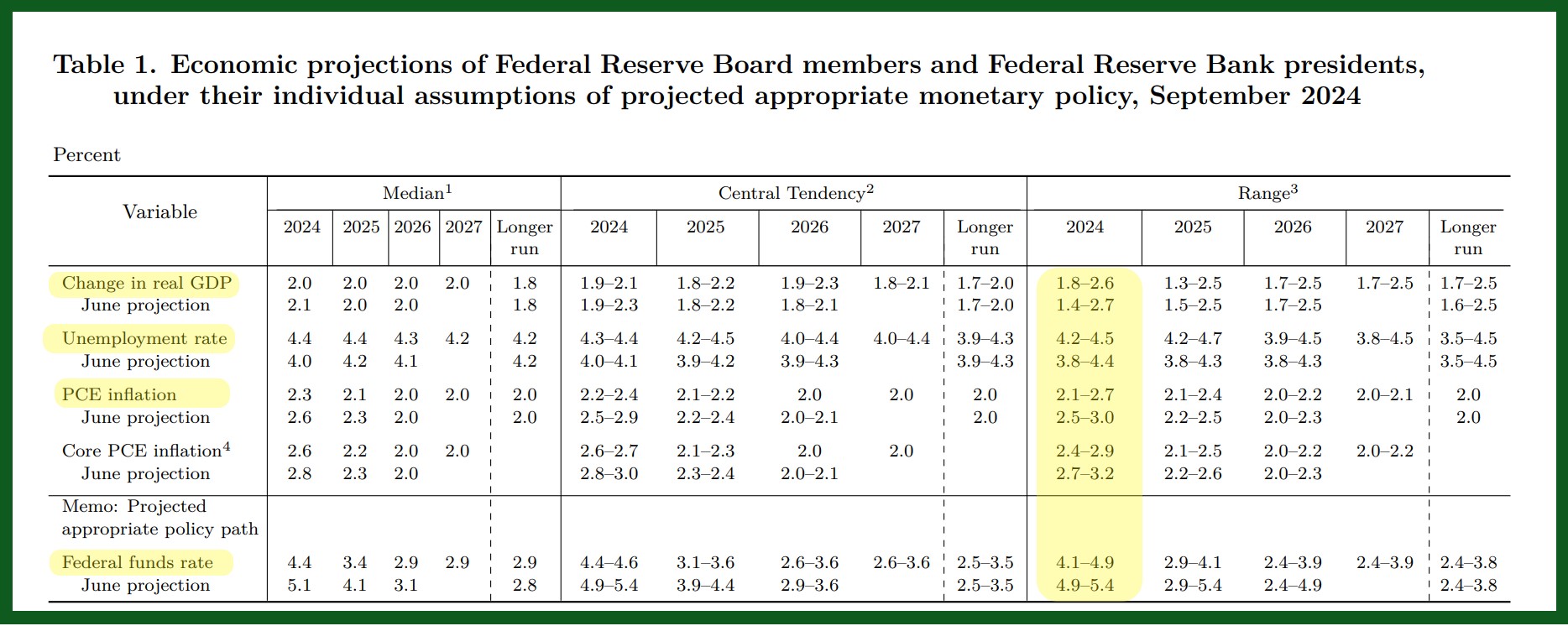

The Federal Reserve released its latest economic projections today, September 18, 2024. Here are some key points:

- GDP Growth: The Fed projects real GDP growth to be around 2.0% for 2024, with similar growth rates expected through 2027.

- Unemployment Rate: The unemployment rate is projected to be 4.4% in 2024, gradually decreasing to 4.2% by 2027.

- Inflation: The Personal Consumption Expenditures (PCE) inflation rate is expected to be 2.3% in 2024, stabilizing at 2.0% in the longer run.

- Interest Rates: The federal funds rate is projected to decrease to 4.4% by the end of 2024, with further reductions expected in the following years.

Source: Federal Reserve

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.