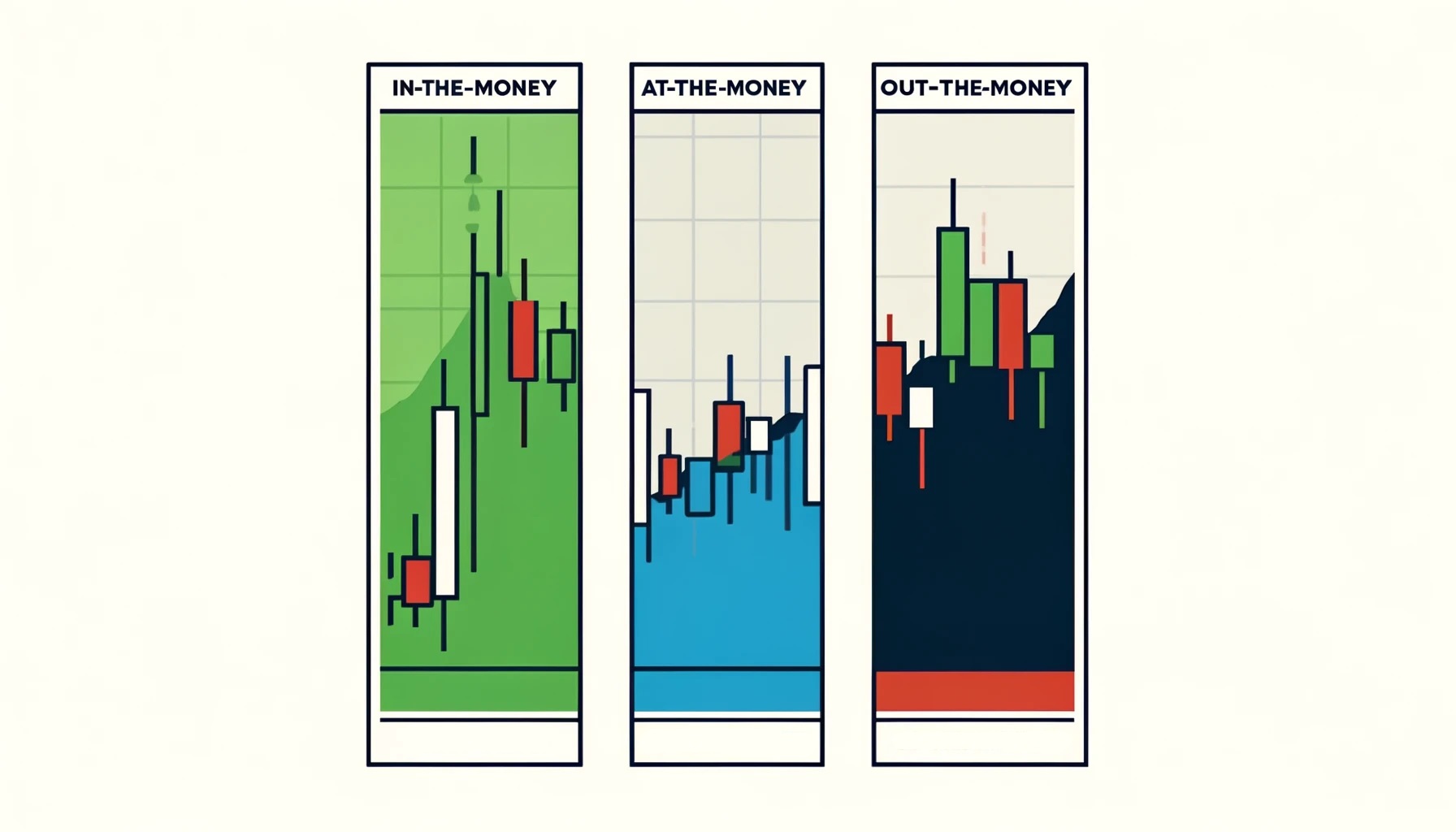

Anyone trading or investing in options must comprehend the ideas behind In-The-Money (ITM), At-The-Money (ATM), and Out-Of-The-Money (OTM) options. The link between the current market price of the underlying asset and an option’s strike price, or the price at which the option can be exercised, is described by these phrases. The intrinsic value and possible profitability of an option are significantly influenced by this relationship.

In-The-Money (ITM) Options

Call Options: When the strike price of a call option is less than the underlying asset’s current market price, the option is deemed to be in the money (ITM). This implies that the option holder can generate instant value by purchasing the asset for less than the going rate. For instance, the option is in-the-money (ITM) if the stock is trading at $105 and the call option’s strike price is $100.

Put Options: A put option is in-the-money (ITM) if its strike price is higher than the underlying asset’s current market value. This gives the option holder the ability to sell the asset for more than the going rate on the market. For example, if the strike price of the put option is $100 and the stock is trading at $95,the option is ITM.

The difference between the strike price and the underlying asset’s current market price is the option’s intrinsic value, or ITM value.

At-The-Money (ATM) Options

When the strike price of an option is the same as, or extremely near, the current market value of the underlying asset, it is said to be an ATM option. Since the option holder would not profit or lose money by exercising the option right away, both call and put options have no inherent value.

Due to their sensitivity to changes in the price of the underlying asset, ATM options are well-liked by traders who want to profit on anticipated price moves.

Out-Of-The-Money (OTM) Options

Call Options: A call option is out-of-the-money if the strike price is higher than the underlying asset’s current market price. There is no motivation to exercise the option because it would involve paying more than the asset’s current market worth. For example, if a stock trades at $95 and the strike price of a call option is $100, the option is out-of-the-money.

Put Options: A put option is out-of-the-money when the strike price is less than the underlying asset’s current market price. Exercising the option entails selling the asset for less than its market worth. For example, if the stock is trading at $105 and the strike price of the put option is $100, the option is out-of-the-money.

OTM options lack inherent value. Their value is solely determined by their time value, which reflects the option’s chance to become ITM before expiration.

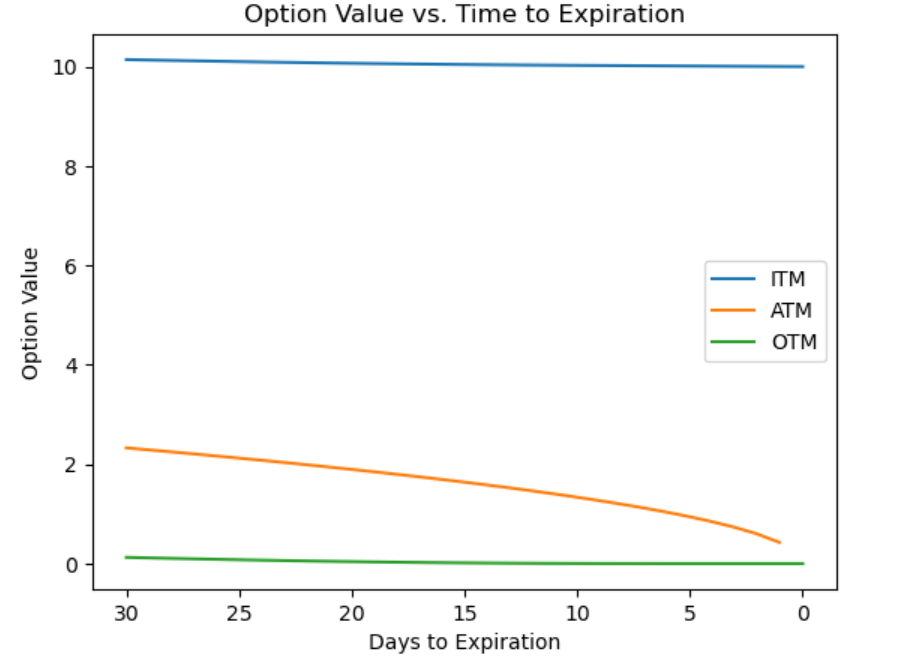

ITM Options (blue line): Due to its inherent value, ITM options typically have a greater value. The graph illustrates how the value of an ITM option begins out high and stays greater than that of ATM and OTM options, even if it lowers as expiration draws near. This is due to the ITM option’s inherent value continuing to increase as the expiration date approaches.

ATM Options (orange line): Over time, the value of ATM options gradually drops. These options have no intrinsic value, thus their value is solely based on their time value, which decreases as the expiration date approaches.

OTM Options (green line): As the expiration date approaches, OTM options consistently decrease in value until they are worthless. As they are worthless in and of themselves,their price is solely based on their time value, which diminishes quickly.

In real terms, the graph indicates to an option holder that the potential value they may realize increases with the earlier they can close or exercise an in-the-money option. Additionally, it shows that out-of-the-money options are more likely to lose value as their expiration date approaches. For this reason, they are frequently traded for speculative purposes, since they represent a higher risk and a larger potential reward in the event that the price of the underlying asset moves in the underlying asset’s favour.