International Business Machines Corporation (IBM) is a globally recognized leader in technology and innovation. It was founded in 1911 and is headquartered in Armonk, New York, with a rich history of developing cutting-edge solutions in areas like artificial intelligence, cloud computing, quantum computing, and cybersecurity. The company’s focus on innovation has solidified its position as a trusted partner for businesses worldwide, helping them solve complex challenges and drive digital transformation.

Over the years, IBM has expanded its expertise across various industries, offering products and services that serve both large and small enterprises. The company is known for its iconic breakthroughs, including mainframe computers and, more recently, generative AI. Also, IBM continues to prioritize research and development, driving innovation and shaping the future of technology.

IBM Fiscal Q1 2025

IBM (IBM) first-quarter 2025 results fell short of expectations but Software revenue growth, improved profit margins, and solid cash flow.

Highlights:

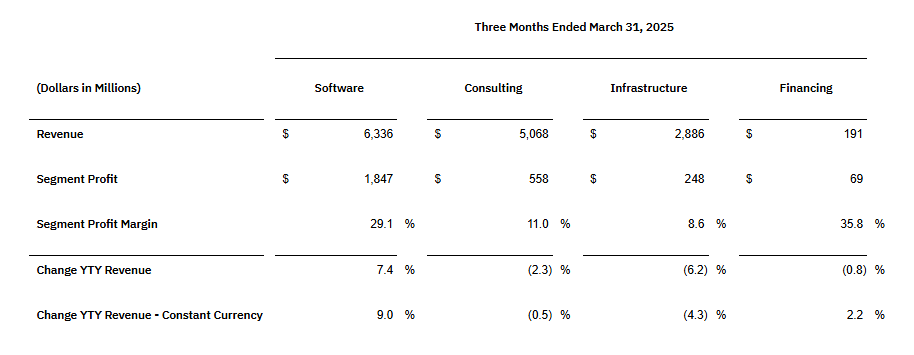

- Revenue: Total revenue reached $14.5 billion, up 1% overall). Software revenue grew strongly by 7% (9% at constant currency), while Consulting revenue remained flat, and Infrastructure revenue dropped by 6%.

- Profit Margins: The gross profit margin improved to 55.2% (GAAP) and 56.6% (non-GAAP).

- Cash Flow: IBM generated $4.4 billion in operating cash flow, with $2 billion in free cash flow.

Software was the standout performer, driven by growth in Hybrid Cloud, Automation, and Data segments. These results reflect IBM’s focus on high-demand technologies like AI and cloud solutions despite challenges in other areas like Infrastructure.

Outlook

The company expects its full-year revenue to grow by at least 5% in constant currency. Current exchange rates are expected to boost growth by about 1 to 1.5 percentage points. For the second quarter, revenue is projected to be between $16.40 billion and $16.75 billion.

The company also anticipates generating around $13.5 billion in free cash flow for the entire year.

Boards Statements

IBM chairman, president, and chief executive officer Arvind Krishna stated that the company increased revenue, profitability, and free cash flow in the quarter, driven by strong performance across its Software portfolio.

He highlighted the continued robust demand for generative AI, noting that IBM’s book of business has grown to over $6 billion inception-to-date, with an increase of more than $1 billion during the quarter.

Krishna expressed optimism about the long-term growth opportunities in technology and the global economy. Despite the fluidity of the macroeconomic environment, he affirmed that IBM is maintaining its full-year expectations for revenue growth and free cash flow based on current insights.

Impact on the Stock Market

Despite exceeding increased revenue and profitability, IBM’s stock fell by 6.8% after earnings were released. This drop was primarily due to the cancellation of 15 U.S. government contracts worth $100 million, which raised investor concerns.

IBM encountered a challenge when 15 U.S. government contracts, totaling $100 million, were canceled due to federal cost-cutting measures. Though the financial impact was small, representing less than 1% of the consulting backlog, the news raised investor concerns and led to a 7% drop in IBM’s stock.

On the upside, IBM’s AI-focused business grew by $1 billion this quarter, bringing its total to over $6 billion. This demonstrates significant progress in the company’s move toward AI-driven enterprise solutions and reflects its transformation from a traditional IT provider to a leader in modern AI innovation.