Trading commodities like crude oil or gold may sound alluring because of the vast sums of money they generate in global commerce. If you are not familiar with commodities you can learn from Beginner’s Guide to Commodities. Also, trading commodities isn’t a get-rich-quick scheme. Like any kind of market speculation, it is a skill that requires knowledge, practice, and dedication. We’ll walk you through the steps involved in commodity trading: what trading instruments are available, popular commodity market analysis strategies, ways to mitigate your risks and how to trade commodities.

Table of Contents

What is Commodity Trading?

You may be familiar with stock trading, but what exactly is commodity trading? It is a way to diversify your trading options, in addition to stocks, through the purchase and sale of commodities. Commodities are such as oil and natural gas, metals, precious metals, and agricultural products such as wheat, coffee, and sugar.

Traders speculate on the future value of a particular commodity in order to profit from price fluctuations. Note that due to the higher volatility, commodities also come with risks. This is because the price can suddenly move against your position, which can lead to losses. Some traders try to hedge against inflation through trading in commodities. As commodity prices rise, so does their profit.

What is The Commodity Market?

Commodity markets have existed since very early in human history. However, a commodity market is where you can trade goods taken from the ground, like cattle, gold, oil and wheat. Also, commodities can be turned into products like baked goods, gasoline or high-end jewelry, which in turn are bought and sold by consumers and other businesses in the commodity market. These traditional markets have served as the physical backbone for exchanging the raw materials upon which societies were built.

Alongside and within these markets, there is a parallel world of financial commodity markets. Here, traders don’t swap bushels of wheat or bales of cotton. Instead, they enter into trade agreements on the future prices of these goods through contracts known as forwards, which were standardized into futures and options in the 19th century. These financial markets don’t directly handle the commodities themselves, though a trader may be on the hook for delivering them in the future but enable trading in interchangeable agreements in regulated exchanges. Commodity markets help airlines hedge against rising fuel costs, farmers lock in grain prices ahead of their harvest, and speculators wager on everything from gold to coffee beans.

Characteristics of The Commodity Market

The commodities traded on international markets have a number of characteristics in common:

- Natural resources needed by most countries or regions

- Limited Geographic Origin

- Price fluctuations

- Standard Quality/Specifications

Commodity prices are largely determined by the various factors that can affect supply and demand, such as economic activity, seasons, weather, and geopolitical events. Major disruptions in supply or new sources of production can cause prices to rise or fall sharply.

What drives commodity prices?

For trading commodities, you need to know what factors influence the market. The price is mainly determined by supply and demand. If the supply goes down, the price goes up. For example, if The Organization of the Petroleum Exporting Countries (OPEC) wants to cut oil production, the supply of oil will decrease, then oil price will surge (like what he did in 2021).

Next, we’ll discuss some of the factors that affect supply and demand, and cause prices to fluctuate.

1) Physical Consumption

The use of raw materials by manufacturers and other consumers is one of the main drivers of prices. For example, if buyers want to buy larger quantities of aluminum and the supply is stagnant or very low, they will have to pay more. On the other hand, if demand drops and more aluminum is available in the market, the sellers will lower their prices to attract buyers.

2) Changes in Production

Fluctuations in supply have a major impact on the commodity markets. If mines have to cut production, crops fail, or oil producers decide to pump less, supply will decrease, and prices will rise. On the other hand, if a new mine, plantation or oil field is put into production, the supply on the market will increase and prices will fall if there is not enough demand to balance the supply.

3) Currency Exchange Rates

Most commodity markets are quoted in U.S. dollars. The value of the U.S. currency therefore determines its prices. If the dollar rises against other currencies, commodities become more expensive for buyers who need to convert their currency to dollars. This can lead to a decrease in demand. Also, if the dollar falls, commodities become cheaper for foreign buyers and demand increases.

4) Geopolitical Background

The production of raw materials is usually done in specific countries or areas. Moreover, political developments can affect supply. For example, the trade war between the US and China in 2018 affected the supply and demand of commodities. Western sanctions on Iran have reduced the supply of crude oil. And the Russian invasion of Ukraine disrupted the supply of grain.

5) Economic Activity

A country’s economic growth determines the demand for raw materials and other basic products. When an economy grows, the purchasing power of the population increases and the demand for products and services increases. For example, the emergence of China and India as key drivers of growth increased their demand for raw materials. However, when a country enters a recession, economic activity shrinks and demand for raw materials decreases.

6) Transport and Storage

The cost of transport, rail and truck transport can also affect raw material prices. In addition, disruptions in transport, for example due to bad weather or strikes, can cause raw material prices to rise at the intended destination. This can also cause prices to fall if traders try to sell the commodity locally. In the crude oil market, when there is a surplus, tankers are used as floating storage areas while traders wait for energy prices to rise. As a result, fewer tankers are available and transport rates are rising.

7) Weather

Adverse weather conditions can also have an impact on various raw materials. This is because it can affect harvests, disrupt oil production or natural gas production, and hinder mining operations, as well as cause logistical problems. For example, cold weather can increase energy demand, causing prices to rise. Conversely, good weather can also produce record harvests, creating a surplus of agricultural raw materials.

8) Seasons

Supply and demand are also affected by seasonal factors. The demand for some raw materials is seasonal: for example, the demand for energy increases in winter and decreases in summer. Another example is the demand in metals for jewelry, such as gold or silver, may also increase during the festive and wedding season in some countries (Like India). In addition, the supply of agricultural products can depend heavily on the time of harvest.

Why Trade in The Commodity Market?

Trading in commodities can offer you various benefits and opportunities. Here are some reasons why you should learn more about how to trade in commodities:

Commodity traders will have a superior means of diversifying and hedging against inflation due to the autonomous movement of commodity prices compared to other types of assets. In times of economic volatility, such as when currency values and bonds experience declines, you can trade gold, as this particular hard commodity is widely regarded as a slightly safer bet.

Commodity derivatives give high leverage for individuals and companies trading in financial markets online. It allows you to buy and sell positions by trading a small capital as an initial margin. Commodity markets are more predictable regarding price movements than other financial instruments. This is because they are often driven by fundamental factors such as supply, demand, and production costs.

How to Trade Commodities?

Commodities are typically traded on futures exchanges, where traders can speculate on future prices. Buyers of raw materials, such as manufacturing companies, also make physical purchases. As a trader, you can trade commodities in a variety of ways, depending on your experience and your preferred mode of operation.

1) Commodity CFDs

One of the most popular ways to trade the commodity markets is to go long or short, without having to trade through conventional commodity exchanges such as CME, ICE, or NYMEX. A Contracts for differences (CFDs) is a derivative instrument and contract between you and your brokerage firm. You participate in the commodities market, but you do not have to buy shares, stocks, futures or options. Profits arise based on picking the correct direction that a commodity price takes over the short-term. Your broker will define how prices are fixed at the end of a contract. The Securities and Exchange Commission (SEC) in the United States does not now permit trading in CFDs.

There are crucial differences between the purchase of physical commodities and the market in commodity CFDs. Due to the overnight fees required to hold positions, CFDs are not typically used as long-term investments.

Note that CFD trading involves risk. Contracts for difference are leveraged products, which means you can increase your potential profits. However, if the market goes against your position, your losses will also be bigger.

2) Commodity Futures

If you have an account with a broker that offers futures, you can buy and sell contracts through a futures exchange. When you trade commodity futures, you enter into an agreement with another trader based on the price you expect for a commodity on a given date. With a futures contract, you actually buy a contract for delivery in the future at a strike price. By using leverage, you can limit your upfront capital exposure. Brokers for the average trader will ensure that delivery is never an issue. You could actually speculate on the direction that prices will take over time for your selected commodity.

For example, you might agree to a commodity future contract to buy 10,000 barrels of oil at $85 a barrel in 30 days. At the end of the contract, you don’t transfer the physical goods, but you close out your contract by taking an opposite position through the spot trading market. So, in this example, when the futures contract reaches its expiration date, you would close out the position by entering another contract to sell 10,000 barrels of oil at the current market price.

If the spot price ends up higher than your contract’s price of $85 a barrel, you would make a profit. However, if it’s lower, you would lose money. On the other hand, if you had entered a futures contract to sell oil, you would make money when the spot price goes down. Also, you would lose money when the spot price goes up. At any point, you could close out your position before the contract expiration date.

3) Commodity Options

Options are derivatives that rely on futures contracts for the underlying asset. The option contracts give the holder the right to buy or sell the underlying commodity at a specified price (called the strike price) in the future. You make a profit if the price moves in the direction of the strike price on the expiration date. Although, you lose the money paid for the contract if the price moves against the position.

4) Purchase of Physical Raw Materials

Speculating on a price via derivatives is perhaps the best way to trade a commodity for retail traders, as one does not want physical delivery. If you do want to own a physical asset, such as gold, silver, or an oil drum, you should buy it from a dealer and have it kept safe.

Direct ownership in a commodity or stock of a producer is the simplest method but is by no means risk-free. To invest in oil, you might choose ExxonMobil or, if gold is your passion, Barrick Gold Corporation may work for you. You may also prefer to buy a commodity directly through a market dealer. For example, you may purchase gold coins or bars to own directly or have an agent secure your bullion in a privately managed vault. Commissions add another form of price risk, so be wary.

5) Commodity Stocks

These stocks are an alternative to speculating directly on the price of a particular commodity, you can also trade the shares of a company that operates in that sector.

For example, you can trade the shares of oil production companies (like Antero Resources Corp with AR ticker) or gold mine (like Newmont Corp with NEM symbol), as their share price depends on the fluctuations in underlying commodity prices. This also allows you to limit your risk, as a well-run company can still make a profit even when commodity prices fall.

Keep in mind that stocks don’t directly follow commodity prices and the stock price can also go against your expectations and lead to losses. This is because stock prices are influenced by a number of other factors, such as the strategy of the company’s management and the fundamental parameters of the company.

6) Commodity ETFs

Exchange traded funds (ETFs) are based on commodities. These funds combine the money from many small investors to build a large portfolio that tries to track the price of a commodity or a basket of commodities. For example, energy ETFs (like Energy SPDR ETF with ticker XLE) based on multiple energy commodities and gold ETFs (like GLD and UGL). The fund may buy futures contracts to track the price, or it might invest in the stock of different companies with commodity exposure. ETFs can buy futures contracts or trade in stocks of commodity companies.

They provide immediate access to a diversified range of assets, which would take much longer to put together on your own. With a small investment, you can gain access to a much larger range of commodities than if you tried to build the portfolio yourself. Plus, you’ll have a professional investor managing the portfolio. However, you’ll need to pay an additional management fee to the commodity fund over what it might cost if you had made the investments yourself. In addition, depending on the fund’s approach, it may not perfectly track the commodity price.

Commodity Market Trading Strategies

There are many trading strategies for the commodity market. Most strategies combine two types of research: fundamental analysis and technical analysis.

Fundamental Analysis in Commodity Market

This type of research involves studying the economic factors that determine the value of an asset. Fundamental analysis requires a trader to develop a keen eye for the supply and demand picture for a particular commodity. Supply and demand are opposing forces. Rising demand positively impacts prices; rising supply negatively impacts prices, all other things being equal.

1) Production Level Patterns

Traders often look for broad trends in the output of individual commodities. Patterns in the level of crops being produced, metals being mined, and crude oil being drilled can offer clues about the direction of markets.

2) Inventories

As with output, inventory levels can be a great fundamental trading tool. Persistent drawdowns in inventories often accompany higher prices, while inventory build ups usually lead to price declines.

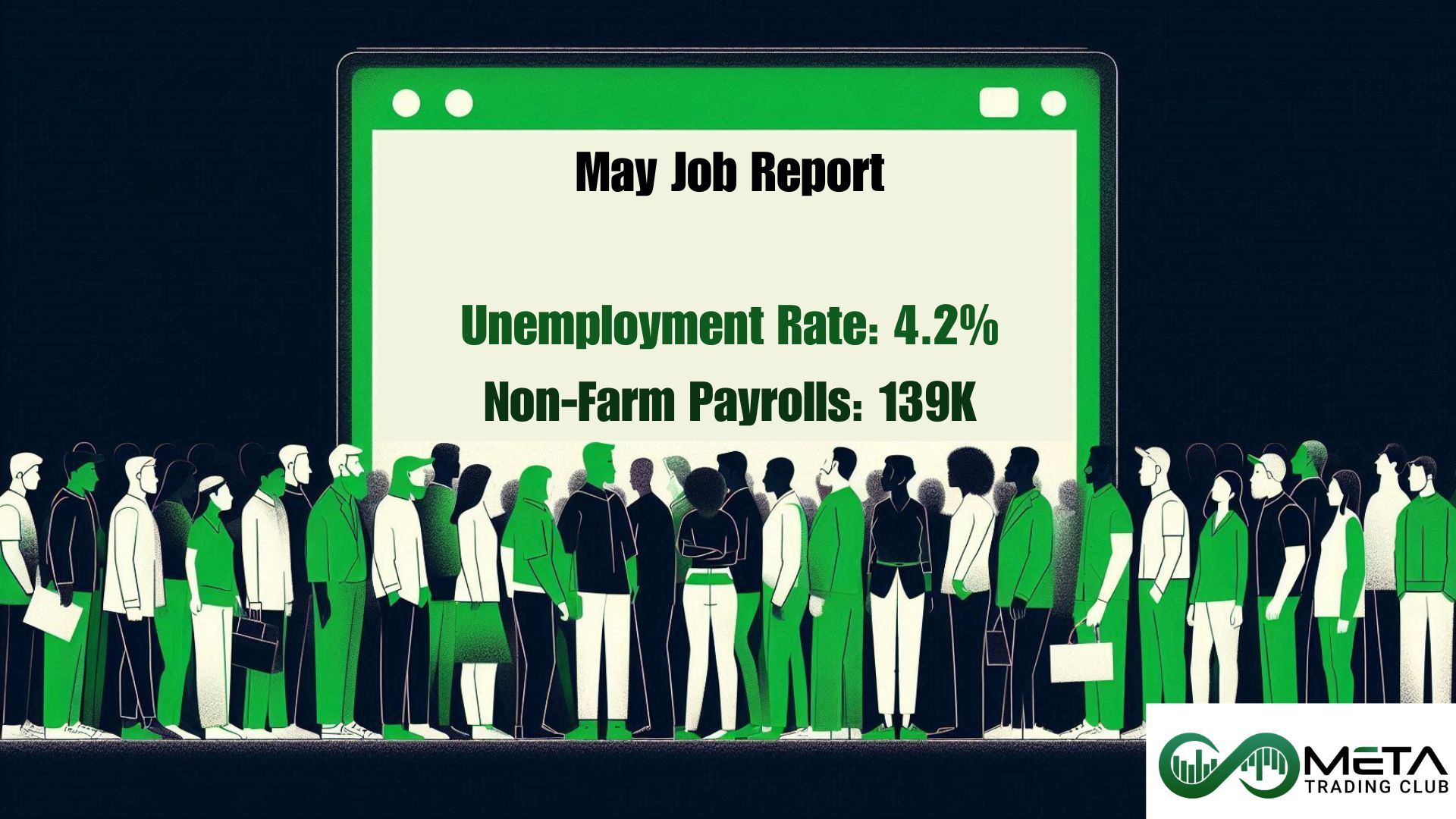

3) Macroeconomic Data

Traders can monitor trends in GDP, unemployment, and retail sales for clues about the strength of a country’s economy. Strong data often coincides with rises in industrial commodity prices, while weak data can lead to lower prices. Commodities End Markets Intermediate-level fundamental traders may want to delve deeper into the end markets for commodities. For example, strength or weakness in the commercial real estate markets in large cities offer clues about demand for steel and other industrial metals. Similarly, the Cattle on Feed Report released by the USDA shows the future supply of cattle coming on to the market. This can offer clues about future beef prices. After becoming familiar with interpreting the significance of these data points, traders can use them to make better trading decisions. More Fundamental Analysis Strategies As traders become more skilled, they can adopt more complex types of fundamental analysis.

4) Bull and Bear Cycle Analysis

Identifying long-term secular trends in markets can produce the largest profits of any trading strategies. Experienced traders look at the pricing of individual commodities compared to their long-term average prices. Differences in these two values often presage the beginning of long-term bull or bear markets.

5) Broad Policy Assessment

Actions by central banks can presage movements in commodities prices. For example, a long period of easing by major central banks often leads to higher commodity prices, while a series of rate hikes can produce bear markets.

6) Major Commodity Analysis

The price action of commodities such as oil and gold often precede movement in lesser commodities. For example, with an uptrend in oil prices a trader might check the prices of other fossil fuels such as natural gas and heating oil.

7) Production Output Assessment

Traders examine the output of leading producers for clues about big economic cycles. For example, companies might close mines and reduce output when metals prices are low. But these actions can also indicate that a market bottom is forming. Using production output from leading producers as a contrary indicator is another trading strategy.

8) Kondratiev Waves Analysis

This technique attempts to make long-term predictions of commodity prices based on economic cycles. Kondratiev waves, also known as super cycles, great surges, or long waves, are hypothesized cycle phenomena in the modern world economy. Also, these waves are associated with technological innovations that drive economic growth. Each wave corresponds to a major technological shift (like the Industrial Revolution and the Information Age). These shifts lead to long periods of prosperity followed by corrections and adjustments.

Technical Analysis in Commodity Market

This type of analysis uses historical charts and data to analyze historical price trends which may have predictive value for prices in the future. When doing technical analysis, traders look for price points in the past where significant buying or selling occurred to try and predict trigger positions once those price levels occur again. If you want to learn technical analysis, Book a Free Discovery Call.

In technical analysis, traders use candlestick charts, classical patterns, trading volume, analysis tools and concepts, to foresee future price movement based on price history.

Although some “purely” technical analysis traders pay no attention to fundamental factors in their trading, many traders use elements of both forms of analysis to make trading decisions.

CFD Commodity Trading

These type of trading products, allows traders to speculate on assets that they may not otherwise have access to, such as gold, silver, oil or natural gas. CFD stands for ‘Contract for Difference.’ It is a financial product that pays the difference between the opening price (at the time of purchase) and the closing price (at the time the contract is sold).

When purchasing CFDs, traders have the potential to go long and profit from a rise in the underlying commodities value or go short and earn money if the value drops. As a derivative product, the trader does not own the underlying commodity. So, they do not have to worry about taking on delivery and storing barrels of oil, for example.

Pros and cons of trading commodities CFDs

CFDs allow you to speculate on the price of commodities without having to take physical delivery or worry about storage costs for assets such as gold or silver bullion. Unlike futures contracts, CFDs do not have a specified expiry date, giving you flexibility as to when you close your position. Note that contracts for difference are considered short-term investments due to overnight fees.

CFDs also provide the option to trade commodities in both directions. Whether you have a positive or negative view of the commodity price forecast, you can speculate on upward or downward future price movements.

Another feature of a CFD is that it is a leveraged product. Leverage makes it highly risky as it may increase losses and profits. For example, a 10% margin (the number may vary depending on the commodity and the CFD broker) means you should deposit only 10% of the total value of the trade you want to open. The rest is covered by your CFD provider.

In this case, if you want to place a trade for, let’s say, $1,000 worth of a particular commodity CFD, and your broker requires a 10% margin, you should spend only $100 to open the trade.

Why should you trade CFDs in commodities

You might want to trade commodities with CFDs if:

- Interested in speculating on the underlying price of commodities

- Want to trade rising and falling markets (going long and short)

- Leverage your exposure

- Take shorter-term positions

- Hedge your portfolio

- Trade without owning the underlying asset

How to Start Trading in the Commodity Market?

You now have a basic understanding of the global commodities market and the types of commodities that are traded. Let’s discuss trading commodities steps.

1) Select a Way for Trading Commodity

If you’re looking for an easy and quick way to make short and long trades in the market, then CFD trading may be a good option for you. You won’t need to be concerned about borrowing assets or dealing with additional fees like you would with traditional short selling.

2) Look for The Best Trading Platform

Finding the best CFD trading platform matters a lot. Choose a reliable online trading platform or brokerage that offers commodity trading. Ensure it provides access to the specific commodities you’re interested in.

3) Open Account

Sign up for an account with the chosen platform. You’ll need to provide personal information and complete any required documentation.

4) Fund Your Account

Deposit funds into your trading account. The amount depends on your risk appetite and the minimum requirements of the platform.

5) Choose Your Commodity

Now it’s time to choose the commodity you’re interested in and start trading it. Common ones include:

- Energy categories: crude oil, natural gas, gasoline

- Metals: gold, silver, copper

- Agricultural products: wheat, soybeans, coffee

5) Develop a Trading Strategy

Come up with your strategy by determining your entry and exit points based on technical indicators and price patterns.

6) Risk Management

- Set stop-loss orders to limit potential losses.

- Determine your position size based on your risk tolerance.

- Avoid risking too much capital on a single trade.

7) Start Trading

Execute your first trades. Monitor price movements, adjust your strategy, and learn from each trade.

Lastly, make sure to regularly review and adjust your strategy as the market changes over time.

Master How to Trade in Commodity Market

It’s important to know the trading basics of commodities CFDs. You need to know the particular commodity you want to trade well, especially what makes its value change. But it’s not just about the steps on how to trade commodities – you should also know why trading commodities could be suitable for your trading style and risk appetite. Apart from that, you must choose carefully the trading platform you’ll be using. It should give you the help and support you need.

At our incubator Program, you’ll get access to various educational resources that will help you become a skilled CFD trader more easily. Join our amazing trading community and start to practice trading the CFD commodity of your choice now.

FAQs

- Is commodity trading profitable?

Commodity trading can indeed be profitable, but it’s essential to understand the nuances and risks involved. The commodity trading industry has experienced significant growth in recent years. Commodity trading value pools nearly doubled from $27 billion in 2018 to an estimated $104 billions of EBIT in 2023. - How are commodity prices determined?

Commodity prices are primarily determined by the forces of supply and demand in the market. Commodities are traded on exchanges, and their prices are influenced by a combination of economic factors, supply and demand dynamics, and external events. - What is the most traded commodity in the world?

The most traded commodity in the world is Brent Crude Oil. It holds the top spot due to its high demand and versatility. Other commodities that also rank high in trading volume include steel, WTI crude oil, soybeans, iron ore, corn, gold, copper, aluminum, silver, coffee, sugar, cocoa, and cotton. - What is a commodity CFD?

A Contract for Difference (CFD) is a financial product in which the profit or loss is calculated from the difference between the price of an asset at purchase and the price at the time the contract is closed. They are derivative products in which the trader does not own the underlying commodity, such as gold, silver, oil or natural gas. - What are spot prices on commodities?

A commodity’s spot price is the local cash price for immediate purchase and delivery (“on the spot”). Spot market transactions are settled within a few days.,