How Swing Trading Works, Have you ever thought about that? Or how you can make more profits than you ever did in just one day by mastering swing trading? If yes, then this blog post is your full guide.

In this post, we will take a look at how to master swing trading, how swing trading works, can swing trading be profitable, and more so make sure to stay with us till the end.

What is Swing Trading? A beginners Guide

Swing Trading is essentially a trading strategy in the stock market that is somewhere between day trading and long-term investments in the stock world.

In this trading strategy, you aim to capture short- to medium-term gains in a financial asset (such as stocks, forex, or commodities) over a short period like a few days to weeks.

To understand swing trading better and how swing trading works, you need to fully grasp the meaning of day trading and long-term investments.

Simply put, Day trading is another trading strategy that most traders use and profit from. How day trading works is you buy and sell your stocks on the same trading day to gain profit and make money.

The long-term version of day trading is a long-term investment where you put your money on one stock and have it become an investment for you soon, mostly 5-10 years.

Overall, swing trading combines elements of both daily trading and long-term investing( like position trading), offering traders the opportunity to capture profits without the need to constantly monitor the market throughout the day.

Swing Trading Vs Day Trading and Position Trading

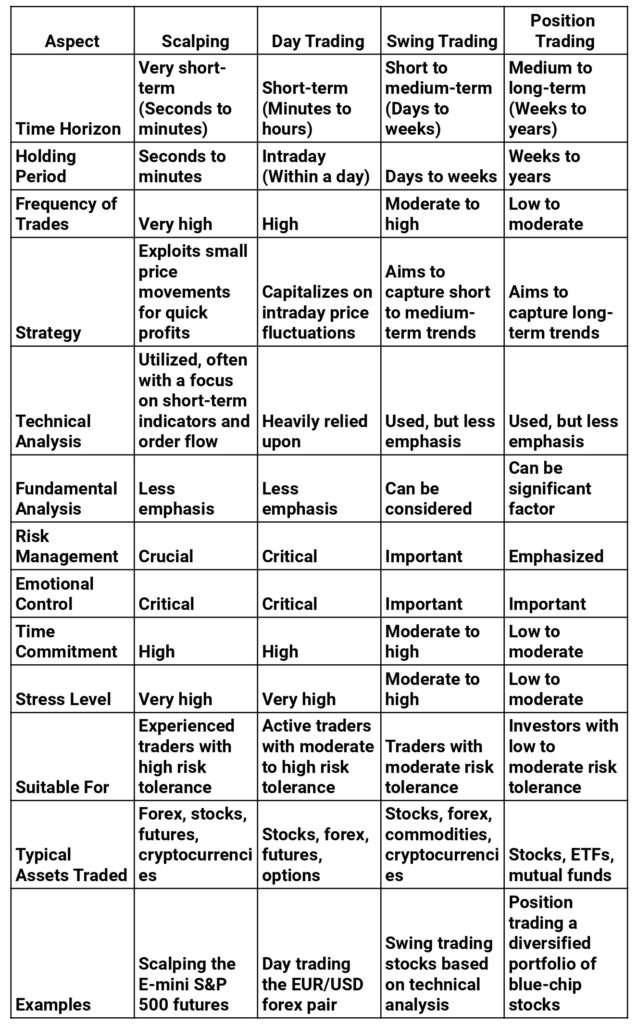

Now that we know what swing trading is in the trading world, let’s compare it with day trading and position trading, and what is the best trading strategy in the table below:

This table provides a full guide on how swing trading works and ultimately, which trading style you choose, all depends on your goals and needs.

Advantages and Disadvantages of Swing Trading

It’s time to talk about the pros and cons of swing trading and can swing trading be profitable if you are a beginner.

The pros of Swing Trading:

- Balanced Time Commitment: Unlike day trading or other trading strategies, swing trading requires much less time and you can easily invest only a few hours in it, to get your required results.

- Reduced Stress Levels: Well, because swing traders aren’t making split-second decisions or sudden changes like day traders, their stress levels tend to be low.

- Potential for Substantial Gains: Swing traders monitor the stocks in a periodic way which results in significant profits if the trade is timed correctly.

- Flexibility in Strategy: Swing trading allows for flexibility in strategy implementation. This is a strategy that allows traders to use as many tools as they want for their technical analyses.

- Less Market Noise Impact: Swing traders have a bigger picture in mind when they are trading, which is why they tend to double any minor price fluctuations and instead focus on the bigger goal.

- Reduced Transaction Costs: Because this trading strategy will be done only in a few trades, you don’t need to worry about transaction costs as day traders go through.

- Suitable for Part-Time Traders: Swing trading can be done by both full-time and part-time traders. Because it has longer holding periods makes it feasible for individuals who can’t dedicate all their time to trading but still want to actively participate in the markets.

The Cons of Swing Trading:

- Overnight Risk: because swing trading holds its place overnight or in the course of several days, it is open to some risks that can happen because of reports, economic data releases, or geopolitical events that can essentially result in a big price gap.

- Missed day trading Opportunities: Unlike day traders who prioritize day trading price movements, swing traders may miss out on short-term trading opportunities that can happen within the trading day. This can make some traders frustrated if significant price movements occur while the trader is not actively monitoring the market.

- Patience Required: To have a successful swing trading journey, you need to patiently wait for optimal entry and exit points.

- Market Timing Risks: Planning the exact timing of the market accurately and correctly is essential in swing trading. However, predicting the exact timing of market reversals or trend continuations can be challenging and hard for beginner traders, leading to missed opportunities or entering trades without a prior background and out of nowhere.

How To Master Swing Trading?

Now that you know the basics of the swing trading world, let’s talk about how you can learn to swing trading and become a professional in it in no time.

1.Educate Yourself

The first and most important thing in the path of learning swing trading is to educate yourself. You need to gain a solid understanding of the principles of swing trading, including technical analysis, fundamental analysis, market psychology, and risk management.

If you are a beginner in trading overall or need professional insight on how to enter the swing trading world, you can book a free discovery call with the Meta Trading Club team, and we will help you in the best way after understanding your needs and goals.

2. Develop a Trading Plan

Before starting anything important in your life, you need to have a clear vision of what you want and how you want to achieve it step by step.

Create a well-defined and well-made trading plan that outlines your trading goals, strategies, risk tolerance, entry and exit criteria, position sizing rules, and overall approach to managing trades.

3. Master Technical Analysis

Become a pro in technical analysis techniques such as chart patterns, support, and resistance levels, trendlines, moving averages, oscillators, and other indicators. Learn how you can monitor stocks efficiently and in a way that helps you reach your goal.

4. Understand Market Fundamentals

Although swing trading primarily focuses on technical analysis, understanding market fundamentals and basics can provide valuable insights into broader market trends, especially if you are a beginner.

5. Practice Risk Management

In the stock and trading world, you need to understand that risk is always part of the job.So, you have to prioritize risk management in your trading approach if you want a successful trading journey. You can use techniques such as setting stop-loss orders, managing position sizes based on risk-reward ratios, diversifying your trades, and avoiding over-leverage.

1.Backtest Your Strategies

Test your trading strategies that you gained over time using historical data to assess their performance under various market conditions.

Have all market conditions in mind, and make your strategies in a way that predicts nearly everything, and the results in your profit.

2. Develop Patience and Discipline

Exercise patience and discipline in your trading activities. Wait for high-quality trade setups that meet your criteria, rather than chasing every market opportunity that happens and can have some kind of a profit for you.

3. Seek Mentorship and Feedback

You can surround yourself with experienced traders by joining trading communities, and seek mentorship from professionals who can provide guidance, support, and constructive feedback.

How To Develop a Swing Trading Strategy?

To have a successful journey and path in swing trading, you need to have practical strategies that are thought through and ready to battle any conditions that are thrown at you by the market.

1.Setting Entry and Exit Points

For entry points, start looking for high-probability trade setups based on technical analysis that is provided by professionals. These analyses can include chart patterns, trendlines, and indicators.

Then consider entering trades when the price breaks out of consolidation patterns or key support/resistance levels. Finally try to use confirmation signals, such as candlestick patterns or volume spikes, to validate potential entry points.

In exit points, try to set clear profit targets based on key resistance levels or the distance of the expected price move that can be seen. Use trailing stops to lock in profits and allow winning trades to run while protecting against potential reversals. Also, consider exiting trades if the original trade thesis is invalidated or if the market conditions change significantly in a way that you didn’t prepare beforehand for it.

2. Risk Management and Position Sizing

As we said before, you need to have a risk management plan. And in that plan, you need to determine a risk management rate that is acceptable per trade. It also is typically a percentage of your trading capital (e.g., 1-2%).

Try setting stop-loss orders based on technical levels, volatility, or the distance between entry and exit points to prevent and limit potential losses.

Also, always remember to avoid risking more than you’re willing to or you plan to lose on any single trade, and maintain discipline in adhering to your risk management rules.

For position sizing, it is recommended to calculate the position size based on your predetermined risk per trade and the distance to your stop-loss level.

Always adjust position sizes based on the volatility of the market or the specific trade setup to maintain consistent risk exposure. In the end, consider diversifying your trades across different assets or sectors to reduce overall portfolio risk.

3. Backtesting and Optimization

As we said before, backtesting is very important especially if you are looking to have a high success rate. You can analyze the performance of your strategy in different market conditions and identify its strengths and weaknesses. Finally, refine your strategy based on the results of the backtesting process, including adjusting entry and exit criteria, risk management rules, and position sizing.

To have maximum optimization, continuously optimize and update your trading strategy based on new insights, market developments, and changes in your risk tolerance. Always have some sort of feedback from live trading experiences and adjust your strategy accordingly to improve its effectiveness.

At last, regularly review and update your trading plan to ensure it remains aligned with your goals and objectives.

What Are Some Advanced Swing Trading Techniques?

Lastly, let’s cover some of the best swing trading techniques that you can use to gain your profit more easily and without losing too much.

- Psychology Techniques in Trading:

For a great trading session, no matter what strategy, you need to have a strong mind and discipline. Trading overall is a very high-risk job that can damage a lot of lives if not used correctly.

A trader has to build up a strong mind that doesn’t make irrational or emotional decisions.

If you want to be such a trader, educate yourself as much as you can before entering the trading world, so you can have high confidence in your decisions and trust yourself in what you are doing.

- Short Selling and Options Trading

Short selling is a technique in swing trading that allows you to borrow shares and sell them with the intention of buying them back at a lower price. In this way, you can always profit from downward price movements, only by having an eye for them.

In Options trading, you can use option contracts to gain exposure to swings in the underlying asset’s price. These strategies include buying calls or puts, as well as more complex strategies like spreads and straddles.

- Using News and Events in Swing Trading

Always stay informed about big events that are happening around the world, especially if they are related to the global market like wars or international events including politics that can change the market even with a simple tweet.

Also, you can always use the news and these big events as additional confirmation or context for your technical analysis-based trade setups.

Last Words

In this post, we took a look at what is swing trading overall and how you can profit from it even if you are a beginner in this field. Also, we covered some simple swing trading techniques that you can use to have a high success rate in your trading session.

If you liked this post, make sure to follow us on our social media platforms, as we always provide educational tips and tricks for beginner traders that can easily help them become a professional trader in no time.

Frequently asked question

Beginners should focus on learning about technical analysis, risk management, and trading psychology. Start with a small account, practice with demo trading, and gradually scale up as skills improve.

Some of the mistakes that swing traders make, especially the beginner ones, are overtrading, neglecting risk management, and chasing momentum.

Yes, Totally. Integrating swing trading with other strategies is possible and can offer benefits like diversification, adaptability to market conditions, improved risk management, potential for additional income, and skill development.

Yes, swing trading can be profitable for traders who effectively adapt to different circumstances, identify opportunities, manage risk, and adhere to their trading plan.

The best trading strategy doesn’t exist, because you always choose your strategy solely based on your goals and your needs.

There are many online platforms that you can learn swing trading from. Our recommendation is to have a Free Meta Trading Club discovery call and if you are suited, you can join MTC Incubator that covers everything you need to know about trading.