Hedging is an important strategy for investors looking to protect their portfolios from market volatility and potential losses. By using various hedging techniques, you can minimize risks and ensure more stable returns, even in unpredictable market conditions. Whether you’re an experienced investor or just starting out, understanding how to effectively hedge your investments is essential for long-term success. Ready to learn more? Explore our comprehensive guide on the best hedging strategies for 2024 and discover how to safeguard your stock portfolio today!

Table of Contents

What is Hedging?

Hedging is a risk management strategy used by traders to protect their portfolios from adverse price movements. It acts as an insurance policy, offsetting steep losses in other assets. Essentially, it involves taking an offsetting position in a related asset to minimize potential losses. Think of it as a form of insurance for your investments.

For example, if you own stocks in a company and are concerned about potential price drops, you might buy put options on those stocks. This way, if the stock price falls, the gains from the put options can offset the losses from the stocks.

How Does Hedging Work?

Hedging involves taking an offsetting position in a related asset to mitigate potential losses. This is akin to buying insurance for your investments. For example, if you own shares in the Tesla (TSLA) company and are worried about a potential decline in its stock price, you might purchase put options on those shares. If the stock price falls, the gains from the put options can offset the losses from the shares. Hedging involves these steps:

- Identify the Risk: The first step in hedging is to identify the specific risk you want to protect against. This could be the risk of a stock price falling, currency fluctuations, interest rate changes, or commodity price movements.

- Choose the Hedging Instrument: Depending on the type of risk, you select an appropriate hedging instrument. Common instruments include options, futures, forwards, and swaps.

- Determine the Hedge Ratio: This involves calculating how much of the hedging instrument you need to offset the risk. The hedge ratio is typically based on the value of the asset you are protecting and the characteristics of the hedging instrument.

- Execute the Hedge: You then execute the hedge by buying or selling the chosen instrument. For example, if you are hedging against a potential drop in stock price, you might buy put options.

- Monitor and Adjust: After setting up the hedge, you need to continuously monitor the market and your positions. Adjustments may be necessary if market conditions change or if the hedge is not performing as expected.

Example of Hedging

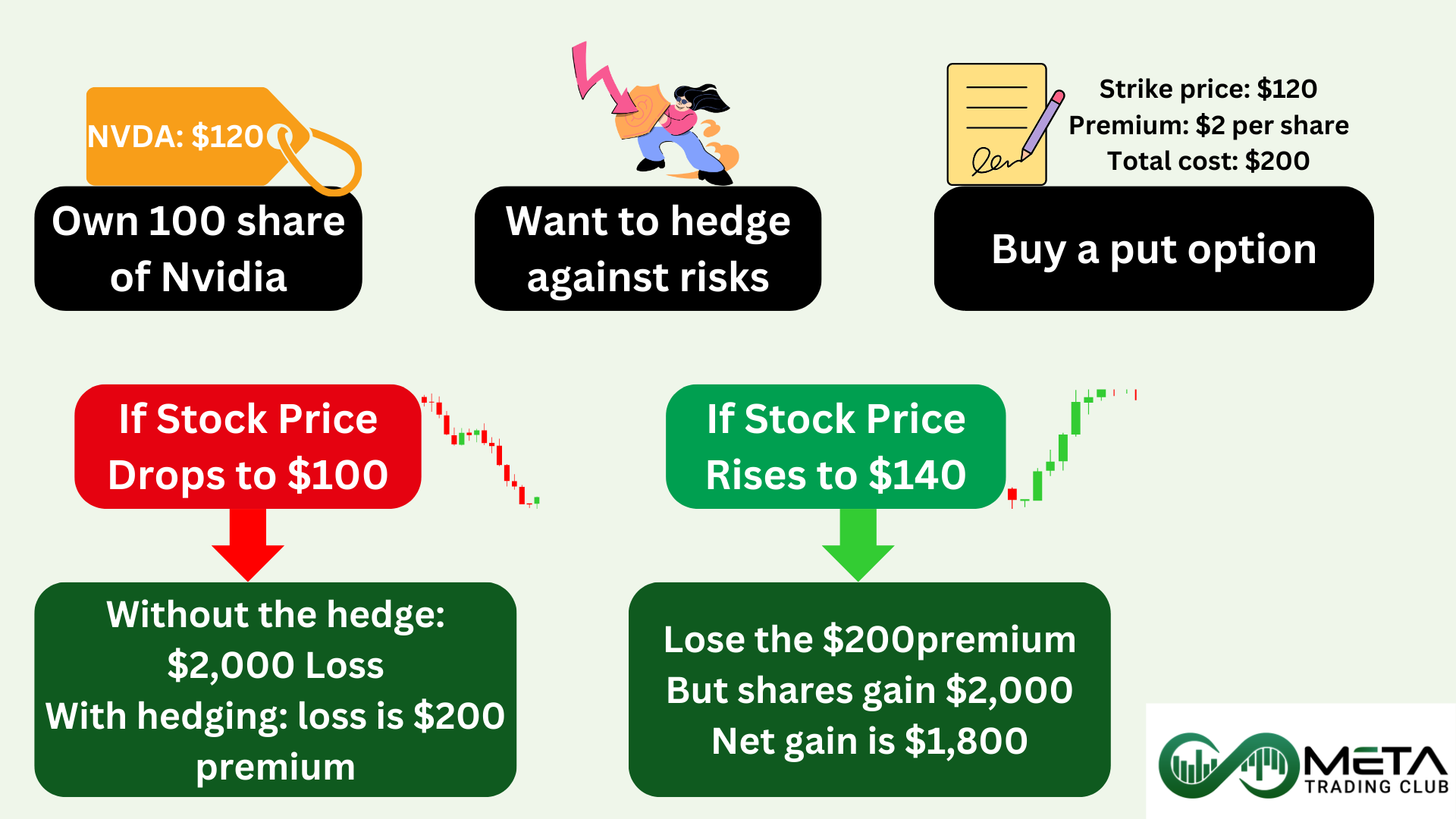

Let’s say you own 100 shares of a technology company Nvidia (NVDA), currently trading at $120 per share. You are concerned that the stock price might drop in the near future due to market volatility. To hedge against this risk, you decide to buy put options.

Put Option Details: You buy 1 put option contract (each contract typically covers 100 shares) with a strike price of $120, expiring in three months. The premium for this option is $2 per share, so the total cost is $200 (100 shares * $2).

- If Stock Price Drops: If the stock price falls to $100, the put option allows you to sell your shares at $120, effectively limiting your loss. Without the hedge, your loss would be $2,000 (100 shares * $20 drop). With the hedge, your loss is limited to the $200 premium paid for the put option.

- If Stock Price Rises: If the stock price rises to $140, the put option expires worthless, and you lose the $200 premium. However, your shares have gained $2,000 in value (100 shares * $20 increase), so your net gain is $1,800.

In this example, the put option acts as insurance, protecting you from significant losses while allowing you to benefit from potential gains.

What are Hedging Types?

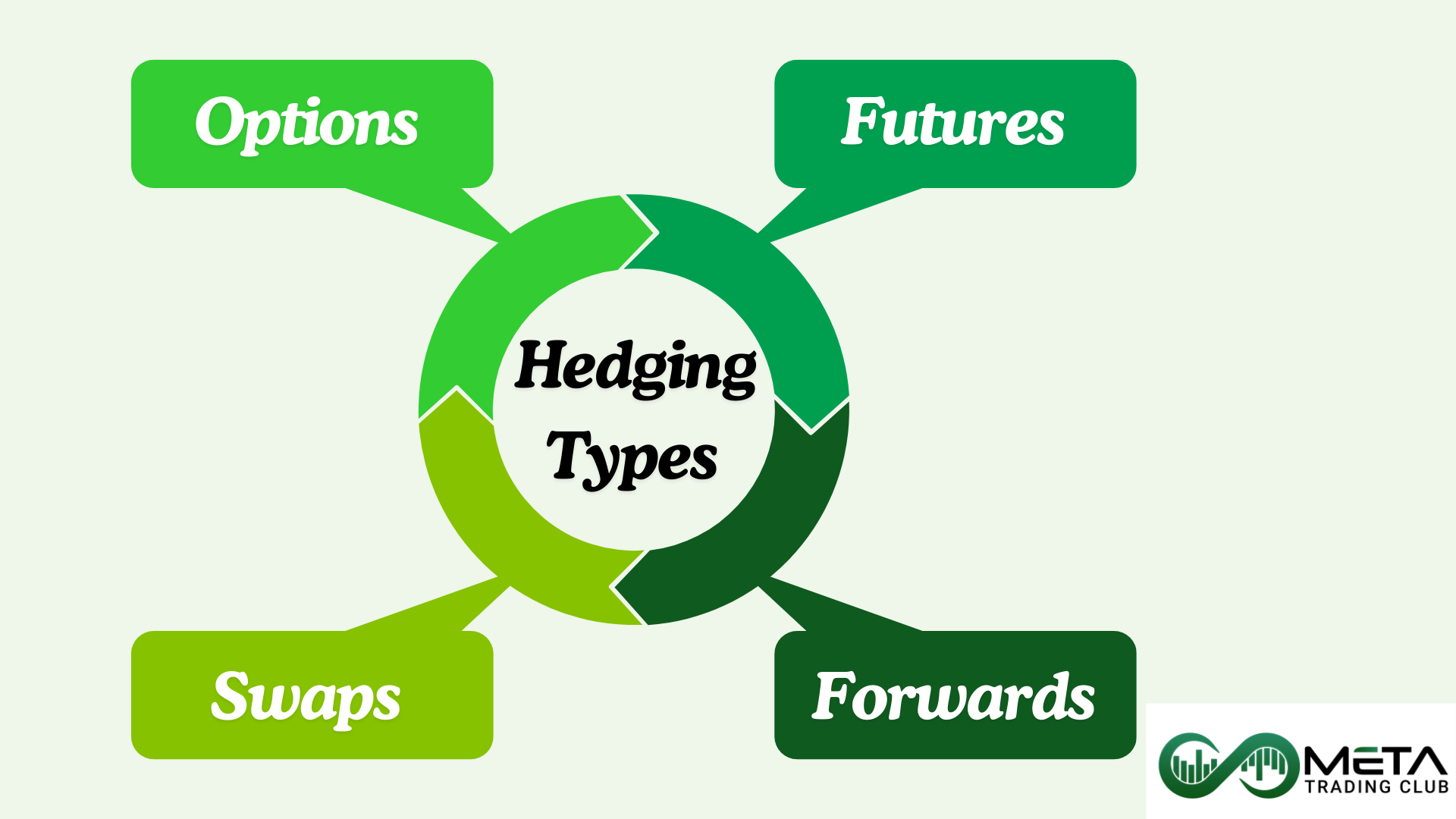

There are several types of hedging strategies that traders can use to manage risk and protect their portfolios. Here are some of the most common types:

Options

Options are contracts that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified date. There are two main types of options:

- Put Options: These allow the holder to sell an asset at a specified price, providing protection against a decline in the asset’s price.

- Call Options: These allow the holder to buy an asset at a specified price, which can be used to hedge against a potential increase in the asset’s price.

Futures

Futures are standardized contracts to buy or sell an asset at a predetermined price at a specified time in the future. They are commonly used to hedge against price fluctuations in commodities, currencies, and indices.

Forwards

Forwards are similar to futures but are customized contracts between two parties to buy or sell an asset at a specified price on a future date. They are often used in currency and interest rate hedging.

Swaps

Swaps are contracts in which two parties exchange cash flows or other financial instruments. Common types include:

- Interest Rate Swaps: These involve exchanging fixed interest rate payments for floating rate payments to hedge against interest rate fluctuations.

- Currency Swaps: These involve exchanging cash flows in different currencies to hedge against currency risk.

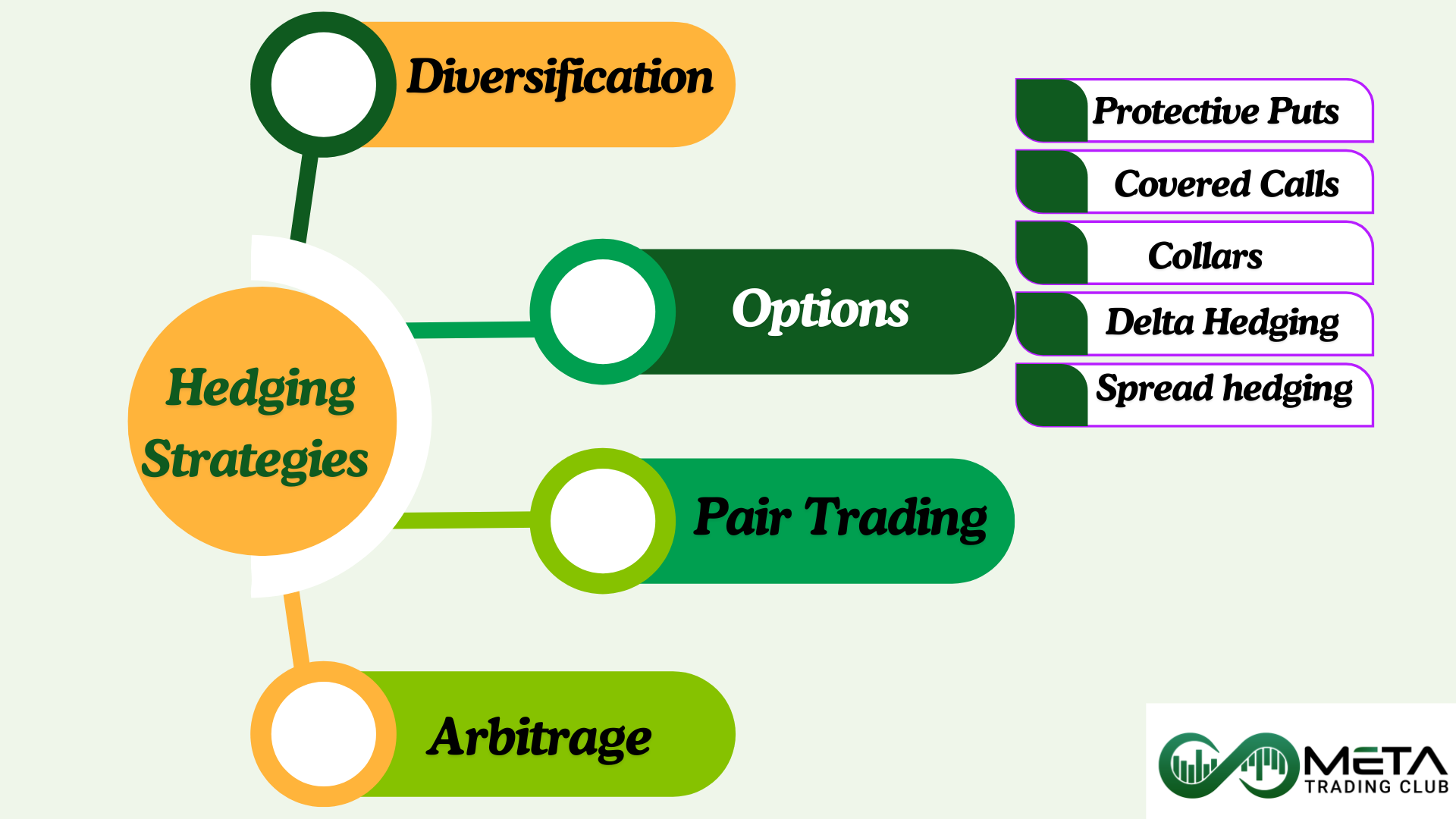

What are Hedging Strategies?

some advanced hedging techniques that experienced traders and investors use to manage risk:

1- Option

Option hedging strategies are techniques that use options to manage and mitigate risk in an investment portfolio. Here are some of the most common option hedging strategies:

Protective Puts

A protective put involves buying a put option for a stock that you already own. This strategy provides downside protection because if the stock price falls, the put option increases in value, offsetting the loss on the stock. It’s like buying insurance for your stock holdings.

For example, you own 100 shares of Apple (AAPL), currently priced at $220 per share. Also, you want to protect against potential losses if the stock price declines.

So, buy a put option (each contract consists of 100 shares) with a strike price below the current stock price (like $210). Assume you pay $3 for the put option premium.

In this case, your maximum risk is $1,300 ((220 – 210 + 3) * 100)

If stock price drops to $190 per share your loss will be $1,300 instead of $3,000.

The protective put provides downside protection until the option’s expiration date. If the stock price falls, the put option acts as insurance, limiting your losses. However, beyond the expiration date, the protection ceases

Covered Calls

In a covered call strategy, you sell call options on a stock that you own. The premium received from selling the call options provides some income that can offset potential losses if the stock price falls. However, if the stock price rises above the strike price, you may have to sell your shares at the strike price, potentially capping your gains.

For example, you own 100 shares of Abbot (ABT), currently trading at $100 per share. Also, you believe the stock market won’t experience significant volatility in the near future and predict the share price of ABT will grow to $105 in the next six months.

So, to lock in profits and protect against downside risk, you sell 1 call option contract with a strike price of $105 (each contract consists of 100 shares).

Also, the premium on this call option is $3 per share in the contract.

- Stock price remains at $100: The call option won’t be exercised. You earn $3 per share from the call premium.

- Stock price increases to $110: The call option is exercised. You receive $105 per share (strike price) plus the $3 per share from the call premium.

- Stock price decreases to $90: You earn the $3 per share from the call premium.

In this covered call, you’ve sacrificed a small portion of potential profit in return for risk protection.

Collars

A collar strategy involves holding the underlying stock while simultaneously buying a protective put and selling a covered call. This strategy limits both the downside risk and the upside potential. The premium received from selling the call option can help offset the cost of buying the put option.

For example, a trader owns 100 shares of Meta (META), which currently trades at $500 per share. The trader is concerned about limits to near-term upside and wants to protect against a significant share price decline.

- Buy Protective Put: The trader purchases an out-of-the-money (OTM) put option on Meta stock. This put acts as a hedge, potentially limiting the downside losses if the stock price falls.

- Sell Covered Call: Simultaneously, the trader sells an OTM call option on the same Meta stock. The premium received from selling the call helps finance the long put.

The collar strategy aims to balance risk and reward. The long put protects against downside risk and the short call caps the potential profit of the long stock.

Delta Hedging

Delta hedging involves creating a position where the overall delta (sensitivity to price changes in the underlying asset) is neutral. This can be achieved by combining options and the underlying asset in such a way that the portfolio’s value remains relatively stable regardless of small price movements in the underlying asset.

Suppose a trader owns 10 call options (each contract consists of 100 shares) on Microsoft (MSFT), where each option has a delta of 0.25. This means that the trader effectively has exposure to 250 shares of MSFT (10 options * 0.25 delta * 100 shares per option).

To delta hedge this option position with shares, the trader would sell 250 MSFT stock to offset the 250 “deltas” from the call options. This way, the trader aims to achieve a delta-neutral position, reducing directional risk associated with price movements in MSFT.

Remember, delta hedging requires constant monitoring and adjustments to maintain the desired hedge ratio.

Spread Hedging

Spread hedging is a risk management strategy used primarily by options traders to limit potential losses while maintaining some upside potential. This strategy involves taking offsetting positions in two or more options with different strike prices or expiration dates. Spread hedging is designed to limit risk by combining multiple options positions. Spread hedging can reduce the cost of hedging and limit potential losses. It also allows for more precise risk management.

For example, you are bullish on a stock currently trading at $50 and expect it to rise, but you want to limit your risk. You could use a bull call spread:

- Buy a Call Option: Purchase a call option with a strike price of $50, expiring in one month, for a premium of $3.

- Sell a Call Option: Sell a call option with a strike price of $55, expiring in one month, for a premium of $1.

Net Cost: The net cost of this spread is $2 ($3 paid for the bought call minus $1 received for the sold call).

2- Pair Trading

pairs trading, is a market-neutral trading strategy that involves taking two offsetting positions in two highly correlated assets.

For hedge pair trading, the first step is to identify two assets (such as stocks) that have a high historical correlation. This means that their prices tend to move together over time.

Also, in pairs trading, you take a long position in one asset (buying it) and a short position in the other (selling it). The idea is to profit from the relative performance of the two assets rather than their absolute price movements.

Because you are both buying and selling, the strategy is market neutral. This means it is designed to profit regardless of whether the overall market is going up or down.

For example, you identify two stocks, Stock A and Stock B, that historically move together. Currently, Stock A is underperforming relative to Stock B. You believe that Stock A will catch up to Stock B, or that Stock B will decline to match Stock A. So, you do:

- Long Position: You buy Stock A, expecting its price to rise.

- Short Position: You sell Stock B, expecting its price to fall or rise less than Stock A.

If Stock A’s price increases and Stock B’s price decreases (or increases less than Stock A), you make a profit from both positions. The key is the relative movement between the two stocks

Hedge pair trading can be a powerful strategy for managing risk and seeking profits in various market conditions, but it requires a good understanding of statistical and technical analysis. However, if the historical correlation between the two assets breaks down, the strategy may not work as expected. Requires careful analysis and monitoring.

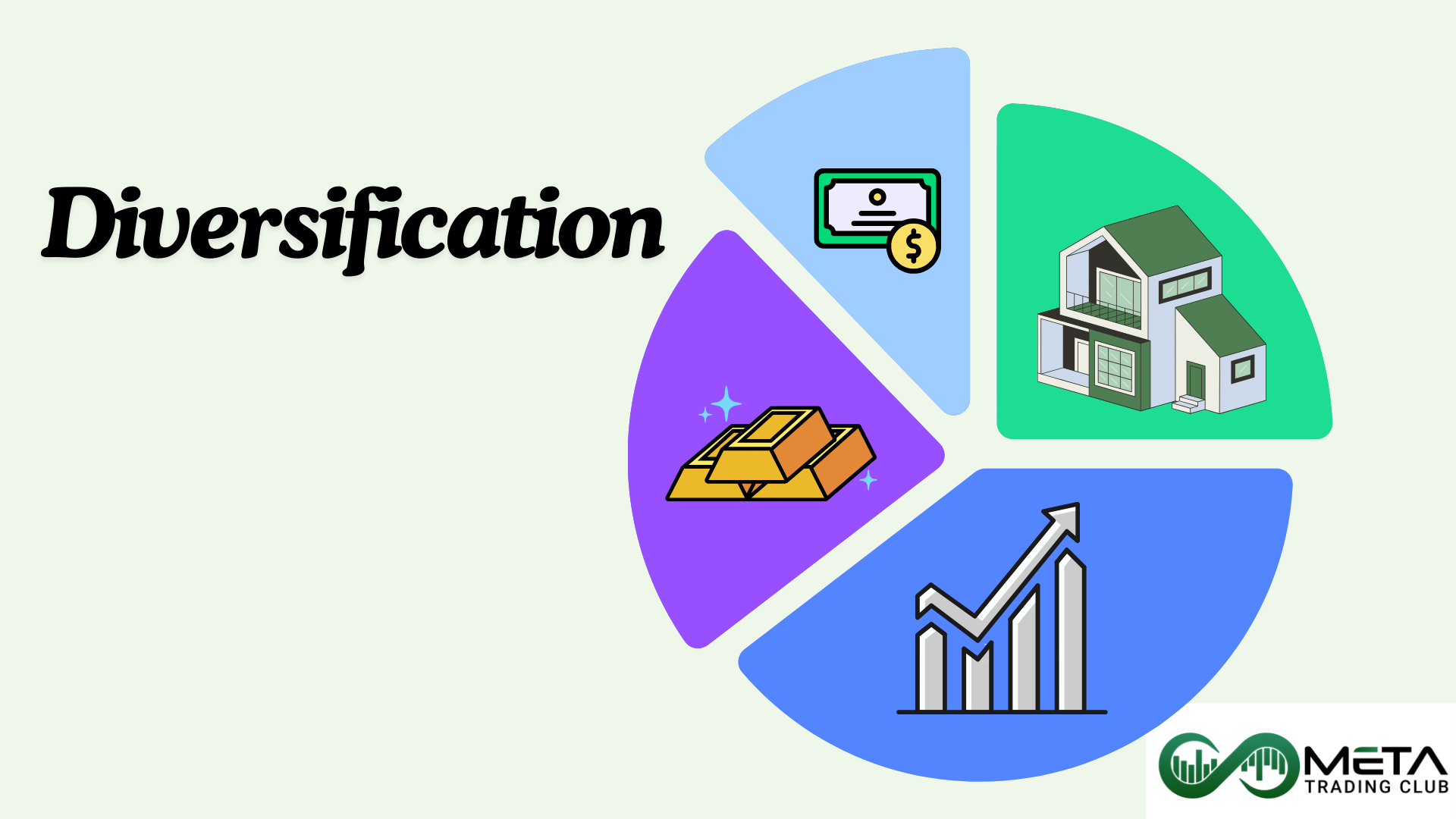

3- Diversification

A diversification strategy involves spreading investments across a variety of asset classes, industries, and geographic regions to reduce overall risk exposure. This approach is based on the principle that different assets often react differently to the same economic event, so by diversifying, you can mitigate the impact of adverse movements in any single asset or market. Each asset class has its own risk and return characteristics, and they often do not move in tandem. For example, when stock prices fall, bond prices might rise, providing a hedge against losses.

Diversification helps to spread risk across multiple investments, reducing the impact of poor performance in any single asset. Also, by holding a diversified portfolio, you are more likely to achieve more stable and consistent returns over time.

A well-diversified portfolio might include:

- Stocks: A mix of large-cap, mid-cap, and small-cap stocks from various industries.

- Bonds: Government bonds, corporate bonds, and municipal bonds.

- Commodities: Investments in gold, oil, and agricultural products.

- Real Estate: Real estate investment trusts (REITs) or direct property investments.

4- Arbitrage

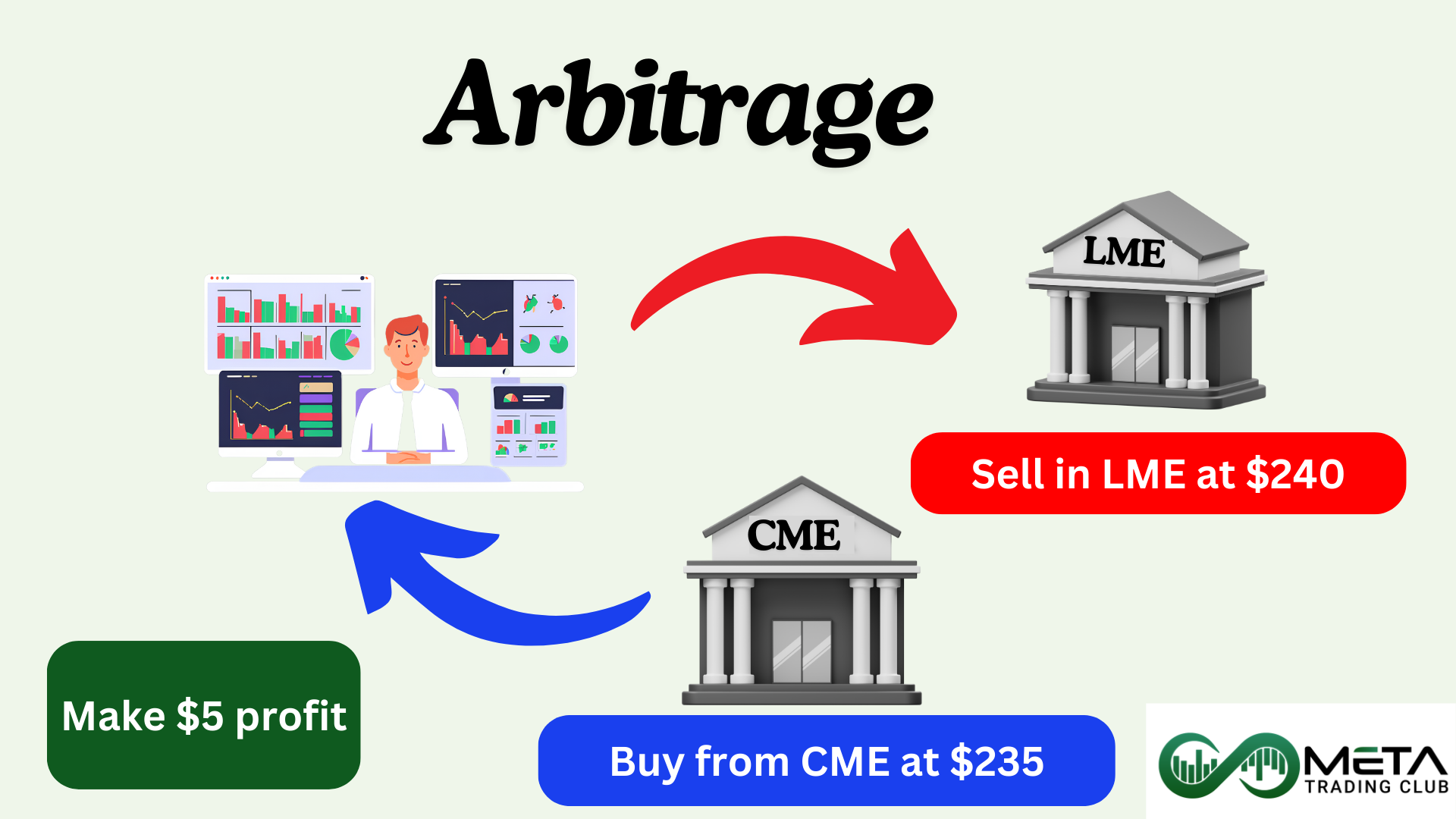

Arbitrage is a hedge trading strategy that combines elements of both hedging and arbitrage to manage risk and exploit price discrepancies in different markets. The strategy begins by identifying price differences for the same or similar assets in different markets. Traders simultaneously buy and sell the asset in different markets to take advantage of the price difference.

For example, imagine a trader notices that coffee is trading at $235 per contract on the Chicago Mercantile Exchange (CME) and $240 on the London Stock Exchange (LSE).

Then the arbitrage trader:

- Buys Coffee on CME at $235.

- Sells Coffee on LSE at $240.

This creates an immediate profit of $5 per contract, minus any transaction costs.

Hedging arbitrage is a sophisticated strategy that can be highly effective for managing risk and capitalizing on market inefficiencies. However, it requires careful planning and execution to be successful.

What are Common Mistakes in Hedging?

When it comes to hedging, avoiding mistakes is crucial. Here are some common pitfalls to steer clear of:

- Over-Hedging: Hedging too much can limit potential gains. Remember, the goal is risk management, not eliminating all risk. Striking the right balance between hedged and unhedged positions is essential.

- Ignoring Costs: Hedging often involves costs (like option premiums, transaction fees). Don’t overlook these expenses, they impact your overall returns.

- Inadequate Understanding: Some traders use complex derivatives without fully grasping their mechanics. Educate yourself thoroughly before implementing any hedging strategy. Want to boost your trading skills and knowledge, participate in our 4-weeks incubator program.

- Timing Mistakes: Hedging at the wrong time can backfire. For example, buying a protective put after a significant market drop might be too late.

- Not Reassessing: Markets change, and so should your hedges. So, regularly review your positions and adjust as needed.

- Correlation Assumptions: Assuming that two assets will always move in opposite directions can lead to ineffective hedges. Also, correlations can shift, so stay vigilant.

- Emotional Reactions: Don’t make impulsive hedging decisions based on fear or panic. Stick to your strategy and avoid knee-jerk reactions.

Remember, hedging is about managing risk, not perfection. Avoiding these mistakes will help you navigate the complexities effectively!

What are Hedging Benefits?

Hedging offers several key benefits for traders and companies looking to manage risk and protect their portfolios. Here are some of the main advantages:

- Risk Mitigation: The primary benefit of hedging is the ability to manage and reduce risk. By taking offsetting positions in related assets, traders can protect themselves from adverse price movements and market volatility.

- Limiting Losses: Hedging allows traders to limit their potential losses to an amount they are comfortable with. For example, using put options can cap the maximum loss on a stock investment.

- Price Clarity: For companies and individuals, such as farmers, hedging can provide price clarity and stability. By locking in prices for commodities or raw materials, they can eliminate the uncertainty of future price fluctuations.

- Financial Stability: Hedging helps maintain financial stability by protecting against significant losses. This is particularly important for businesses that rely on stable cash flows and financial health.

- Peace of Mind: Knowing that potential risks are managed can provide peace of mind to traders and business owners. This allows them to focus on their core activities without constantly worrying about market volatility.

- Enhanced Decision Making: With a hedging strategy in place, traders and companies can make more informed decisions. They can plan for the future with greater confidence, knowing that they have measures in place to protect against adverse market movements.

What are Hedging Risks?

While hedging can be an effective strategy for managing risk, it also comes with its own set of risks and drawbacks. Here are the main risks associated with hedging:

- Cost: Hedging is not free. The cost of hedge instruments, like options premiums can be significant. These costs can reduce overall returns, especially if the hedging strategy is not executed effectively.

- Complexity: Hedging strategies can be complex and require good knowledge. This complexity can lead to mistakes or miscalculations, which can negate the benefits.

- Reduced Gains: While hedging can protect against losses, it also typically reduces potential gains. For example, if you hedge a stock with put options, you may limit your losses, but you also incur the cost of the options, which reduces your overall profit.

- Basis Risk: This occurs when the hedge does not perfectly offset the risk of the underlying asset. This can occur if the hedging instrument and the underlying asset do not move in perfect correlation. So, the hedge may not protect against losses.

- Liquidity Risk: Some hedging instruments, such as certain derivatives, may have limited liquidity. This can make it difficult to enter or exit positions quickly, potentially leading to higher costs.

- Counterparty Risk: When using over the counter (OTC) derivatives, there is a risk that the counterparty may default on their obligations. This counterparty risk can lead to significant losses if the other party defaults.

- Over-Hedging: This occurs when a trader hedges more than the actual risk exposure, leading to unnecessary costs and reduced returns. It is important to carefully calculate the appropriate hedge ratio to avoid this issue.

- Regulatory Risks: Hedging activities are subject to regulatory oversight, and changes in regulations can impact the effectiveness and cost of hedging strategies. Compliance with these regulations can also add to the complexity and cost of hedging.

Final Word

Hedge offers a way to safeguard your investments against uncertainties and market volatility. Also, hedging is an essential tool for investors looking to manage risk and protect their portfolios from adverse market movements. By understanding and implementing various hedging such as options, futures, forwards, swaps, and diversification, investors can achieve greater stability and peace of mind in their investment journey. While hedging can reduce potential losses, it’s important to remember that it also comes with costs and complexities. Therefore, a well-thought-out approach, continuous monitoring, and adjustments are crucial for effective hedging.

Note that the key to successful hedging lies in understanding your risk tolerance, choosing the right instruments, and continuously adapting to changing market dynamics.

FAQs

Hedging is like buying insurance for your investments. It involves making a trade to protect against potential losses from another investment.

A hedge in trading is a strategy used to reduce or eliminate the risk of adverse price movements in an asset. It typically involves taking an offsetting position in a related security, such as using options or futures contracts.

Hedging works by taking an opposite position in a related asset to offset potential losses. For example, if you own stocks, you might buy put options to protect against a drop in stock prices.

Hedging in forex involves opening additional positions to offset potential losses from adverse currency movements. You might take an opposite position in the same currency pair or use forex options to manage risk.

An example of hedging is an airline buying oil futures contracts to lock in fuel prices. This protects the airline from rising fuel costs, ensuring stable expenses even if oil prices increase.

For example, you can use a protective put option contract which is buying a put option for a stock that you already own. This strategy provides downside protection because if the stock price falls, the put option increases in value, offsetting the loss on the stock. It’s like buying insurance for your stock holdings.