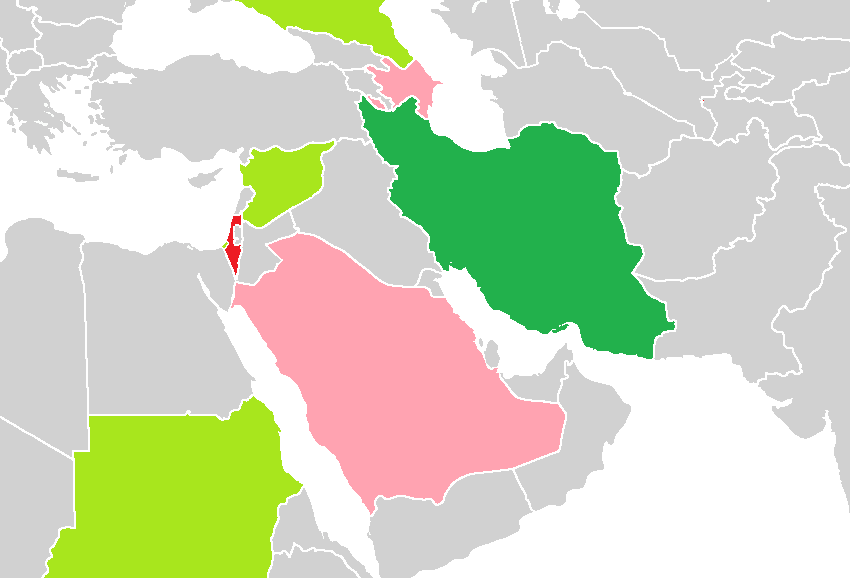

Israel has been targeted by Iran’s recent drone strike, escalating geopolitical tensions in the region and causing concerns and uncertainty across global financial markets. Military positions of Israel were the aim of the attack, heightening fears of potential retaliation and further military escalation, thus exacerbating volatility in asset prices and investor sentiment. The evolving situation is closely monitored by market participants, who prioritize assessing the impact of such geopolitical developments on various sectors for informed decision-making and risk management strategies.

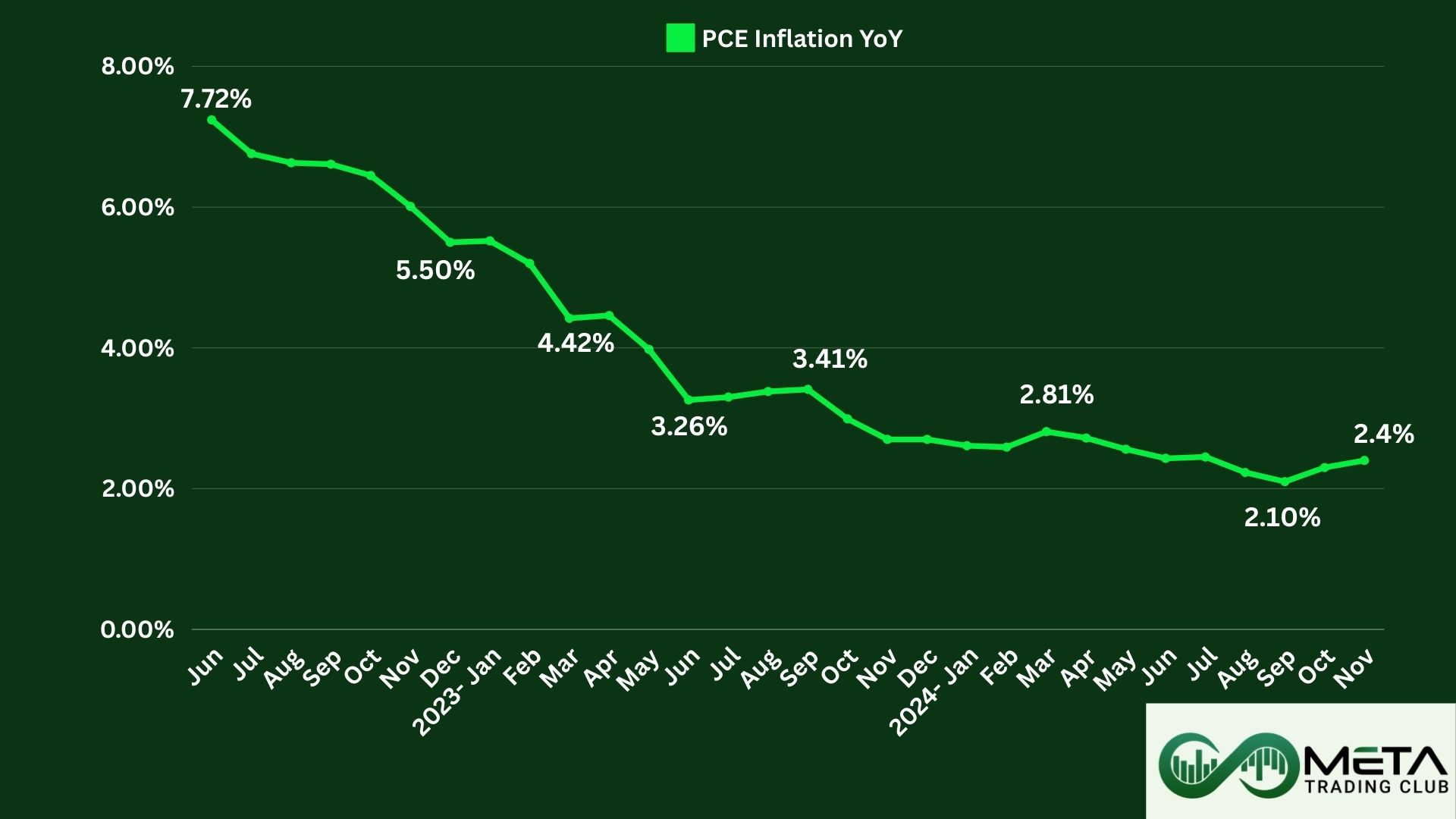

In the forex market, a distinct behavior is typically exhibited after each geopolitical tension (considering the magnitude of the tension). Safe-haven currencies witness increased demand, while commodity currencies are often supplied. Notably, the geographical location of the tension holds significant importance. Given Iran’s crucial role in the energy market as a crude oil supplier, high volatility is anticipated in oil and energy markets this week.

Conversely, riskier markets such as the cryptocurrency and stock markets may see continued downward movements. Increased demand is expected for safe-haven currencies such as the US Dollar, Japanese Yen, and Swiss Franc, with the Swiss Franc showing strengthening trends towards the end of Friday. Conversely, currencies like the Australian Dollar and New Zealand Dollar, which have performed reasonably well in recent weeks, may face selling pressure due to market risks. Gold, alongside US Treasuries, as one of the safest assets globally, is anticipated to maintain its positive momentum this week, reflecting increasing tensions.

Furthermore, important ranges have been identified in each of the major charts for reference.

Gold

In the gold chart, from February to the end of last week, a strong upward wave was depicted, leading to its reaching its all-time highest price. Zigzag ranges in this chart are considered suitable ranges for examining the possibility of a correction in the price of gold. Therefore, by breaking the resistance level of $2420, a rise in the price to $2550 can be expected.

WTI

The global oil price chart is the second chart under consideration. Since Iran is involved in one side of these geopolitical tensions, the price of oil will be significantly affected this week. Iran’s status as one of the world’s major oil suppliers increases the likelihood of an increase in the price of West Texas Intermediate (WTI) oil. Given the positive trend in oil prices, the $91 range for this energy source is crucial.

BTC

With the Bitcoin halving approaching and the reduction in miners’ rewards, it seems that the cryptocurrency market, as one of the primary risk markets, will be influenced. By analyzing the lower volume than the $61,000 support range, there is no other significant range, and if this support range breaks, the $52,000 support range for Bitcoin becomes very crucial.

S&P500

The S&P 500 index is considered one of the safest assets globally. Given the emerging risks, it may undergo a corrective wave. Investors tend to preserve their capital in assets like gold and silver during times when the probability of war increases. By examining cash flows, it can be said that corrections in the index may present the best opportunity for long-term investment. However, for swing trading, the current sentiment in the stock market and indices is negative.

Important and key supports for the S&P 500 index are at $4960 and subsequently at $4760.

EURUSD

Lastly, the pair of currencies, Euro against the Dollar, is observed. The strengthening trend of the dollar under the influence of monetary policy factors and the FOMC meeting minutes in the past week continued. On the other hand, the statements of Federal Reserve officials in recent weeks have also persisted. It should be noted that amidst the effort to strengthen the dollar, political tensions serve as a stronger driver. The dollar is another safe-haven asset in the forex market. After the release of PMI and Core CPI data, it seems that the headwinds of easing policies continue to bother the Euro. Therefore, the sentiment for the Euro is assessed as negative in the next two weeks, while the sentiment for the dollar remains positive. The important support range for the Euro to Dollar pair is the parity rate range of 1.0356.

Conclusion

For this week, significant fluctuations in the markets are predicted. The flow of funds is continuously monitored, and if sentiment changes, new content will be prepared accordingly. However, for conclusions, positive and upward sentiment is anticipated for gold, oil, and the dollar index, while a more downward trend is expected for Bitcoin, the Euro, and the S&P 500. Of course, the entry strategy for these asset classes may vary. A day of peace and tranquility for the world is wished for.

Meta Trading Club is a leading educational platform dedicated to teaching individuals how to trade and invest independently. Through comprehensive educational programs, personalized mentorship, and a supportive community, Meta Trading Club empowers traders to navigate financial markets with confidence and expertise.