Gross Domestic Product (GDP) quantifies total value of all goods and services produced within a nation’s borders. Therefore, it serves as a measure of economic activity. GDP can be computed using three approaches: production, income, and expenditure. Importantly, real GDP adjusts for inflation, providing a true growth picture. Governments, businesses, and economists utilize GDP to understand trends. Hence, it aids in making informed decisions.

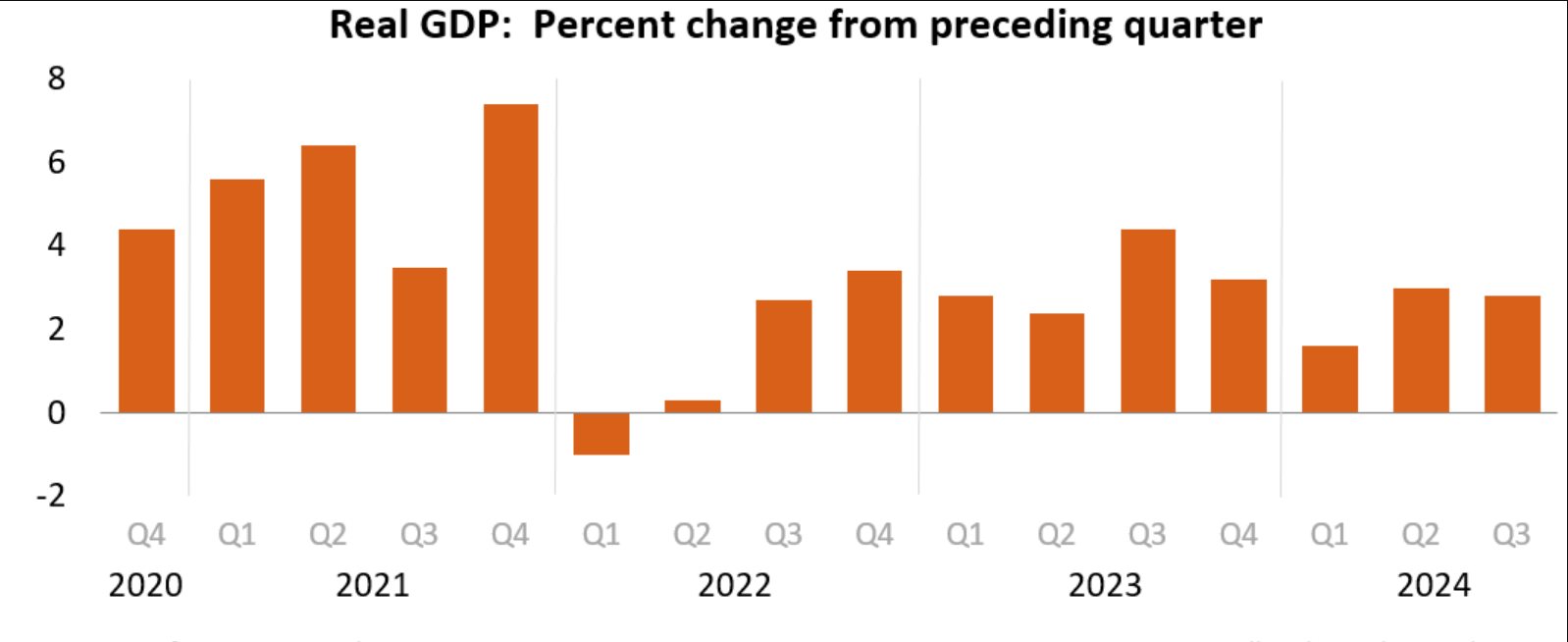

Gross Domestic Product, Third Quarter 2024

In the third quarter of 2024, the U.S. economy continued its expansion, with real gross domestic product (GDP) increasing at an annualized rate of 2.8%, following a 3.0% increase in the second quarter. This advance estimate, provided by the U.S. Bureau of Economic Analysis, reflects preliminary data and is subject to revision.

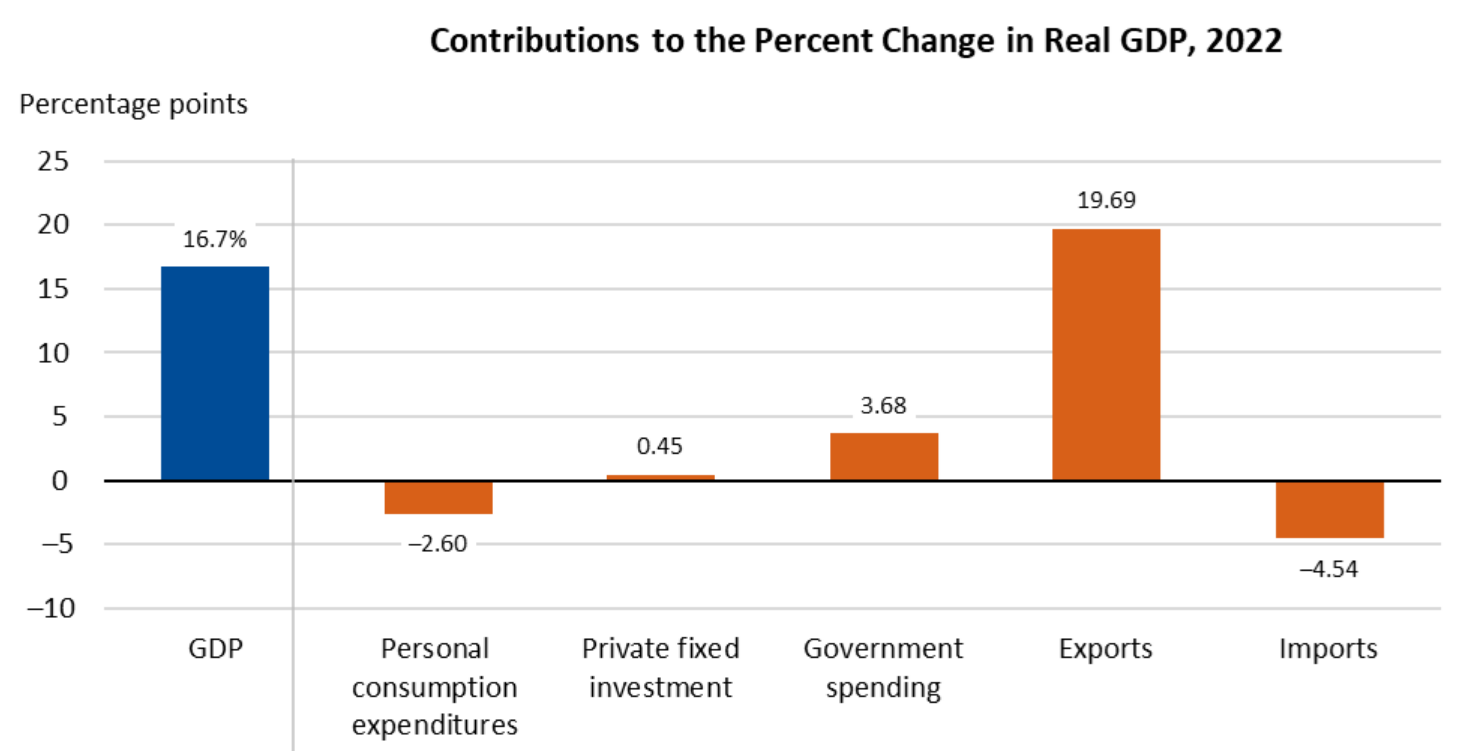

Key Contributors to Q3 GDP Growth:

- Consumer Spending: Spending experienced an upswing, fueled by growth in both goods and services. Key drivers within the goods sector included other nondurable goods, with prescription drugs leading the way, and motor vehicles and parts. On the services side, significant contributions came from health care, particularly outpatient services, as well as food services and accommodations.

- Exports: Growth in exports was primarily due to an increase in goods, with capital goods (excluding automotive) playing a major role.

- Federal Government Spending: Federal spending increased, led by a notable rise in defense expenditures.

- Imports: Imports, a subtraction in GDP calculations, increased due to higher goods imports, particularly capital goods (excluding automotive).

Factors Influencing the Deceleration in GDP

Compared to the previous quarter, the deceleration in GDP growth was primarily attributed to:

- A downturn in private inventory investment.

- A larger decrease in residential fixed investment. These were partially offset by:

- Accelerations in exports, consumer spending, and federal government spending.

- A faster pace of growth in imports.

Current-Dollar GDP and Inflation Indicators

Nominal GDP: Increased by 4.7% at an annualized rate in the third quarter, adding $333.2 billion to reach a level of $29.35 trillion. This growth was slower than the 5.6% rise in the second quarter.

Price Index for Gross Domestic Purchases: Increased by 1.8%, down from 2.4% in the second quarter.

Personal Consumption Expenditures (PCE) Price Index: Overall PCE prices increased by 1.5%, compared to 2.5% in the second quarter. Also, the core PCE prices (excluding food and energy) rose by 2.2%, down from a 2.8% increase.

Personal Income and Saving

Personal Income: Current-dollar personal income rose by $221.3 billion, slower than the $315.7 billion increase in the second quarter. The growth was primarily driven by increases in compensation.

Disposable Personal Income (DPI): Current-dollar DPI increased by $166.0 billion, or 3.1%, down from a 5.0% rise in the previous quarter. Real DPI (adjusted for inflation) rose by 1.6%, compared with 2.4% growth in the second quarter.

Personal Saving: Personal savings totaled $1.04 trillion, down from $1.13 trillion in the second quarter. The personal saving rate decreased to 4.8% from 5.2%.

The U.S. economy maintained positive momentum in the third quarter of 2024, with consumer spending, federal expenditures, and export growth underpinning GDP expansion. However, a deceleration in private inventory investment and residential fixed investment moderated growth compared to the prior quarter. Inflation indicators and personal income measures reflected a cooling trend, aligning with a more sustainable economic trajectory. The upcoming second estimate will provide further clarity on the third quarter’s economic performance.