Last week’s market and economic data key points:

- Federal Reserve may deliver a 50-bps rate cut in September

- US mortgage rate drops to 6-Month low

- US unemployment rate rose to 4.3%

- Warren Buffet sold about 50% of its stake in Apple

- Amazon stock drops after earnings report

- Intel’s worst stock drop in decades & sheds $34B in market cap

- Apple beats earnings estimates

- $10 billion increase in AI spending by Meta

- Microsoft drops and raise concerns over AI spend

- AMD profit surges on growing AI demand

- Dow Jones wipes out, optimism turns to pessimism

- Nasdaq enters correction as recession fears rises

- Japanese yen extends and hits 4 month high

- The Bank of England cut rate for the first time in over 4-years

- Ethereum price crashes below $3,000

Last Week’s Reports

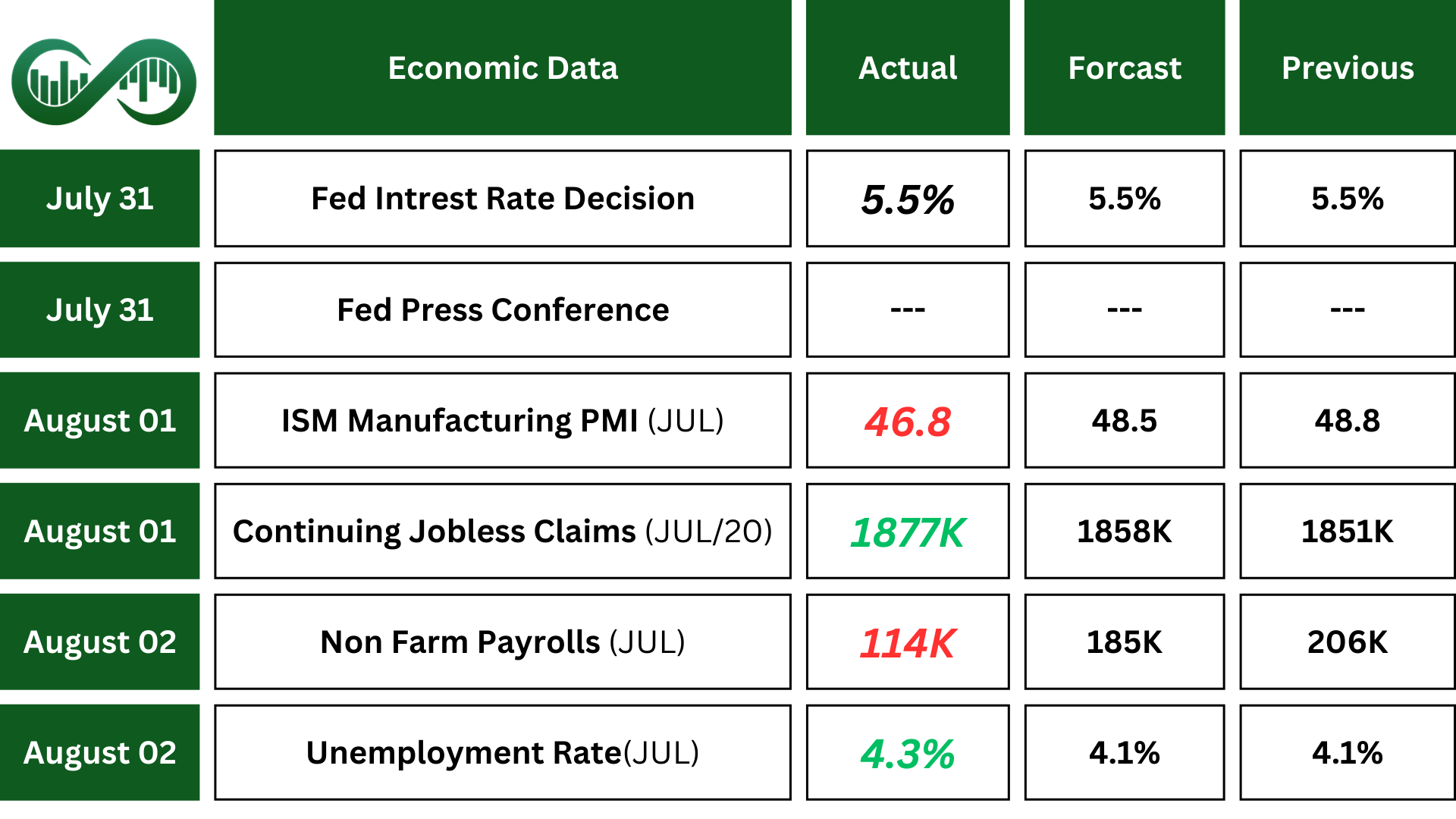

Economic Reports

FOMC: The Federal Reserve maintained the federal funds rate at a 23-year high of 5.25%-5.50% for the 8th consecutive meeting in July 2024, in line with expectations. Policymakers noted that there has been some further progress toward the 2% inflation goal although it remains somewhat elevated. Also, recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. There is no clue of a rate cut in the FOMC statement.

Fed press conference: Chair Powell said, “We’re getting closer to the point at which it’ll be appropriate to reduce our policy rate, but we’re not quite at that point.”

Powell’s comments were more dovish than the changes in the FOMC statement. He said upside risks to inflation have come down as the labor market has cooled off. While recent anecdotal data have been mixed, he continues to expect a soft landing for the economy. The report gives the Federal Reserve the green light to start cutting rates in September.

The ISM Manufacturing PMI fell to 46.6 in July, firmly below market expectations (reflects the sharpest contraction in US factory activity). It showed the impact of high interest rates on goods demand, pressured by a fresh contraction in the level of new orders.

Non Farm Payrolls: The US economy added 114K jobs in July, well below forecasts. It is also the lowest level in three months, below the average monthly gain of 215K, signaling the labor market is in fact cooling off.

The Unemployment Rate in the United States rose to 4.3% in July from 4.1% in the previous month, the highest since October of 2021, and above market expectations that it would remain at 4.1%. This is also a signal of a cooling labor market which may lead to cutting rates.

Earning Reports

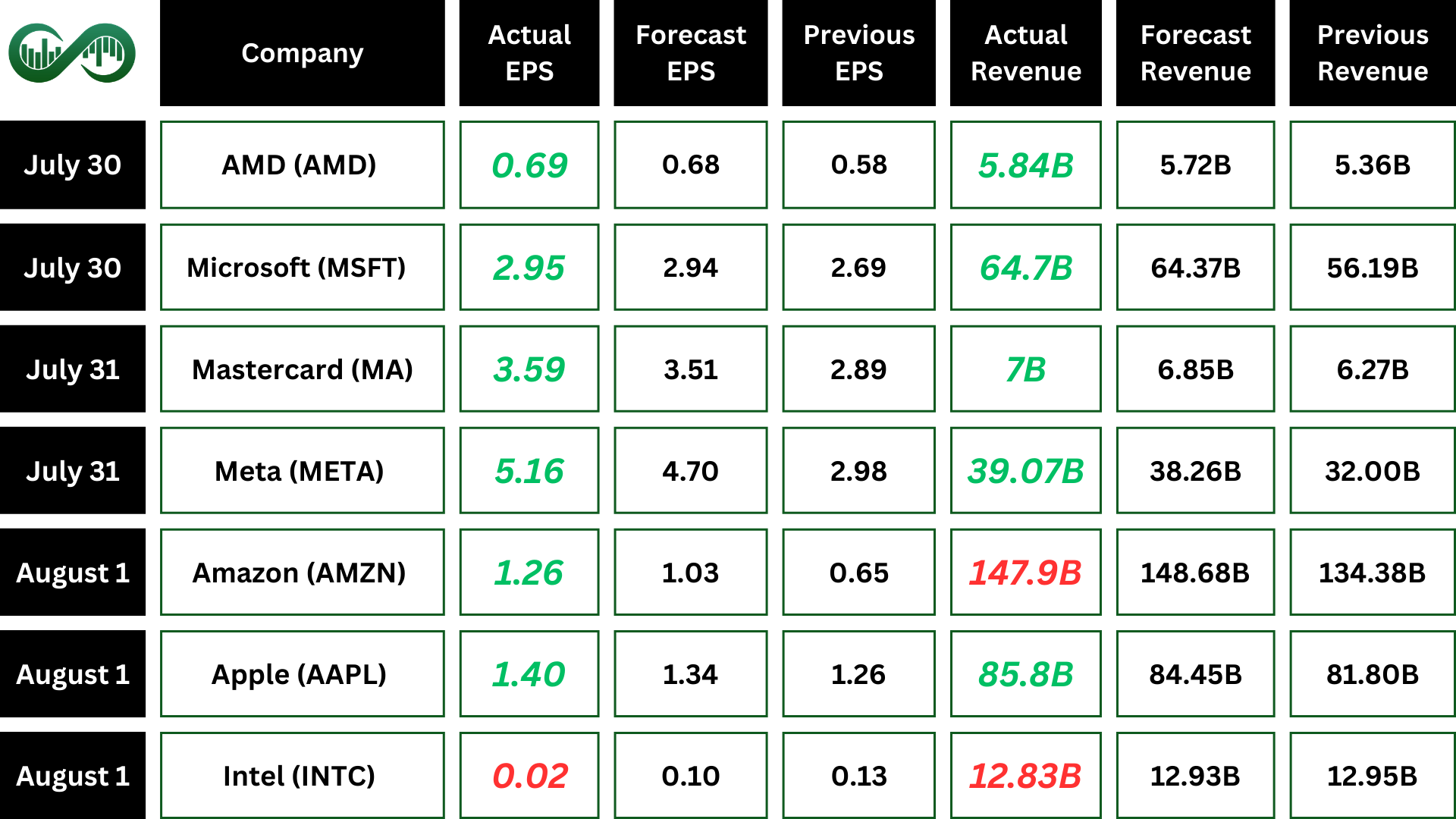

AMD

Semiconductor giant Advanced Micro Devices (AMD) reported higher profits in the second quarter as data center revenue grew and AI demand accelerated.

Revenue rose to $5.84 billion, beating expectations. AMD said the earnings growth was driven by record revenue from its data center business segment, which more than doubled to $2.8 billion.

The company also saw double-digit revenue growth in its client segment and double-digit contractions in its gaming and embedded segments. The company’s AI business continued to accelerate, there is an expectation of strong revenue growth in the second half of the year driven by demand for Instinct, EPYC and Ryzen processors as advances in AI drive demand.

The company predicted revenue between $6.4 billion and $7 billion for the third quarter.

AMD is below 100-MA , 200-MA and completing a correction. However, the price reached a static support zone at $132.

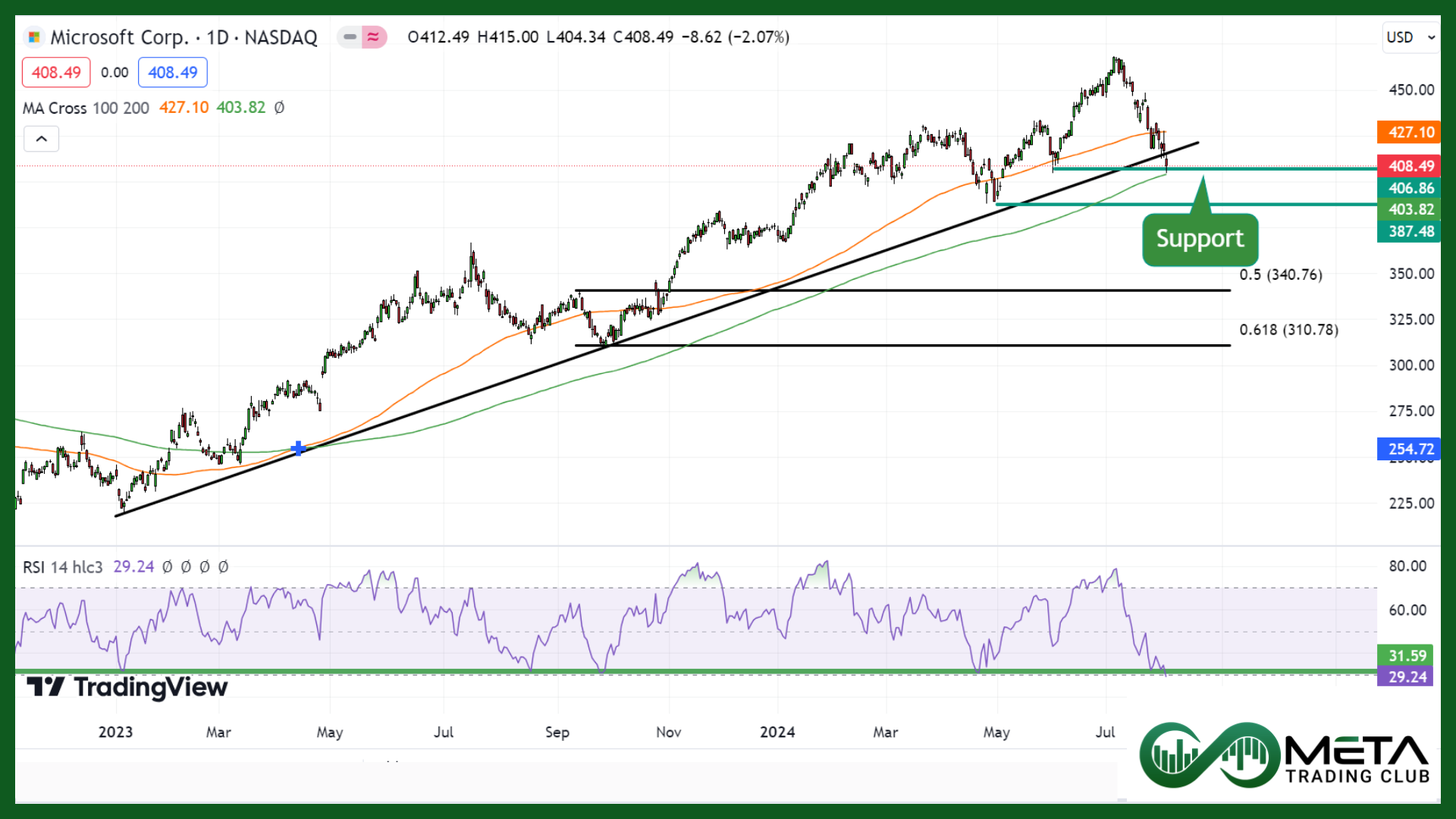

Microsoft

Microsoft (MSFT) reported revenue of $64.7 billion, up 15% YOY. The total revenue and earnings beating estimates.

The intelligent cloud segment’s sales jumped 19% annually to $28.52 billion, driven by a 29% surge in cloud-computing platform Azure and other cloud services.

The productivity and business processes division reported an 11% sales increase to $20.32 billion, buoyed by gains in Office 365 commercial and LinkedIn.

Revenue in the personal computing unit increased 14% to $15.9 billion due to gains in Windows and Xbox, weighed down by an 11% slide in devices revenue.

However, Microsoft’s shares were down 5% last week. The Azure growth missed expectations, sending Microsoft stock lower prices. In addition, MSFT’s capital spending rose 77.6% to $19B, nearly all on cloud and AI-related activities.

Microsoft is breaking a very strong trend-line which may lead to a correction. However, the price didn’t break its dynamic trend line (200-MA).

Meta

Meta Platforms (META) earnings and sales surpassed estimates, driven by stronger-than-expected advertising revenue for the Facebook parent.

Ad revenue increased to $38.33 billion from $31.5 billion. Both the average price per ad and aggregate ad impressions advanced 10% annually in the second quarter.

Facebook’s daily active users increased 7% YOY to 3.27 billion on average for June. Meta, which also owns Instagram and WhatsApp, expects third-quarter consolidated revenue of $38.5 billion to $41 billion.

Meta now expects its 2024 capital expenditures to have risen between $37 billion and $40 billion, lifting the bottom end of the prior outlook from $35 billion. The company expects significant capital expenditures growth in 2025 to support our artificial intelligence research and product development efforts.

If the RSI breaks the downward trend-line, then there is a good chance that the price could break strong resistance of $542.

Amazon

Amazon (AMZN) shares fell 8% after the retailer disclosed its latest quarterly earnings report. The company cut its revenue outlook and plans to spend more on AI.

Total revenue is below forecasts. However, revenue from Amazon’s cloud computing unit, Amazon Web Services, grew by about 19% to a higher-than-expected. Also, there is a consolidated operating income increased to $14.67B in the second quarter.

Sales came in at $148 billion, 10% higher than a year ago and in line with expectations. Also, profit for the quarter was $13.5 billion.

Apple

Apple (AAPL) reported earnings of $1.40 per share, which beat estimates and increased 11.1% YoY.

Net sales increased 4.9% to $85.78B and beat the estimates. However, iPhone sales decreased 0.9% from the year-ago quarter and accounted for 45.8% of total sales.

Overall, product sales (71.8% of sales) climbed 1.6%, Services revenues grew 14.1% to 28.2% of sales.

The company expects the September quarter’s revenues to grow at the same rate as of June quarter. Also, for the Services segment, Apple expects a double-digit growth rate.

Apple bulls will continue to hold their view that the iPhone is entering a super cycle later this year driven by GenAI and will act as an accelerant to Services growth.

Apple has broken its trend line and completed the pull-back to this line. Also, there are support lines at $206 and $214. If apple starts a correction, it could correct till it’s 50% Fibonacci retrace zone.

Intel

Intel (INTC) reported a loss in revenue and income. The loss was primarily attributable to higher operating expenses and lower income tax benefits accrued in the quarter.

Intel observed that weaker-than-anticipated demand trends were largely due to a challenging macroeconomic environment and export restrictions to China, which is one of its larger markets. The company expects customer inventory levels to remain elevated through the remainder of 2024.

Intel sheds about $34B in market cap in less than a day after it announced plans to lay off thousands of employees this year and pause dividend payments.

Specifically, the stock is trading below its five, 20 and 50-day exponential moving averages, signaling the risk of further bearish movement.

These indicators collectively suggest that Intel may continue to face downward momentum unless a reversal in market conditions occurs.

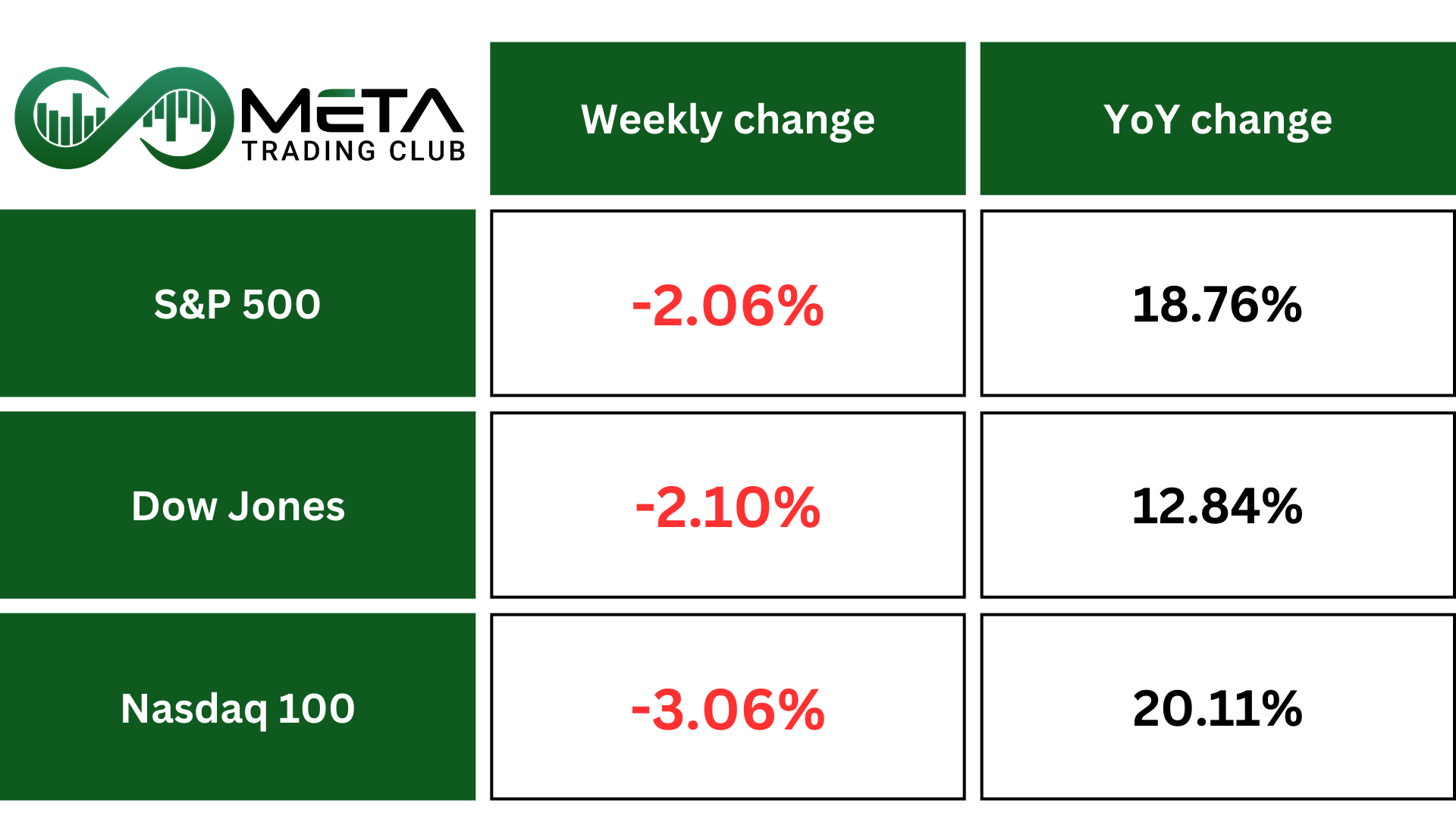

Indices

Indices’ Weekly Performance:

S&P 500 (SPX) extends losing streak to three weeks, slides 2% as recession fears reemerge. Also, the Nasdaq tumbled 3%, while the Dow Jones lost 2.1%. Lackluster jobs and manufacturing data released ahead of the opening bell flagged some worrying hiccups in the economy. The selloff was especially painful for tech giants.

Moreover, Cboe Volatility Index (VIX), Wall Street ‘fear gauge’, leaps on Fri to nearly 30, closing at its highest since Mar 2023.

Though 100-MA, just above 5,300, acting as support, breaking that dynamic and static support zone which highlighted in the chart, essentially contains SPX weakness.

Stocks

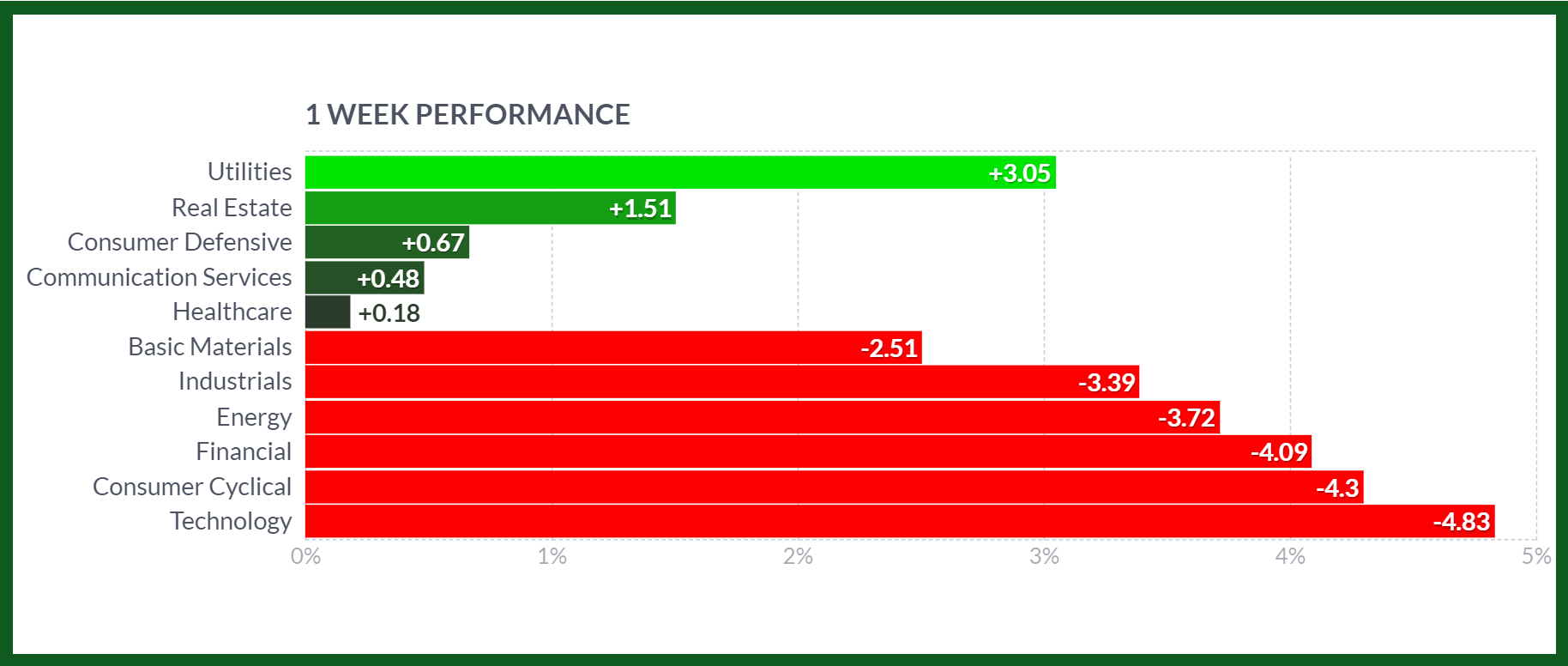

Stock Market Sector’s Weekly Performance:

Source: Finviz

- Tech sheds 4.8%. Intel plunges about 31% on the weak report (weakness spills over across chip stocks).

- Semiconductor index dives nearly 10%. Microsoft falls after cloud results raise questions over AI spend. However, there is a bright spot, Apple rises after earning beat.

- Energy sector retreated 3.7%. Chevron drops after profit miss, and Hess declines as proposed sale to CVX faces fresh delay. Also, Exxon Mobil reports profit beat, finishes week down fractionally.

- Financial sector faded 4%. Banks fall amid growth concerns after weak economic data (S&P 500 banks index trips 8%).

- Industrials crumble 2.8%. Boeing lifted after naming Kelly Ortberg new CEO to steer turnaround as cash burn rises. Still, BA descends 9% on the week.

- Communication Services gains 0.48%. Facebook advances on upbeat forecasts, although digital ad sales counter AI spending worries.

- Real Estate rallies 1.5%. Senior housing REIT Ventas climbs.

Stock Market Weekly Performance:

Source: Finviz

The big news Saturday morning in Berkshire’s financial report for the second quarter was a nearly 50% reduction in the size of its Apple stake to about 400 million shares (It was $277 billion on June 30).

Most of the rise in cash reflected the Apple stock sales. Cash now represents about 30% of Berkshire’s market value of more than $900 billion.

Warren Buffett is a sophisticated investor with a solid long term record in the stock market and he is reporting some massive sales that have continued into the third quarter.

Also, Berkshire has sold about $3.8 billion of Bank of America stock in July. Buffett’s actions make traders concerned about his outlook for the markets and economy. The trends at Berkshire offer Buffett insight into the economy.

Commodity

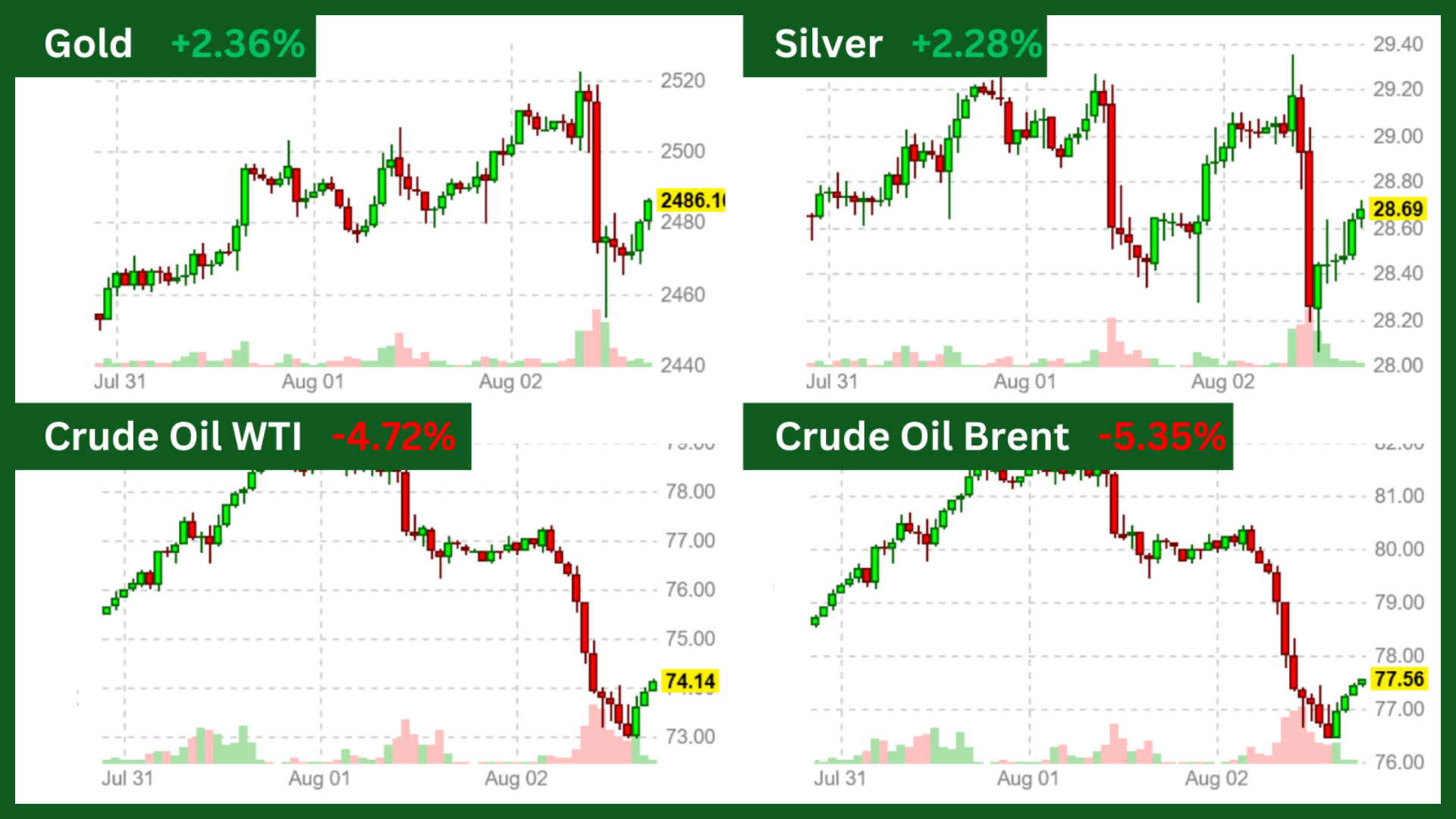

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Source: Finviz

Gold soared to over $2,474 per ounce on Friday, a new record high, after a weak jobs report in the United States added to the magnitude of the dovish pivot (interest rate cut) expected by the Federal Reserve.

Also, markets expected that the Federal Reserve may deliver a 50-bps rate cut to start its new cycle in September. In the meantime, tension in the Middle East continued to spur demand for safe-haven assets (like gold and silver).

Bonds

The yield on the US 10-year Treasury note hit a session low of 3.79%, or its lowest level since December 2023, after the sharp payroll miss added to concerns of a slowing economy.

The price of the 10-year bond is reached to the early 2024 support zone. Also, RSI indicates a high level of overbought. But the whole trend is bearish due to hopes of cutting rates in September.

Forex

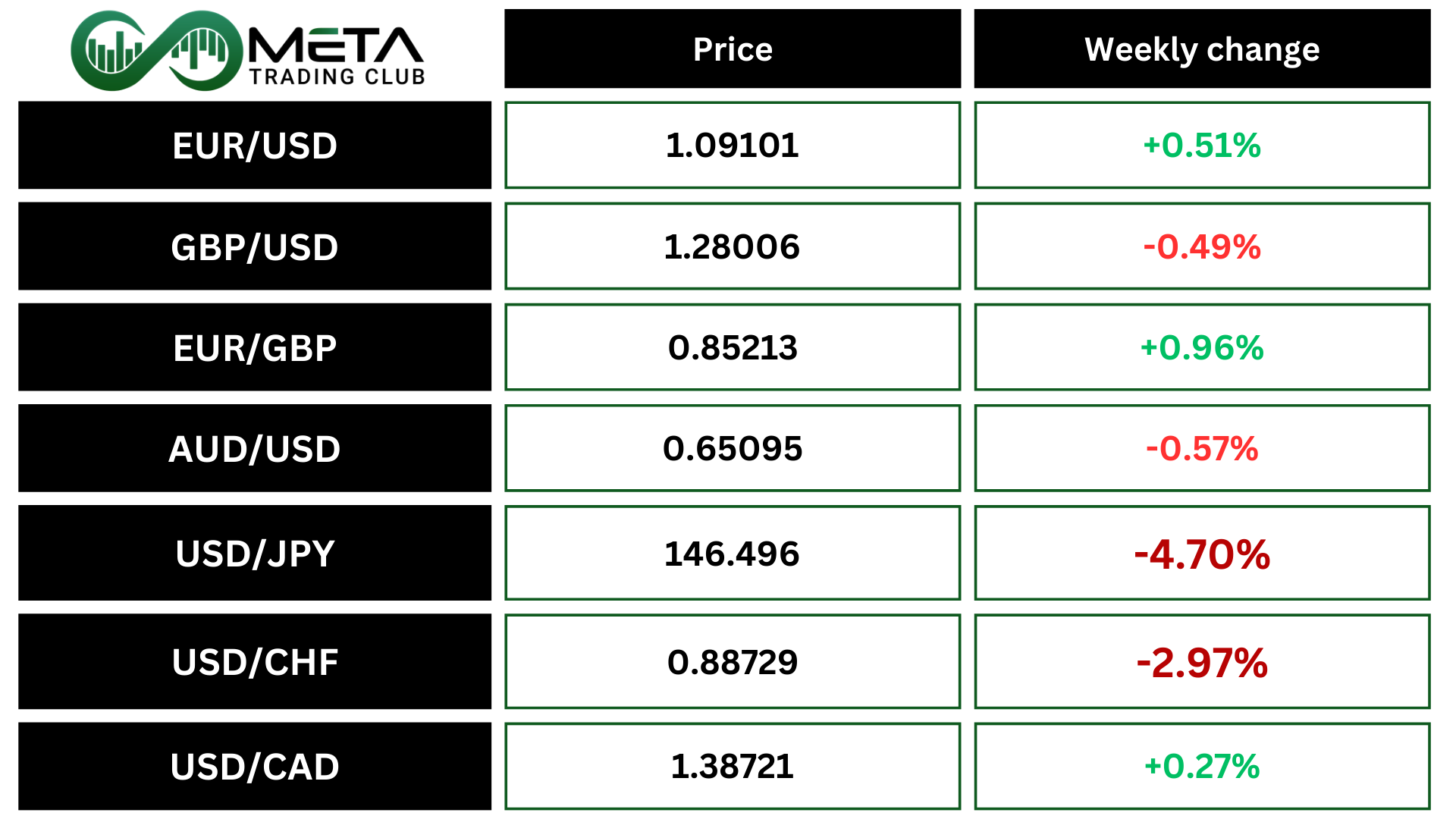

Weekly Performance of Major Foreign Exchange Pairs:

USD/JPY: The Japanese yen extended its surge past 146 per dollar, its strongest since March, after the latest economic data widened the divergence between monetary policy expectations of the Federal Reserve and the Bank of Japan. A poor jobs report in the US drove markets to position for larger rate cuts by the Fed this year in response to growing signs of a slowing economy.

In the meantime, the BoJ raised its policy rate to a 16-year high of 0.25% and signaled the will to hike rates further if the economy warrants. Markets are betting on two more rate increases this fiscal year that ends March 2025, with the next hike seen in December. Recent data also showed that Japanese authorities spent 5.53 trillion yen to support the currency via intervention in July. Meanwhile, Japan’s government said that a weak yen could erode households’ purchasing power by pushing up inflation more than wage growth drives an urgent need to support the currency.

Crypto

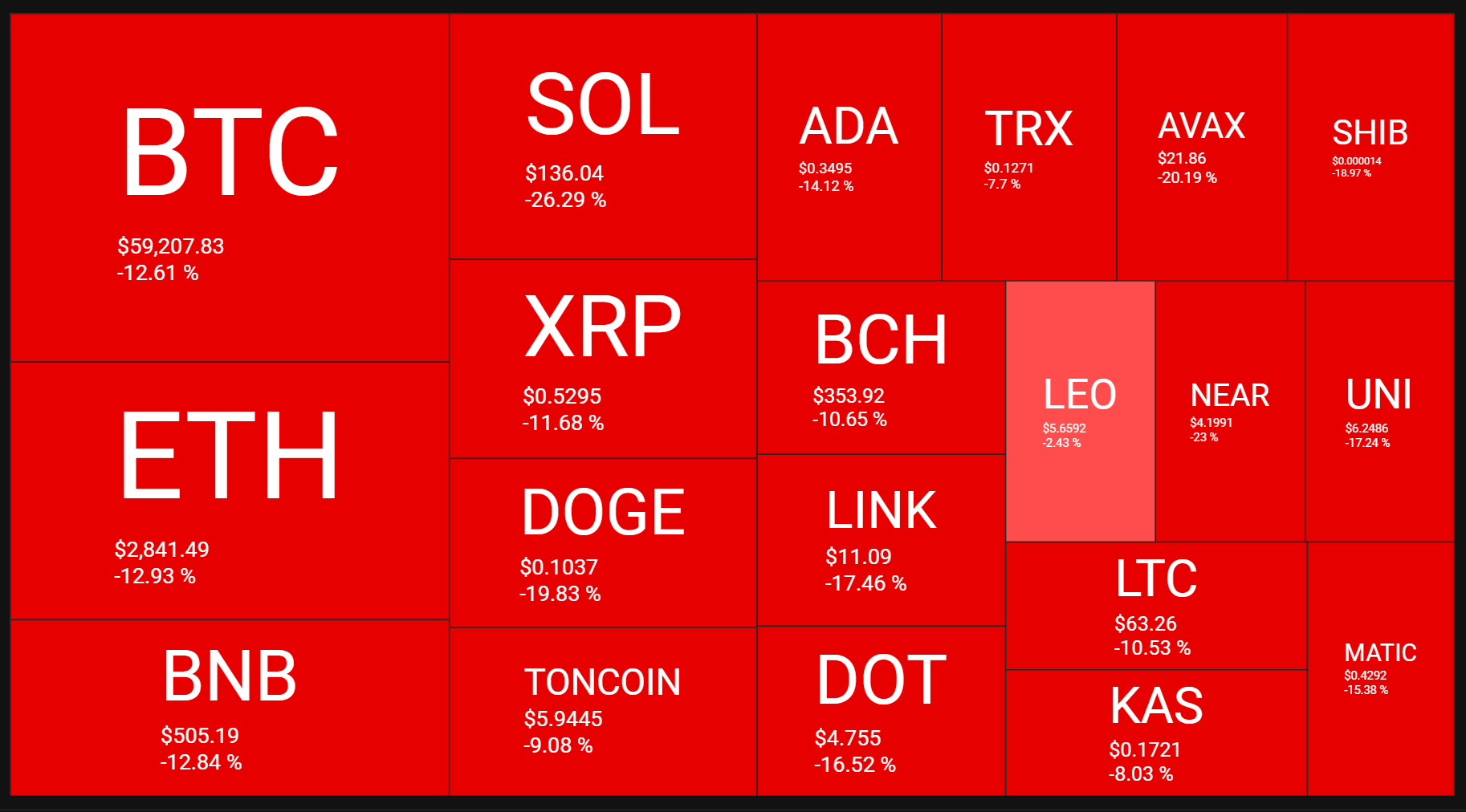

Crypto Market Weekly Performance:

Source: quantifycrypto

Ethereum (ETH) is down below $3,000, with this downtrend believed to be due to several factors. One is the outflows, which the Spot Ethereum ETFs have been experiencing since they began trading on July 23. Data shows that these funds again experienced a net outflow of $54.3 million on August 2.

Ethereum down over 10% since these funds began trading. Also, these funds have suffered cumulative net outflows of $510.7 million since they launched. Grayscale’s Ethereum Trust (ETHE) has been individually responsible for these outflows, with $2.12 billion flowing out of the fund.

This has put significant selling pressure on ETH, leading to its recent downtrend. Ethereum was bound to suffer a significant decline following Bitcoin’s drop. Meanwhile, both assets currently have a strong price correlation.

ETH has a strong support in $2800-$2920. If this is lost, Bitcoin is likely going to test $60K and Ethereum will test under $2,800 as the final big correction.

Next Week’s Outlook

Economic Events

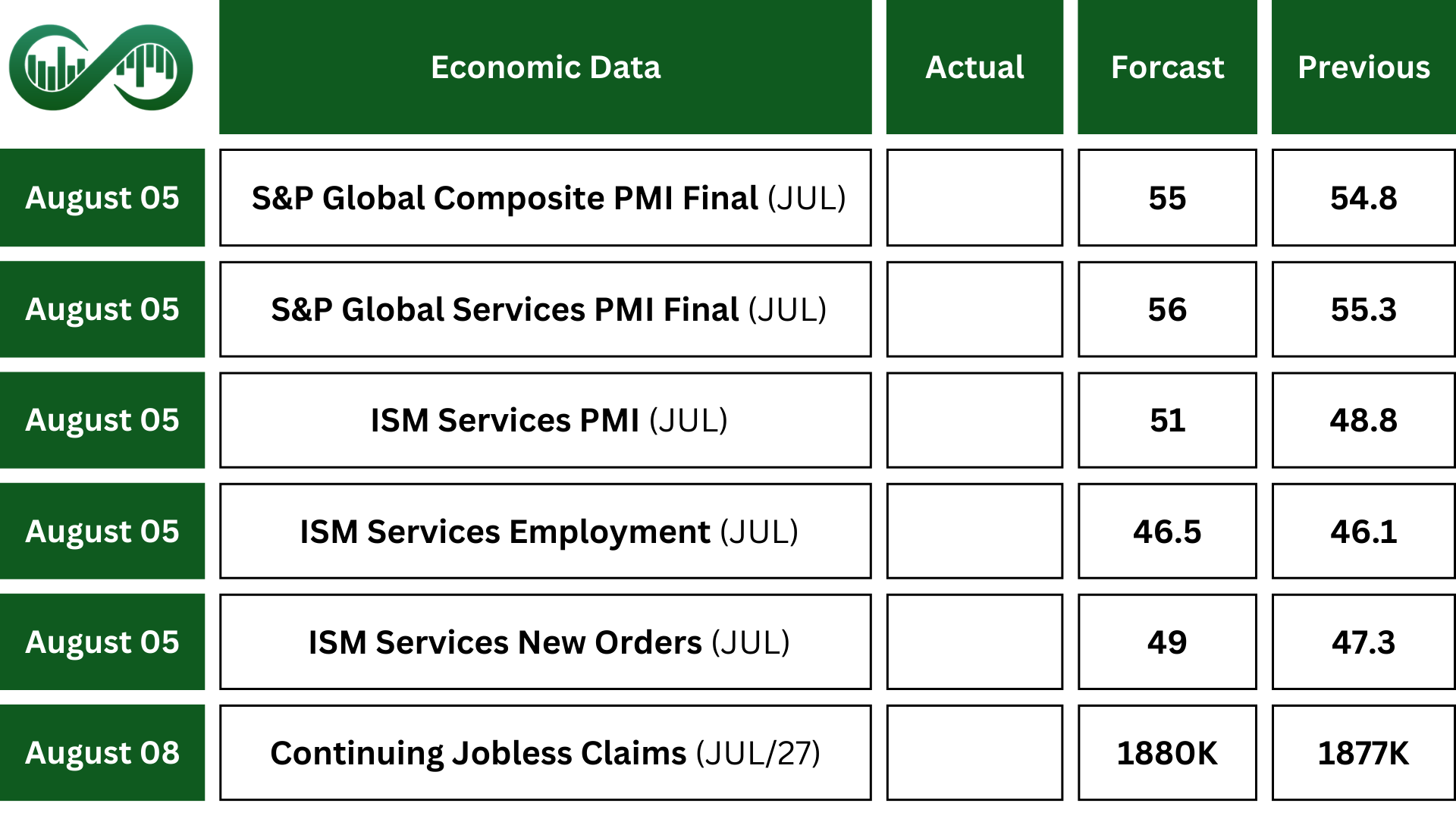

The US economic calendar will be soft in the week ahead, with the focus on the ISM Services PMI, expected to show the services sector returned to growth in July after a contraction in June. Other key indicators to follow include final S&P Global Services and Composite PMIs.

Earning Events

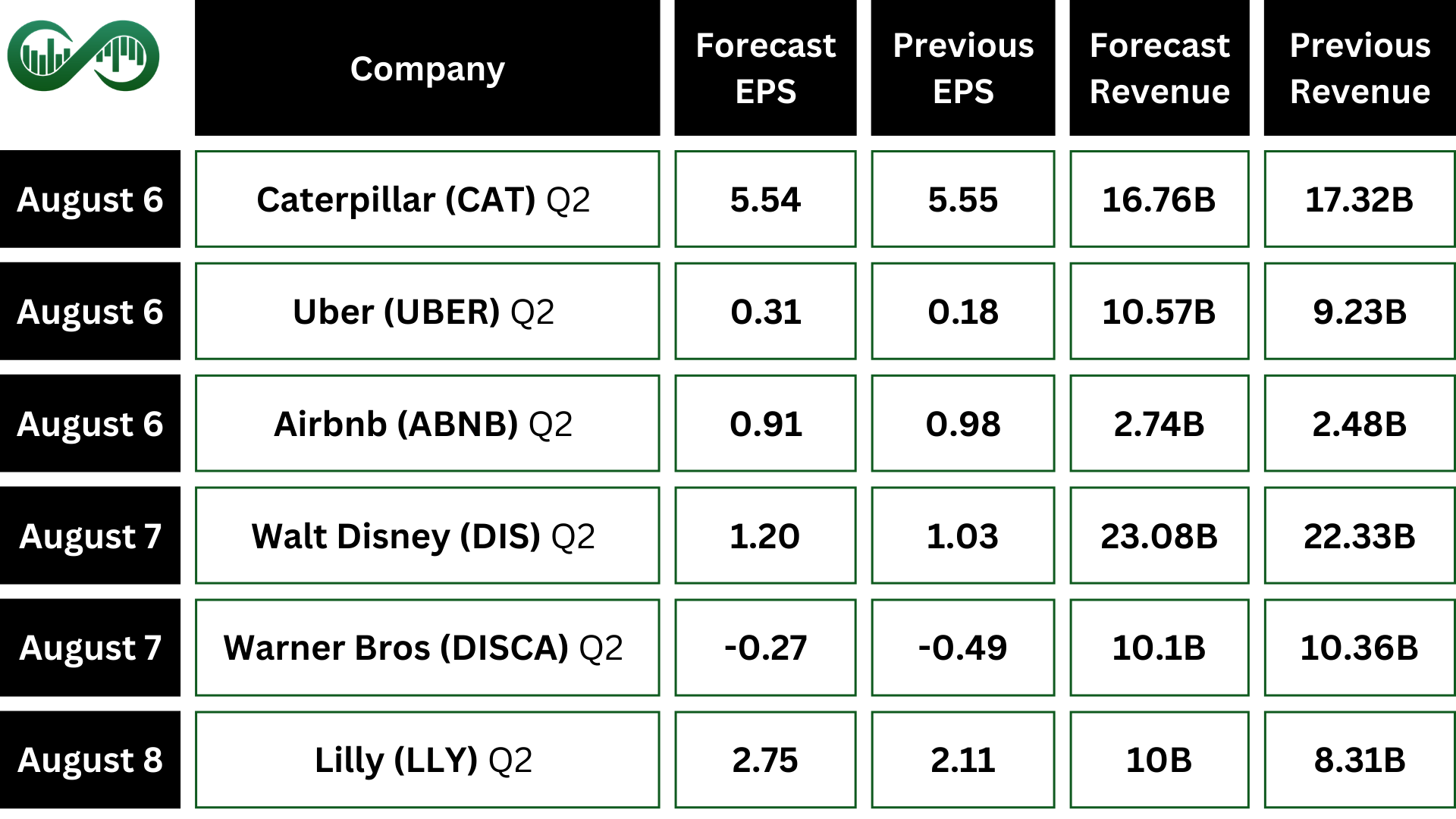

The earnings season continues with reports from Amgen, Caterpillar, Uber, Walt Disney and Eli Lilly.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.