The Personal Consumption Expenditures (PCE) Price Index is a key inflation gauge used by the Federal Reserve to assess the prices of goods and services consumed by households. Unlike the Consumer Price Index (CPI), the PCE adjusts for changing consumer behavior, reflecting how people shift spending as prices change.

The core PCE, which excludes volatile food and energy prices, is especially watched by policymakers to understand underlying inflation trends. It’s considered a comprehensive measure of inflation and guides decisions on interest rates and monetary policy.

February PCE Price Index

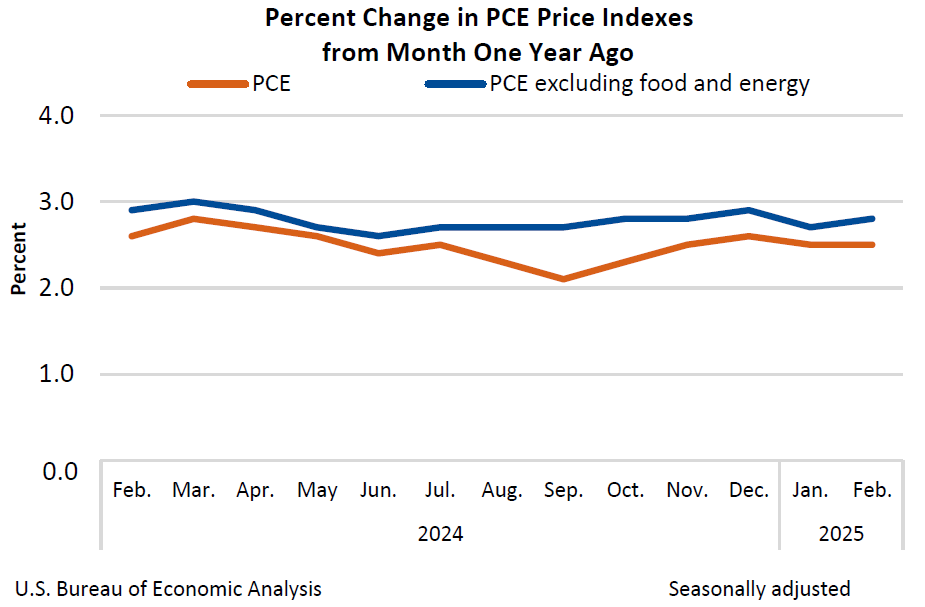

The PCE Price Index, which tracks changes in prices for goods and services, went up by 0.3% from January to February and rose by 2.5% compared to the same month in the previous year.

Excluding food and energy, the Core PCE Price Index increased by 0.4% month-over-month, the largest rise since January 2024, and by 2.8% year-over-year.

Personal Income and Personal Spend

In February 2025, personal income increased by 0.8%, which is a gain of $194.7 billion. Disposable income, which is income after taxes, rose by 0.9%, or $191.6 billion.

Also, people spent more in February, with personal consumption expenditures going up by 0.4%, an increase of $87.8 billion. Spending included $56.3 billion on goods and $31.5 billion on services.

Personal outlays, including spending, interest payments, and transfer payments, increased by $118.4 billion. Savings totaled $1.02 trillion in February, and the personal saving rate was 4.6%, which is how much people saved out of their disposable income.

The rise in personal income was driven by higher wages in both services-producing and goods-producing industries, along with government social benefits and business payments related to settlements. Spending increased while inflation remained moderate.

Impacts of February PCE Data

The February PCE data could lead to short-term volatility in the stock market. The higher-than-expected rise in the core PCE price index (0.4% month-over-month and 2.8% year-over-year) signals persistent inflationary pressures. This might prompt concerns about tighter monetary policy from the Federal Reserve, potentially delaying rate cuts.

As a result, sectors sensitive to interest rates, such as technology and growth stocks, could face selling pressure. On the other hand, sectors that benefit from inflation, like energy and consumer staples, might see increased interest from investors. Overall, the market reaction will likely depend on how investors interpret the data in relation to the Fed’s future actions.

The SPY pulled back down from the 200-day Moving Average, with diminishing momentum, remaining under the $570 resistance level. This suggests a potential decline toward the $560 Fibonacci support, or even lower levels. For the index to climb, it would need to break through $570 with significant strength and momentum.