Option prices are made up of two main values, intrinsic and extrinsic values.

Intrinsic values

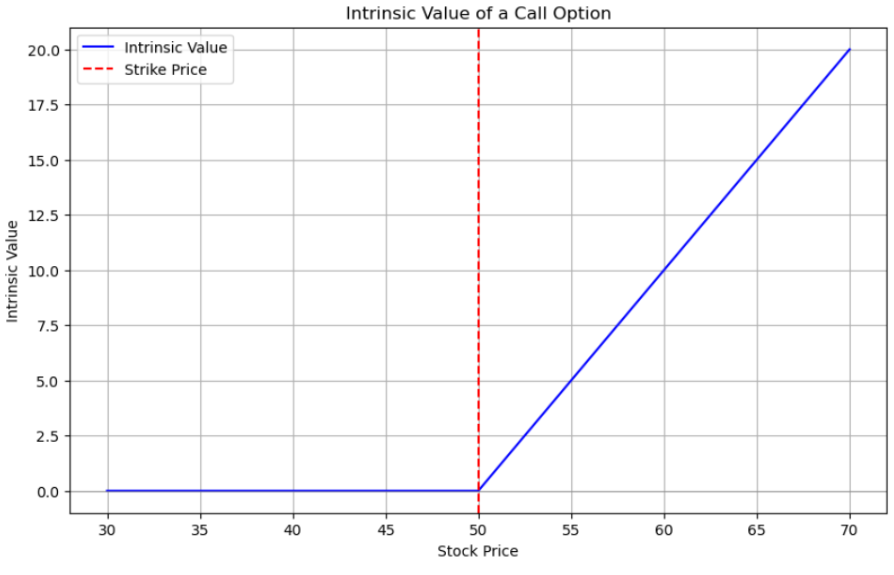

The intrinsic value of an option represents its real value if exercised immediately. It is defined as the difference between the current price of an asset and the strike price of an option. Intrinsic values can be positive or zero, but not negative.

This visualization above represents that the intrinsic value is zero when the stock price is below the strike price and increases linearly as the stock price rises above the strike price. That proves that intrinsic value can never be negative.

Intrinsic value for a call option:

If the stock price is above the strike price then these call options have intrinsic value that means the current stock price minus the strike price.

Intrinsic value for a Put option:

If the stock price is below the strike price the these put options have intrinsic value , that means the strike price minus the current stock price

Example:

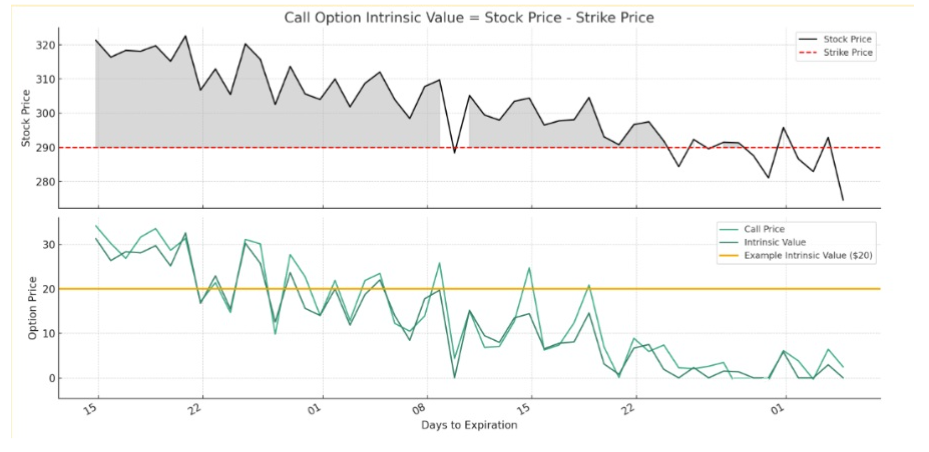

Current stock x price = $310

Strike price = $290

Intrinsic value = $310 – $290 = $20

The top chart displays the stock price relative to the strike price over 51 days from April 15th to June 1st, The red line represents the strike price, while the shaded area indicates that whenever the stock price is above that line we have the positive intrinsic value.The bottom chart shows the option price and its intrinsic value over the same period.

Extrinsic values

Options without intrinsic values may still be profitable if there is a long time till expiration and they have extrinsic or temporal value. Extrinsic value, often known as time value, represents the premium an investor is ready to pay over intrinsic value for the likelihood that the stock price would rise before the expiration date. Volatility, expiration date, and interest rates can all have an impact on extrinsic value.

Example:

Current stock price : $260

Strike price of call option A: $255

Strike price of call option B: $265

As Expiration date approaches

There is value in exercising Call Option A since it enables the buyer to acquire the stock for less than the current market price because the stock price is above the strike price. Call Option A is worth $5 ($260 – $255) at expiration, which is the difference between the stock price and the strike price.

On the other hand, the remaining time and the anticipated volatility of the stock price affected the value of Call Option B as well. Nevertheless, the option’s price trended to zero as the expiration date approached and the stock price remained below $265, indicating that there was no advantage to executing the option.

Impact of Greeks on Intrinsic and Extrinsic values

The Greeks primarily affect the extrinsic value of options because the intrinsic values are the difference between the underlying asset’s price and option’s strike price. Whereas the Greeks measure various factors that affect the option’s price like time,volatility, and interest rates.

Delta:

- It measures the rate of change in an option’s price per $1 change in the price of the underlying asset.

- A high delta means the option’s price is sensitive to stock price changes.

- This sensitivity can increase the extrinsic value since the potential for profit changes significantly with stock price movements.

Gamma:

- Gamma measures the rate of change in delta for a $1 change in the underlying asset’s price.

- High gamma values typically happen when the option is near the money, influencing the extrinsic value because it signifies potential for the delta, and hence the option’s price, to increase rapidly.

Theta:

- Theta reflects the time decay of the option’s price, meaning the loss of extrinsic value as time passes.

- As expiration approaches, theta increases, accelerating the decay of the extrinsic value.

Vega:

- Vega indicates how the option’s price changes relative to changes in the underlying asset’s volatility.

- An increase in volatility can inflate the extrinsic value, reflecting the greater probability of the stock price moving to benefit the option holder.

Rho:

- Rho is less commonly used but measures the sensitivity of an option’s price to interest rate changes.

- Rho can affect the extrinsic value because it impacts the cost to carry or hold an option.

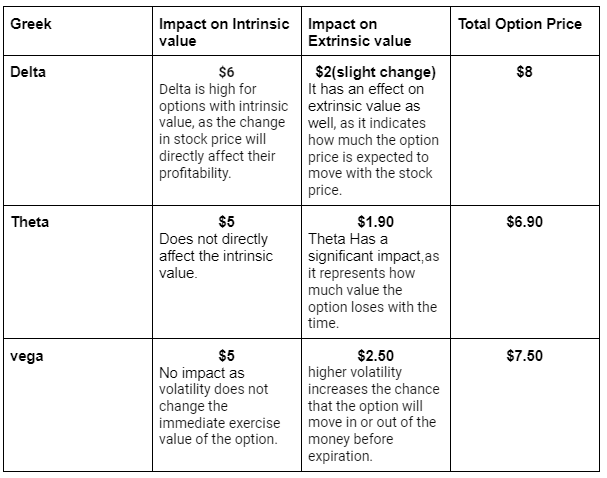

Example

Stock price of X = $55

Call option strike price = $50

Intrinsic value = $5

Extrinsic value = $2

Delta impact:

If the stock price increases to $56, the intrinsic value would rise to $6, and the extrinsic value may slightly change due to the option becoming less risky.

Theta impact:

If the stock price stays at $55 but one day passes, the intrinsic value remains at $5, but the extrinsic value might decrease to $1.90, for example.

Vega impact:

If the stock price remains the same but the market becomes more volatile , the intrinsic value stays at $5, but the extrinsic value might increase, say to $2.50, as the option has a higher chance of finishing with more value at expiration.

From the above example, the difference between each greek.

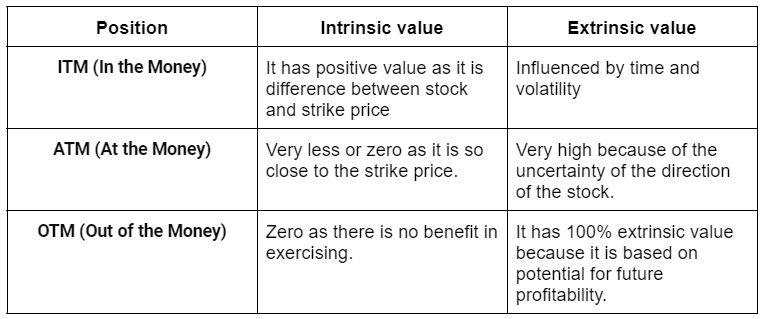

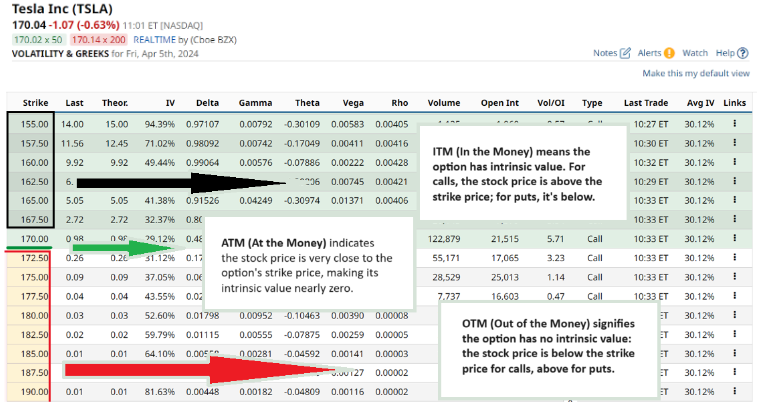

Out of the Money (OTM), In the Money (ITM), and At the Money (ATM) impact on Intrinsic and Extrinsic values

Intrinsic value

In the Money (ITM):

Call Options: The stock price is higher than the strike price. The intrinsic value is the difference between the current stock price and the strike price.

Put Options: The stock price is lower than the strike price. The intrinsic value is the difference between the strike price and the current stock price.

At the Money (ATM):

The stock price is equal to the strike price. There is no intrinsic value because exercising the option does not lead to a gain or loss.

Out of the Money (OTM):

An option is OTM if exercising it would not result in a profit based on the underlying current price.

- For a call option, OTM means the stock price is below the strike price.

- For a put option, OTM means the stock price is above the strike price.

Extrinsic Value

In the Money (ITM):

ITM options have extrinsic value in addition to their intrinsic value. This reflects the time value and volatility which provide a chance for the option to gain additional worth before expiration.

At the Money (ATM):

ATM options consist entirely of extrinsic value. This is because there’s a significant chance of the option moving ITM before expiration, which the market prices in.

Out of the Money (OTM):

OTM options also consist solely of extrinsic value. The price of these options is based on the probability and potential for them to move ITM before they expire.