Since the dawn of history, financial markets have been recognized as a mirror reflecting all economic dynamics and events in reverse. In the past week, global markets witnessed complex transformations that influenced their speed and direction. From political upheavals to economic data releases, various factors have been instrumental in sustaining this dynamic world.

One of the most significant events that had a profound impact on financial markets was the political crisis between Iran and Israel, which occurred in a geopolitically sensitive region. This event not only directly affected the relevant markets but also raised concerns about global stability and energy prices. Many countries are still grappling with policies aimed at reviving economies affected by the COVID-19-induced lockdowns. However, as evident, war and instability are inflationary, and if this inflation is influenced by oil prices, it can be said that economies will no longer be able to withstand such pressure. Additionally, the announcement of important economic indicators such as unemployment rates and industrial production was another factor that influenced market developments. Central banks need to monitor labor market trends to initiate interest rate reductions, which they continue with the onset of labor market shocks.

But what predictions can be made for the coming week? Given the dynamic nature of financial markets, making accurate and error-free predictions has always been a major challenge. However, there are some noticeable signs and patterns that may indicate the direction of market movements in the future. For example, the impact of economic data releases on market decisions can be significant. Additionally, geopolitical events and easing geopolitical tensions are constantly changing and influencing financial markets.

In general, it is always important to carefully and intelligently observe the developments in financial markets and strive to predict their future direction through accurate and fundamental analysis. Since financial markets are always a dynamic and complex subject, only through intelligent and knowledge-based actions and analysis can desirable results be achieved in this field.

Economic Events:

On April 15, 2024, the United States retail sales data was released, surpassing expectations by 0.4%, reaching 0.7%. This is excellent news, indicating a lower risk of recession for the United States due to increased demand. However, there is still disagreement among Federal Reserve members regarding the trajectory of interest rates.

On April 16, 2024, several data points were available, including China’s Gross Domestic Product (GDP), UK employment data, Europe’s ZEW Economic Sentiment Index, Canada’s inflation data, and US building permits. China’s GDP exceeded expectations at 5.3%, surpassing market estimates, which was reflected in the market pricing at 5. The UK unemployment rate increased, while Europe’s Economic Sentiment Index significantly exceeded market expectations at 43.9 compared to the forecasted 37.2. Canada’s monthly inflation came in at 0.6%, slightly below the market’s expectation of 0.7%, and US building permits were lower than market expectations. However, this data cannot be a reliable indicator of economic strength.

On April 17, 2024, Australia’s inflation data was released at 0.6%, in line with market pricing. On the other hand, UK’s inflation data was released, showing a core inflation rate of 0.1% higher than the market’s expectation. Europe’s inflation also came in at 2.9%, as per market predictions. It is noteworthy that while Europe’s inflation is on a downward path towards the 2% target, a closer look at the UK’s data reveals inefficiencies in its inflation control policies. With the Bank of England’s high balance sheet, it is expected that the UK will attempt to curb inflation by reducing its balance sheet. Australia also demonstrated appropriate inflation data, which can be expected with the improvement in China’s conditions, as China’s increased demand for coal can boost Australia and New Zealand’s economies.

On April 18, 2024, Australia’s employment data was released, lower than market expectations at -6.6K, indicating that the Reserve Bank of Australia (RBA) is prepared to initiate rate cuts.

On April 19, 2024, only Japan’s inflation data was released at 2.7%, in line with market expectations. Japan is currently concerned about the yen’s exchange rate, which has reached the 155 range. This range is dangerous for Japan’s economy and could put pressure on its people. However, with the increase in wages, Japan expects to see consumer inflation, which, if realized, can ultimately help Japan’s economy grow and prevent the country from falling into a future inflation crisis.

Expected Economic Events:

In the upcoming week, the most important data to be released first is Australia’s inflation data, which will be published on 24.04.2024. Considering the employment data of Australia from the previous week, this data holds special significance as it will indicate the path of Australia’s monetary policy. On the same day, durable goods orders for the United States will be released, which undoubtedly is one of the most important indicators for assessing the likelihood of a recession or non-recession.

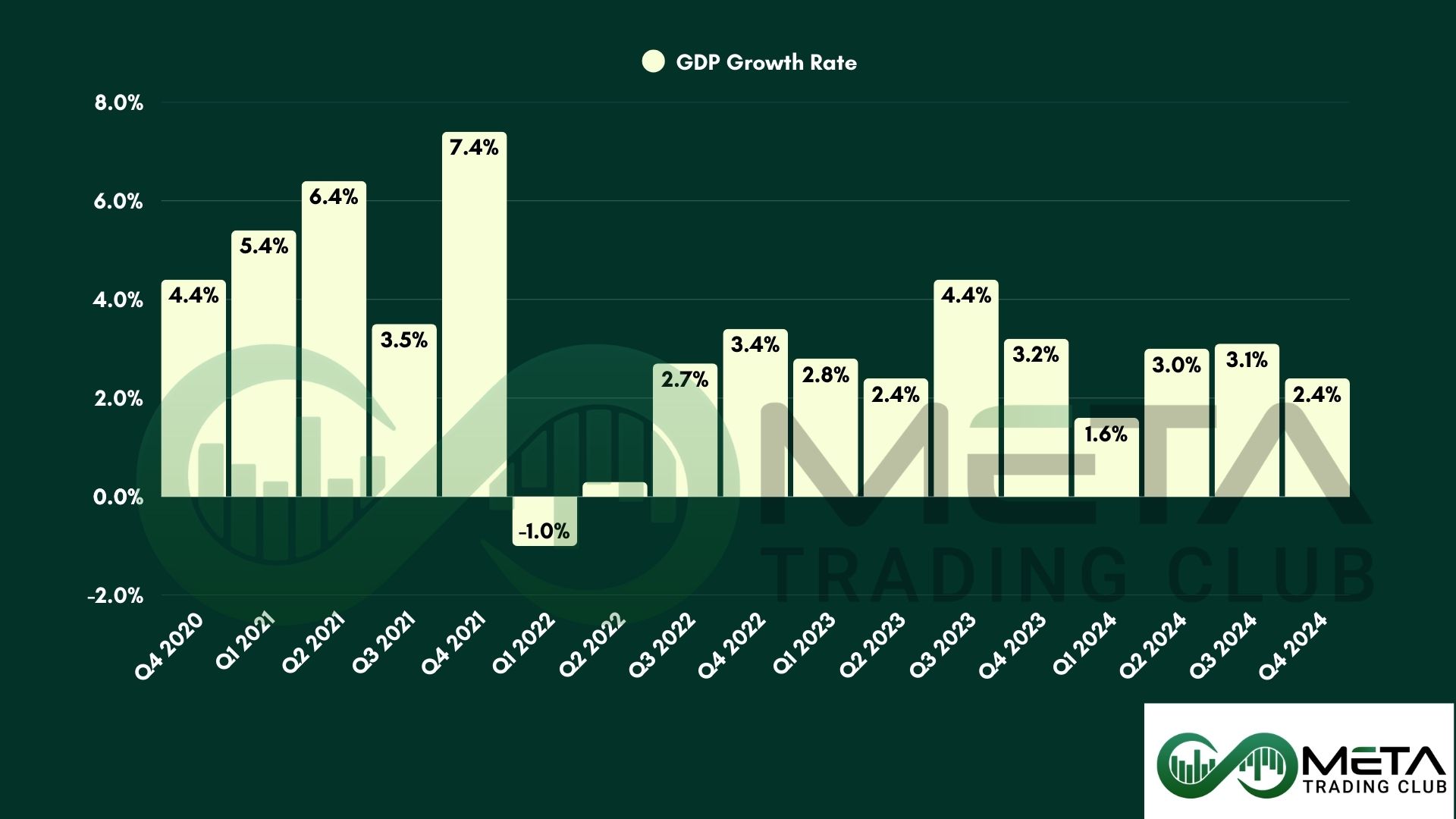

On April 25th, the Gross Domestic Product (GDP) of the United States will be released, with forecasts indicating a 2.1% economic growth in America. The dollar is expected to experience a volatile week as these important economic data points follow the last FOMC statement and Federal Reserve officials’ remarks, holding significant importance.

The busiest day of the week is Friday, April 26, 2024, as the interest rate decision meeting for Japan is scheduled. This meeting is the most important session in recent months as the USD to JPY rate has reached the range of 155, with the possibility of Japan exiting negative interest rates.

Finally, the Personal Consumption Expenditures (PCE) data of the United States will be released, which is the favorite data of FOMC members for assessing America’s inflationary situation. These data can largely determine the course of countries’ monetary policies and the likelihood of the first rate cut.

Based on the economic data of countries and the economic calendar, we can consider the following currency pairs for weekly swing trading:

USDCAD:

GBPUSD:

AUDUSD:

Earnings:

Last week, company income reports were released, with most of them showing higher EPS and revenue compared to market expectations. On 15.04.2024, Goldman Sachs’ income report was published, with an EPS of 11.58 and revenue of 14.2B.

On 16.04.2024, income reports for Bank of America and J&J were released, both of which presented positive data. It’s evident that the stock market has been paying more attention to geopolitical tensions in recent weeks, with capital flowing out of the stock market and towards gold and short-term US Treasury securities. Nevertheless, you can observe the support and resistance levels for these stocks below.

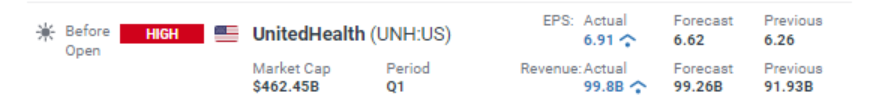

On the same day, income reports for UnitedHealth and Morgan Stanley were also released, both of which surpassed market expectations in terms of income and EPS.

Source : Dailyfx

On April 18th, income reports continued with Blackstone (BX), which reported an EPS of 0.98 and revenue of 3.69 billion, both of which exceeded market expectations.

Netflix, however, was the most significant company to report its income last week. Despite an increase in EPS and revenue, the company revised its outlook for the next income report downwards. This led to a decline in its stock price.

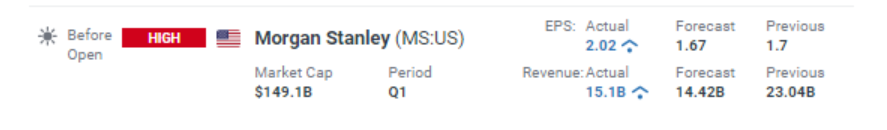

On Friday, American Express and P&G also released their income reports. AXP reported positive earnings compared to market expectations and pricing. However, P&G’s income for the first quarter of 2024 was lower than market predictions.

Source : Dailyfx

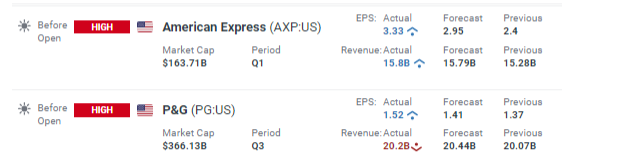

Below, you can see the table of the most important income reports for the upcoming week. Among the most important ones are Meta, Tesla, Visa, Google, Microsoft, IBM, and ExxonMobil. Most of the reports for the upcoming week are related to mega-cap companies, which can have a significant impact on indices, especially those with a higher weighting in the technology sector such as the NASDAQ.

Source : Earnings Whispers

Indices :

Among the stock indices, European indices such as Spain and France performed relatively neutrally, while American indices including the S&P 500, NQ100, Dow 30, and Rus2000 showed significantly negative performance. The weakest indices were the Nikkei 225 in Japan and the NASDAQ Composite, both experiencing nearly a 5% decline. China’s CN50 index also saw approximately 3% growth, influenced by the country’s Gross Domestic Product (GDP). You can see possible scenarios for the major indices in the specified charts below.

NQ100:

S&P500:

Dow30 :

US Crude Oil WTI :

West Texas Intermediate (WTI) crude oil experienced a 4% decline last week, largely influenced by the US oil inventory report and the Strategic Petroleum Reserve (SPR) levels in the country. On the other hand, with the reduction in tensions between Iran and Israel, it can be expected that the price of oil during OPEC policies, especially those of Saudi Arabia, as well as the concerns of European and American countries about a resurgence in energy prices and consequently inflation, will decrease.

You can see the price chart of West Texas Intermediate (WTI) crude oil and its important support and resistance levels below.

XAUUSD (GOLD):

Gold was positive by 2% in the past week, regardless of dollar pricing, although downward momentum is observed in lower timeframes. By examining real interest rates and dollar pricing, and on the other hand, with the reduction in tensions, gold may experience a downward trend for the week. However, it should be noted that the current trend of gold prices is positive, and it is evident that taking a short and speculative selling position carries very high risk.

Bitcoin (BTC):

The Bitcoin halving event occurred on April 19, 2024, resulting in miners’ income being halved. The main question now is whether miners will find it profitable to continue operating on the network despite this reduction in income. Typically, after each halving, we initially witness a neutral movement, followed by a sudden drop. However, experience has shown that the price is significantly affected by halving and the reduction in Bitcoin supply. Important Bitcoin ranges should be noted. The $60,000 support level for Bitcoin is crucial, and if broken, we can expect a significant drop in Bitcoin to around $53,000. However, the upward momentum under the influence of halving can lead to higher Bitcoin tops.

Future Week Outlook:

For this week, there is a greater inclination towards risk-taking in the forex market and currency pairs. However, this risk appetite may arise due to demand from China. Therefore, strengthening of the Aussie and Kiwi dollars is not unexpected. On the other hand, a decrease in oil prices may impact the Canadian dollar. The US dollar may also experience a temporary correction. The downward trend for the euro and pound seems to continue for now, and it may be possible to trade against strong currencies in the coming weeks, such as the Swiss franc.

However, the most important currency this week is the Japanese yen, as the BOJ interest rate decision meeting could lead to a volatile week. For the oil market, fluctuations are more likely to be negative, although the US oil inventory report on Thursday is of great importance. However, fears of war and increasing geopolitical tensions in the Middle East are still present, so any increase in these conflicts and tensions can be positive for oil.

Gold, like oil, may have a calm week, as real interest rates have reached a high range, which could create additional selling pressure for gold. However, it is important to note that gold pricing in dollars is very influential, and if the value of the dollar decreases, gold may continue its current trend.

In the stock market, indices are mostly influenced by income reports and cash flow this week. It should be noted that every trend requires correction, considering the significant rally in the stock markets in recent months. Therefore, the presence or absence of liquidity in these markets should be considered. Bitcoin, due to Halving and the reduction in miners’ income, is still not experiencing selling pressure. However, typically, Bitcoin has seen a correction after each halving event and then gained attention.

Considering the mentioned topics and potential scenarios in each asset class, it is essential to re-evaluate the capital allocation percentage and choose the best options based on risk-to-reward ratios, market conditions, and probabilities. Wishing everyone a profitable week ahead with the Meta Trading Club!

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.