Welcome to the chaotic, wonderful, and often breathtaking world of cryptocurrency trading! If you’ve ever fantasized about becoming an overnight millionaire just by dabbling in digital coins, Congrats! you’re in for a reality check. Don’t worry though, it’s going to be an entertaining ride.

The truth is, crypto trading isn’t a get-rich-quick scheme; it’s more like navigating a rollercoaster blindfolded, exciting but requiring a lot of skill and a bit of luck.

This article is your ultimate guide to navigating the crypto cosmos, where we’ll demystify everything from spot trading to the often misunderstood crypto CFDs, the so-called Crypto Futures.

We’ll break down different trading strategies, multiple trading tips and tricks, the pros and cons of various cryptocurrencies, and how to develop a trading plan that doesn’t rely on luck alone.

By the end, you’ll have a clear understanding of which type of trading suits your style and risk tolerance. Let’s debunk myths, embrace the chaos, and most importantly, have some fun while we’re at it.

Table of Contents

Why Crypto Trading?

People are always on the hunt for the next big thing, the new technology that promises to revolutionize the world and, hopefully, make them a fortune along the way. Crypto trading got everyone from tech enthusiasts to your next-door neighbor buzzing with excitement.

But let’s be real, crypto trading is a lot like chess: deceptively simple to get started with, but devilishly difficult to master. Every day, a swarm of eager beginners floods the market, hoping to strike it rich, only to discover that mastering the crypto game takes more than just a bit of luck and a flashy app.

The crypto space is experiencing massive adoption across the globe, and this widespread interest is slowly but surely contributing to the long-term viability of digital currencies. On the other side of the spectrum, there are social media influencers claiming they’ve made millions from Bitcoin and an ocean of other cryptocurrencies.

These self-proclaimed crypto gurus seem to pop up like mushrooms after rain, each with their own cult-like following of hopeful recruits. It’s almost as if their wealth depends more on the number of followers they can attract rather than their actual trading prowess.

Compared to traditional markets like forex and stocks, the cryptocurrency market is infamous for its violent price swings. These fluctuations can be mind-boggling and even unbearable for seasoned forex or stock traders who are used to more stable, predictable movements.

However, for those who arm themselves with sufficient knowledge and experience, these wild price changes can present unparalleled opportunities. The high volatility of crypto means that while the risks are significant, the potential for untold gains is also within reach for those who can navigate the turbulence skillfully. In the crypto world, fortune truly favors the brave and the well-prepared.

Despite the risks, there are indeed stories of traders making 10x profits on a daily basis, sniping newly launched tokens with the precision of a sharpshooter. However, let’s not get too carried away, these success stories represent only a tiny fraction of the market. For every trader who manages to snipe that perfect new token, there are countless others who fall short, often learning the hard way that in crypto trading, high rewards come hand-in-hand with extreme risks.

Though if you properly educate yourself and challenge your assumed knowledge of crypto trading, you most likely will secure your share of the market as your learnings solidify and experience level goes up. But what is the best crypto for trading?

What Crypto to Trade?

Choosing which cryptocurrency to trade depends heavily on your personality, goals, and trading strategy. Are you a cautious planner or a thrill-seeking adventurer? Your background and preferences will help determine your best fit in the crypto landscape.

If you’re transitioning from the forex market, you might feel more at home with relatively more stable currencies like Ripple (XRP), which with its massive circulating supply and 30 Billion Dollar market cap, offers a bit more predictability. Just make sure to wear a life jacket while navigating these so-called “More Stable Cryptocurrencies” ; their deep dives can be quite unexpected compared to Forex and Stocks Securities.

On the other hand, if you’re a stock market veteran, you might gravitate towards coins with strong utility and solid foundations, like Bitcoin, Ethereum, or Flux. These coins often mirror the fundamentals and growth potential of established companies, making them a more comfortable choice for those accustomed to the stock exchange.

For those who lack patience and prefer quick in-and-out trades, more volatile coins with smaller market caps, such as Fantom Coin or various DeFi-based cryptocurrencies, could be more suitable. These coins can experience rapid price movements, providing ample opportunities for quick profits, though they come with higher risks.

Now, if you truly believe you can handle the mental pressure, stress, and absolute craziness of the market, you might be ready for the dark side of cryptocurrencies. Here, legends are born in mere hours, and often meet their demise even faster!

Trading tokens with extremely high volatility can be the sharpest double-edged sword you’ve ever seen, offering the potential for fast, unheard-of profits while posing equally extreme risks.

But if you’re just starting out, I recommend sticking with the Godfather of them all: Bitcoin. As the most traded and liquid cryptocurrency, Bitcoin offers a sense of stability and predictability that aligns well with a beginner’s learning curve. It’s the most logical choice for a healthy mind stepping into the world of crypto trading.

Struggling to find a trading plan tailored to your unique personality? Don’t worry, we’ve got your back! You don’t have to navigate the wild seas of crypto alone. Join our community of successful traders and start making profits, no matter which way the market moves, with our comprehensive 4-week program.

How to Trade Cryptocurrencies?

The answer to this question depends largely on your preferred trading style, as discussed in the previous section. If you’re a newcomer to crypto trading, I recommend starting with one of the major Centralized Crypto Exchanges (CEXs).

These platforms offer a user-friendly interface and built-in guides that help you navigate the exchange, familiarizing you with all its sections and functions. Additionally, CEXs provide 24/7 customer support to assist with any questions or issues you might encounter.

Most major CEXs support Crypto Spot trading and offer a variety of other significant derivatives, including Futures (both Perpetual Futures with no expiry date and Quarterly Futures with a set expiry date), Options, and CFDs.

Spot Trading: How to buy Cryptocurrency?

If you’re interested in swing trading or holding crypto for the long haul, Spot trading is your go-to option. Let’s break down the process of buying crypto step by step:

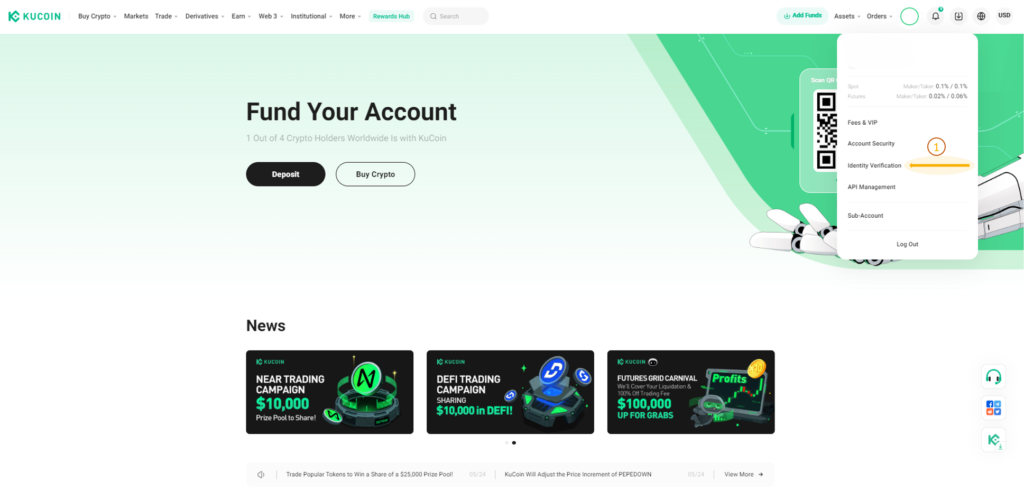

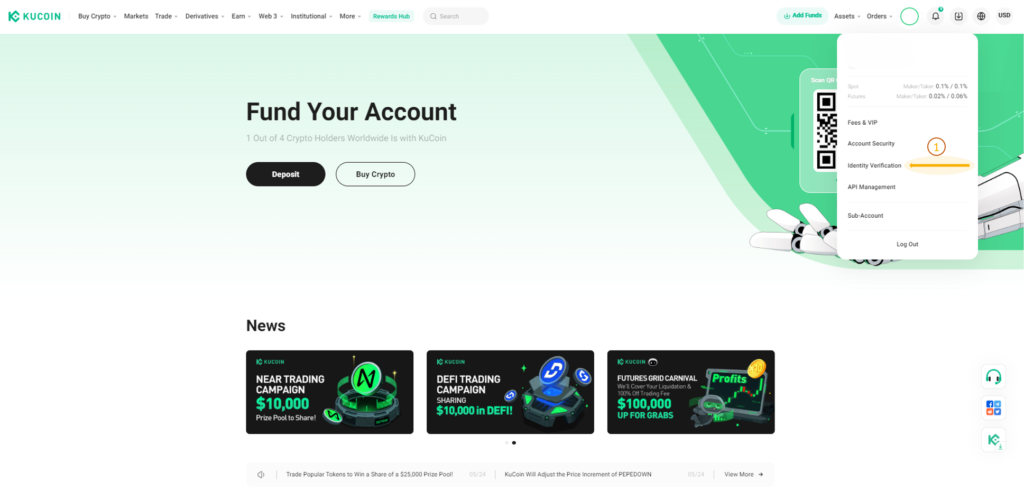

Step One: First, create an account on your chosen exchange and complete the Know Your Customer (KYC) verification process.

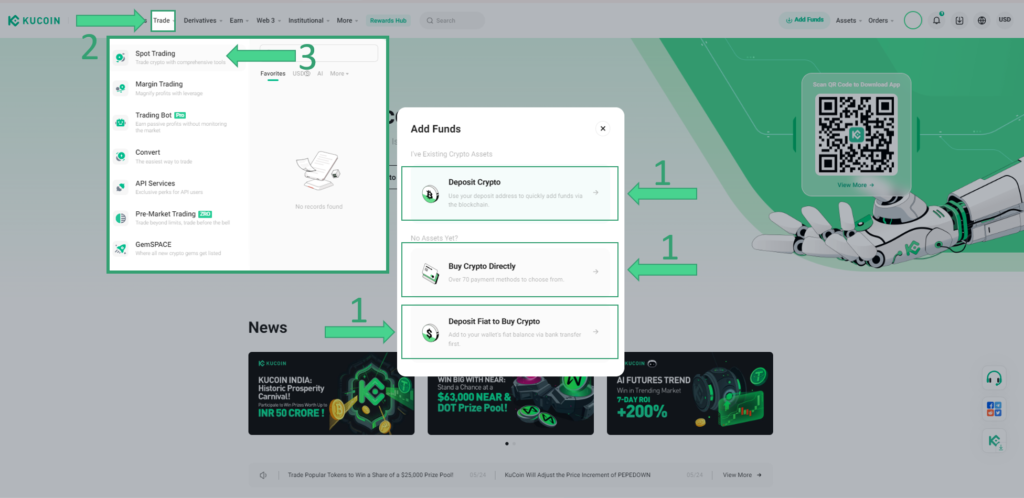

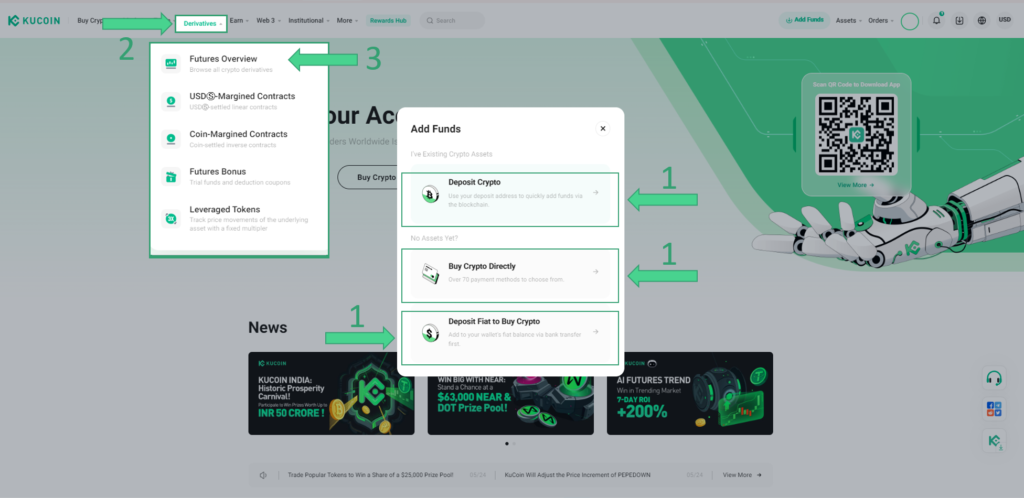

Step Two: Once your KYC is approved, deposit money into your exchange account. This can be done through various methods, such as PayPal or by depositing stablecoins like USDT.

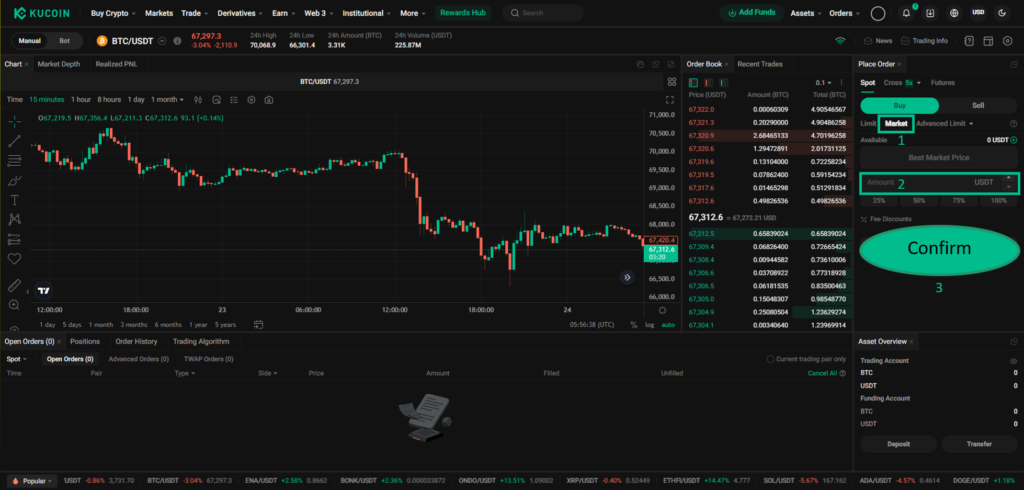

Step Three: Navigate to the Spot trading section, select your preferred cryptocurrency, and purchase it using the money you deposited. There are multiple ways to execute your order, but the simplest method is using a Market Order.

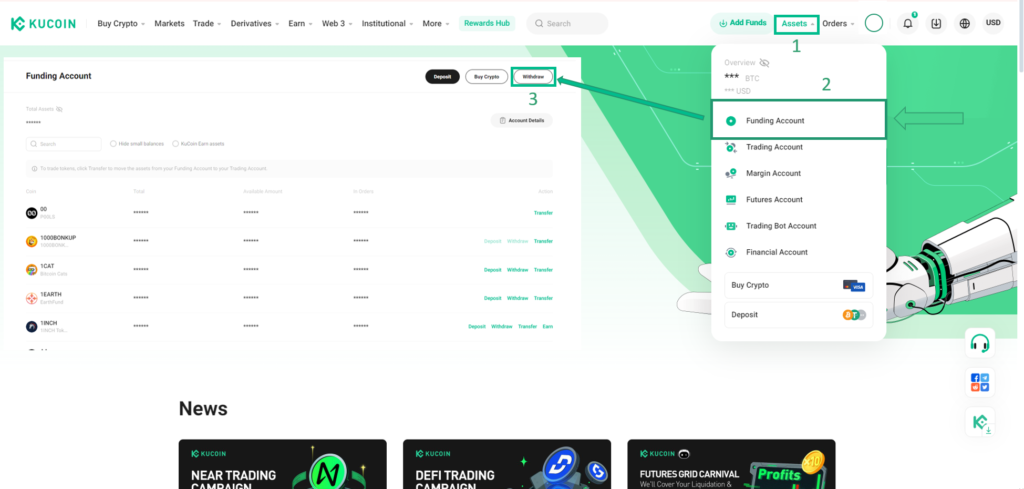

Step Four: After purchasing crypto on a CEX, it will be added to your exchange wallet, which only you have access to. Although exchanges claim their built-in wallets are safe, it’s always recommended to withdraw your crypto to your personal wallet, preferably a cold wallet, which is more secure than an always-online hot wallet.

Step Five: When you’re ready to sell your crypto, deposit it back into your exchange wallet and sell your assets.

But what if someone wants to buy a trending token, or newly launched once that has true potential? Well, if you really want to swim with the sharks you have three options:

- CEX Tokens: Centralized Exchanges sell some major trending tokens and even allow CFDs for such tokens. However, the selection lacks diversity, primarily featuring a limited range of well-established tokens.

- DEX Tokens: Decentralized Exchanges are the birthplace of innovation and the breeding ground for fraudsters! are where legends are born, and so are scammers. Although for every major hit token there are a hundred scams, if you have the sniping skills to find these gems early, overnight wealth might no longer be just a slogan for you.

- DEX Tools: DEX trading tools such as DEXScreener or DEXTools have an advantage over most DEXs, having access to all tokens across all blockchains. Moreover, they have access to various tools such as charts, indicators, analysis tools, social media and reliability scores, trade history and Demo accounts.

Another key aspect of using DEXs is that you need to have a hot wallet installed on your browser or mobile device. After setting up your crypto hot wallet, you connect it to the DEX dApp, allowing you to proceed with transactions.

Unlike CEXs, there’s no need to deposit funds into the exchange’s wallet. The DEX dApp connects directly to your hot wallet, using the funds already stored there. Don’t worry about the security of major DEXs, smart contracts operate autonomously and can’t be manually tampered with.

While smart contracts always request your permission for transactions, using a cold wallet is still a safer choice. Cold wallets require you to manually enter a password using their built-in keyboard, adding an extra layer of security.

If you’re interested in spot trading cryptocurrencies, especially tokens, start with paper trading. Use the virtual funds provided to assess the risks and test your trading skills. This approach helps you avoid learning hard lessons, profits don’t come easy.

Crypto Futures

Let’s be clear, the so-called crypto futures that people see in exchanges are not actually Futures Contracts, But leverage trading using CFDs. Regardless, they are easy to access for beginners and useful for traders who have the skills but not the capital needed for considerable profits.

Some brokers also offer CFDs on cryptocurrencies, but they typically only cover major cryptos like BTC, ETC, and XRP. If you’re already a seasoned forex trader, check if your broker supports BTC so you can dive into the world of cryptocurrencies without missing a beat.

Though if you are a beginner, you must first understand that using CFDs to trade any cryptocurrency does not give you ownership over the underlying asset. In crypto futures you only speculate on the price change of a crypto and if you come on top, profits follow.

However, leverage trading using crypto futures not only time folds your profits, it also multiplies your losses and if you don’t properly use a stop loss, might result in you going liquid after a single failed trade.

It’s basically a form of gambling on the knowledge you have gathered based on technical or fundamental analysis, On-Chain and sentiment analysis. Although it is easily accessible for average joe to future trade crypto, it is not that easy to make greens all the time as some social media gurus claim it to be.

Yes, the social media crypto gurus, those dazzling showmen flaunting their massive profits while conveniently glossing over their losses. They make it seem like making informed decisions in the unpredictable crypto space is a breeze, but don’t be fooled.

These self-proclaimed experts are more about spectacle than actual trading prowess. Becoming a master futures trader, like any other skill, requires proper education, rigorous training, extensive experience, and, yes, plenty of failed trades.

So, the next time you see someone bragging about their latest windfall, remember: behind every highlight reel, there’s a blooper reel they’re not showing you.

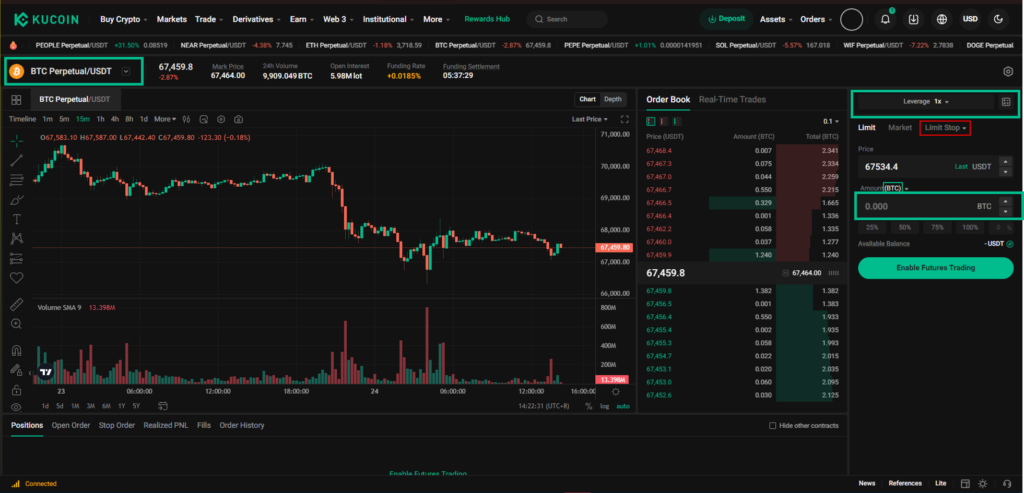

So how exactly should one begin trading crypto futures? Well, let’s begin with a tour shall we?

- Step One: Choose your Exchange, the more volume it gets the better.

- Step two: Creating an account and KYC approvement.

- Step Three: Deposit Funds, this can be done either by using Fiat currencies or Cryptocurrencies.

- Step Four: Go to the future trades section and pick your favorable crypto.

- Step Five: Set the trade leverage, this increases your exposure to the market.

- Step Six: If you’re bullish, open a long position and close it when you see fit. Alternatively, you can open a short position to profit from a decrease in the asset’s price. In both long and short positions, you have the flexibility to close a portion of your position instead of the entire amount.

Now that you know the basics, let’s move on asset analysis so you can maximize your win rates and profits as a result.

Crypto Analysis

Ah, so you finally took the bait and found crypto trading attractive. Welcome to the club, pal! The cheese you see on that piece of wood might seem free, but make sure you have sufficient knowledge of technical analysis, fundamental analysis, sentiment analysis, and on-chain analysis, or you might end up getting trapped.

In the chaotic crypto space, there are four key types of analysis you need to get cozy with. First up is technical analysis, where you stare at charts and pretend to know what those squiggly lines mean.

Then there’s fundamental analysis, where you dig into the project’s whitepapers and team backgrounds, basically becoming a part-time detective.

Sentiment analysis involves gauging the mood of the market, which is a lot like trying to predict a teenager’s mood swings. Finally, on-chain analysis involves looking at blockchain data, making you feel like a cyber-investigator.

It’s crucial to get a grip on these analyses before you jump on the hype train, thinking you’ll catch the next bull run, only to get pummeled by the bears.

Without this knowledge, you’re just a fish out of water, flopping around while the seasoned traders swim circles around you. So, before you dive headfirst into the rocky crypto abyss, arm yourself with these tools to avoid becoming the market’s next punchline.

Crypto Technical Analysis

Some people think technical analysis is like rocket science, but honestly, it’s more like the masculine version of astrology. Instead of ladies using the night sky to predict love stories, you guys are using price charts to predict market moves. No crystal balls here, just candlestick charts and a lot of squiggly lines.

Most of your technical analysis magic is done with candlestick charts. These tools show price movements within a specific time frame and can tell you a lot about market sentiment.

Sure, there are other charts like bar charts or line charts, but candlesticks are the bread and butter. They come in bullish, bearish, and neutral flavors, helping you guestimate whether prices will rise, fall, or just stay put.

When candlesticks come together, they create bigger patterns known as classical patterns. Think of these as the constellations of the trading universe. Some traders argue that these patterns are as reliable as a horoscope, but usually, the issue lies in the user’s lack of knowledge, not the stars themselves.

Then we have indicators, with trading volume being the superstar. Volume is so common and crucial that some traders don’t even call it an indicator; it’s just part of the ecosystem, like water to fish or coffee to tech workers.

Volume tells you how much of a particular asset is being traded, which helps measure the strength of a trend.

There are various indicators out there, each serving a unique purpose. The top five most used ones include:

- The Moving Average: Measures the average price over a specific period.

- Relative Strength Index: RSI, shows if an asset is overbought or oversold.

- Moving Average Convergence Divergence: MACD, indicates trend direction and strength.

- Bollinger Bands: Upper and lower bonds indicating price volatility.

- Stochastics: Measure the momentum of price movements to indicate overbought or oversold conditions.

Think of these indicators as tools in a toolbox, each one giving you specific data to make sense of the market. Some traders even create their own indicators, like wizards creating spells, thinking one magical formula can solve all trading problems.

Beyond the basics, there are other major concepts and tools you’ll need to know, like channels, triangles, Fibonacci levels, Elliott waves, support and resistance, supply and demand zones, proper take profit and stop loss levels, and valid breakouts. Channels help you see where the price is likely to go within a certain range, triangles indicate potential trend reversals or continuations, and Fibonacci levels show where the price might retrace before continuing its trend. Elliott waves provide insight into market cycles, while support and resistance zones indicate where the price movement might halt or reverse.

Remember, all these techniques can be applied to the price over time chart or the market cap over time chart, especially useful for those small-cap crypto tokens.

Lastly, while technical analysis is a powerful tool, don’t forget that it works best when combined with fundamental analysis. After all, a well-rounded decision is your best bet in navigating the wild world of crypto trading.

Crypto Fundamental Analysis

Time to crawl into the world of Crypto fundamental analysis, or as I like to call it, the financial background check. Imagine you’re about to buy a used car.

You wouldn’t just trust the shiny exterior, right? You’d check the engine, the mileage, and probably run a Carfax report to make sure it hasn’t been in a dozen accidents. Well, fundamental analysis is like running a Carfax for crypto projects.

To do proper fundamental analysis in the crypto space, you need to dig deep. Start by checking out any interviews or CEO meet-ups. These can give you insight into the people running the show.

But be warned: if you’re not careful, you might fall into a malicious scheme or a rug pull. Watch those interviews with an eagle eye. They should hype the project but also address the associated risks.

If the interview is just a love fest without any tough questions, it’s like a used car salesman promising you that the old beater has “personality” without mentioning the leaky transmission.

Next up, keep an eye out for CEO livestreams. These are goldmines of information. You can learn a lot about the project’s direction and the CEO’s vision.

If you can’t catch it live, no worries, there are plenty of analysis videos on YouTube where someone else has done the heavy lifting for you. Just make sure to get the popcorn ready and prepare to sift through the show.

Now, let’s talk about the project’s whitepaper and website. This is the holy grail of fundamental analysis. A well-written whitepaper will tell you how the smart contracts work, the details of the crypto tokenomics, and the future plans for the project.

Read carefully though. If the tokenomics math doesn’t add up, the sustainability is under question, or if the future plans are vague, it’s time to steer clear of that free cheese. It’s probably sitting on a human-sized trap.

So remember, doing your homework with fundamental analysis can save you from a lot of headaches. And combining it with technical analysis gives you a better chance at making smart decisions in the volatile crypto world. But wait…There’s more!

Crypto Sentiment Analysis

Think of sentiment analysis as playing psychologist to the entire crypto community. It’s about figuring out if the market is in a good mood, like it just got a puppy, or in a bad mood, like it just stepped on a Lego.

To get started, you’ll need to gather data from social media, forums, and news articles. This means scrolling through endless tweets, Reddit posts, and news headlines to see what everyone’s yammering about.

Is the crowd hyped about a new coin or freaking out over a market dip? Tools like social media sentiment trackers and news aggregators can help you sift through this mountain of noise.

Next, you’ll want to measure the overall mood. Are the majority of posts positive, negative, or just plain confusing? Sentiment analysis tools can give you a score or percentage that reflects the general vibe.

For instance, if everyone’s tweeting about how Bitcoin is going to the moon, you might see a high positive sentiment score. Conversely, if the talk is all about a market crash, the sentiment will be decidedly negative.

Why should you care? Because understanding market sentiment can give you a heads-up on potential price movements. If the mood is overwhelmingly bullish, prices might rise as people buy in.

If it’s bearish, prices could drop as people start selling off. So, before you make your next move, tune into the market’s mood swings. It might just save you from getting caught in a downward spiral.

Crypto On-Chain Analysis

If you thought technical analysis was a rabbit hole, buckle up because you haven’t seen anything yet. On-chain analysis is a whole new level of deep diving.

It’s like moving from backyard astronomy to hunting for aliens. Although it might seem complex on the surface level, it is nothing but tracking the footsteps of giants.

Since this topic is so vast, we’ll cover it in depth in a future article. For now, let’s hit the key points. On-chain analysis involves tracking transactions on the blockchain.

And yes, that includes those shiny crypto whales, individuals holding hundreds of thousands or even millions of dollars in crypto assets. Knowing what these big players are up to can give you serious insights.

One way to find these whale wallets is by using tools like Whale Alert. This handy service notifies you of major transactions, letting you see when big fish are making moves.

If the whale is large enough, you might want to mimic their actions. After all, if a whale’s swimming in a particular direction, it might be wise to follow.

Alternatively, you can put on your detective hat and do the legwork manually. Head over to a blockchain scanner like Etherscan, search for the contract address of your chosen crypto, and voila, you’ll see a list of holders and the amounts they hold.

Congratulations, you’ve found the whale. Now, track it, follow its every move, and you’ll gain insights into what cryptocurrencies are catching the big players’ eyes. Follow their trails, and you might just find sweet rewards.

Final Words

Crypto trading is a wild ride in a relatively young market, bursting with opportunities. But for every gold mine hit, there are a hundred landmines blowing eager traders to smithereens. It’s like a treasure hunt, where fortunes can be made, or lost, in the blink of an eye.

Getting started in crypto is easier than ever. With just a few simple steps, you can access both decentralized exchanges (DEXs) and centralized exchanges (CEXs), offering a wide array of coins and tokens to trade. The barriers to entry are lower, but that doesn’t mean the journey is smooth sailing.

However, if you don’t equip yourself with the latest gear, trading knowledge, including technical, fundamental, sentiment, and on-chain analysis, you’ll probably lose the free cheese and get trapped like countless other careless souls.

Before hopping on your pirate ship to seek boundless riches, it’s wise to paper trade first, no matter how confident you are in your trading strategies. Wishing you happy crypto trading, and may your portfolio shine like gold in the sunlight!

FAQ

- How to Buy Cryptocurrencies?

To buy cryptocurrencies, select a CEX for established coins or a DEX for new tokens, depending on the cryptocurrency’s prominence and availability. To access a wide range of tokens you can also use DEXScreener or DexTools. - How to trade Cryptocurrencies?

To trade cryptocurrencies, develop a strategy, gain knowledge, and create a trading plan with risk management. Then, open an account on a crypto exchange and begin trading. To own crypto that you buy, choose spot trading; for speculation and leverage, opt for crypto futures. - What’s the difference between DEX and CEX?

A DEX (decentralized exchange) operates without intermediaries, enabling peer-to-peer trading directly on the blockchain. A CEX (centralized exchange) is managed by a central authority, offering faster transactions and customer support but requiring users to trust the exchange with their funds. - What crypto is best for trading?

The best crypto for trading depends on your goals, trading style, and personality. Beginners should start with BTC for its relative stability, while seasoned traders seeking higher risks and rewards might prefer DeFi tokens. - Which is better hot wallet or cold wallet?

A cold wallet is much safer than a hot wallet but more complex to operate. Hot wallets offer a simpler user experience but are less secure due to their internet connectivity. Choose based on your priority: security or convenience.