Costco Wholesale Corporation is a global membership-based warehouse club known for offering a wide range of products at competitive prices. Founded in 1983, Costco operates on a business model that emphasizes high sales volumes and low profit margins. The company sells everything from groceries and electronics to clothing, appliances, and luxury goods, often in bulk, catering to both businesses and consumers. It also offers services such as optical care, pharmacy, and travel deals. Costco is renowned for its commitment to customer satisfaction, employee benefits, and its strong focus on quality and value. With over 800 locations worldwide, it is one of the largest retailers in the world.

Costco Fiscal Q4 2024

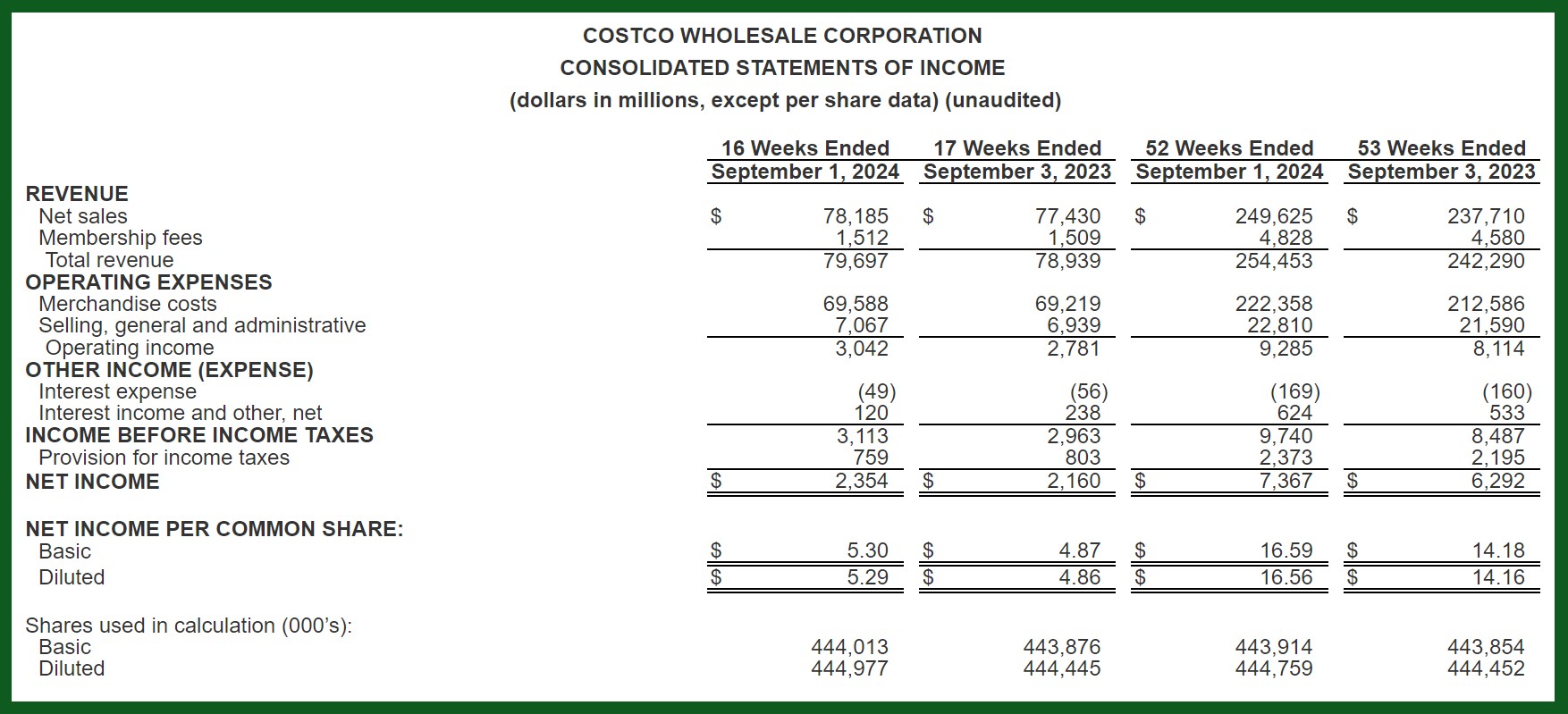

Costco (COST) fourth-quarter earnings report for fiscal year 2024 revealed a mixed performance that reflected both resilience and challenges for the wholesale retailer. The company reported total revenue of $79.7 billion, which was a 1% increase year-over-year but fell slightly short of analyst expectations of $79.973 billion. In terms of profitability, Costco achieved a net income of $2.354 billion, or $5.29 earning per share, which surpassed the projected $5.08 per share. This was an increase of about 7% from the prior year.

Comparable sales showed robust growth, with a 5.4% increase overall—5.3% in the U.S., 5.5% in Canada, and 5.7% in international markets. E-commerce sales also surged by 18.9%. However, this growth rate marked a slowdown from over 20% in previous quarters. This indicates the potential challenges in sustaining e-commerce momentum.

Key highlights from Costco’s Q4 2024 earnings report:

- Revenue Performance: Costco reported total revenue of $79.7 billion, reflecting a 1% increase.

- Net Income: The company achieved a net income of $2.354 billion or $5.29 earning per share.

- Comparable Sales: Comparable sales increased by 5.4% year-over-year, with 5.3% growth in the U.S.

- E-commerce Growth: E-commerce sales rose by 18.9%, though this represented a slowdown from previous quarters.

Also, Membership fees increased to $1.512 billion, slightly higher than the prior year. This is a slight increase in membership fees, which rose by $5 effective September 1, though this change did not impact the reported quarter’s results. The firm’s operating income for the quarter was $3.042 billion, reflecting solid management of operating expenses, which were up 4% year-over.

Future Outlook

Costco’s upcoming earnings report for the first quarter of fiscal year 2025 (ending November 2024) is anticipated on December 12, 2024. Analysts predict earnings per share (EPS) to range between $3.84 and $4.11, with an average estimate of about $3.96.

For the fiscal year 2025, consensus estimates project Costco’s revenue to be approximately $273.3 billion, marking a 7.71% increase from the previous year. In terms of earnings, expectations are set at about $17.98 per share.

Analysts forecast steady revenue growth for the next few years, with revenues expected to reach $291.6 billion by fiscal year 2026 and $311.5 billion by fiscal year 2027.

Costco is projected to perform well, reflecting robust consumer demand and effective management strategies. Although its earnings growth is anticipated to be slightly below the broader industry and market averages.

Costco’s Board Statement

During Costco’s Q4 2024 earnings call, the Board emphasized the company’s commitment to its core strategy of providing high-quality goods at the lowest possible prices.

CEO Ron Vachris highlighted that this fiscal year, Costco witnessed significant growth in various areas, including a 9% increase in net income year-over-year, reaching $2.354 billion.

This strong performance was supported by a 1% rise in net sales to $78.185 billion and a notable 18.9% surge in e-commerce sales, indicating successful adaptation to changing consumer behaviors.

The Board also pointed out the impressive renewal rates for membership, with 92.9% in the U.S. and Canada, reflecting strong customer loyalty.

Furthermore, they reported the opening of 30 new warehouses during the fiscal year, demonstrating their commitment to expansion. This growth was complemented by a focus on improving operational efficiency, as seen in the 40 basis points increase in gross margin.

Costco’s management expressed pride in their 333,000 employees, attributing the company’s consistent financial results to their dedication to customer service and maintaining the quality of the Costco shopping experience.

Impact of Earning on Stock

Despite these positive earnings, Costco’s stock saw a modest decline of about 1, likely reflecting investor concerns about the slower growth rate in sales and e-commerce. Overall, while Costco continues to perform well financially, it faces pressures related to sales growth and market conditions moving forward.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.