Commodities are unprocessed physical goods that result from mining, drilling or agriculture. Commodities are goods that are typically used as inputs in the production of other goods and services. They are usually produced in large quantities by many independent producers. Commodity prices are determined by supply and demand interactions in the global marketplace. Supply and demand conditions may be influenced by factors like the weather, geo-political events, and supply-side shocks (e.g., wars, hurricanes). For traders, commodities offer attractive potential returns and are often used as a tool to hedge against inflation and recession. In this article we are going to explain the types of raw commodities, financial commodities and express how you can participate in commodity trading. Let’s get familiarized with understanding the commodity in our initial step.

Table of Contents

What is Commodity?

A commodity is a basic good used in commerce or in the production of manufactured goods. It is usually interchangeable with other goods or for money. Also commodities are most often used as inputs in the production of other semi-finished or finished goods.

Commodities are very important products in our lives today and constitute non-negligible sources of income for many nations and countries. The quality of a given commodity may differ slightly, but it is essentially uniform across producers. In other words, there should be no difference in the same commodity produced from one producer or another one, as long as the stated quality is the same. For example, a barrel of a stated quality of oil is basically the same product, regardless of the producer. By contrast, for manufactured electronic products, the quality and features of a given product may be completely different depending on the producer.

Throughout history, commodities have played a major role in shaping the global political economy and have affected the lives and livelihoods of people. History is replete with examples of how shortage of critical commodities sparked huge public outcry and social unrest. Commodity trading has undergone significant changes in recent times, adapting to various economic, technological, and regulatory shifts. These changes reflect a dynamic and evolving commodity trading landscape, influenced by both global events and advancements in technology.

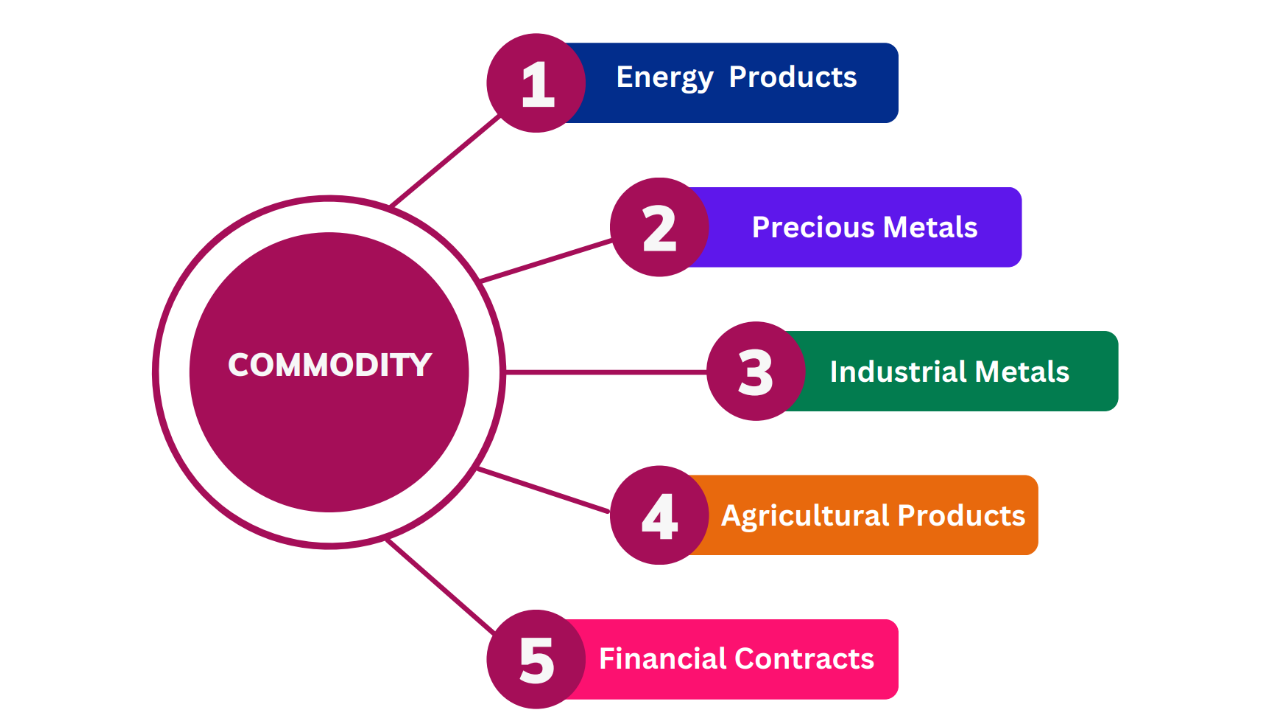

Types of Commodities

The main types of commodities are raw materials and financial commodities.

Raw Materials Commodities

Raw commodities are base material extracted from the ground, either through mining or farming. Commodity products are composed of agriculture commodities, metals and energy products.

Energy Products

Energy commodities such as oil and natural gas are used to generate energy and chemical raw materials. Global energy consumption has more than doubled in the last 40 years. Oil remains one of the most important energy sources. Over 50% of global oil reserves are located in the Middle East, which is therefore a major exporter of oil, while the US and China are significant importers. Energy is highly dependent on global economic growth but is also sensitive to geopolitical events.

Precious Metals

Gold, silver, platinum and palladium are the most important precious metals. Regarding the demand for precious metals, a distinction is made between the physical demand (industry and the jewelry trade) and the demand for precious metals as a commodity trading demand. The physical demand depends above all on economic growth, while trading demand is based on interest rate developments, currency fluctuations (mainly the US dollar because of the high trade volume in US dollars), and the level of inflation. In addition, gold is an attractive commodity trading product for traders especially in times of market uncertainty like inflation or recession.

Industrial Metals

Aluminum, copper, nickel, zinc, lead and tin are well-known industrial metals. Industrial metals, which are also known as base metals, are non-ferrous metals. Their main applications are in highly cyclical economic sectors such as the automotive, aviation, and construction industries. Early economic indicators are therefore crucial in the development of prices. China is the main consumer of industrial metals, meaning that Chinese economic data also plays an important role in trading industrial metal products.

Agriculture

Agricultural commodities are staple crops and animals produced or raised on farms or plantations. Most agricultural commodities include grains such as corn, wheat, and soybeans, oil seeds and other plants such as sugar or cotton.

The prices are formed from the interaction between supply and demand. If the demand outstrips the supply, it becomes necessary to fall back on inventories. This means that prices typically rise as availability of a commodity decreases, especially if reserves are tight.

Most agricultural commodities are products that meet basic needs and are therefore less dependent on economic growth than other cyclical trading commodities. Because agricultural commodities are renewable, the price cycles are typically shorter than for other commodities. The prices of agricultural commodities are also dependent on the weather conditions and the availability of water.

Financial trading commodities

Financial commodities refer to tradable financial instruments that derive their value from underlying commodities. These instruments allow traders to participate in commodity markets without physically owning the actual goods. Here are some common types of financial commodities:

Commodity Future Contract

These contracts represent an agreement to buy or sell a specific quantity of a commodity at a predetermined price on a future date.

Futures contracts are standardized and traded on organized exchanges. They allow traders to speculate on price movements or hedge against price fluctuations.

For example, a gold futures contract allows traders to speculate on the future price of gold without physically owning the metal.

Commodity Exchange-Traded Funds (ETFs)

ETFs are trading funds that track the performance of a specific commodity or a basket of commodities.

Traders can buy and sell ETF shares on stock exchanges, providing exposure to commodity price movements.

Examples include oil ETFs, agricultural commodity ETFs and precious metals ETFs.

Commodity Options

Options give the holder the right (but not the obligation) to buy or sell a commodity at a specified price (the strike price) on or before a specific date.

Call options allow buying, while put options allow selling.

Commodity options provide flexibility for hedging or speculative purposes.

Commodity Indices

These indices track the overall performance of a group of commodities.

Examples include the S&P GSCI (Goldman Sachs Commodity Index) and the Bloomberg Commodity Index.

Traders can use commodity indices to diversify their trading products.

What is The Commodity Trading Market?

A commodity market is the place where commodity traders meet to buy and sell commodities.

Commodities are traded on two types of market:

- The spot commodity markets refer to the physical market where goods are bought and sold for immediate delivery.

- Derivatives commodities markets are centralized exchanges where financial products based on various commodities are traded in the form of futures, forward and option contracts.

The Commodity Trading Exchanges

Commodities are traded on an exchange through futures contracts, stocks and ETFs, while they can also be bought and sold in their physical states.

A commodity exchange is an exchange, or market, where various commodities are traded. Trading on an exchange includes various types of derivatives and contracts based on these commodities, such as forwards, futures and options, as well as spot trades.

The largest commodity trading exchanges in the world are:

- CME Group

- Tokyo Commodity Exchange

- Euronext

- Dalian Commodity Exchange China

- Multi Commodity Exchange

- Intercontinental Exchange

- Africa Mercantile Exchange

What is Commodity Trading?

When you trade a commodity, you are speculating on the price change of raw physical assets, like gold or crude oil. Many parameters, especially supply and demand will impact the market price. Also there are millions of traders and corporations taking part in commodity trading with various goals, but we can split them into Hedgers and speculators.

Hedger

In commodity trading, a hedger is an individual trader or a firm that trades the actual physical commodities. Most of these hedgers are commodity producers, wholesalers, and retailers which are affected by fluctuations in commodity prices.

Hedgers trade future contracts to manage and mitigate the risk associated with price fluctuations. Their goal is not to profit from speculation but rather to avoid a negative consequence caused by price volatility in the commodities. This strategy allows them to protect their financial interest without speculating on price movements.

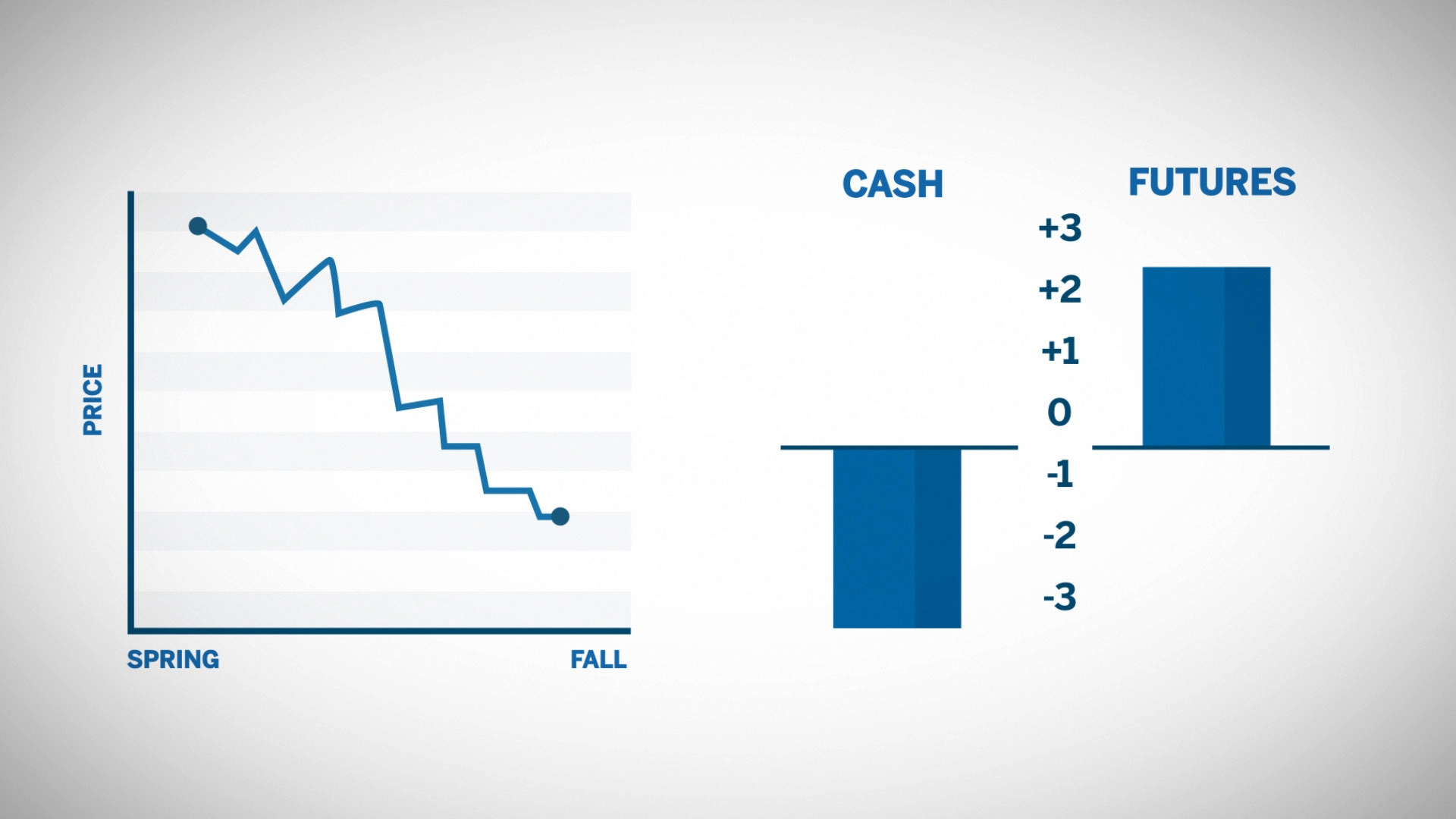

Imagine a farmer in the spring season who is concerned about the price for his crops when he sells in the fall. If prices drop at harvest, the farmer will have to sell the crop at a lower price.

One way the farmer could hedge his exposure would be to sell a corn futures contract. When harvest rolls around and the price of corn drops, he will see a loss in price when he sells his crop in the local market, however that loss would be offset by a trading gain in the futures market. If prices rallied at harvest, the farmer would have a trading loss in the futures market but his crop would be sold at a higher price in the local market.

In either scenario, the hedged farmer has added protection against adverse price movements. The use of futures enabled him to establish a price level well before he sells the crop in his local market.

Speculator

Speculators are primary traders in the futures market. A speculator is any individual or firm that accepts risk in order to make a profit. Speculators can achieve these profits by buying low and selling high. But in the case of the futures market, they could just as easily sell first and later buy at a lower price.

Obviously, this profit objective is easier said than done. Nonetheless, speculators aiming to profit in the futures market come in a variety of types. Speculators can be individual traders, proprietary trading firms, portfolio managers, hedge funds or market makers.

Ways to trade in commodity markets

There are several ways to trade commodities in the market. Let’s explore some of them:

Spot (cash transaction)

The physical commodity is bought on the spot. The trader receives the commodity immediately in exchange for cash. Individual traders can perform cash transactions in precious metals like gold, silver, platinum and palladium. In general, this is not possible for other commodities (you can’t buy a barrel of oil in spot 🙂)

Futures

A common form of commodity trading is futures, which are exchange-listed and standardized contracts for the delivery of a specific quantity of a commodity at a specific location, on a certain date and at a specified price. Futures are derivatives and traders first of all need to open a margin account in order to be able to trade in them. In addition, futures positions must be actively monitored because they need to be closed before maturity date in order to prevent an unwanted physical delivery.

Index products

Index products bundle several commodities futures, with a wide range of products and strategies available.

Besides the changes in the spot rate, the roll yields and the interest income have an impact on the index performance. Roll yields and losses are incurred when contracts have to be sold before their maturity dates and the earnings are reinvested in new contracts.

Structured products

Structured products provide access to commodity markets for investors who are not willing or able to open margin accounts. In commodity trading by a bank, commodity derivatives are traded and investable products are structured for private clients. The counterparty of the trader is the issuing bank. These products are available for a whole variety of underlyings and may contain barriers or other clauses

Funds / ETF / ETC

Fund managers invest the resources they have gathered from investors across the entire commodities sector in accordance with the fund prospectus. For example, they invest in commodity trading products such as futures, funds and also in stocks issued by commodity producing companies. There are also funds with physically deposited commodities and therefore involve no counterparty risk. Fund performance depends on the trading skill of the fund manager and the restrictions stated in the fund prospectus. Exchange traded funds (ETFs) are trading funds that are listed on an exchange and are traded in the same way as equities. Most ETFs are index funds that replicate an equity or bond index. Exchange traded commodities (ETCs) are also listed on an exchange. They provide a cost-effective way of trading in physical commodities or in a commodity index based on at least one commodity.

Equities

Trading the stocks of commodity producing companies makes it possible to indirectly trade commodities that are difficult to access. The development of the share price can deviate significantly from the performance of the underlying commodity.

What are the advantages of trading commodity?

Commodities are among the world’s top-rated products. Here are the reasons:

Liquidity: The large derivatives market for commodities, consisting of market makers, speculators, hedgers and corporations, makes it a highly liquid market. This means that traders can easily buy and sell, i.e., get in and out of their positions when they wish to do so. It also means the market is more open and transparent, that the cost of trading the instrument is cheaper than in illiquid markets and that it cannot be easily manipulated.

Some commodity trading products are more liquid than others. For example, gold and oil are among the most traded instruments worldwide. On the other hand, commodities like corn and soybeans are less liquid, and price movements could be more erratic.

Low margin: The margin deposit needed to start futures trading can be as low as 5-10% of the total value of the contract. A lower margin requirement allows traders to control larger positions with less capital being used as margin.

Hedging capabilities: Traders in the market who are exposed to physical commodities may seek to mitigate their risk by trading in the derivatives market. Rather than looking to profit from their positions, their goal is to protect themselves from adverse price swings.

Diversification: Investors who feel overexposed to a certain asset class, such as stocks can choose investments in the commodities space to diversify their portfolio. This can be done through: ETFs, Future positions, CFDs and shares of commodity-producing companies.

Protection against inflation or recession: Commodity prices tend to increase during times of high inflation. Gold is one of the most famous inflation hedges, and traders demand tends to spike when inflation is on the rise.

Why are commodities so volatile?

There are several factors that can contribute to instability in commodity markets. Although the more volatile the market, the more satisfied a daily trader 🙂.

- Supply and Demand Imbalances: When the supply of a commodity doesn’t match its demand, prices can fluctuate significantly. For instance, a disruption in production can lead to a spike in prices due to a shortage, while an oversupply can cause prices to drop.

- Political and Economic Instability: Changes in government policies, economic conditions, or natural disasters in major commodity-producing countries can disrupt production and cause price fluctuations.

- Global Macroeconomic Shocks: Since 1996, global demand shocks have accounted for 50% of the variance in global commodity price growth, while global supply shocks have accounted for 20%.

- Speculation and Market Manipulation: Like other financial markets, commodity markets are subject to speculation and manipulation, which can lead to volatility.

- Liquidity Issues: Some commodities may face issues with liquidity, affecting their volatility.

- Exposure to Natural Disasters and Geopolitics: The impact of natural disasters and geopolitical tensions can greatly influence commodity prices. (like Covid-19 situation which gold and other metal commodities surged significantly in that period 🙁)

Conclusions

In summary, commodities are essential for various industries and play a significant role in financial markets. Whether it’s gold, oil or agricultural products, commodities have a far-reaching impact on our daily lives and global economy. If you are new to commodity trading, it is vital that you educate yourself on how the market works and the risks involved. So if you are interested in trading commodity products and you are excited to learn the lifelong skill of trading Schedule Free discovery call.

FAQ

- What do you mean by commodity?

Commodities are unprocessed physical goods that result from mining, drilling or agriculture. Commodities are goods that are typically used as inputs in the production of other goods and services. - What is considered a commodity?

A commodity is a basic good used in commerce or in the production of manufactured goods. It is usually interchangeable with other goods or for money. Commodities are most often used as inputs in the production of other semi-finished or finished goods. - What is the difference between commodity and product?

Commodities are raw material or primary agricultural products that are interchangeable with other goods of the same type. While products refer to end result goods that are ready for consumption or use by consumers. Unlike commodities, products can vary significantly in terms of quality, features and brandings - What is the commodity type?

There are two major types of commodities: Raw materials and financial products. Raw materials are divided into 4 major categories such as Energy products (like natural gas and crude oil), Precious metals (like gold and silver), Industrial materials (like copper and irons) and agricultural products (like wheat and coffee). While financial commodities are tradable financial instruments that derive their value from underlying commodities such as future and options. - What are the top 3 commodities in the world?

Three of the most traded commodities are oil, gold, and base metals