The Coca-Cola Company, founded in 1886, is a global beverage leader headquartered in Atlanta, Georgia. The company built an iconic, globally recognized brand with its flagship product, Coca-Cola. Over the years, Coca-Cola has expanded its portfolio to include a diverse range of non-alcoholic beverages, such as sparkling and still drinks, waters, juices, teas, coffees, and energy drinks.

Operating in over 200 countries, Coca-Cola’s extensive distribution network ensures its products are available to billions of consumers daily.

Beyond its beverages, Coca-Cola has made significant strides in corporate social responsibility, focusing on environmental initiatives, health and wellness, and economic empowerment. Also, the company is committed to reducing its environmental footprint through initiatives like World Without Waste. Also, aims to collect and recycle the equivalent of every bottle or can it sell by 2030.

Coca-Cola Fiscal Q1 2025

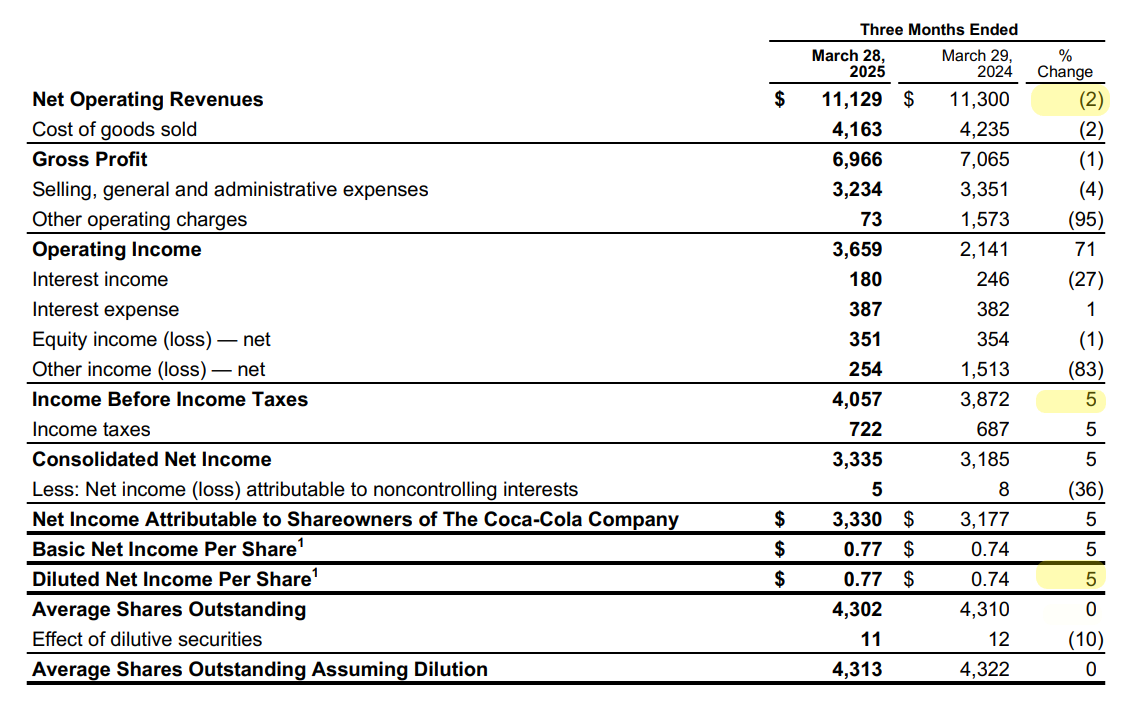

Coca-Cola (KO) reported its First Quarter 2025 results, highlighting a 6% growth in organic revenues. However, there was a 2% decline in net revenues. This missed revenue, impacted by currency headwinds and re-franchising bottling operations.

Key highlights include:

- Global Unit Case Volume: Increased by 2%.

- Net Revenues: Decreased by 2%.

- Organic Revenues (Non-GAAP): Increased by 6%.

- Operating Income: Grew by 71%.

- Operating Margin: Improved to 32.9% (was 18.9% last year).

- Comparable Operating Margin (Non-GAAP): Rose to 33.8% (was 32.4% last year).

- EPS (Earnings Per Share): Grew by 5%, reaching $0.77.

- Comparable EPS (Non-GAAP): Increased by 1%, reaching $0.73.

Coca-Cola gained value share in the nonalcoholic ready-to-drink (NARTD) beverages market by leveraging local opportunities.

Coca-Cola served over 180 million beverages at India’s Maha Kumbh Mela.

The company achieved double-digit volume growth in Türkiye through local campaigns.

In China, high single-digit growth was driven by Lunar New Year activations.

Outlook

Coca-Cola’s 2025 outlook highlights expectations for 5% to 6% organic revenue growth (non-GAAP) and 7% to 9% comparable currency neutral EPS growth (non-GAAP).

Moreover, the company anticipates manageable impacts from global trade dynamics and projects a higher effective tax rate of 20.8%. Currency headwinds of 2% to 3% are expected to affect comparable net revenues and EPS growth. Also, free cash flow, excluding the fairlife payment, is estimated at $9.5 billion, reflecting strong operational cash flows and controlled capital expenditures.

Boards Statements

James Quincey, Chairman and CEO of The Coca-Cola Company, highlighted the company’s quarterly performance as a testament to the success of its all-weather strategy.

While acknowledging challenges in key developed markets, he emphasized how the company’s global reach enabled it to effectively navigate a complex external environment. Also, Quincey expressed confidence in the organization’s ability to generate lasting long-term value by staying committed to its purpose and maintaining close connections with consumers.

Impact on the Stock Market

Coca-Cola’s (KO) stock reacted positively to its strong first-quarter earnings, with EPS of $0.73 meeting the expectations. Despite a slight revenue drop, the stock rose around 1% in premarket trading. In addition, investors remain confident in Coca-Cola’s ability to handle challenges like currency headwinds and global trade pressures, seeing it as a reliable and stable choice during uncertain times.