CFD trading offers the opportunity to speculate on the rising or falling prices of fast-moving global financial markets. This form of trading allows traders to experience the thrills of the markets without the need for ownership of the underlying assets. If CFDs sound a little unfamiliar with you, read the Beginners Guide to CFDs.

In this article we are going to explore CFD trading and learn how to trade CFDs step by steps and with practical examples. Equip yourself with the right knowledge, develop a robust trading plan, and join the ranks of successful traders. Don’t let this opportunity slip through your fingers.

Table of Contents

What Is CFD Trading?

CFD trading is a form of derivative trading that involves buying or selling a contract for difference (CFD) on an underlying asset, such as a stock, currency, commodity, or index. CFDs allow traders to speculate on the price movements of these assets without actually owning them. Instead, traders enter into a contract with a broker to exchange the difference in the price of the asset between the time the contract is opened and closed. The profit or loss made on a CFD trade is based on the difference in price, multiplied by the number of contracts traded.

CFD trading offers traders several advantages over traditional trading, such as the ability to go long or short, the use of leverage, and the ability to trade a wide range of underlying assets from a single platform.

How Does CFD Trading Work?

When you open a CFD position, you select the number of contracts (the trade size) you would like to buy or sell. Your profit will rise in line with each point the market moves in your favor. Although, there is a risk of loss if the market moves against you.

To understand how CFD trading works, let us consider an example. Suppose a trader wants to speculate on the price movements of Apple Inc. shares. They believe that the price of Apple will rise, and they decide to buy a CFD on Apple from their CFD broker. The trader purchases 100 CFDs at a price of $210 per share, making the total value of the contract $21,000.

Suppose a week later, the price of Apple shares has increased to $220 per share, and the trader decides to close their position. The trader sells the 100 CFDs back to the broker at the new price of $220 per share, making a profit of $1,000 (100 CFDs * ($220 – $210) = $1,000).

However, if the price of Apple shares had fallen to $200 per share, the trader would have made a loss of $1,000 (CFDs * ($200 – $210) = -$1,000).

Long and Short CFDs

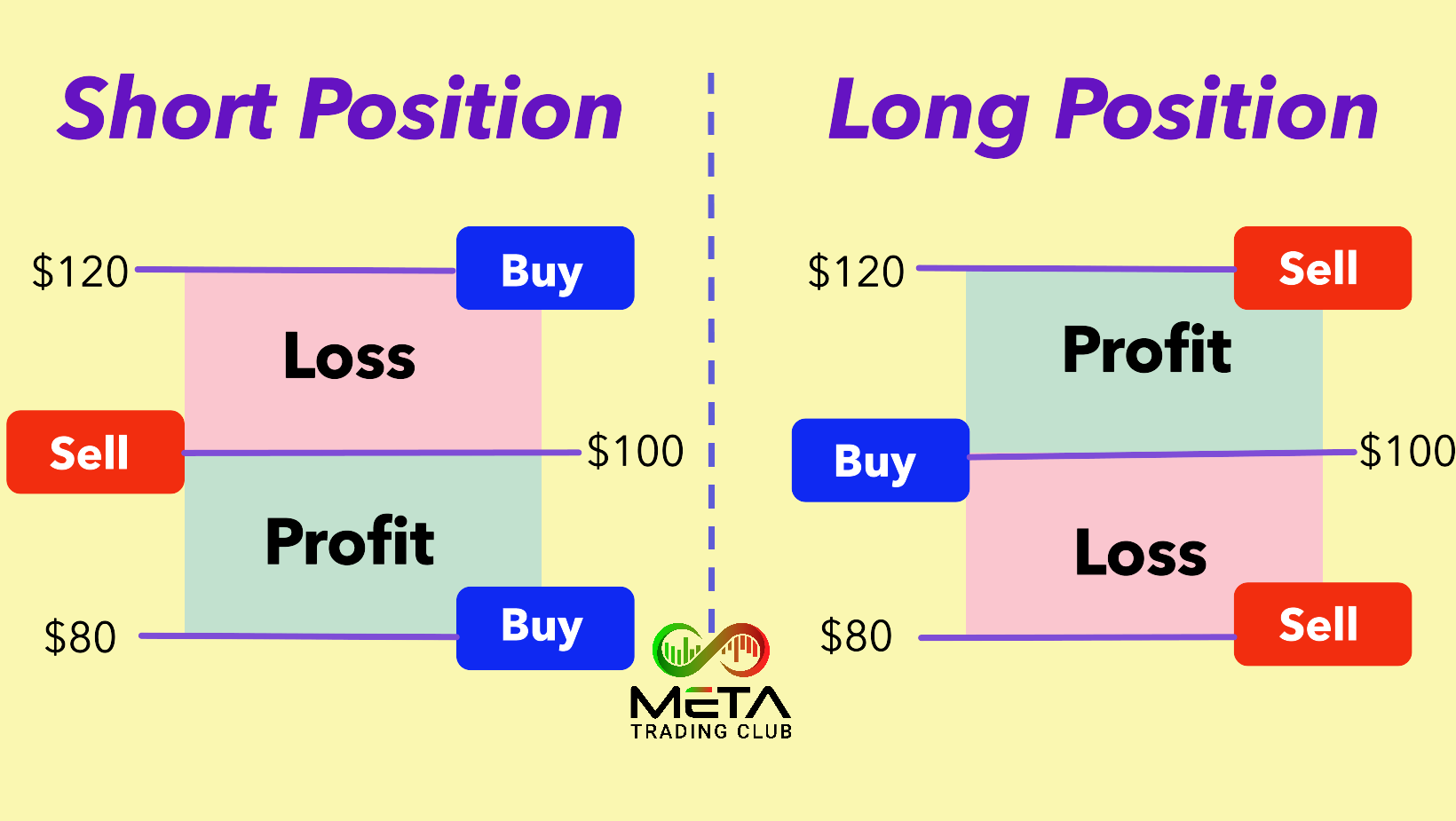

A CFD is composed of two trades. The first trade constructs the open position, which is later closed out through a reverse. However traders can opt to go long and buy if they think the asset’s market price will increase. Also, they go short and sell if they believe the market price will decrease.

In addition, if a trader believes the asset’s price will increase, their first trade will be a buy or long position, the second trade (which closes the open position) is a sell. Conversely, if the trader thinks the asset’s value will decline, their opening trade will be a sell or short position, the closing trade a buy. The trader’s net profit is the price difference between the opening and closing-out trade (minus any commission or interest).

Going long

If you think the price of an asset will rise, you will open a long (buy) position, profiting if the asset price rises in line with your expectations. However, you would risk making a loss if you were wrong.

For example, your expectation is that the value of Nvidia’s (NASDAQ: NVDA) stock will increase, and you want to open a long CFD position to take advantage of this opportunity. You buy 100 CFDs on Nvidia shares at $100 a share, so the total value of the trade will be $10,000. In addition, if Nvidia’s share price shoots to $120, you make $20 a share and totally $2,000 profit.

Going short

If you think the price of an asset will fall, you would open a short (sell) position, profiting if it falls in line with your prediction. However, once again, you would be risking making a loss if you were mistaken.

For example, you believe that Nvidia stock will decrease in value, and you want to profit from this movement. To do this, you can open a short CFD position (known as short-selling) and profit from a tanking market. This time, you have decided to sell 100 CFDs on Nvidia at $100 per share, which then proceeds to fall to $80 per share. Hence, you will have made a profit of $2,000, or $20 per share.

Leverage in CFD trading

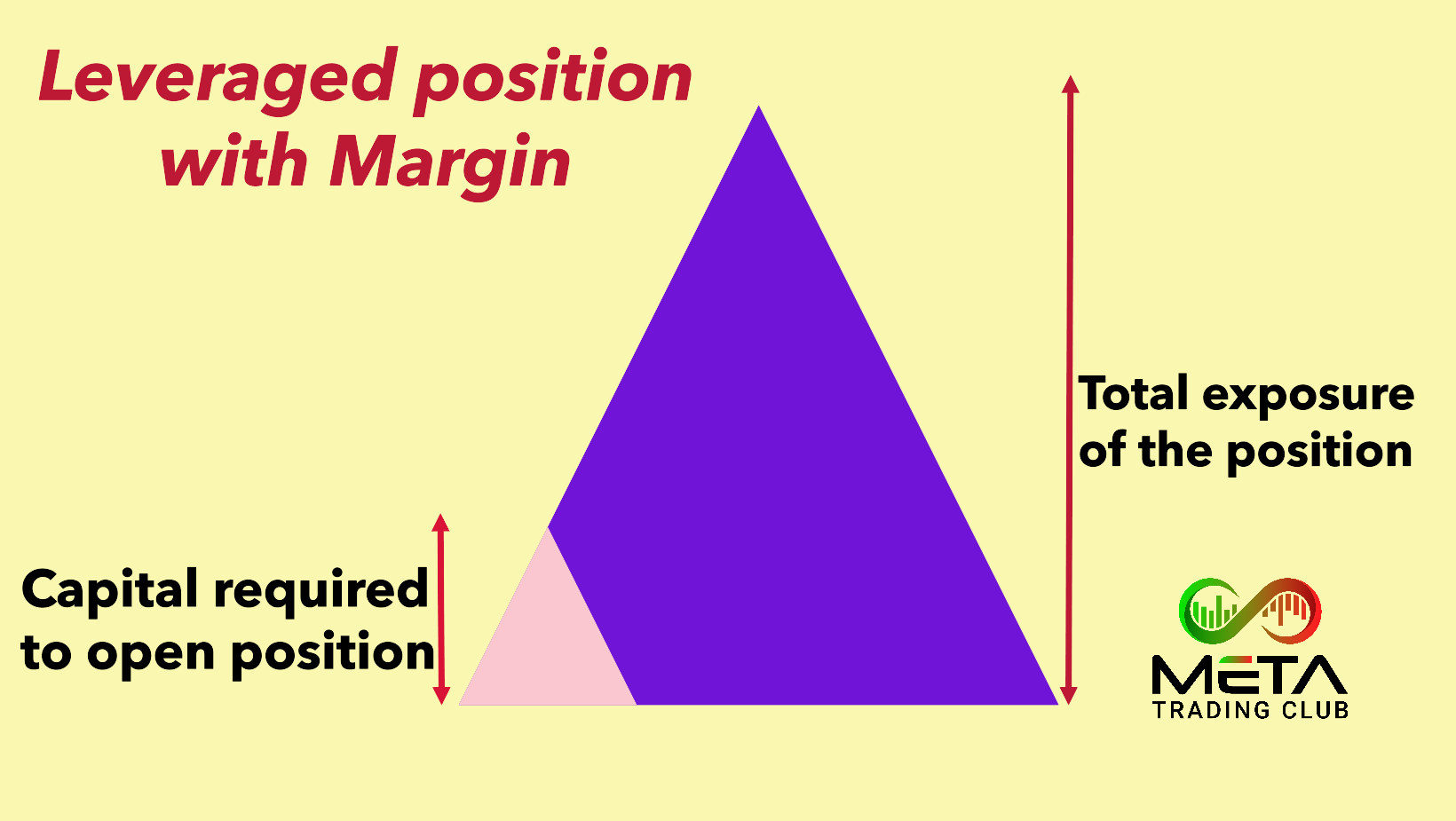

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

Leveraged trading is also referred to as trading on margin. A 10% margin means that you have to deposit only 10% of the value of the trade you want to open. The rest is covered by your CFD provider.

For example, if you want to place an order for $1,000-worth of Gold and your broker requires 10% of margin, you will need only $100 as the initial amount to open the trade.

Margin trading

Leveraged trading is also referred to as margin trading. This is because the funds required to open and maintain a position (known as the CFD margin) are only a part of the total trade size.

There are two types of margin you should be familiar with when trading CFD shares.

- Deposit margin is the amount required to open a position.

- Maintenance margin is equity required in your account to cover for your trade in case it starts making losses. The margin increases if the market price is rising and decreases when they fall. Equity goes up when running profits increase and goes down when running losses occur.

The margin required depends on your broker. Also, it varies between asset classes and within different regulated areas.

For example, you buy 100 CFDs on Tesla, Inc (TSLA) at $195. Your initial outlay is $3,900 ($195 * 100 shares * 20% margin). Then Tesla stock moves to $210. You decide to sell.

The profit from this trade is $1,500 (100 shares * (210 -195) = $1,500). Always remember that trading can amplify your profits but can also boost your losses.

CFD Trading Fees and Charges

The costs associated with CFD (Contract for Difference) trading can vary depending on the broker and the specific market being traded. Here are the main costs to consider:

Overnight Fees or Swaps

Overnight fees or swaps are the cost for using borrowed money or in other words, they are the interest rate that you get charged for the opportunity of having a leveraged trade open for longer than a day.

However, overnight fees, also known as swaps or rollover fees, are charges that traders incur when they hold a CFD (Contract for Difference) position open overnight. Also, swap fees are based on the swap rate of the product being traded on your brokerage account.

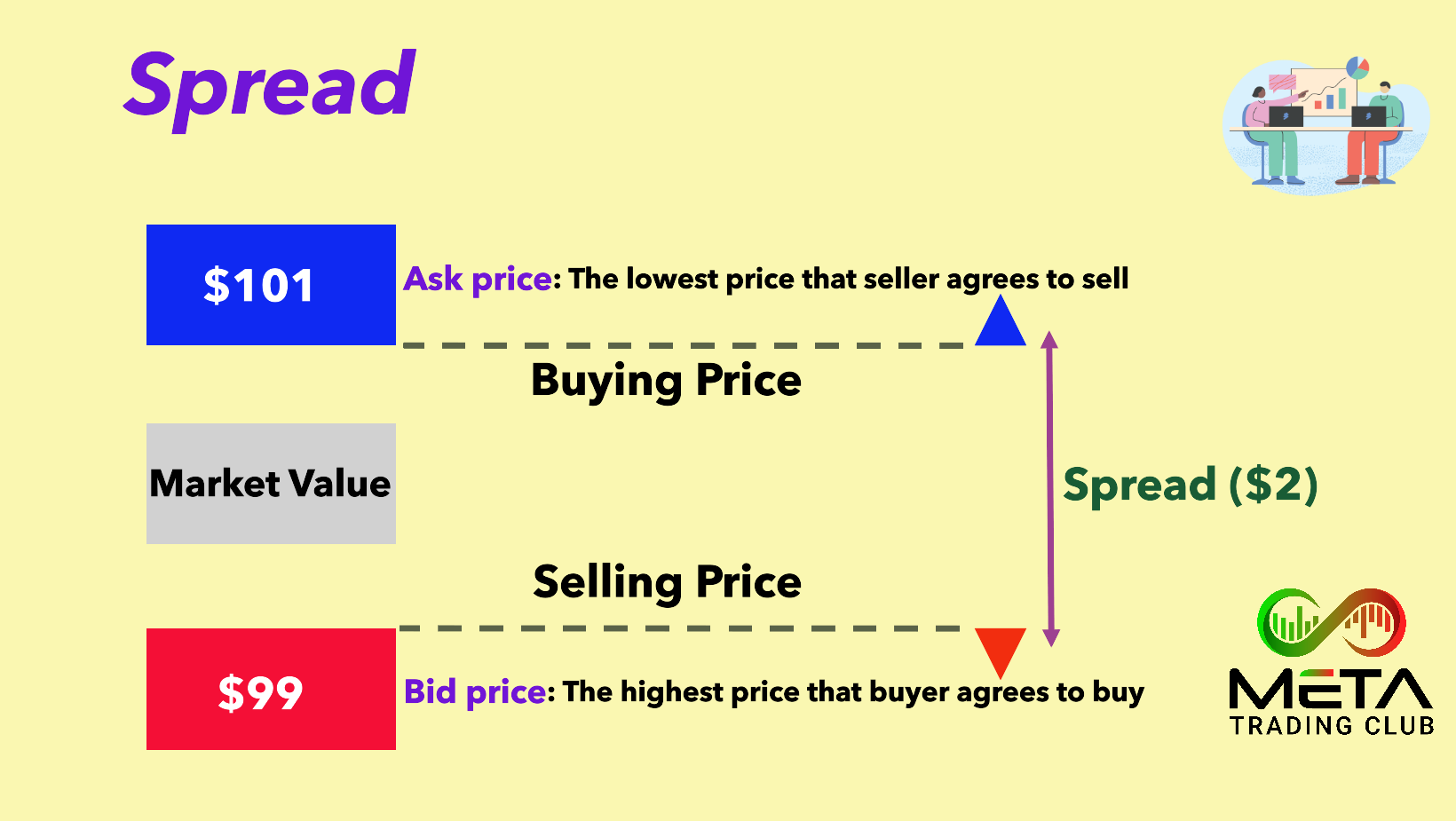

Spread

The spread is the difference between the buy and sell prices (bid and ask) and is precisely the reason why each trade opens in minus.

The price to buy will always be higher than the current underlying value and the sell price will always be lower. The difference between these prices is called the CFD spread.

In long position: The buy price (ask) is the price at which you start or open your position. Also, you close your position when you sell with the current bid price.

In short position: The sell price (bid) is the price at which you open your position. Also, you close your position when you buy with the current ask price.

For example, we have the following prices:

Selling price: $99 and Buying price: $101

The spread is the difference between those two prices, in our example it is $2.

Shorting at $99 when the buying price is at $101 means that you’re paying $2 in spread right from the start. Also, buying at a $101 price when the selling price is at $99 means that you’re paying $2 in spread right from the start.

In both prices you’re starting your trade with a disadvantage and that’s how market maker brokers make money, by quoting the buy and sell prices with spread in the middle.

Commissions in/out

They are charged every time you open a trade, and you close a trade. Usually, this commission is pure pain.

For example, if the minimum in/out commission of U.S. stocks CFDs is $10 on a particular broker. Moreover, if you open a 200 shares long trade and then you decide to close it partially by selling 100, then 100 more, you’ll have paid $30 in commissions.

Luckily this commission is not charged by many brokers. However, the funny thing is that usually when they charge it, it’s because they provide better execution than their competitors and have less conflict of interest against traders. There is no such thing as a free lunch.

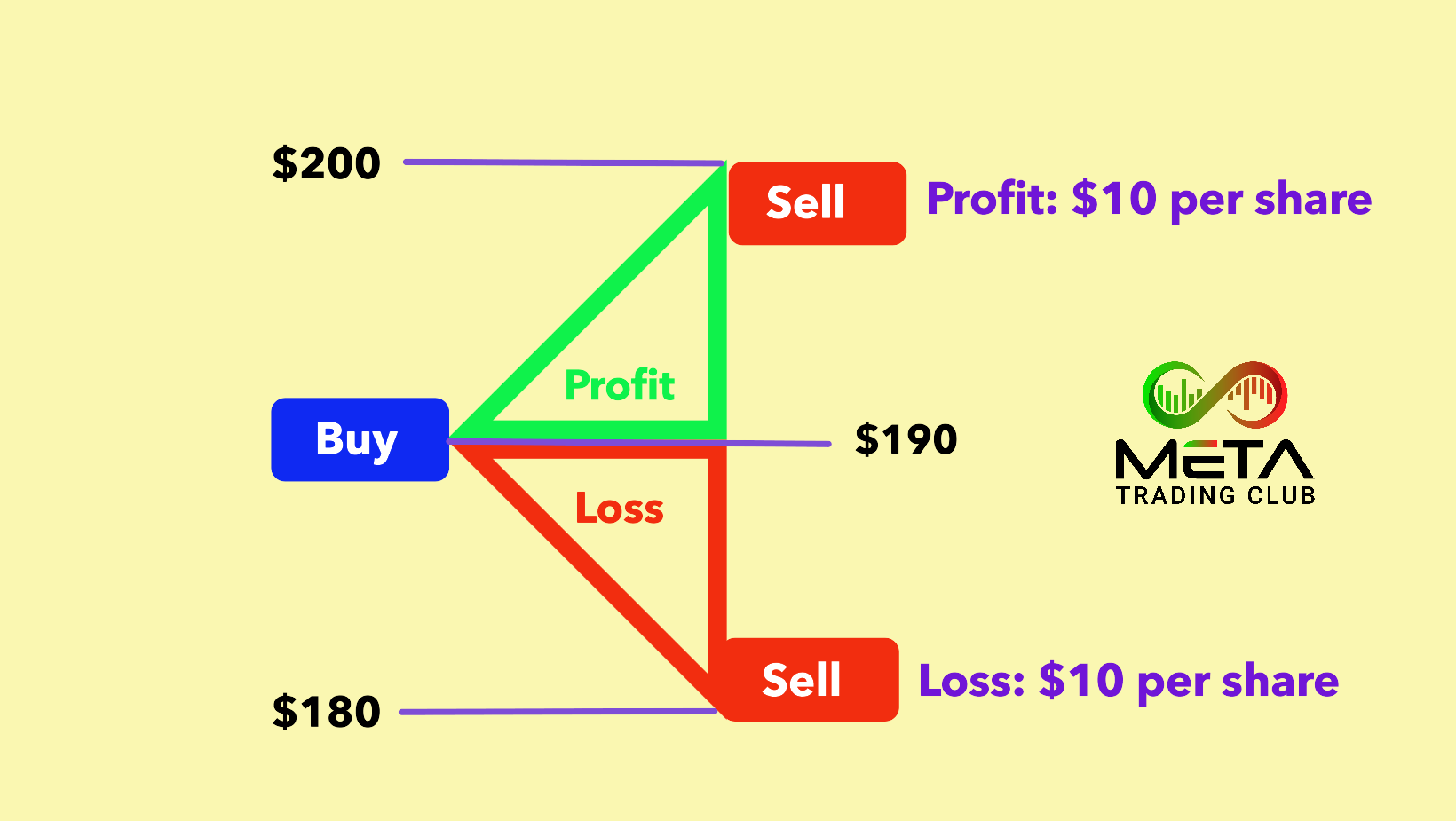

Profit and Loss

Once you’ve identified an opportunity and you’re ready to trade, you can open a position. From this point, your CFD profits or losses will move in line with the underlying asset’s price in real time. However, you’ll be able to monitor open positions on the platform and close them when you want.

Profit and loss can be calculated by multiplying the number of contracts you hold by the difference in price. Your profit to loss ratio, often abbreviated to P&L, can be defined using the following formula:

P&L = number of CFDs x (closing price – opening price)

For example, if you buy 100 CFDs on Amazon (AMZN) at $190 a share and sell them at $200, your profit would be $1000. This is illustrated below.

CFD Timeframes

With CFDs, you can either trade the spot market or with CFD futures. It is depending on the market that you’re looking to take a position on.

- Spot CFD trading (also known as cash trading) is best for shorter-term trading, as the spot price is the immediate real-time price of the asset. However, brokers charge an overnight funding fee for spot positions that are kept open until the next day. Also, Spot trading is best for shorter-term trading as the spot price is the immediate real-time price of the asset.

- CFD futures are best for medium to longer-term trades, as they enable you to speculate on the price that underlying asset will be on a specific date. Also, brokers don’t charge overnight funding on CFD futures. So, this makes it a popular choice for those who plan to keep positions open longer than a day or two.

How to Trade CFDs?

- Your first step towards trading CFDs is to learn how CFD works (as we discussed above).

- Create and fund a CFD trading account in a brokerage platform.

- Deposit funds into your CFD account.

- Choose your market and timeframe (Spot vs Futures)

- Decide whether to buy or sell. You’d buy if you thought the price was going to rise. However, you’d sell if you thought it was going to fall.

- Decide the position size (and margin) you want.

- Set your stops and limits (because a trade’s profit or loss is only calculated once it’s closed). Furthermore, stops and limits are parameters that close your trade for you automatically once it has reached the level of profit or loss you’re comfortable with.

- Monitor your CFD trade and close your position. Hence, your profit or loss is calculated by multiplying the amount the market moved by the size of your trade.

The Risks of Trading CFDs

Although CFD trading can provide traders with a range of opportunities to make profits, it also poses significant risks, which traders should be mindful of before entering the market.

One of the key risks associated with CFD trading is the use of leverage. Leverage allows traders to open larger positions with a smaller amount of capital, but it also amplifies the potential losses. This means that traders can lose more than their initial investment if the market moves against them.

In addition to leverage, traders should also be aware of the risks associated with the underlying asset they are trading. For example, there is a risk of price volatility, which can result in significant losses if the market moves against the trader. There is also a risk of liquidity, which can make it difficult to exit a position if there are no buyers or sellers in the market. Finally, there is a risk of political instability, which can impact the price of the underlying asset and result in losses for the trader.

CFD trading carries a high level of risk, and traders should be aware of the risks involved before trading. It is important to have a solid understanding of the market and the underlying asset being traded, as well as to use risk management strategies to mitigate potential losses. Boost your trading and risk management skills with our 4-week incubator program.

Final Words

As we wrap up this comprehensive guide on CFD trading, it’s important to reflect on the key lessons learned. CFDs offer a flexible and accessible way to trade various financial instruments, but they also require a disciplined approach to risk management.

Throughout this guide, we’ve explored the mechanics of CFD trading, from setting up a trade to closing positions.

Remember, successful CFD trading is not just about making profitable trades; it’s about making informed decisions based on thorough analysis and sound risk management practices. As you move forward, keep honing your skills, refining your strategies, and learning from each trade.

FAQs

- What is a CFD in trading?

A CFD, or Contract for Difference, is a popular form of derivative trading. CFD allows you to speculate on the rising or falling prices financial markets, such as shares, indices, commodities, and currencies. - Is CFD trading profitable?

CFD trading can be profitable, but it also carries significant risks. The profitability of CFD trading depends on the trader’s ability to speculate accurately on the price movements of financial markets. - Is CFD good for beginners?

CFD (Contract for Difference) trading can be appealing to beginners due to its accessibility and the potential to trade on margin, which allows for a larger exposure with a smaller initial capital. - Why is CFD trading so hard?

CFD trading can be challenging for several reasons. Leverage Management, risk management, market volatility and complex analysis are some of challenges that traders deal with. - Is it illegal to trade CFDs?

The legality of CFD trading varies by country. In some countries, like the United States, CFD trading is not allowed due to regulatory reasons. However, in many other parts of the world, including Europe and Australia, CFD trading is legal and regulated.