Table of Contents

Options strategies can be basic or sophisticated, with one or many option contracts and, in some cases, the underlying asset. These tactics are intended to mitigate risk, speculate on volatility, and profit from specific market conditions.

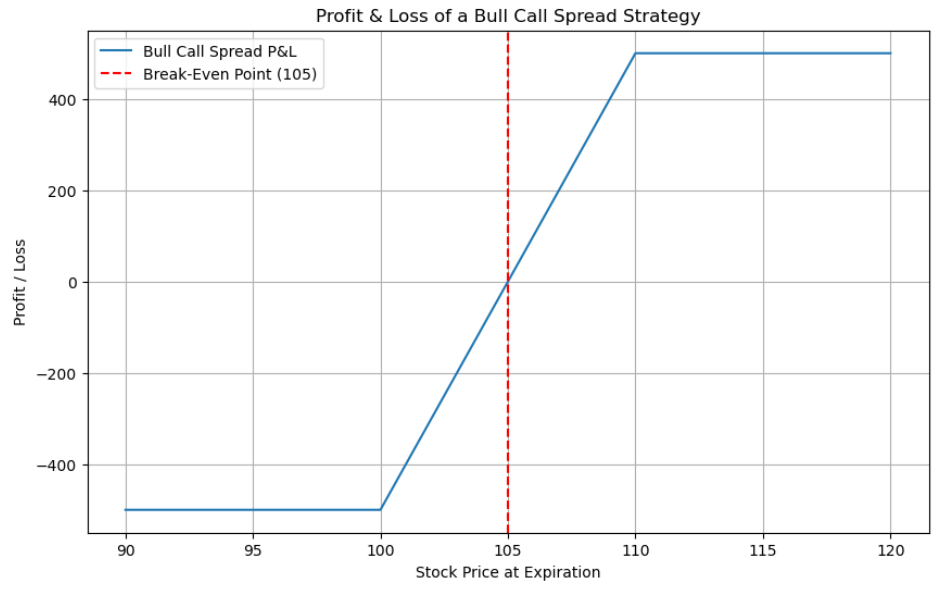

Bull Call Spread Strategy

How It Works

A bull call spread includes buying call options at a specific strike price and selling an equal amount of call options at a higher strike price. Both sets of call options cover the same underlying asset and have the same expiration date.

Objective

The fundamental purpose of using a bull call spread is to profit from a moderate increase in the price of the underlying asset. This technique is used by investors who are confident about the asset’s future but expect the price increase to be moderate rather than dramatic.

Risk and Rewards

The bull call spread approach restricts both the maximum possible profit and loss. The investor’s maximum profit is limited because the gain from the long call option (the call option purchased) is offset by the loss on the short call option (the call option sold) when the price of the underlying asset exceeds the strike price of the short call. In contrast, the maximum loss is restricted to the net premium paid (the difference between the long and short call premiums). This strategy effectively manages risk by reducing the net cost of entering the trade, making it a preferred option for investors seeking to balance their risk-reward ratio in scenarios of moderate market optimism.

You can see that this is a bullish approach from the P&L graph above. The trader must see an increase in stock price in order to profit from the trade in order for this technique to be correctly implemented. A bull call spread comes with the trade-off that your upside is constrained (despite the fact that the premium amount is lowered). Selling higher strike calls against outright calls is one strategy to counteract the increased premium associated with them. This is the construction of a bull call spread.

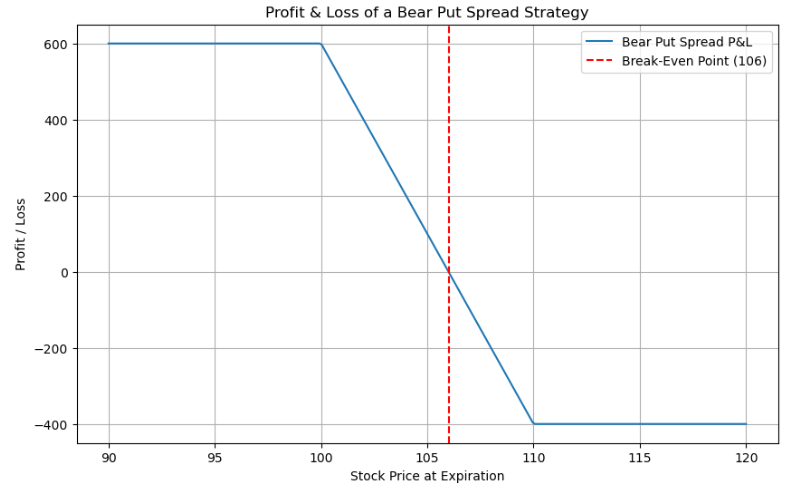

Bear Put Spread

How It Works

The bear put spread technique involves purchasing put options at a specific strike price while simultaneously selling an equal amount of put options at a lower strike price. These transactions are performed on the same underlying asset, and the options all have the same expiration date, resulting in a vertical spread.

Objective

This technique is used by traders who are pessimistic about the future price direction of the underlying asset and expect it to fall. It is intended to profit from a decrease in the asset’s price while operating within a controlled and predictable framework that restricts potential losses and gains.

Risk and Rewards

The key advantage of the bear put spread is its capacity to define the greatest potential loss and gain at the start of the deal. The maximum loss is limited to the net cost of entering the position, which is calculated as the difference between the premiums paid for the bought and sold puts. On the other hand, the maximum gain is limited to the difference between the two strike prices minus the trade’s net cost. This managed risk-reward ratio makes the bear put spread an interesting technique for traders looking to speculate on an asset’s price decrease while limiting their risk exposure.

You can see that this is a bearish approach in the P&L graph above. The stock price must drop for this method to be implemented properly. You have less upside but spend less premium when you use a bear put spread. Selling lower strike puts against outright puts is one strategy to counteract the high premium if they are pricey. This is the construction of a bear put spread.