Components of an Options Chain

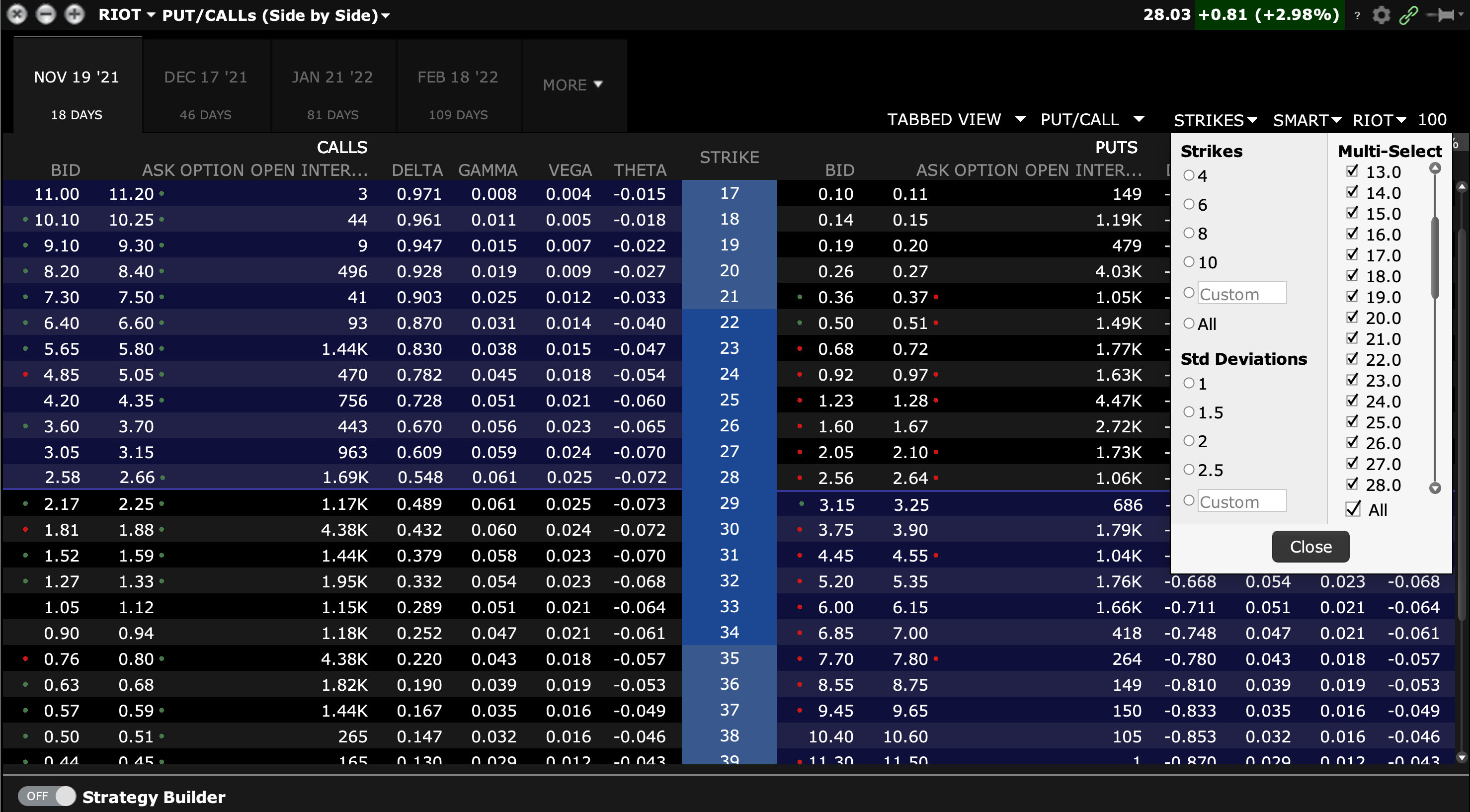

Call and Put Options: There are two divisions in an options table: one for call options and the other for put options. Generally, puts are listed on the right while calls are listed on the left.

Strike Price: The price at which an option may be exercised is known as the striking price. Options tables are often arranged according to strike price, making it simple to compare options with various strike values.

Expiration Date: This represents the date on which the option ends. Because it establishes the amount of time the option has to turn a profit, the expiration date is important. Because there is less time for the underlying asset to move in the desired direction, shorter-term options are typically riskier but also less expensive.

Premium: The amount that sellers receive for writing an option and what purchasers pay to obtain it together make up the option’s price, or premium. The price of the underlying asset, its volatility, the amount of time left until expiration, and interest rates are some of the variables that affect this price.

Bid And Ask Price: The price at which a buyer is willing to pay the most for an option is known as the bid price, and the amount at which a seller is willing to sell is known as the ask price. The spread, which is the difference between the ask and bid prices, can be used to gauge the liquidity of an option.

Volume: This indicates how many contracts were exchanged during the most recent or current trading session. Better liquidity and tighter bid-ask spreads are frequently correlated with high volume, which suggests strong interest in that particular option.

Open Interest: The entire number of outstanding option contracts that have been exchanged but not yet settled through an exercise, expiration, or offsetting trade is known as open interest. Greater liquidity is sometimes indicated by high open interest, which facilitates the entry or exit of positions.

How to Use an Options Chain

Choose Your Approach: Depending on your risk tolerance and market forecast, decide if you would rather buy calls, purchase puts, sell calls, or sell puts.

Choose the Expiration: Select an expiration date that fits both your forecast period and your plan. Recall that time decay causes options to lose value as they get closer to expiration.

Select the Strike Price: Choose a strike price that strikes a fair balance between the option’s cost (premium) and its likelihood of expiring in the money. This entails examining the price, volatility, and anticipated direction of movement of the underlying asset.

Evaluate Liquidity: Examine the volume and open interest of the options at the strike prices and expirations you have chosen in order to assess liquidity. It will often be simpler for you to initiate and exit deals when the numbers are higher.

Examine the Premiums: To gain an understanding of how the market values the option and the cost of entering the trade, compare the ask and bid prices. Your choice may also be influenced by the difference in these prices; a smaller difference indicates that you are probably receiving a more equitable price.

Meta Trading Club is a leading educational platform dedicated to teaching individuals how to trade and invest independently. Through comprehensive educational programs, personalized mentorship, and a supportive community, Meta Trading Club empowers traders to navigate financial markets with confidence and expertise.