The start of the week has been relatively calm; however, the crypto market, particularly Ethereum, experienced a sharp surge, increasing by nearly 20%. Gold, after climbing to the $2450 range, has retraced, while oil prices have shown negative movement. Indices, after surpassing their historical highs, are now forming a Point of Control (POC). This setup indicates potential consolidation or distribution phases in the market.

Economic Events:

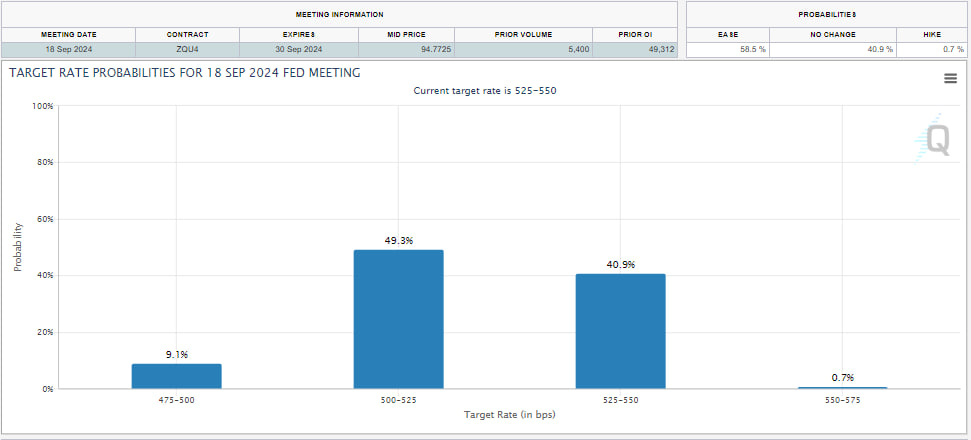

As highlighted in the weekly report, this week the market is heavily influenced by speeches from Federal Reserve officials. Market expectations for a rate cut in September have risen to 52%. This sentiment has contributed to the weakening of the dollar index, which is now approaching the 104 level. The current risk-on sentiment in the markets reflects a cautious optimism. The continued weakening of the dollar index could see it fall further, affecting various asset classes.

Source : CME

Earning Calendar and S&P 500 Analysis:

The most significant event today is Nvidia’s earnings report. Yesterday’s market activity was subdued, with low trading volumes and little price movement since last week’s CPI report. However, this is expected to change today as the VIX pinning passes and the Fed minutes at 2 PM ET provide new information for the markets.

Fed official Chris Waller added to market speculation by suggesting a delay in rate cuts to later this year or early next year. He hinted that the neutral rate might be higher than previously expected, a topic likely to be expanded upon in Friday’s speech. This aligns with the June dot plot preview, which may show only one rate cut in 2024 and potentially higher long-run rates, implying fewer cuts in 2025.

Yesterday, the VIX1D and the 30-day VIX were down, but if there were a 2-Day VIX, it would likely show higher implied volatility. Fixed strike volatility for the S&P 500 for May 23 expiration indicated increased implied volatility (IV) across the curve, particularly skewed towards rising S&P 500 prices. This suggests bullish positioning ahead of Nvidia’s (NASDAQ: NVDA) earnings report, with call delta buildup outweighing put delta.

If Nvidia delivers exceptional results, exceeds guidance expectations, or announces a significant stock split, market bets on further upside might be rewarded. However, the outcome remains uncertain. The market stalemate is expected to break today or Thursday, with a significant move likely. Given the overall low implied volatility, a substantial market move could come as a surprise, especially if it is to the downside.

Us500:

NVDA :

Gold (XAUUSD):

Gold prices have surged, breaching historical highs above $2,400 per ounce following a brief correction in April. Silver is also showing strong potential, with room for further gains even though it has not yet peaked.

Several factors are driving the upward trend in gold:

- Weakening Dollar: A softer dollar makes gold more attractive to foreign buyers, as it becomes less expensive.

- Declining Bond Yields: Lower U.S. bond yields reduce the opportunity cost of holding non-yielding assets like gold, enhancing its appeal.

- Geopolitical Tensions: Ongoing geopolitical concerns, particularly following the death of Iranian President Raisi, have increased the safe-haven demand for gold.

With these factors in place, analysts are forecasting further gains for gold, with the next significant target being $2,500 per ounce.

Gold continues to shine as favorable conditions in the bond market bolster its attractiveness. This shift is largely due to the recent decline in U.S. Treasury yields, especially the key 10-year note. Since the start of May, these yields have been falling, reversing the upward trend that dominated 2023.

Lower bond yields make gold more appealing as an investment. When yields drop, investors often turn to gold, which, despite not offering a fixed return, is viewed as a safe haven in times of economic uncertainty.

Foreign Exchange Market (FOREX):

The Reserve Bank of New Zealand (RBNZ) held its interest rate steady, as predicted, but issued a notably hawkish statement. This stance is likely to bolster the New Zealand dollar, which benefits from strong economic ties with China, currently undergoing a robust recovery. This economic resurgence in China is poised to significantly support New Zealand’s economy.

Japan’s 10-year government bond yield surpassed 1% on Wednesday for the first time since May 2013, driven by traders betting on further policy tightening by the Bank of Japan (BOJ) this year. Last week, the BOJ surprised the markets by reducing the amount of JGBs it offered to buy in a regular operation, sparking speculation about future quantitative tightening. The BOJ faces pressure to raise interest rates again amid sharp yen depreciation. These developments follow the BOJ’s March decision to end its negative interest rate policy and abandon its yield curve control program. Despite this, traders remain cautious, expecting the BOJ to manage monetary settings carefully to prevent yields from rising too quickly. JGB yields were also pressured by weak demand in a recent auction of 40-year bonds.

Ethereum (ETH):

Ethereum’s price surged to a two-month high of $3,824 amid rumors of the SEC potentially approving spot Ether ETFs.

Ethereum (ETH), the world’s second-largest cryptocurrency, experienced a significant price surge, reaching a two-month high of $3,824, following rumors that the U.S. Securities and Exchange Commission (SEC) may soon approve spot Ether exchange-traded funds (ETFs).

The news sparked a bullish sentiment in the cryptocurrency market, with Ethereum’s price increasing by over 22% within a few hours and the overall digital asset market gaining 7.5%, reaching a market cap of $2.6 trillion with a 130% increase in trading volumes.

The cryptocurrency market showed significant gains, with Ethereum’s price surging by 21.93% to $3,796.83, Bitcoin (BTC) hitting $70,338.38, and other altcoins like Dogecoin (DOGE) and Cardano (ADA) also rising.

Reports suggesting the SEC might approve Ether ETFs soon contributed to the price surge, with Ether’s price rising by 24.50% to around $3,790, the highest level in two months.

The primary reason behind Ethereum’s significant price increase is the growing speculation about the SEC nearing approval for spot Ether ETFs.

Two main factors drove Ether’s recent price surge: increasing chances of U.S. approval for a spot Ethereum ETF and a DOJ indictment reducing the likelihood of ETH being classified as a security. The SEC’s reported engagement with cryptocurrency exchanges and ETF issuers to update their filings has significantly raised investor confidence.

At the same time, a sharp increase in Ether Futures open interest and funding rates indicated growing investor interest and bullish sentiment towards Ethereum.

UK Oil Brent:

Brent crude futures dipped below $82.5 per barrel on Wednesday, marking a third consecutive session of declines due to uncertainties surrounding the timing of US Federal Reserve interest rate cuts, which have clouded the demand outlook. Recent remarks from Fed officials have emphasized the need for caution and confidence that inflation will return to 2% before cutting rates. Additionally, industry data revealed an unexpected increase in US crude inventories by 2.48 million barrels last week, against an anticipated decrease of 3.1 million barrels. The diminished risk premium from Middle Eastern tensions, as oil supplies remain unaffected, also contributed to the decline. Market participants now focus on the upcoming OPEC+ meeting on June 1, where major producers are expected to extend output cuts to prevent oversupply and support prices.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.