How It Works.

The long call butterfly spread is a complicated options strategy that incorporates characteristics of both bull and bear spreads while employing three different strike prices. To execute this strategy, an investor will buy one in-the-money (ITM) call option at a lower strike price, sell two at-the-money (ATM) call options, and purchase one out-of-the-money (OTM) call option. All of these options involve the same underlying asset and have the same expiration date. The approach is designed to ensure that the distance between the lower strike price and the ATM strike price is equal to the distance between the ATM strike price and the higher strike price, resulting in balanced “wings” of the butterfly.

Objective

The fundamental purpose of a long call butterfly spread is to profit from a stock or asset with a generally constant price until the options expire. This technique is best suited for instances where an investor expects little to no major price fluctuation in the underlying asset. The investor enters this method with a net debit, which means that the cost of the long positions surpasses the premiums earned from the short positions, and the goal is to maximize profit when the stock price is close to the middle strike price at expiry.

Risk and Rewards

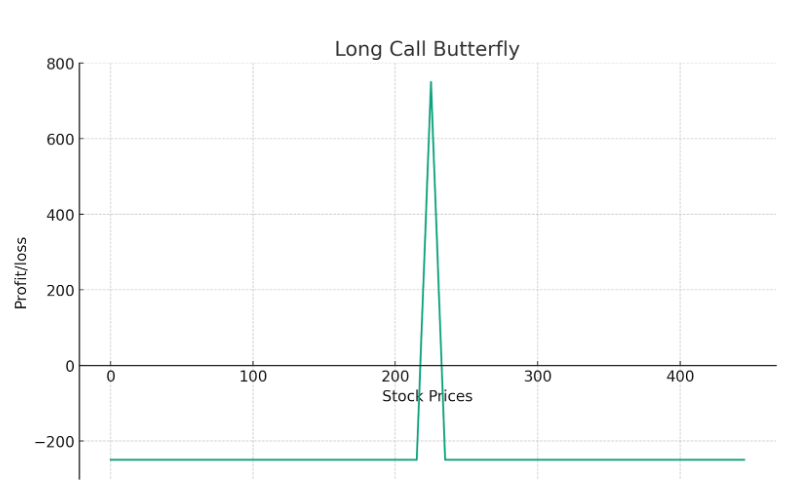

The long call butterfly spread has a limited risk/reward potential. The biggest loss an investor can incur is the net debit used to construct the spread. This loss would occur if the stock price at expiration is less than the lower strike price or greater than the higher strike price, leading all options to be either out-of-the-money or, in the case of the lower strike, having the two positions cancel each other out in value.

The highest profit happens when the stock price reaches the strike price of the ATM call options at expiration. This scenario enables the investor to profit from the greatest difference between the lower long call and the two short calls, with the highest strike long call expiring worthless, optimizing the spread’s value. This strategy is favored for its defined risk and reward, making it a preferred choice for investors who seek a low-risk, moderate-reward setup predicated on market stability.