In the dynamic realm of finance, the term “tradable products” encapsulates a vast array of assets, each with its own unique characteristics and potential for profit. From commodities to stocks, forex to cryptocurrency, and indices to options, these tradable products serve as the lifeblood of global markets, fueling investment opportunities and shaping economic landscapes. While commonly referred to as securities within the trading community, the term “tradable products” is much more beginner friendly, though unprofessional.

Embarking on a journey through this intricate web of tradable products, one finds themselves navigating a maze of terminology, strategies, and market dynamics. To simplify this complex landscape, we present a comprehensive guide designed to equip both novice and seasoned traders with the knowledge needed to thrive in the world of securities.

Throughout this article, we delve into each tradable product, shedding light on its defining features, trading mechanisms, and inherent risks. Whether you’re intrigued by the allure of futures contracts or seeking to understand the intricacies of government bonds, our guide serves as your roadmap to mastering the diverse universe of securities. So, buckle up and prepare to embark on a journey of discovery as we explore the fascinating realm of tradables.

Table of Contents

Main Types of Financial Securities

In the world of trading, individuals have a plethora of options when it comes to choosing tradable securities that align with their investment objectives and risk tolerance. There are nine primary types of tradable securities, each offering distinct features and opportunities for investors. These include commodities, forex (foreign exchange), stocks, indices, ETFs (exchange-traded funds), cryptocurrencies, futures, options, and bonds.

Each of these nine asset classes has its own set of advantages and disadvantages. Commodities, for instance, offer tangible assets like gold, oil, and agricultural products, providing diversification and a hedge against inflation. However, they can be influenced by factors such as geopolitical events and supply-demand dynamics, leading to price volatility.

Forex trading, on the other hand, enables investors to trade currencies from around the world, offering high liquidity and the potential for profit in both rising and falling markets.

Nonetheless, forex trading carries inherent risks related to geopolitical events, economic indicators, and currency fluctuations. One unique property of forex is its 24/5 trading availability, allowing investors to trade around the clock, five days a week.

Stocks represent ownership in a company and can offer capital appreciation and dividends. However, they are subject to market volatility and company-specific risks. Indices, such as the S&P 500 or Dow Jones Industrial Average, provide exposure to a basket of stocks, offering diversification benefits and a benchmark for performance.

Nevertheless, they can be impacted by broader market trends and economic factors. One unique property of indices is that they allow investors to track the performance of entire market segments or industries without having to purchase individual stocks.

ETFs combine features of stocks and mutual funds, providing diversification, liquidity, and relatively low expense ratios. Despite these advantages, they can be susceptible to tracking errors and may not always perfectly mirror the underlying index.

You can find the list of securities we will go through in the list below:

- Commodities

- Forex

- Stocks

- Indices

- ETFs

- Cryptocurrencies

- Futures

- Options

- Bonds

Without further ado, let’s jump on the first security traded by the human race: Commodities.

What is the Commodity Market?

Without a shred of doubt, Trading Commodities has the longest history among all other Securities. Since the dawn of mankind, our destiny has been tangled with Trading commodities, massive infrastructures like the Silk road were built for easier and more accessible commodity trading, mercantile guilds were created, glories empires such as the ancient Carthage rose to power for the sole reason of extensive Commodity Trade chains via land and sea.

With the passage of time and parabolic growth of population, nowadays the ever-increasing demand for commodities is at its peak. Although for the majority of human history, physical goods were traded in person, some merchants grew a knack for trading via their intermediary agents. These middlemen buy raw goods or material from farmers, miners or other traders and sell them with a higher price to a company or Factory that needs the material to produce goods with.

The Commodity market cap in the 21st century may seem alien to ancient traders, but at its core, modern commodity trading is not that much different, except for the new technologies we use to ease the trades.

The Commodity market consists of two major categories, the hard and the soft commodities. The hard commodities refers to Energy, Metal Products and raw material(e.g. lumber) while soft commodities are agricultural like coffee, wheat, beans and livestock products. Some sources also put commodities in four categories of metal, energy, livestock and agricultural products.

But which commodities each category covers? Well the list is as follows:

- Metal: Gold, Silver, Copper, etc

- Energy: Crude Oil, Charcoal, Petroleum, etc

- Livestock: Dairy products, meat, livestock

- Agricultural Products: Wheat, Coffee, Soybeans, Corn, etc

Since ancient times, traders were concerned about having enough foreign currencies to catch every buying opportunity as they come. This itself created a market between traders who had foreign currencies at their disposal and those who were in need of it, a market that nowadays is the largest and the most liquid of all others, the Forex Market.

What is the Forex Market?

The foreign exchange market aka Forex, not only has the most liquidity, but it also is one of the oldest markets after commodities. Back in the days of ancient merchants, the exchange rate between different currencies was often determined by factors such as the relative scarcity of each currency, the perceived value of the metal or material used in the coinage, and the prevailing economic conditions in the respective regions.

However, unlike the Commodity market, Forex has come a long way since then. In the past, the Forex market was closed off to the masses and only banks, government organizations and other elites had access to it.

But as time passed by, many individuals showed interest in Forex trading and with the help of brokers, the Forex market was finally opened to public and retail traders.

In the Forex market you’ll get the chance to trade over a hundred currency pairs though only a handful of them get considerable trading volume.

It is recommended to trade these seven major pairs only since they get the highest trading volume and usually have the least price spread. But what are these seven popular currency pairs? Well, we ranked them based on the trading volume they get from highest to lowest:

- Euro and U.S Dollar (EUR/USD)

- U.S Dollar and Japanese Yen (USD/JPY)

- British Pound and U.S Dollar (GBP/USD)

- U.S Dollar and Swiss Franc (USD/CHF)

- Australian Dollar and U.S Dollar (AUD/USD)

- U.S Dollar and Canadian Dollar (USD/CAD)

- New Zealand Dollar and U.S Dollar (NZD/USD)

These major currency pairs are also referred to as G7 paris.

Although these 7 seven currency pairs eat the most trading volume of the forex market, there are other minor currency pairs with relatively high trading volume. We will cover the Forex market in depth in the near future so stay tuned for our upcoming articles at Meta Trading Club.

A very common question among traders and investors alike is where the value of a currency comes from? Unlike Commodities that gets its value mainly from supply and demand, a currency’s value comes from multiple variables such as:

- Interest Rates

- Key economic indicators (like GDP growth, employment rates, trade balance, and inflation rates)

- Political stability and the perceived strength of a country’s institutions

- Market Sentiment

- Central Bank Policies

To trade in the forex market first you need to find a proper broker with low commission, very close spread, supporting all major currency pairs, and most importantly regulated by trusted regulatory agencies. After that comes creating a broker account well suited for your needs and connecting it to a trading software such as MT4 or MT5.

Passing the birthplace of trading, the Commodity market, we got to the forex market. But what comes next? A market which is younger by centuries, a market with endless opportunities, a market that legends were made in, the Stock Market.

What is the Stock Market?

Imagine a company so massive that even other foreign militaries fear the might of its security forces. In the 1600s London, this company was the birthplace of the Stock market.

The East India Company, formally known as the Governor and Company of Merchants of London trading into the East Indies, was created by a group of English merchants and investors. It was granted a royal charter by Queen Elizabeth I on December 31, 1600, making it the first English joint-stock company, with the aim of trading with the East Indies, primarily India, Southeast Asia, and China.

It was the first company with shared ownership and people could buy or sell their shares in what we call the stock market. Each share represents a percent ownership of the company, some shares simply appreciate in value and traders can cash out the difference and other shares pay dividends.

Stock market is much larger and more diverse compared to its younger days. You as a trader or investor can pick any stock in various fields such as:

- Technology

- Finance (including banks, insurance, and financial services)

- Consumer goods (including retail, food, and beverage)

- Healthcare

- Consumer services (including hospitality, entertainment, and leisure)

- Energy (including oil and gas companies)

- Basic Materials (including mining and chemicals)

- Real Estate

- Industrials (including manufacturing, aerospace, and defense)

- Utilities

- Telecommunications

Ownership of a stock is not limited to selling it high for a profit or receiving dividend yields, some also get you the right to vote on various company policies. But should you own company shares by investing your money for the long haul or trade it with short to mid term profits in mind? That mainly depends on your personality and trading strategy.

If you are serious about upping your trading game then you need to evaluate your personality, risk tolerance, ability to make decisions under pressure, and develop strategies to overcome market challenges. All of these aspects can be mastered through the Meta Trading Club’s 4-week plan. Our comprehensive program not only covers essential market concepts but also tailors strategies to your individual personality traits. Take advantage of our special offer, which ends in 14 days, and seize the once-in-a-lifetime opportunity to join a community of successful traders.

Although Stock market is more diverse and holds more opportunities of making money, it also holds relatively higher risk to safer options such as Bonds and savings accounts. This issue can be dealt with either by choosing high volume stocks or other asset classes, Such as Indices and ETFs. These may be a mouth full, but in heart are nothing but a measurement tool and a jar of gummy bear.

What are Indices?

Back in the early days of the stock market, indices emerged as crucial tools for investors, bringing order to the chaos of trading. These early indices were pioneers, providing investors with a benchmark to measure the performance of their investments in the bustling landscape of Wall Street. Their goal was simple: to offer clarity and guidance in an otherwise murky and unpredictable market.

As the stock market grew, so too did the need for more sophisticated indices. Enter the Dow Jones Industrial Average, which made its debut in 1896. Created by Charles Dow and Edward Jones, this index was a game-changer, tracking the performance of 12 of the largest publicly traded companies in the United States at the time. It was like shining a spotlight on the biggest players in the market, giving investors a clear picture of how these key companies were faring.

The Dow Jones Industrial Average quickly became the gold standard of indices, setting the stage for the modern era of index investing. It’s a simple yet effective approach to tracking the market, served as a blueprint for future indices to come. Over time, the Dow expanded to include more companies and evolved to reflect the changing landscape of the stock market, but its core purpose remained the same: to provide investors with a reliable measure of market performance.

In the modern trading world, a plethora of indices exists, each catering to different segments of the market and providing investors with unique insights. These indices range from broad-based benchmarks like the S&P 500 and the NASDAQ Composite to specialized indices focusing on specific sectors such as technology, healthcare, or energy. Together, they form a comprehensive toolkit for investors seeking to understand and navigate the complexities of the stock market.

Here are some of the top indices many financial activists use to measure stock performance:

- S&P 500

- NASDAQ Composite

- Dow Jones Industrial Average

- Russell 2000

- FTSE 100

- Nikkei 225

- DAX 30

- Hang Seng Index

Index trading offers several advantages over stock trading. For starters, it provides exposure to a diversified portfolio of stocks, reducing the risk associated with individual company performance. Additionally, trading indices can be more cost-effective and efficient than trading individual stocks, especially for investors looking to gain broad market exposure.

However, index trading also has its drawbacks. Unlike stock trading, where investors can capitalize on the potential growth of individual companies, index trading limits the upside potential to the overall performance of the market segment. Moreover, index trading can be subject to market volatility and external factors that affect the broader market, making it important for investors to carefully manage risk and stay informed about market trends.

As we delve further into the world of securities, it’s essential to explore the various instruments available to capitalize on market opportunities. One such instrument is Exchange-Traded Funds (ETFs), which harness the power of indices to provide investors with diversified exposure to specific market segments or investment strategies.

ETFs offer a seamless transition from index trading, allowing investors to access a wide range of assets while enjoying the benefits of liquidity, transparency, and cost-effectiveness. Let’s dive deeper into the world of ETFs and uncover how they can enhance your investment portfolio.

What are ETFs?

You are a survivor in post-apocalyptic earth. After days of thirst and starvation you come across a shop, untouched by the raiders and other survivors of the end times. Would you rather loot drinkables or food? Or maybe you are sick or wounded and in need of immediate medical attention so you grab as many antibiotics as possible? Regardless of your situation, the smart decision would be to manage your storage and loot a combination of all the necessities you can lay your hands on.

Managing your portfolio might not be a life or death situation, but surely has immense and long lasting effects on your life. ETFs make this management easy by allowing you to get pieces of all goodies and make the most of resources you have, minimizing risks while maximizing the profit potential.

In the mentioned survival situation, you can imagine ETFs as a survival package, perfectly organized with supplies maximizing the time you can stay alive by taking it. So instead of manually picking up supplies and trying your best to keep the balance of drinkables, medicine and non-perishables, it makes the most sense to simply pick as many survival packages as possible.

Let’s snapback to reality, ETFs or Exchange-Traded Funds are investment funds that are traded on stock exchanges, similar to individual stocks. They are designed to track the performance of a specific index, commodity, bond, or basket of assets. ETFs offer investors the opportunity to gain exposure to a diverse range of assets, including stocks, commodities, and bonds, in a single investment. They provide liquidity, transparency, and often have lower expense ratios compared to traditional mutual funds. Some of the most famous ETFs are as follows:

- SPDR S&P 500 ETF (SPY)

- Vanguard Total Stock Market ETF (VTI)

- Invesco QQQ Trust (QQQ)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard FTSE Developed Markets ETF (VEA)

A common question among junior traders is the differences between an ETF and an Index. Let’s explore the similarities and the differences of these two asset classes.

ETFs & Indices Comparison

Investors looking to gain exposure to broad market segments often consider ETFs and indices as viable options. While both vehicles aim to track the performance of specific indices, they differ in structure, liquidity, and costs, offering investors various options to suit their investment preferences.

Similarities

The first similarity between ETFs and Indices is diversification. Both investment vehicles offer investors instant diversification across a basket of securities. By investing in ETFs or trading indices via CFDs, investors can spread their risk and potentially mitigate the impact of poor performance from any single asset.

The other similarity lies on how these securities are viewed as. both ETFs and index trades are often associated with passive investing strategies, where investors seek to match the performance of the underlying index rather than actively selecting individual securities. This passive approach tends to be more cost-effective and less time-intensive than active trading strategies.

Though similar, ETFs and Indices have some significant differences that are important to be aware of.

Differences

The First difference of the two lies in their accessibility. ETFs are investment funds that are traded on stock exchanges, while index trades typically involve buying or selling futures contracts or options, based on the performance of the index. This difference can impact factors such as liquidity, trading hours and price.

As for the contrast in liquidity, ETFs generally offer higher liquidity than index trades, as they trade on stock exchanges throughout the trading day. This liquidity allows investors to buy and sell ETF shares at market prices with relative ease. On the other hand, Index trades may have lower liquidity, particularly for futures contracts.

The other major distinction is in the trading hours and price, ETFs are tradable throughout the day, whereas index funds are only traded at the fixed price determined at the close of the trading day.

The youngest entry in our guide belongs to an unpredictable and Volatile asset class, cherished by younger generations: Cryptocurrencies.

What is Crypto?

Welcome, traveler, to the fabled island of cryptocurrencies, a place cloaked in mist and mystery, where whispers of boundless treasures beckon the daring and the curious alike. Legend has it that within the swirling fog lies unimaginable wealth, waiting to be unearthed by those brave enough to venture into its depths.

But beware, for this island is no ordinary land of plenty. Many a sailor has set sail in search of its elusive riches, drawn by tales of untold fortune and promises of instant wealth. Yet, of the countless souls who have dared to brave the treacherous waters that surround this enigmatic isle, only a few have returned, their tales woven with threads of triumph and tragedy.

Some return with empty hands, their dreams dashed against the jagged rocks of uncertainty. Others emerge from the mist, their pockets heavy with the weight of newfound riches, their faces weathered by the trials of their journey. And still, there are those who bear the scars of their adventures, their stories etched into the very fabric of their being.

So heed this warning, dear traveler, as you set foot upon the shores of the crypto island: tread lightly, for the path ahead is fraught with peril and uncertainty. But fear not, for within the mist lies the promise of adventure and discovery, waiting to be claimed by those bold enough to seek it.

The Crypto space might sound horrifying for newcomers, an unregulated market solely controlled by the people with no overseers and supervision, no laws and no enforcement, the wild west of securities. A compilation of boundless opportunities, overnight millionaires, steady passive income with unprecedented APYs, along with fraudsters, scammers, deceptive schemes, rug pulls and outright theft of capital.

However, Bitcoin the Godfather of cryptocurrencies was developed with good intentions. Its origins trace back to a mysterious figure known by the pseudonym Satoshi Nakamoto. In August 2008, Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” which outlined the concept of a decentralized digital currency. The following year, on January 3, 2009, Nakamoto mined the first block of the Bitcoin blockchain, known as the “genesis block,” effectively launching the cryptocurrency into existence.

Satoshi Nakamoto’s true identity remains unknown to this day, adding an air of mystique to Bitcoin’s origin story. Some speculate that Nakamoto may be an individual working alone, while others believe it could be a group of people or even a pseudonym for a larger organization. Regardless of Nakamoto’s identity, their creation of Bitcoin sparked a revolution in the world of finance, introducing a decentralized form of digital currency that operates without the need for intermediaries like banks or governments.

Since its inception, Bitcoin has experienced dramatic fluctuations in value, capturing the attention of investors, technologists, and governments worldwide. Despite facing skepticism and regulatory challenges, Bitcoin has continued to gain adoption as a store of value and medium of exchange. Today, it remains the most widely recognized and traded cryptocurrency, serving as a testament to the ingenuity of its enigmatic founder and the transformative potential of blockchain technology.

In contrast to cash, Bitcoin operates on a finite supply model, meaning there is a predetermined limit to the total number of bitcoins that can ever exist. Once the final bitcoin is mined, no new bitcoins will enter circulation. This scarcity sets Bitcoin apart from many other assets, such as shares, cash, and commodities, which can be created or printed in unlimited quantities. Therefore, Bitcoin’s finite supply adds a unique dimension to its value proposition, positioning it as a store of value with unparalleled scarcity and resistance to inflation.

Many Bitcoin fans can see the good intention in creation of a decentralized payment system, however the path to hell is covered with good intentions. Bitcoin has the largest market cap of all crypto assets, but Bitcoin is one out of more than 2 million Cryptos in existence (Data provided by Coinmarketcap.com). Additionally, a multitude of tokens on various blockchains are generated every second of a day, often by individuals with a smidgen of blockchain knowledge. This in turn creates lucrative avenues for those with malicious intent, emphasizing the importance of caution and due diligence in the crypto space.

Other than crypto coins and tokens, NFTs or Non Fungible Tokens also can be created and sold in decentralized finance which by itself opens a massive Pandora’s box.

Not all is risk in the crypto space though, many legitimate crypto projects exist that bring actual substance. The advent of blockchain technology has revolutionized global payments, enabling individuals to engage in faster and more convenient transactions for goods and services through cryptocurrencies. However, navigating the volatile and unpredictable nature of these digital assets raises the question: How does one effectively invest in or trade these dynamic assets?

If you have a keen interest in cryptocurrencies and believe in their potential as the future of finance, you have the opportunity to engage in spot trading and acquire a diverse range of digital currencies through reputable exchanges like Binance, Coinbase, or Crypto.com. Additionally, some crypto exchanges and brokerages offer the option to trade Crypto CFDs, providing another avenue for participation in the crypto market.

With the Risky side of the spectrum covered, let’s jump to the safest type of securities, the Government Bonds.

What are Government Bonds?

In the realm of investment securities, bonds stand as a pillar of stability and income generation. Governments, much like any other entity, require funds to finance various projects and initiatives. To meet this need, governments issue bonds, effectively borrowing money from investors. In exchange for providing funds, investors receive a promise of repayment along with periodic interest payments over the bond’s lifespan.

Types of Government Bonds

Government bonds come in various forms, each tailored to meet different investment objectives and time horizons. Here are some common types of government bonds:

Treasury Bonds: Treasury bonds, issued by national governments, typically have longer maturities ranging from 10 to 30 years. These bonds offer fixed interest payments, known as coupon payments, which investors receive semi-annually until the bond matures.

Treasury Notes: Treasury notes are intermediate-term bonds with maturities ranging from 2 to 10 years. Similar to treasury bonds, they offer fixed coupon payments, providing investors with a steady stream of income.

Treasury Bills: Treasury bills, also known as T-bills, are short-term bonds with maturities of one year or less. Unlike treasury bonds and notes, T-bills are sold at a discount to their face value and do not pay periodic interest. Instead, investors earn a return by purchasing the bill at a discount and receiving the full face value at maturity.

Bonds Interest Rates and Yield

The interest rate on government bonds, often referred to as the coupon rate, determines the amount of interest income investors receive. Bonds with higher coupon rates offer higher interest payments, while those with lower coupon rates provide lower interest income.

Additionally, the yield on a bond reflects its annual return based on its current price, taking into account factors such as coupon payments and the bond’s purchase price. As interest rates in the broader economy fluctuate, bond prices may also change, impacting the yield investors receive.

How to Purchase Government Bonds

Investors have several avenues for purchasing government bonds, offering flexibility and accessibility. One common method is through primary market auctions, where new bonds are issued and sold directly by the government. Investors can participate in these auctions through government websites or financial institutions.

Alternatively, government bonds are also available for purchase on the secondary market, where previously issued bonds are bought and sold among investors. Brokerage firms, online trading platforms, and bond mutual funds provide avenues for investors to access the secondary market and buy government bonds.

Advantages of Government Bonds

Government bonds are widely regarded as a safer investment option compared to other types of securities for several reasons. Firstly, they are backed by the full faith and credit of the government issuing them, making them virtually risk-free from default. This assurance of repayment provides investors with a sense of security and stability, particularly during times of economic uncertainty.

Additionally, government bonds typically offer fixed interest payments, providing investors with a predictable stream of income over the bond’s lifespan. This predictable income stream can be particularly valuable for income-focused investors seeking steady cash flow.

Furthermore, government bonds often exhibit lower volatility compared to other asset classes such as stocks or commodities. Their stable value and steady income make them an attractive option for conservative investors looking to preserve capital and minimize risk. Additionally, government bonds can serve as a diversification tool within an investment portfolio, helping to offset the volatility of other assets and maintain a balanced risk-return profile.

Overall, the safety, stability, and income-generating potential of government bonds make them a compelling investment option for investors seeking capital preservation and income generation.

What is a Futures Contract?

As implied by its name, Futures contracts involve transactions scheduled for future dates. In simple terms, futures contracts are financial agreements that obligate the buyer to purchase, and the seller to sell, a specific asset at a predetermined price on a specified future date. These contracts are standardized and traded on organized exchanges, facilitating price discovery and liquidity for various commodities, financial instruments, and indices.

How does a Futures Contract Work?

To start off, grasping Futures contracts isn’t overly complex—it’s as straightforward as a seller committing to sell an asset to a buyer at a predetermined price, agreed upon in the present, for a future date.

For the buyer of a futures contract, the goal is typically to profit from a price increase in the underlying asset. By purchasing a futures contract at a predetermined price (known as the futures price), the buyer locks in the purchase price for the asset, regardless of any price fluctuations in the market. If the price of the underlying asset rises above the futures price by the contract’s expiration date, the buyer can sell the futures contract at a profit.

On the other hand, for the seller of a futures contract, the objective is often to profit from a price decrease in the underlying asset. By selling a futures contract at a predetermined price, the seller commits to delivering the asset to the buyer at the agreed-upon price on the expiration date. If the price of the underlying asset falls below the futures price by the contract’s expiration, the seller can repurchase the futures contract at a lower price, thus profiting from the difference.

Each futures contract specifies certain obligations for both the buyer and the seller. The buyer is obligated to take delivery of the underlying asset and pay the agreed-upon price (futures price) at the contract’s expiration. Similarly, the seller is obligated to deliver the underlying asset to the buyer and accept payment at the predetermined price on the expiration date. But what does this expiration date mean for the Bears and Bulls of the Futures contract?

The expiration date of a futures contract represents the date on which the contract ceases to exist. At this point, both parties are expected to fulfill their obligations by either taking or making delivery of the underlying asset. Futures contracts have predetermined expiration dates, which vary depending on the asset class and the specific contract. It’s essential for traders to be aware of the expiration date when entering into futures contracts, as positions must be closed or rolled over before expiration to avoid physical delivery of the underlying asset.

In the modern era of trading, the digitalization of futures contracts has revolutionized the way these financial instruments are bought, sold, and managed. Gone are the days of paper-based transactions and manual processing. Instead, electronic trading platforms have streamlined the entire process, offering traders unprecedented speed, efficiency, and accessibility.

Digital futures contracts are executed through electronic trading platforms, which connect buyers and sellers from around the world in real-time. These platforms provide a user-friendly interface that allows traders to view market data, place orders, and manage their positions with ease. With just a few clicks, traders can enter into or exit futures contracts, monitor market movements, and adjust their strategies accordingly.

One of the key advantages of digital futures trading is the ability to access global markets 24 hours a day, six days a week. Unlike traditional floor trading, which is limited by location and operating hours, electronic trading platforms operate around the clock, enabling traders to react to market developments and news events in real-time, regardless of their geographical location.

Furthermore, digitalization has enhanced transparency and price discovery in the futures market. Real-time pricing information is readily available to all market participants, allowing for fair and efficient price formation. This transparency benefits traders by providing them with accurate and up-to-date information to make informed trading decisions.

But what happens when you combine Futures contract, modern technologies and cryptocurrencies? Might sound like creating an abomination, a frankenstein of some sort, but that can’t be further from the truth.

Cryptocurrency Futures trading only is available for certain crypto assets and open to traders round the clock, every day. Crypto Futures is a much more simplified and beginner-friendly alternative to the Futures market.

Crypto Futures also offer leverage, a tool that enables traders to magnify both their gains and losses, even with limited capital. Yet, this capability is a double-edged sword, potentially leading traders to substantial losses if they fail to implement a well-placed stop loss.

While Futures contracts provide traders with the means to hedge against price fluctuations and capitalize on price movements, Options provide another avenue for managing risk and optimizing investment strategies. While Options trading carries inherent risks, understanding the mechanics of Options is not overly Complex.

What are Options?

Unlike Futures contracts, where both parties are obligated to execute the transaction at a predetermined price on a specified future date, Options provide traders with more choices and fewer obligations. In an Options contract, the buyer holds the right, but not the obligation, to buy or sell the underlying asset at a predetermined price after a specific time. Conversely, the seller of an Options contract is obligated to fulfill the terms of the contract if the buyer chooses to exercise their right.

How do Options Work?

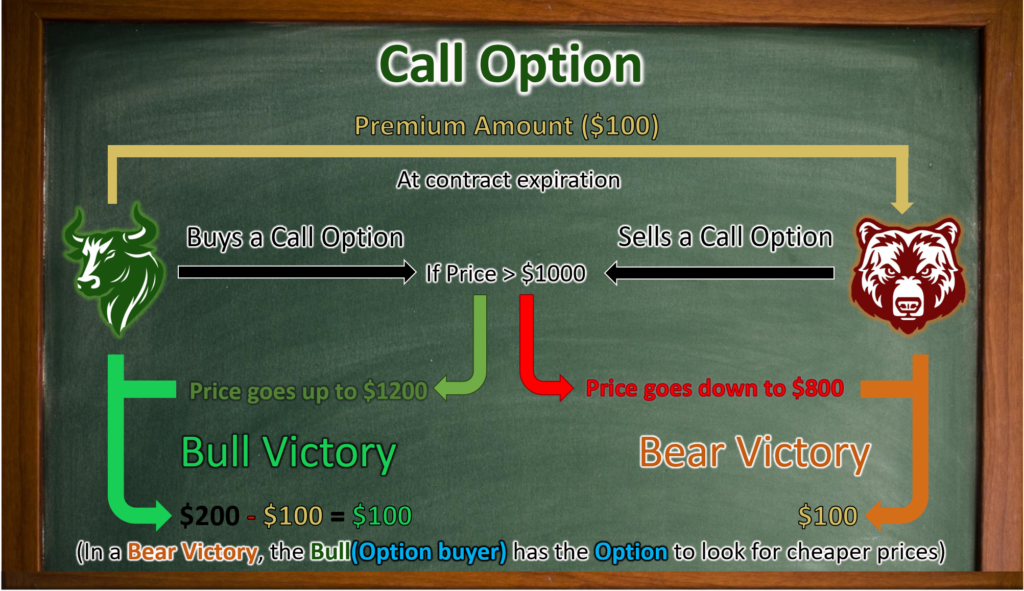

To better understand how an Options contract works, let’s imagine a bull wanting to buy an Apple company stock options contract. The other party, the contract seller, is a bear in this case, believing that the price of the stock doesn’t have much upward potential.

In the options contract, the bull holds the right to buy the shares at a predetermined price (referred to as exercise price). For example, the agreed upon price in this case $1000, which means at the end of contract expiration date, in this case a month, the bull has the option to buy the stock at the set price of $1000. At the end of the month, if the price grows from $1000 to $1200, then the buyer profits $200 from the agreement by buying the shares at a lower price and selling them higher. But what happens if the price doesn’t go above $1000?

In that case, the buyer has the option to not buy shares at $1000 since there are available shares with lower prices. Incredible opportunity for the bull buyer since he has nothing to lose.

Wait, I guess we forgot to mention the bear seller who gains absolutely nothing from this contract with the probability of even losing money! Well what’s the catch?

To protect the interest of the contract seller in this case, there will be a set amount of money referred to as The Premium Amount that the buyer agrees to pay the seller at the expiry date of the contract. This premium amount is non adjustable and non returnable and the seller receives it regardless of the contract outcome.

In our last example, if the premium amount is $100 and the share price gets to $1200 at the time of contract expiration, the buyer’s total profit would decrease from $200 to $100. Conversely, the seller’s loss would decrease from -$200 to -$100.

Should the price go down to $900 though, the buyer would seek lower prices, resulting in a profit of $100 for the seller, a favorable outcome. But what if the buyer is a bear while the seller is a bull? Well, let’s go through an alternative scenario.

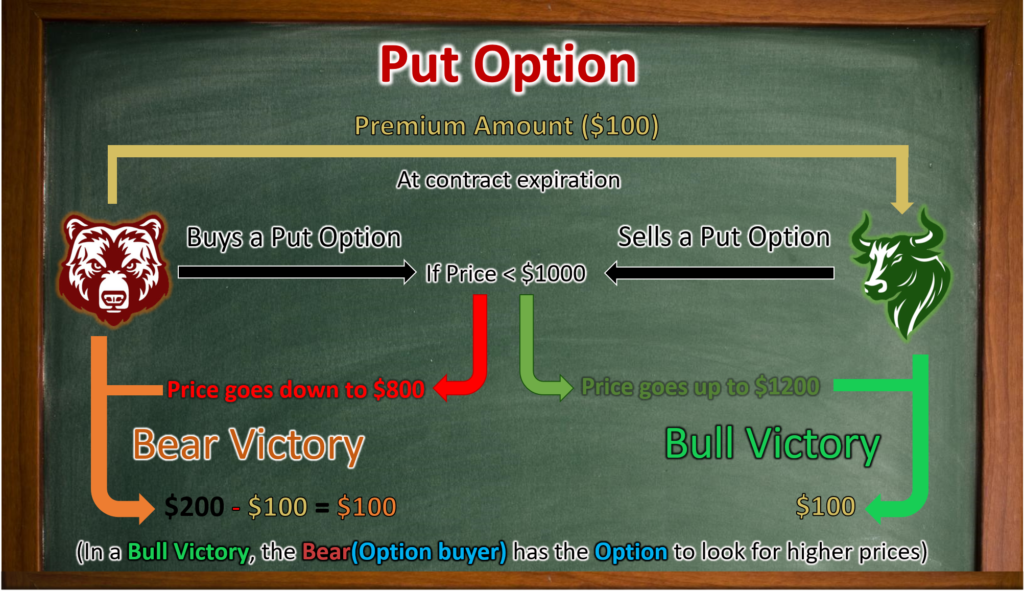

This time a bear is the Option Buyer while the bull is the Option Seller. The first thing that would change would be the name of the options, if a buyer is bullish on the securities, he buys a Call Option and if the buyer is bearish, he buys a Put Option.

s explained previously, a Call Option allows the buyer to purchase the underlying security at a lower predetermined price. The buyer of a Put Option can sell the security at a higher predetermined price when the price goes down.

If the exercise price is $1000 and at time of contract expiry the asset price is $800, the buyer of a put option can execute his right and sell the security for $1000 and after paying a premium amount of $100, cash out the $100 profit. The seller on the other hand only loses 100 bucks.

However, if the price remains above $1000 at the contract expiry date, the option buyer has the option to either sell the security for $1000 or look for better prices while still paying the Option Seller a premium of $100. But how is this premium amount calculated?

Option Premium Calculation Factors

The option premium value changes based on multiple factors, these factors are as followed:

- Underlying Asset Price: The current market price of the underlying asset directly impacts the option premium. For call options, as the underlying asset price increases, the premium typically rises, reflecting the increased likelihood of the option being profitable. Conversely, for put options, as the underlying asset price decreases, the premium usually increases due to the higher potential for the option to be exercised profitably.

- Strike Price: The strike price, or the price at which the option holder can buy (for call options) or sell (for put options) the underlying asset, also affects the option premium. Generally, the closer the strike price is to the current market price of the underlying asset, the higher the option premium.

- Time to Expiration: The amount of time remaining until the option expires is a crucial factor in determining the option premium. Options with longer expiration periods tend to have higher premiums.

- Volatility: Volatility, or the degree of price fluctuation of the underlying asset, significantly influences option premiums. Higher volatility leads to increased uncertainty and risk, resulting in higher option premiums to compensate for this risk.

- Interest Rates: Interest rates also play a role in option pricing. Generally, higher interest rates lead to higher call option premiums and lower put option premiums, reflecting the opportunity cost of holding the option versus investing in a risk-free asset.

- Dividends: For options on stocks, dividends can impact the option premium, particularly for call options. When a stock pays a dividend, the stock price typically decreases by the amount of the dividend, which may reduce the value of call options.

Final thoughts on Securities

As we conclude our exploration into the diverse world of tradable securities, it becomes evident that each asset class offers unique opportunities and challenges for investors and traders alike. From the tangible nature of commodities to the decentralized allure of cryptocurrencies, and the intricate strategies of options trading, the spectrum of securities presents a multitude of avenues for individuals to participate in the global financial markets.

Throughout this journey, we’ve uncovered the foundational principles and key characteristics of commodities, forex, stocks, indices, ETFs, cryptocurrencies, futures, options, and bonds. We’ve delved into their rich histories, examined their roles in modern finance, and discussed the factors influencing their prices and performance.

While each security possesses its own set of advantages and disadvantages, they collectively contribute to the vibrancy and dynamism of the financial ecosystem. Commodities offer tangible assets for hedging against inflation and diversifying portfolios, while forex markets provide opportunities for speculation and international trade.

Stocks and indices grant investors access to the growth potential of companies and sectors, while ETFs offer convenient diversification and liquidity. Cryptocurrencies and their underlying blockchain technology challenge traditional notions of currency and finance, while futures and options provide sophisticated tools for risk management and speculation. Bonds, with their fixed-income nature, offer stability and income generation in uncertain times.

As investors navigate the ever-evolving landscape of tradable securities, it is essential to approach each asset class with careful consideration, thorough research, and a well-defined investment strategy. Whether seeking capital appreciation, income generation, or risk mitigation, the breadth of securities available empowers individuals to pursue their financial goals with confidence and agility.

.

FAQ

- What are financial securities?

Financial securities are tradable assets representing ownership or debt obligations, issued by governments, corporations, or other entities. These instruments include stocks, bonds, derivatives, and commodities, among others. - What are the types of securities?

Securities encompass a wide range of tradable financial assets, including commodities, forex (foreign exchange), stocks, indices, ETFs (exchange-traded funds), cryptocurrencies, futures, options, and bonds.

- What are cryptocurrencies?

Cryptocurrencies are decentralized digital assets created on a blockchain. These digital assets consist of three major categories including Coins, Tokens and Non Fungible Tokens (NFTs). - What is an Index?

An index is a benchmark that tracks the performance of a specific group of assets, providing investors with insight into the overall market trends. It’s typically calculated as a weighted average of the individual components’ prices or values. For example, the S&P 500 index tracks the performance of 500 large-cap stocks in the US. - What is an ETF?

An ETF, or Exchange-Traded Fund, is a type of investment fund that holds assets like stocks, commodities, or bonds and trades on stock exchanges. Essentially, it’s a basket of securities that can be bought or sold throughout the trading day, just like individual stocks. - What is the Difference Between Options and Futures?

Options provide the buyer with the right, but not the obligation, to buy or sell the underlying asset at a predetermined price (known as the strike/exercise price) within a specified period (known as the expiration date). On the other hand, futures contracts obligate both the buyer and the seller to fulfill the terms of the contract at a specified future date.