Last week was relatively calm in the financial markets. At the beginning of the week, we witnessed relatively stable fluctuations, indicating consolidation. However, following the release of US unemployment claims data, liquidity entered the market. The dollar index grew by 0.23 percent. Nevertheless, the possibility of a negative movement for the dollar still seems to exist.

The stock market experienced positive movements, while oil and gold moved in the opposite direction, which was not solely due to dollar pricing.

Economic Events:

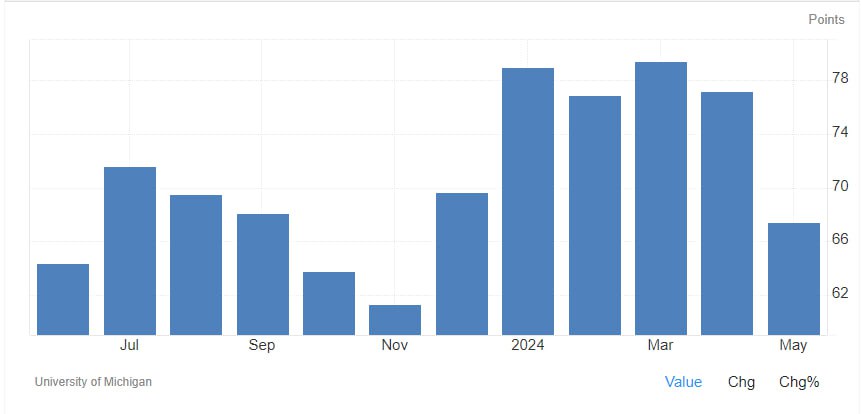

The preliminary estimates indicate that the University of Michigan consumer sentiment index for the US declined to 67.4 in May 2024 from 77.2 in April, marking the lowest level in six months and falling short of market expectations of 76. Additionally, inflation expectations for the year ahead rose to 3.5%, the highest level in six months compared to 3.2% in April. Furthermore, the five-year inflation outlook increased to 3.1%, also the highest in six months, up from 3.0%. Both current conditions (68.8 compared to 79 in April) and expectations (66.5 compared to 76) experienced declines. Consumers expressed concerns regarding the potential unfavorable direction of inflation, unemployment, and interest rates in the coming year.

United States Michigan Consumer Sentiment

Source : Tradingeconomy

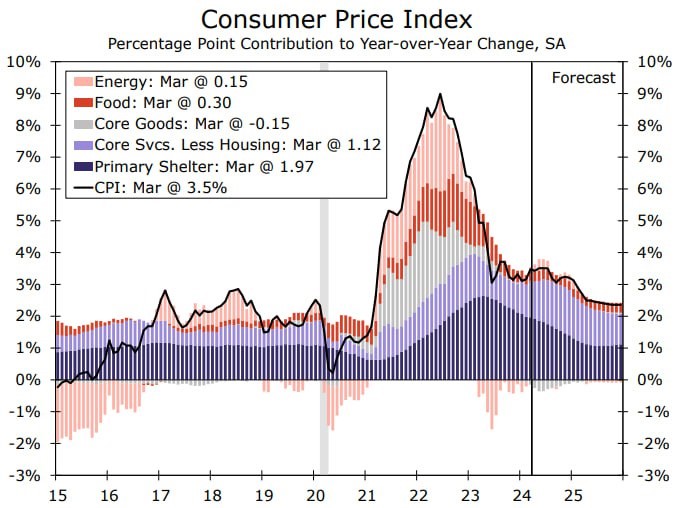

The hotter price growth observed in the first quarter suggests that inflation may slow down more gradually in the future. Businesses are still inclined to raise prices, but with robust consumer spending, there is less pressure to keep prices stable. It is believed that the underlying trend in inflation is not picking up speed again.

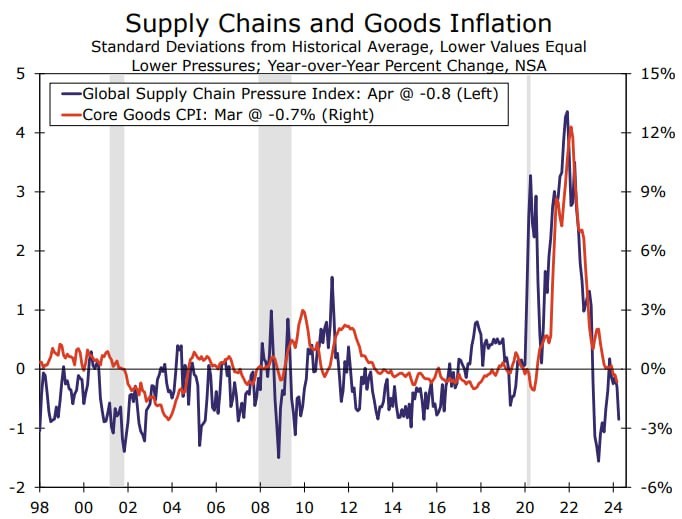

The strong disinflationary trends seen in the goods sector over the past two years have diminished, but upward pressure on goods prices remains minimal. Supply pressures are not easing as quickly as before, but they are not increasing either. Margins in the goods sector are still high compared to the 2010s, allowing firms to adjust pricing as consumers become more selective in their purchases. These factors are expected to keep core goods experiencing mild deflation in the near term. Similarly, food and energy-related commodities are not declining as sharply as before, which means their contribution to headline inflation is not increasing significantly.

Source : US Department of labor and Wells Fargo Economics

With goods inflation likely to remain stable, services will need to slow down further to continue the downward trend in overall inflation. It is believed that services will play a larger role in disinflation. Shelter inflation is expected to continue cooling down as apartment vacancy rates rise and spot rents decelerate. Primary shelter, currently experiencing a 5.9% increase year-over-year, is expected to slow down to 4.1% by December and stabilize at just over 3% around the middle of next year.

Outside of housing, upward pressure on services inflation is also easing. The stability in goods prices should provide some relief to services inflation through lower input costs, with motor vehicle insurance inflation likely benefiting the most. Meanwhile, the gradual improvement in the labor market is leading to slower nominal wage growth, while productivity trends are strengthening. Overall, the high rate of services inflation earlier this year is largely attributed to services being slower to respond to changes in the broader price environment in this cycle, rather than indicating that inflation is getting

Source : US Department of labor and Wells Fargo Economics

Gold (XAUUSD):

In the wake of easing geopolitical tensions and lacking significant economic data releases during the past week, the gold market once again turned its attention towards the prospect of a Federal Reserve interest rate cut. Gold began the week slightly above $2300 per ounce and traded within a $30 range throughout the week. However, starting from Friday following the release of higher-than-expected US unemployment claims data, it began its upward trajectory.

Following remarks by Jerome Powell, the Federal Reserve Chair, indicating that a rate cut remains on the table for 2024, gold traders inferred that the stronger-than-expected unemployment figures increased the likelihood of a rate cut. This was sufficient to break gold’s resistance at $2330 and propel it to a peak of $2378.56. Although there was a slight decline in gold prices on Friday, gold maintained its luster.

Indices:

Over the past week, the S&P 500 extended its upward trend from May, nearly reaching its previous record high. This surge in performance was largely attributed to a stronger-than-anticipated earnings season, signaling ongoing economic and profit growth. Approximately 90% of S&P 500 companies have reported earnings for the first quarter, surpassing analyst predictions by 8.5%, marking the largest positive deviation since Q3 2021. Despite a slight deceleration in economic expansion, revenue growth remains robust at around 4%. Notably, sectors such as communication services, consumer discretionary, and technology continue to demonstrate significant growth, while others like industrials, financials, and consumer staples also exhibit solid performance.

Us500:

Although some sectors, including energy, materials, and health care, experienced earnings declines, the overall outlook remains positive. Artificial intelligence remains a dominant theme, particularly benefiting large-cap technology companies. Looking ahead, first-quarter results and company guidance suggest that earnings are poised to increase by over 10% in 2024, defying the typical pattern of downward revisions throughout the year. Additionally, recent declines in bond yields, coupled with expectations of a potential interest rate cut by the Fed, have provided further reassurance to the markets.

Recent economic indicators, such as the GDP estimate for the first quarter and job market data, hint at a potential softening in economic growth and employment. From the perspective of the Federal Reserve, a gradual slowdown in economic activity could help stabilize inflation, aligning with policymakers’ objectives. Market sentiment post-FOMC meeting suggests anticipation of rate cuts, reflecting the Fed’s inclination towards accommodative monetary policy. However, the timing of such actions will largely hinge on inflation dynamics rather than labor market conditions, which are expected to remain relatively stable amidst positive corporate earnings.

Us100:

US30:

Bitcoin (BTC):

During the opening hours of the US stock market, Bitcoin witnessed a downturn, despite significant activity from Asian traders. While regions like Hong Kong celebrated the recent introduction of BTC and ETH exchange-traded funds (ETFs), the sentiment in Wall Street was the opposite.

Amidst a rise in outflows and a decrease in institutional buying, demand for BTC has waned. For instance, Thursday saw reported outflows of $11.3 million from ETFs in the US. Notably, Grayscale was the sole ETF provider experiencing negative flows, with outflows totaling $43.4 million, while other providers saw mixed flows or remained neutral.

Despite overall negative net flows, Thursday marked the sixth consecutive day where every ETF provider, except Grayscale, saw either positive or neutral flows. While this signals a trend shift, with Grayscale’s negative flows diminishing, trading volume has remained subdued.

With the launch of Bitcoin ETFs four months ago, the market witnessed eager buyers and scarce sellers. However, as more investors have acquired ETFs, the supply of potential sellers has increased. Coupled with diminishing demand from new buyers, ongoing ETF outflows are exerting downward pressure on BTC prices.

Social metrics, including social volume and dominance, indicate a decrease in mainstream discussion and FOMO surrounding Bitcoin. This decline in social activity often correlates with lower asset volatility. Amidst this, there’s an uptick in sell calls, particularly in the US, suggesting increased market recovery probabilities.

While there’s growing polarization between traders, with rising mentions of ‘buy the dip’ calls, there’s also a noticeable level of concern among traders, hinting at a potential relief rally. Despite bullish sentiment fueled by historical price performance and ETF excitement, Bitcoin’s ability to surpass $80,000 hinges largely on the behavior of major players and various network metrics.

US Crude Oil WTI :

We are entering a pivotal period for oil fundamentals, one that will determine whether the oil market becomes more competitive or remains subdued.

Energy markets started the new month with a 3% decline. Following the surprising reports on Thursday regarding oil inventory levels, doubts have arisen about future oil demand.

On a global scale, the outlook for oil and gas appears to be more bullish. The supply and demand balance for oil this year indicates a significant deficit, contrasting sharply with the large surplus conditions in early 2023.

The support level at $77.42 per barrel is crucial for oil prices. Currently, the momentum for oil is negative. It remains to be seen whether this support can withstand further oil price declines or not.

Weekly Outlook:

For the upcoming week, the stock market may see a new ceiling. Sentiment towards US indices is positive, with a prediction of a risk-off environment. Oil is expected to experience minimal decline and approach its support range. Gold, considering unemployment data and recent scenario changes, may initiate a positive movement after a minor correction.

Bitcoin has recently diverged more towards the stock market, indicating that prices are less influenced by dollar pricing. If there is a decline this week as well, there is likely to be an expectation of a strong downward movement.

Wishing everyone a profitable week ahead with the Meta Trading Club!

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.