Today, due to the lack of significant data and important drivers aside from the speeches of Federal Reserve officials, we will present a roadmap for each asset class in this article.

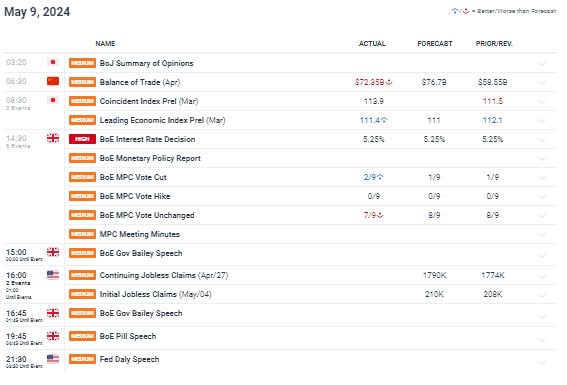

Economic Events:

In today’s calendar, we only have important speeches from Federal Reserve officials and BOE. In this section, we will focus on categorizing these officials based on their current stance on interest rates:

The Doves:

Doves are Federal Reserve officials who generally advocate for monetary policies that prioritize economic growth and employment over concerns about inflation. They are inclined towards keeping interest rates low for longer periods to stimulate economic activity. Among the dovish members listed, those who are “Leaning Dovish” may exhibit a slightly stronger preference for accommodative policies compared to others in this category. The dovish members include Brainard, Evans, Bostic, and Daly.

The Center:

Members categorized under “The Center” typically represent a balanced approach to monetary policy. They strive to maintain a neutral stance, carefully weighing economic indicators such as inflation, employment, and growth. While they may not lean heavily towards either dovish or hawkish policies, they aim to steer monetary policy in a direction that fosters stability and sustainable economic expansion. The central members include Powell, Williams, Kashkari, Barkin, and Harker.

Leaning Hawkish:

Officials classified as “Leaning Hawkish” tend to express concerns about inflationary pressures and may advocate for gradually tightening monetary policy. They prioritize controlling inflation and may be more inclined to support interest rate hikes to prevent the economy from overheating. However, they may not exhibit as strong a stance as the members categorized under “The Hawks.” The leaning hawkish members are Mester, Bowman, and George.

The Hawks:

Hawks are Federal Reserve officials who prioritize controlling inflation and maintaining price stability over concerns about economic growth and employment. They advocate for tighter monetary policy, including raising interest rates, to curb inflationary pressures. Hawks are typically more aggressive in their approach to monetary policy compared to other members, often expressing a preference for preemptive action to prevent potential inflationary risks from materializing. The hawkish members are Bullard and Waller.

Source: Dailyfx

Gold (XAUUSD):

The scenario for gold has changed since the writing of this report. As you can see, it has currently reached a fair price level. This increase in demand could potentially drive gold up to the range of $2375. You can see the roadmap for gold below.

S&P500:

The S&P 500 index has followed a similar scenario to previous reports, now with an increasing bullish momentum. With this uptrend gaining momentum, it could potentially move higher to reach a higher fair price level.

Foreign Exchange Market (FOREX):

The Dollar index, like Bitcoin, has formed a counter trend with greater penetration. Now, it remains to be seen whether the downward movement of the Dollar will start from here or not. Currency pairs like USD/JPY and EUR/USD can potentially have good trading opportunities and movements this week.

Bitcoin (BTC):

BTC has experienced a deeper correction, but as observed, it is currently demand-driven from a significant support range until the time of writing this report.

US Crude Oil WTI :

Fairprice ranges are considered the most suitable and reliable price reversal ranges because they are determined based on market psychology principles. Currently, after oil demand reached the fairprice range of $79.18 from the range of $77.42, a consolidation phase is likely to be observed.

Disclaimer: The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.