Options strategies can be basic or sophisticated, with one or many option contracts and, in some cases, the underlying asset. These tactics are intended to mitigate risk, speculate on volatility, and profit from specific market conditions.

Long Call

With a specified risk, investors can bet on the future appreciation of the price of an underlying asset by using the relatively simple Long Call strategy in options trading. Here’s a thorough examination of its goals, methods, and related dangers and benefits:

How It Operates

Buying a Call Option: Buying a call option gives a shareholder the choice—but not the duty—to acquire the underlying asset at a designated strike price prior to the option’s expiration.

Premium Payment: The call option seller receives an upfront payment from the investor. The cost of joining the trade is represented by this premium, which takes into account the volatility of the underlying asset, the time until expiration, and the current price of the asset in relation to the strike price.

Contractual Details: Typically, a call option contract equals 100 shares of the underlying asset. This allows for significant price movement exposure to the asset without requiring the full outlay of capital needed to purchase the shares directly.

Objective

Making money off of an expected rise in the underlying asset’s price is the main objective of a long call strategy. When investors are confident in the future of the asset but want to keep their downside risk to the option premium, they employ this technique. The technique seeks to take advantage of the asymmetry between the theoretically infinite gain and the potentially limited loss, which is restricted to the premium.

Risk

Limited Losses: The option’s maximum risk is limited to the option’s premium. The option expires worthless and the investor loses the premium if the price of the underlying asset does not increase above the strike price by the time of expiration.

Break Even Point: In order to turn a profit, the underlying asset’s price needs to rise above the strike price by more than the premium that was paid. The effectiveness of the plan depends critically on this breakeven point.

Rewards

Unlimited Profit : The most alluring feature of the long call strategy is the possibility of making infinite profits should the price of the underlying asset increase sharply above the strike price.

Leverage: The technique provides leverage, increasing possible earnings in relation to the initial investment, since each contract owns 100 shares for the premium amount.

Flexibility and Control: Depending on their risk tolerance and market forecast, investors can select from a range of strike prices and expiration dates. They can also close the position before it expires in order to maximize gains or reduce losses.

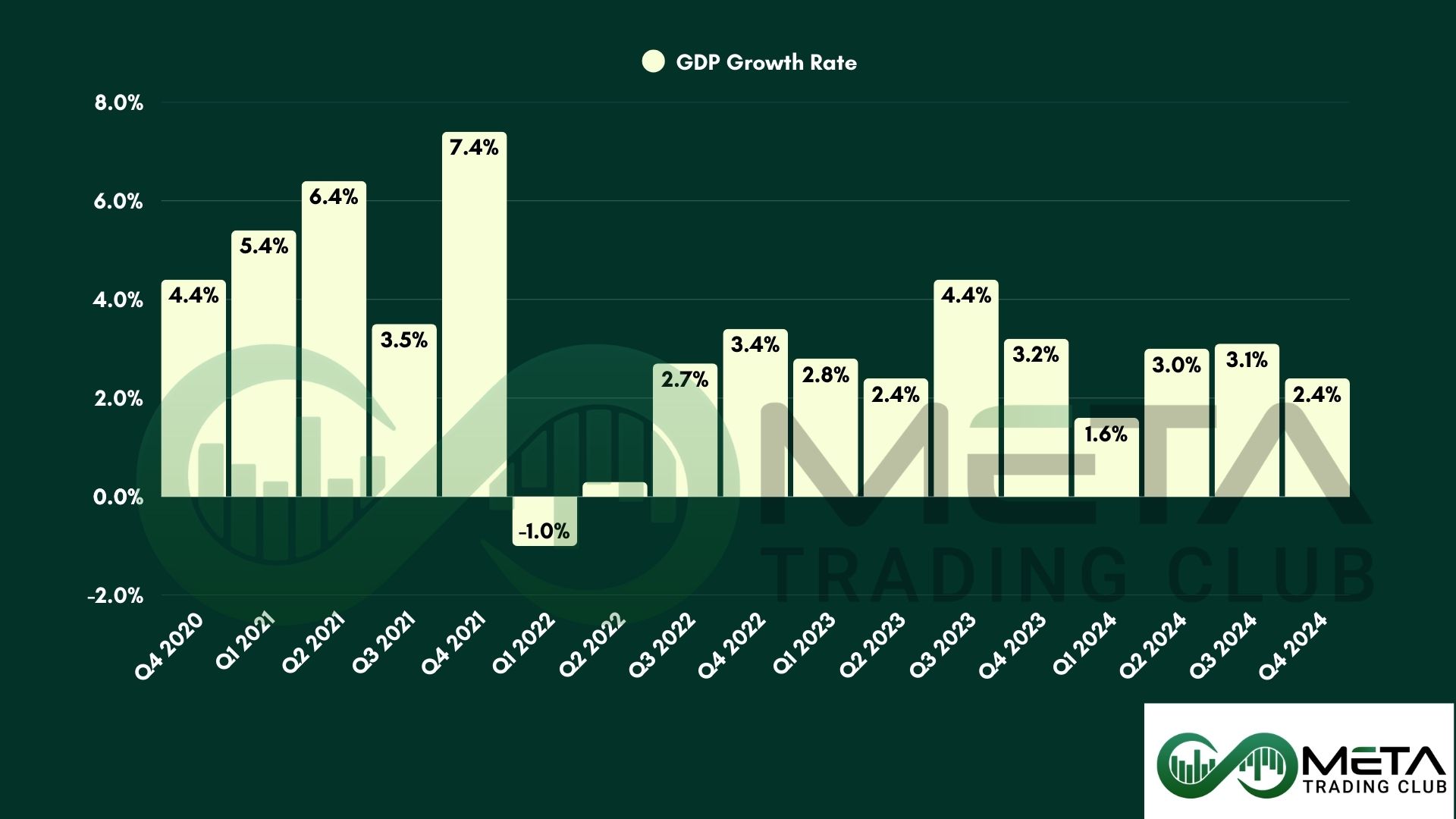

For a long call, the payout diagram is simple to understand. The option’s cost determines the maximum risk. The potential for profit is boundless. The stock price must be higher than the strike price by the long call option’s cost in order to break even on the trade at expiration.

For instance, if a long call option with a $100 strike price is bought for $5.00, the maximum loss is $500 and, should the stock continue to grow, the profit potential is uncapped. To earn a profit, though, the underlying stock needs to be higher than $105 at expiration.

Long Put

A simple but effective technique for investors who predict a drop in the price of an underlying asset is the long put options strategy. Buying a put option entails providing the buyer the choice to sell the underlying asset at a defined strike price before or at the option’s expiration, but not the responsibility to do so. This tactic is employed to speculate on an asset’s price decline or as a hedge against downside risk. This is how it functions, along with its goals, dangers, and benefits.

How It Works

Buying a Put Option: When an investor purchases a put option, they gain the authority to sell the underlying asset at the option contract’s strike price.

Payment of Premium: The option seller receives a premium from the buyer. This premium, which represents the cost of purchasing the put option, is determined by a number of variables, including the volatility of the underlying asset, the time to expiration, and the strike price’s distance from the current market price.

Contractual Details: Every put option contract normally represents 100 shares of the underlying asset, just like call options do. This eliminates the requirement for the buyer to directly sell the asset short and gives them substantial exposure to the asset’s price volatility.

Objective

The main motivation behind using the Long Put strategy is the belief that the underlying asset’s price will drop. It can act as a speculative vehicle to profit from anticipated downward price fluctuations or as a type of insurance for investors holding stakes in the underlying asset. The goal is to sell the asset at the higher strike price by taking advantage of the price decline and keeping the difference after deducting the premium.

Risk

Limited Losses: The maximum amount of risk involved in a long put strategy is the amount spent on the put option’s purchase premium. The option may expire worthless, in which case the investor would forfeit the premium if the price of the underlying asset does not drop below the strike price.

Break Even Point: The price of the underlying asset must drop below the strike price by a greater amount than the option premium in order to benefit on a long put. The strategy’s profitability must be ascertained using this breakeven point.

Rewards

Potential for Profit from Price Declines: The main benefit of a long put is the possibility of making money off of the underlying asset’s price decrease. As the price of the underlying asset falls below the breakeven point, the profit potential rises.

Leverage: Long Puts, like Long Calls, offer leverage because the premium is usually substantially less than the cost of directly short selling the underlying asset. Potential returns in relation to the initial investment may be increased as a result.

Protection from falls: Long Puts can act as a hedge for investors who own the underlying asset, providing protection against substantial price falls.

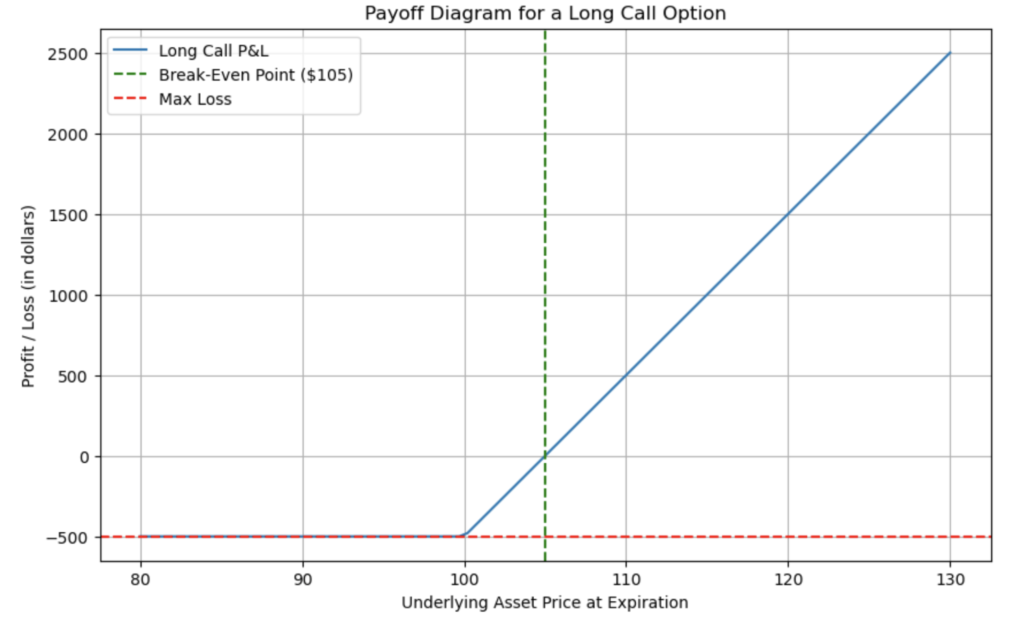

A long put’s payoff diagram is simple to understand. The option’s cost determines the maximum risk. Until the underlying asset approaches zero dollars, there is no limit to the profit possibilities. The stock price needs to be lower than the long put option’s strike price in order for the trade to break even at expiration.

For instance, the maximum loss is $500 and the maximum profit is infinite until the stock hits $0. If a long put option with a $100 strike price is bought for $5.00. To earn a profit, though, the underlying stock needs to be below $95 at expiration.