In the past day, the financial markets witnessed a pattern of consolidation across most asset classes. Apart from oil, where notable movements occurred, other markets exhibited relatively neutral behavior. This consolidation phase reflects a period of indecision among investors, as they await further developments and key catalysts to drive market direction. In this article, we delve into the events that unfolded in various asset classes over the past day, shedding light on the factors influencing market sentiment and potential implications for traders and investors

economic event :

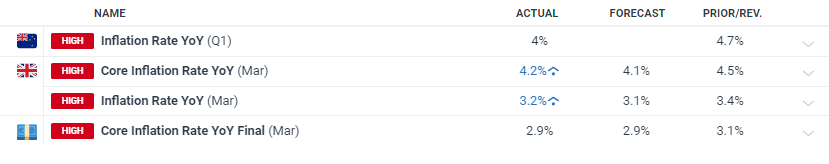

Yesterday, Australia’s inflation data was released during the early hours of the market, showing a 4% reading. Compared to the previous reading of 4.7%, this suggests a continued downward trend in inflation in the country. It remains to be seen when Australia’s central bank will implement its first interest rate cut, considering the country’s labor market conditions.

For the UK and the European region, inflation reports were also released. Inflation in the UK increased, while inflation in Europe decreased. The Bank of England may opt for a balanced approach instead of lowering interest rates in response to the inflation uptick. Meanwhile, Europe’s inflation data indicated an improvement in inflationary conditions and the effectiveness of monetary tightening policies.

During the early trading hours in the United States, the US crude oil inventory data was released. Given the reduced geopolitical risks and the pricing dynamics of oil concerning geopolitical tensions, this led to a 3% decline in WTI crude oil prices.

Source : Dailyfx

Earning :

Today, earnings reports from major companies such as Netflix and Blackstone are set to be released. So far, with positive earnings reports from companies in recent days, they have outperformed market expectations. This indicates that the Federal Reserve’s tightening policies have not yet had a significant impact on these companies. As these companies experience better conditions and the labor market thrives, Fed members may delay the first rate cut, leading to a strengthening dollar. Therefore, so far, the banking sector and to some extent, the healthcare and technology sectors have reported favorable earnings. It remains to be seen how Netflix, the world’s entertainment giant, will perform in today’s earnings report

Source : Earning whispers

SP500:

As mentioned, the S&P 500 retreated after forming a significant volume TPO (Time Price Opportunity) profile yesterday, but regained much of its losses with the opening of the Asian trading session last night. For the current trading day, two important resistance levels are crucial for the S&P 500, one at $5058 and the other at $5156.

The recent downturn in the stock market over the past few days indicates the formation of a price pivot and the beginning of a counter-trend move, the continuation of which depends on earnings and dollar pricing. The most important earnings reports today are from Netflix and TSM. With the current momentum in the stock market, further correction can be expected

BTC :

The upcoming Bitcoin halving event has sparked doubts and speculations regarding the remaining miners on the network, despite the reduction in reward costs. Additionally, the escalating geopolitical tensions in the region add another layer of uncertainty to Bitcoin’s behavior. Historically, preceding each halving event, Bitcoin has often undergone a significant correction, followed by a pivot towards new highs. The million-dollar question for market participants is whether Bitcoin will pivot soon or face further correction due to miners exiting the network and jeopardizing its security. This topic will be further explored in the weekly report.

For Bitcoin, the range of $63,500 serves as the primary resistance, while the range of $55,800 acts as the first line of support against further declines in Bitcoin

WTI :

In the previous report, reference was made to the critical support range of $81. This range is considered a robust consolidation zone. With the release of the US SPR oil inventory data, it appeared that oil had been pricing in geopolitical tensions in recent weeks, which may result in a corrective move for this asset following the reduction in these tensions. Now, if the $81 range is breached, it is expected that this negative momentum for oil will persist. However, an increase in demand in the first instance could push this asset up to the $82.40 per barrel range.

Forex :

In the image above, you can observe the strength of forex markets over the past 24 hours (prior to the opening of the US market). The increase in market risk appetite has positioned commodity currencies such as the Australian dollar and the New Zealand dollar among the strong currencies. On the other hand, the Japanese yen continues to weaken due to the BOJ’s monetary policies.

However, the Governor of the Bank of Japan and the Minister of Finance of Japan have warned about the dollar-yen exchange rate. If the dollar-yen pair reaches a rate of 155, the central bank of Japan may intervene using tools such as exiting negative interest rates or changing the YCC policy. The correlation of the Japanese yen with treasury yields is an interesting point that will be covered in educational content.

Source : Babypips.com

Gold :

Gold continues its positive trend. As mentioned in the previous report, the range of 2415 serves as a significant resistance level that gold may reach during the US trading session. Gold can strengthen under two factors: risk aversion and negative pricing of the dollar. Despite the reduced risk shadow from the markets, gold can maintain its upward momentum under the influence of dollar supply.

Today’s Outlook :

For today’s trading session, market momentum and cash flow are likely to move towards gold demand on one hand, and the possibility of reduced focus of investors on the dollar and euro on the other hand. On one side, the recent decline in oil prices can alleviate inflationary pressures from the energy sector on developed countries, potentially prompting central banks to initiate rate cuts, which could be perceived as a positive driver. However, the markets are currently in a correction phase. Especially, the stock market, due to the significant expansion of the technology and artificial intelligence sectors in the past two months, has shown remarkable performance. Nevertheless, it’s important to remember that corrections in risky markets will occur with even more intense momentum. Therefore, don’t forget capital management in your trades.

Disclaimer :

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.